Tramino/iStock Unreleased via Getty Images

Investment Thesis: On the basis of strong performance in terms of a growing inventory ratio and strong quick ratio performance, I take a long-term bullish view on Volkswagen AG.

In a previous article, I made the argument that Volkswagen AG (OTCPK:VLKAF) (OTCPK:VWAGY) could see further upside to the €300 mark.

My reason for making this argument was that a strong rebound in sales along with growing optimism that Volkswagen can effectively compete with Tesla (TSLA) in the electric vehicles market could be drivers of growth for the stock.

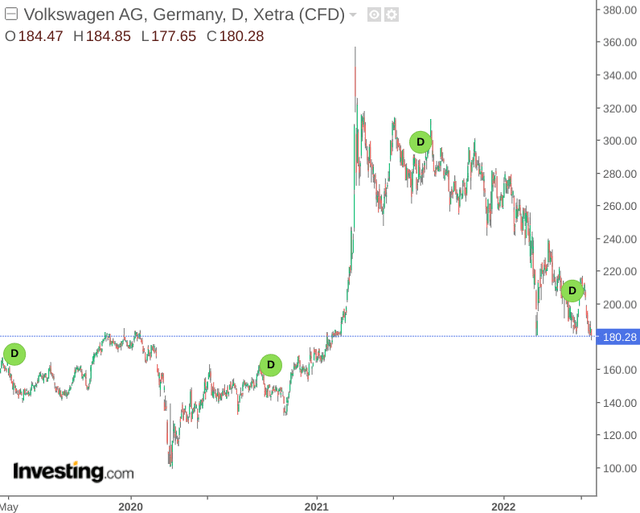

However, on the back of a challenging macroeconomic environment, we have seen the stock take a sharp decline in the past year:

I argue that there is a disconnect between price and recent performance, and Volkswagen has the potential to see a strong rebound in upside once market conditions start to settle.

Inventory Turnover

With commercial vehicle sales having declined by 27.1% in April across the European Union as a result of supply chain and inflationary concerns, it is possible that the short to medium-term could see further pressure on sales for Volkswagen – both as a result of potential customers cutting back on spending due to higher prices as well as supply chain concerns meaning that demand may not be fulfilled.

However, I am particularly interested in the company’s inventory turnover over a longer-term period. Naturally, the higher the inventory turnover ratio, the faster the company is selling its inventory – which is an encouraging sign.

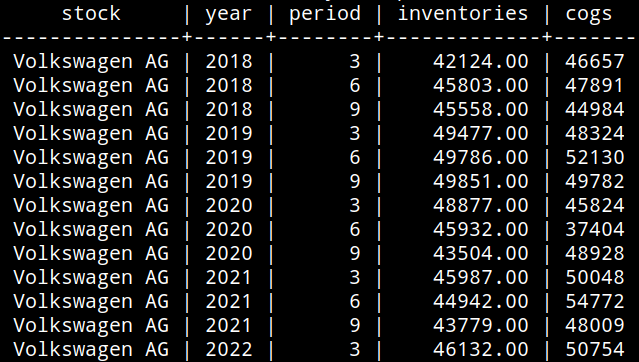

In order to determine the overall trajectory of the inventory ratio – I decided to collate quarterly figures for the cost of sales (or cost of goods sold) and inventories from 2018 to the present.

Figures sourced from Volkswagen AG historical interim reports (2018 – present). SQL table created by author.

Taking the sum of the cost of goods sold for each year and dividing by the average inventory for each year, the following results were obtained:

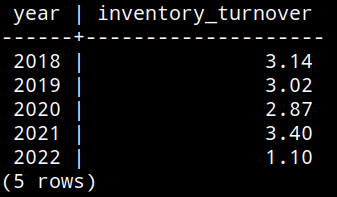

Inventory turnover ratio calculated by author using SQL.

We can see that while inventory turnover had declined up to 2020 – the ratio had actually rebounded quite strongly in 2021 in spite of inflation and supply chain issues having already become a concern in the latter half of the year (2022 only includes the first quarter of data, and so should not be used for comparison on a yearly basis).

