Smileus/iStock via Getty Images VMBreakouts.com

Introduction

The Top Dividend Growth stock model expands on my doctoral research analysis on multiple discriminant analysis (MDA) adding new complexities with these top picks. Research shows that the highest frequency of large price breakout moves is found among small cap stocks with low trading volumes offering no dividends and delivering higher than average risk levels.

The challenge with the Top Dividend & Growth model is to deliver a combination toward optimal total return with characteristics that typically reduce the frequency and size of price breakouts, but deliver more reliable growth factors for higher profitability longer term.

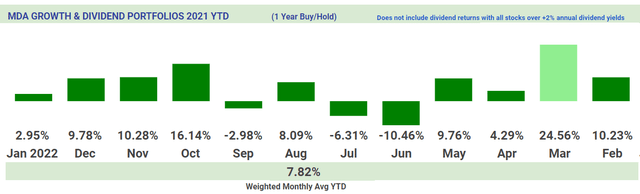

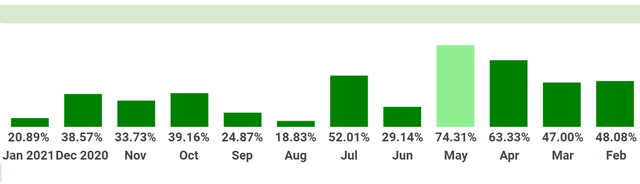

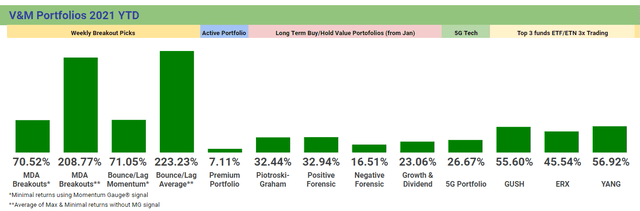

Returns to date on the MDA Growth & Dividend selection model not including large % dividends from all stocks:

VMBreakouts.com VMBreakouts.com

The 1-year return of the January 2021 portfolio reached the end of the measurement period with +21.5% annual gains (not including dividends). The 1 year January 2021 portfolio ended with 4 out of 5 stocks positive led by Ameriprise Financial (AMP) +53.4% and Toronto-Dominion Bank (TD) +39.1%.

The current January 2022 portfolio is up +2.95% leading the S&P 500 by +9.96% YTD.

Readers are free to buy/hold for the one-year measurement period of each portfolio, hold longer, or update your Growth & Dividend portfolios with newer selections. The list of top performing MDA Growth & Dividend stocks is in the table near the end of the article.

MDA Growth & Dividend Methodology

Each monthly selection portfolio consists of 5 stocks above a minimum $10 billion market cap, $2/share price, 500k average daily volume and a minimum 2% dividend yield. The population of this unique mega cap segment is approximately 330 stocks out of over 7,800 stocks across the US stock exchanges. While these stocks represent less than 5% of available stocks, their market cap exceeds $19 trillion out of the approximately $33 trillion (57.6%) of the US stock exchanges. Efforts are made to optimize total returns on the key MDA price growth factors (fundamental, technical, sentiment) for the best results under these large cap constraints with high priorities for dividend growth and dividend yield.

Top Growth & Dividend Stocks For January 2022

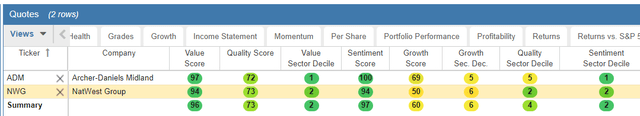

Score Overview of the Growth & Dividend Stocks for January

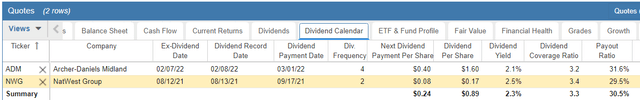

Dividend Calendar

The factors shown above are not necessarily selection variables used in the MDA analysis and dividend algorithms for growth and strong total returns. These additional financial perspectives and reports are included to enhance your investment decisions for total returns.

