Jaskaran Kooner

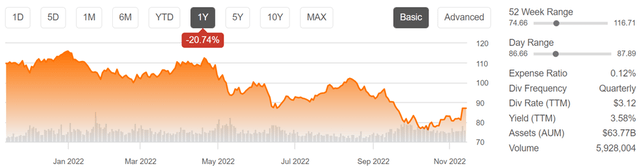

The Vanguard Real Estate ETF (NYSEARCA:VNQ) has done rather well since I visited the stock a month ago, returning 12.3%, beating the 11.2% return of the S&P 500 (SPY) over the same timeframe. Yet, it still remains relatively cheap compared to its 52-week high of $117. As shown below, VNQ’s share price has still declined by 21% over the past year. In this article, I highlight the merits of owning VNQ for automatic diversification and growth, so let’s get started.

Why VNQ?

VNQ is an exchange traded fund from Vanguard, arguably the gold standard of asset managers. Unlike other brokerages, Vanguard does not have shareholders, and is owned by the investors in its mutual funds. It uses its profits to lower fees that it charges shareholders. As one would expect, VNQ charges a low 0.12% expense ratio, sitting well below the 0.45% ETF sector median.

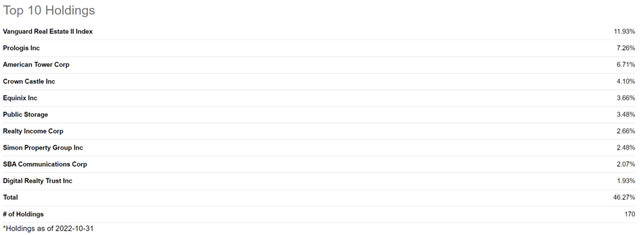

VNQ carries a number of familiar names among its top 10 individual holdings, including the logistics juggernaut Prologis (PLD), communications giants American Tower Corp. (AMT), Crown Castle Inc. (CCI), and SBA Communications (SBAC), as well as the “monthly dividend company” Realty Income Corp. (O) and the biggest retail REIT, Simon Property Group (SPG). As shown below, VNQ’s top 10 holdings comprise nearly half (46%) of the portfolio total.

VNQ Top 10 Holdings (Seeking Alpha)

While VNQ remains relatively cheap compared to its 52-week high, REIT earnings belie this weakness with strong earnings results and dividend raises. This was noted by Hoya Capital in a recent article a few days ago.

REIT earnings season was surprisingly strong across nearly all property sectors. Among the 90 REITs that have provided full-year Funds From Operations (“FFO”) guidance, 58 REITs (64%) raised their outlook while just 14 REITs (16%) have lowered or withdrawn their outlook. Strong results from REITs come amid an otherwise disappointing earnings season for the broader equity market as, per FactSet, just 48% of S&P 500 companies boosted their outlook.

Earnings results from Shopping Center, Industrial, and Net Lease REITs were most impressive – accounting for exactly half of the 58 guidance hikes. Residential and technology REIT results were more hit-and-miss – accounting for half of the 14 downward guidance revisions. Notably, during REIT season running from October 17 through yesterday’s close on November 9, the Equity REIT Index outperformed the broader S&P 500 by nearly 10 percentage points while the Mortgage REIT Index outperformed by over 15 percentage points.

While plenty of headwinds remain for the economy, notably of which includes the recent FTX crypto exchange blow-up, and job layoffs at tech companies such as Meta Platforms (META), I believe real estate remains one of the relatively safer places to be. This is also considering positive signs from the October inflation report, which showed that a moderate 7.7% increase in consumer prices compared to last year, sitting below the levels seen in the prior months. This all bodes well for the real estate industry and the potential for a moderating of interest rate increases by the Federal Reserve.

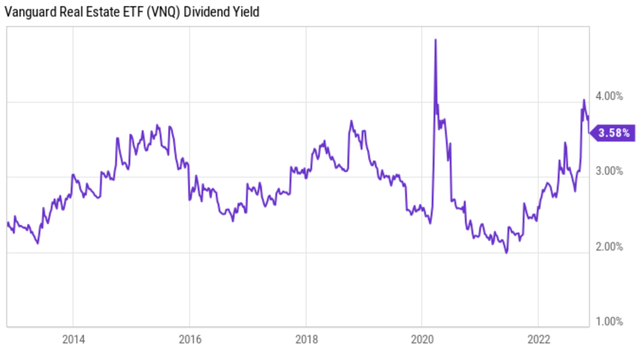

Meanwhile, VNQ carries many sleep-well-at-night attributes, given its mix of both faster-growing industrial REITs, high dividend retail REITs, and middle of the road stable and reliable net lease REITs. Many REITs still remain undervalued compared to their historical norms, and this is reflected in VNQ’s price and dividend yield. As shown below, VNQ’s dividend yield of 3.6% sits at the high end of its 10-year range.

Investor Takeaway

Income investors would be well served by taking a closer look at VNQ, as it offers automatic diversification and exposure to a mix of high-growing, high-yielding, and stable segments of the REIT universe. With a low expense ratio and a historically high dividend yield, I view VNQ as being an attractive option for long-term growth and income.

Be the first to comment