JHVEPhoto

The Invesco High Income Trust II (NYSE:VLT) is a closed-end fund (“CEF”) aimed at providing high current income from a portfolio of junk bonds. Although VLT has a high current yield of 10.9%, its distribution is not fully funded from investment income and total returns. Comparing the VLT to peer junk bond-focused CEFs, the VLT scores poorly on many metrics. I would avoid the VLT.

Fund Overview

The Invesco High Income Trust II is a closed-end fund that aims to deliver high current income through investments in a diversified portfolio of non-investment grade (“junk”) bonds. The VLT fund is small, with only $77 million in net assets. The VLT fund charges a 1.55% expense ratio.

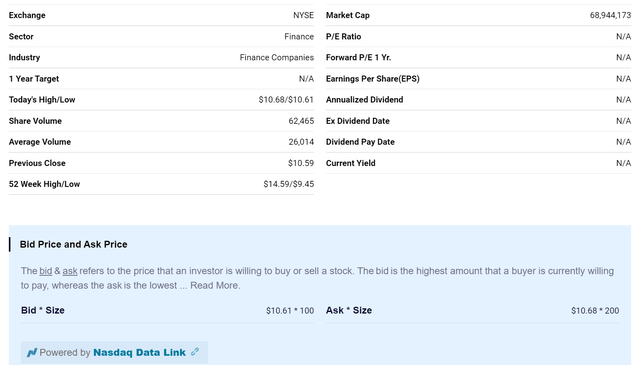

Investors should be careful with smaller funds, as their trading liquidity is lower, with wider bid/ask spreads. The VLT fund trades an average of 26,000 shares per day or ~$280,000 (Figure 1).

Figure 1 – VLT has poor trading liquidity (nasdaq.com)

Portfolio Holdings

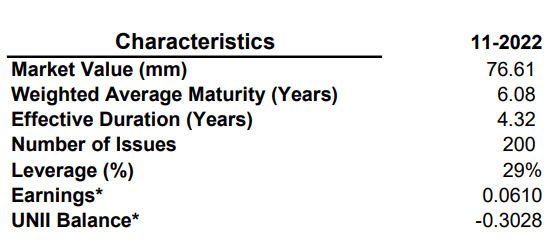

The VLT fund contains 200 positions, with an effective duration of 4.3 years as of November 30, 2022 (Figure 2).

Figure 2 – VLT fund characteristics (VLT November 2022 factsheet)

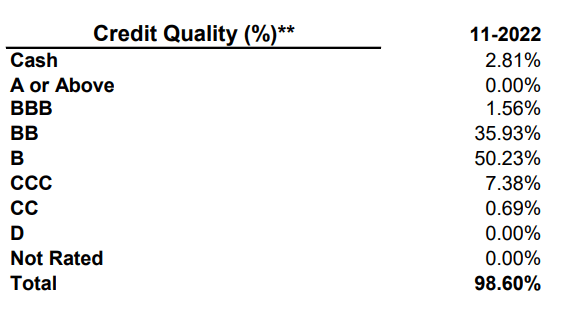

Figure 3 shows the VLT fund’s credit allocation. 36% of the fund is rated BB, 50% is B, and 8% is rated CCC or below.

Figure 3 – VLT fund credit allocation (VLT November 2022 factsheet)

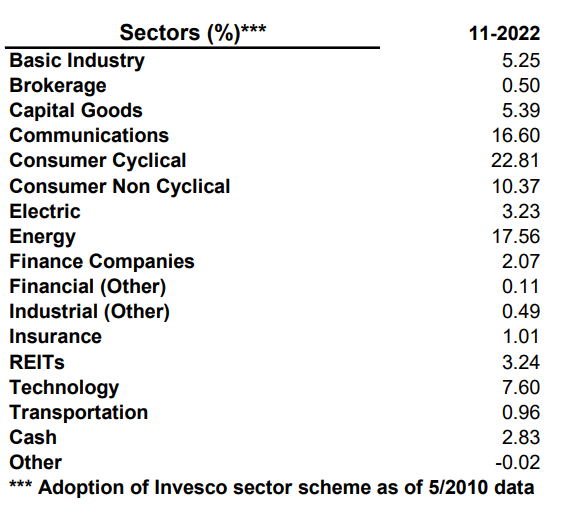

The VLT fund is broadly diversified in terms of sector allocation, with the largest sector weight being Consumer Cyclicals at 23%, Energy at 18%, and Communications at 17% (Figure 4).