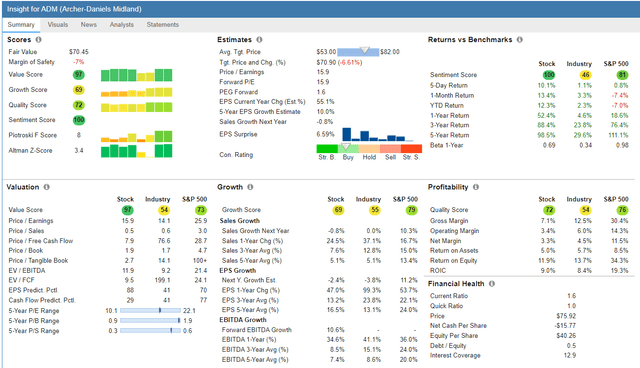

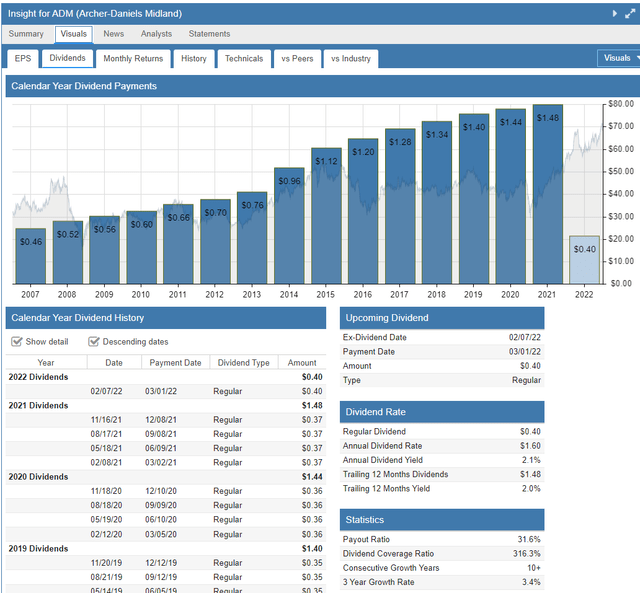

Archer-Daniels Midland

(Source: FinViz)

Archer-Daniels-Midland Company procures, transports, stores, processes, and merchandises agricultural commodities, products, and ingredients in the United States and internationally. The company operates through three segments: Ag Services and Oilseeds, Carbohydrate Solutions, and Nutrition. It procures, stores, cleans, and transports agricultural raw materials, such as oilseeds, corn, wheat, milo, oats, and barley. The company also engages in the agricultural commodity and feed product import, export, and distribution; and structured trade finance activities. In addition, it offers vegetable oils and protein meals; ingredients for the food, feed, energy, and industrial customers; crude vegetable oils, salad oils, margarine, shortening, and other food products; and partially refined oils to produce biodiesel and glycols for use in chemicals, paints, and other industrial products.

