Lyubov Smirnova/iStock via Getty Images

Strive not to be a success, but rather to be of value. – Albert Einstein

The Vanguard Mid-Cap Value ETF (VOE) invests in a basket of mid-caps that are regarded as value stocks – in other words, stocks that trade at a lower price despite having robust fundamentals like a healthy dividend payout history, and consistently strong earnings and revenue growth. Typically, people like to chase growth stocks because the concept of “growth” is connected with “multi-bagging” stocks, making it exciting for the investors. Value stocks, on the other hand, are passed over – even those with high dividend yield and low Price/Earnings ratio – because they are perceived to be old-fashioned and non-growth businesses.

VOE latches on to value stocks and manages its assets at a very low expense ratio of 0.07%. Here is my take on the ETF’s investable quotient:

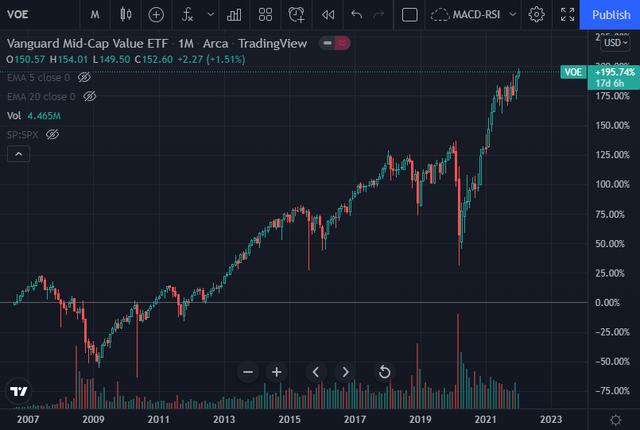

Price Momentum

Since its inception in 2006 and January 2020 (15 years), which represents the pre-COVID-19 era, the ETF’s price gained just 127% (single-digit growth every year on a simple average basis). However, in the last 12 months, VOE’s price gained a whopping 23% because investors were all over the place – pushing up the ETF’s price gain from its inception to January 2022 (16 years) to 196%. However, I believe that this price gain of the last 12 months is a one-off.

VOE’s price momentum implies that the ETF’s price appreciates at a rather slow pace annually over the long term. This kind of moderate appreciation is expected of value stocks, and therefore attractiveness of such stocks lies in their dividend payout. Let us check if VOE fulfills the expectation on the dividend yield front.

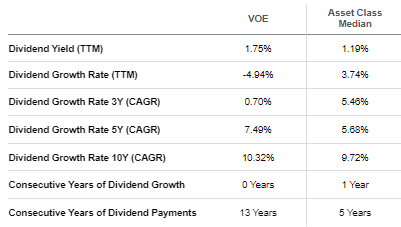

Dividend Yield

SeekingAlpha

For an ETF that invests in value stocks, VOE’s TTM dividend fares poorly at 1.75%. The only silver lining is that VOE pays dividends consistently and has been paying them consecutively for the last 13 years. Given that its TTM dividend growth rate is a negative 4.74%, I believe that its forward dividend yield will hover between 1.675% and 1.75%. This is almost equal to the current 10-Year Treasury rate, which is all set to rise this year.

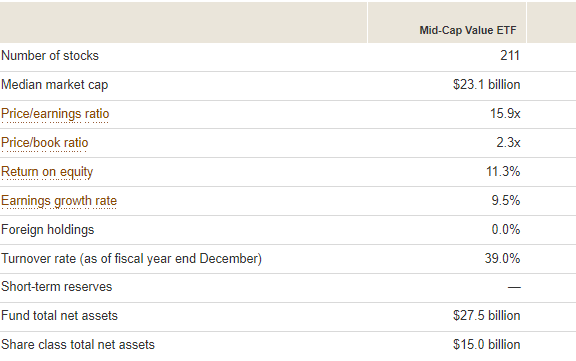

Portfolio Analysis

Vanguard

VOE’s portfolio truly looks like a high-value one. An average Price/Earnings ratio of 15.90 and an average Price/Book ratio of 2.3 suggest that its portfolio is underpriced. As of November 30, 2021, the ETF had invested its assets in 211 stocks, with 10.90% of its assets invested in its top 10 holdings.

The ETF’s managers flip 39% of its holdings every year. Though VOE is tagged high (5/5) on its risk meter, its long-term price data reveal that the ETF’s price appreciates at a low rate.

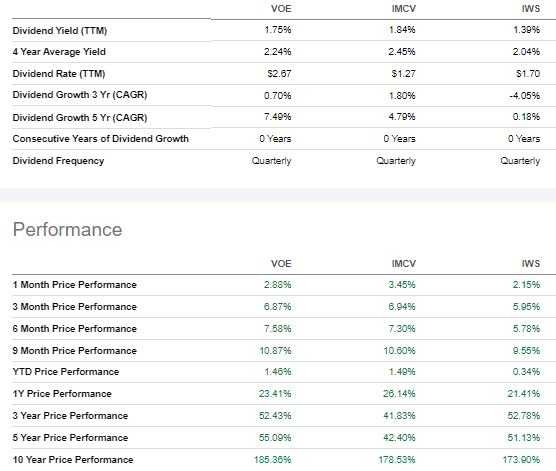

Peer Comparison

SeekingAlpha

A comparison of VOE’s dividend yield and price momentum with those of its peers, the iShares Morningstar Mid-Cap Value ETF (IMCV) and iShares Russell Mid-Cap Value ETF (IWS), reveals the following:

- IMCV has lagged behind VOE and IWS in the 3–5 years price momentum shootout. Both VOE and IWS have performed at par in this period.

- However, IMCV has performed at par with its peers in the 10-year price momentum comparison.

- VOE’s price has gained the most in the last 10 years.

- VOE’s TTM dividend yield is slightly lower than IMCV’s and moderately higher than IWS’s.

There is really no takeaway about VOE from a peer comparison.

Summing Up

Typically, ETFs that invest in value stocks are preferred by income investors. However, VOE’s TTM dividend yield is just about at par with the 10-year Treasury rate, which makes it unattractive for income investors.

Data suggest that the ETF’s price grows at a low annual rate over the long run. That makes it a no-no for growth investors too.

The ETF makes the cut only for a rare class of investors – long-term investors who are okay with earning moderate combined returns (price gains plus dividend yield), with the majority of returns being delivered by price gains.

As VOE does not check all my value stocks investment boxes, I’ll go with a neutral rating.

Anticipate Crashes, Corrections, and Bear Markets

Anticipate Crashes, Corrections, and Bear Markets

Sometimes, you might not realize your biggest portfolio risks until it’s too late.

That’s why it’s important to pay attention to the right market data, analysis, and insights on a daily basis. Being a passive investor puts you at unnecessary risk. When you stay informed on key signals and indicators, you’ll take control of your financial future.

My award-winning market research gives you everything you need to know each day, so you can be ready to act when it matters most.

Click here to gain access and try the Lead-Lag Report FREE for 14 days.

Be the first to comment