To attempt to gauge performance so far this year, I decided to calculate the cost of goods sold for the period of March (where period = 3) across each year and divide by the recorded inventory within the period.

Inventory turnover ratio calculated by author using SQL.

While the above only considers performance across the month of March, we can see that the ratio saw a slight uptick on that of 2021, in spite of the continuing macroeconomic pressures.

Although it is too early to determine what performance will look like for the rest of this year, I take the view that should we see the inventory turnover ratio maintain or improve on levels seen in 2021 – then this would serve as a signal that the company is showing strong sales performance in the current environment and this could prove to be a key driver of a rebound in stock growth.

Looking Forward

Given the rebound in performance that we saw in 2021 – my view is that if Volkswagen does come under pressure in the near-term – it is likely to be supply rather than demand-related.

It remains to be seen as to what extent the war in Ukraine is likely to impact supply chains for this year as a whole. However, Volkswagen has warned that as the company is significantly dependent on natural gas deliveries from Russia, this could place additional strain on production capacity.

However, customer demand is still reported to be strong and the company reports that it is on track to meet demand for 2022. Should this prove to be the case – then I see the risk of further downside in the stock diminishing – the effects of inflation and the war in Ukraine is likely to be priced in already and the market would welcome resilient performance from a sales standpoint.

Additionally, one concern that is likely to be on the mind of investors is whether Volkswagen AG can maintain a healthy cash position to meet short-term liabilities in the case of lower sales.

To gain a longer-term overview, I calculated the quick ratio ((current assets – inventory)/current liabilities) for the first quarter from 2019 to the present:

| Current Assets | Inventory | Current Liabilities | Quick Ratio | |

| Q1 2019 | 186326 | 49477 | 167486 | 0.82 |

| Q1 2020 | 193399 | 48877 | 183053 | 0.79 |

| Q1 2021 | 203489 | 45987 | 169766 | 0.93 |

| Q1 2022 | 211967 | 46132 | 172322 | 0.96 |

Source: Figures sourced from historical Volkswagen AG Interim Reports. Quick ratio calculated by author.

With the quick ratio reaching a high of 0.96 for Q1 2022, the company does seem to be in a good position to withstand potential short-term sales pressure, while continuing to meet its liabilities.

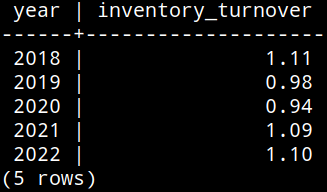

In terms of potential valuation, we can see that the EV to EBITDA ratio itself is trailing near a 5-year low, while EBITDA per share has climbed strongly to near a 10-year high.

ycharts.com

This could be an indication that the company is undervalued on an earnings basis – and investors are being too avoidant of the stock due to fears regarding supply chain and inflation concerns. Therefore, I see a rebound to above the €300 mark as being quite plausible once bullish interest starts to rebound.

As regards potential risks, the two main ones are 1) Tesla significantly out-competing Volkswagen in terms of bolstering electric vehicle sales and 2) the potential implications of car plants no longer being operational if gas imports from Russia suddenly cease.

While Volkswagen has succeeded in bolstering interest in its electric vehicle offerings, the potential of a lower than expected appetite for electric vehicles coupled with supply chain concerns means that uptake remains below expectations. More broadly, the ongoing war in Ukraine has had strong implications in regards to energy sanctions between the EU and Russia. Should we see a situation where this intensifies in the coming winter months – then supply concerns stand to be exacerbated greatly.

Conclusion

Given the current macroeconomic situation, Volkswagen AG is not without risk. However, I take a long-term bullish view on Volkswagen AG on the basis that both the company’s inventory turnover and quick ratio have continued to rise over a longer-term period. Should we see inventory turnover for the year as a whole continue to rise despite supply chain pressures along with the company maintaining a healthy cash position – then I see a rebound to above the €300 mark as being very plausible once bearish market sentiment starts to fade.

Additional disclosure: This article is written on an “as is” basis and without warranty. The content represents my opinion only and in no way constitutes professional investment advice. It is the responsibility of the reader to conduct their due diligence and seek investment advice from a licensed professional before making any investment decisions. The author disclaims all liability for any actions taken based on the information contained in this article.

Be the first to comment