Source: Company resources

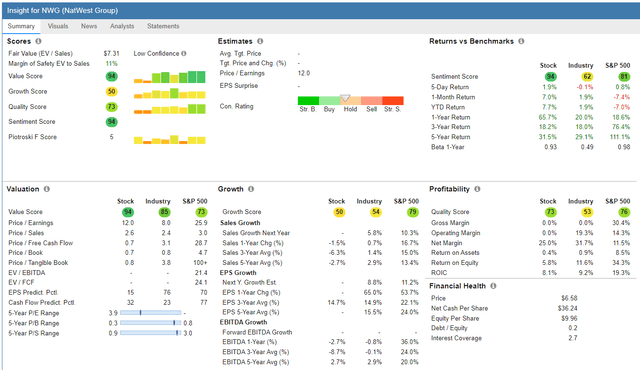

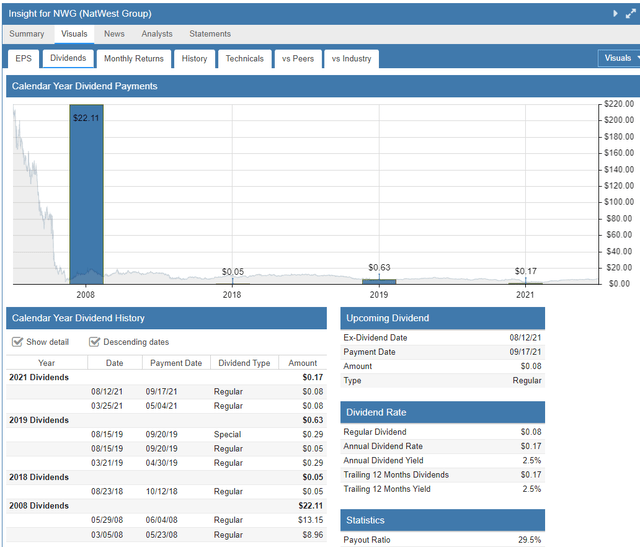

NatWest Group

(Source: FinViz)

NatWest Group plc, together with its subsidiaries, provides banking and financial products and services to personal, commercial, corporate, and institutional customers. It operates through Retail Banking, Ulster Bank RoI, Commercial Banking, Private Banking, RBS International, and NatWest Markets segments. The company’s Retail Banking segment offers a range of banking products and related financial services, such as current accounts, mortgages, personal unsecured lending, and personal deposits, as well as mobile and online banking services in the United Kingdom.

Source: Company resources

2 Additional Top Stocks from Prior Portfolios

The two additional samples below are among the strongest selections across prior portfolios with continued strong conditions and dividends for high total returns. It’s common that each set of monthly portfolio selections have a different sector composition and growth story based on events at that time.

For example, the October dividend portfolio is heavily weighted toward financials and energy, while the February selections were primarily consumer defensive/food production stocks. The inflationary trade supports further gains in financial and energy stocks through 2022.

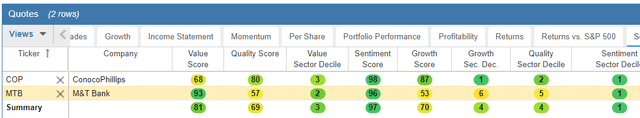

- ConocoPhillips (COP) is up +111.9% from the May 2020 portfolio and continuing to setup for breakouts to all time highs.

- M&T Bank Corporation (MTB) is up +66.1% from the Nov 2020 portfolio setting up for continued breakout conditions.

(Source: StockRover)

ConocoPhillips – daily chart

M&T Bank Corporation

Prior Long-Term Gainers to Consider

This section is a brief review of strong prior selections that have delivered on the long term growth forecasts. These prior portfolios are available in the list of published articles. From the start of the year across all the long term Growth & Dividend MDA selections, the following stocks have significantly outperformed on price alone, not including dividends. Year end performance returns are linked here:

| Symbol | Company Name | Price | Return from Selection |

| (KLAC) | KLA Corp | 366.65 | 155.08% |

| (INFY) | Infosys Ltd ADR | 22.66 | 145.50% |

| (TSM) | Taiwan Semiconductor Mfg. Co. Ltd. | 117.61 | 118.44% |

| (AMP) | Ameriprise Financial, Inc. | 298.09 | 112.82% |

| COP | ConocoPhillips | 89.22 | 111.92% |

| (HPQ) | HP Inc | 36.30 | 108.26% |

| (UMC) | United Microelectronics Corp | 9.29 | 93.95% |

*Returns to date on the MDA Growth & Dividend selection model do not include large dividends from each stock:

Conclusion

These stocks continue a live forward-testing of the breakout selection algorithms from my doctoral research applied to large cap, strong dividend growth stocks. None of the returns listed above include the high dividend yields as part of the performance and would further increase total returns for each stock. These monthly top Growth & Dividend stocks are intended to deliver excellent long-term total return strategies leveraging key factors in the MDA breakout models used in the small cap weekly breakout selections.

Nearly all the portfolio types are beating the S&P 500 for 2022. Leading portfolios are Piotroski-Graham +5.82%, Negative Forensic -1.84%, Growth & Dividend +2.95%, Premium Portfolio +1.55%, and the new active ETF portfolio +22.12%. The final 2021 returns for the different portfolio models from January of last year are shown below.

All the very best to you!

JD Henning, PhD, MBA, CFE, CAMS

Be the first to comment