Figure 4 – VLT fund sector allocation (VLT November 2022 factsheet)

Returns

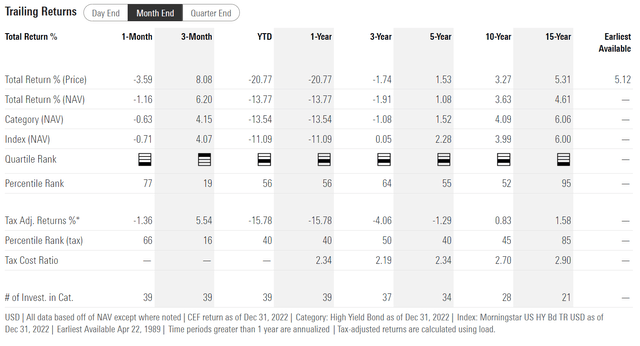

Figure 5 shows the VLT’s historical returns. Medium to long-term average returns are mediocre for the VLT, with 3/5/10/15Yr average annual returns of -1.9%/1.1%/3.6%/4.6% respectively to December 31, 2022.

Figure 5 – VLT historical returns (morningstar.com)

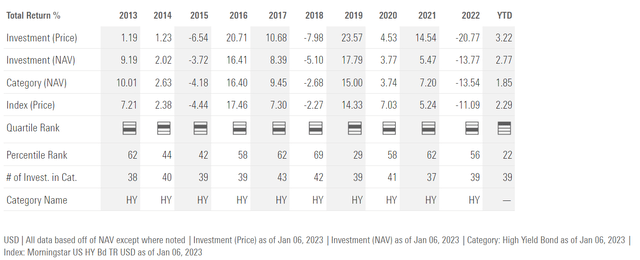

Annually, we can see 2022 was the worst performance of the VLT fund in the past decade. Annual returns have ranged from a high of 17.8% in 2019 to a low of -13.8% in 2022 (Figure 6).

Figure 6 – VLT annual returns (morningstar.com)

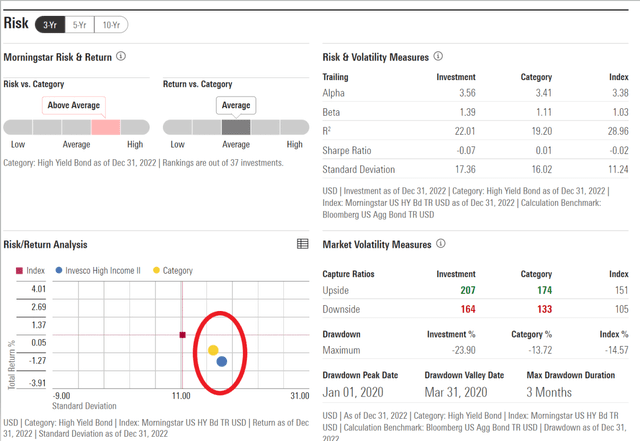

Morningstar categorizes the VLT in the High Yield Bond category and shows VLT having lower returns and higher volatility than peers (Figure 7).

Figure 7 – VLT risk metrics (morningstar.com)

Distribution & Yield

The VLT fund pays a monthly distribution of $0.0964, or $1.16 annualized. The current yield on VLT is 10.9% on market price or 9.7% of NAV. VLT’s distribution is paid according to a ‘Managed Distribution Plan’ that was last amended to a fixed monthly distribution rate of 8.5% of the closing market price as of August 1, 2018.

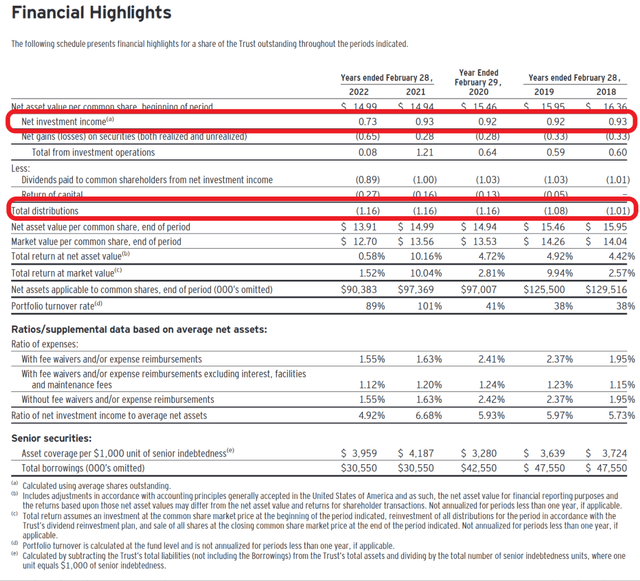

Investors should note that VLT has not ‘earned’ its distribution, as distributions have been consistently higher than the net investment income (“NII”) of the fund (Figure 8).

Figure 8 – VLT financial summary (VLT 2022 annual report)

This creates a situation where the (earnings – distribution) shortfall is funded from capital gains and/or return of capital (“ROC”), from an accounting standpoint. Funds that consistently underearn their distributions are called ‘return of principal’ funds from an economic point of view.

“Return of principal” funds are poor long-term investments, as the fund’s NAV is paid back to investors as yield and reduces the income-earning assets of the fund, making future distributions harder to maintain. This creates a negative spiral, decreasing NAV and distributions in the long run.

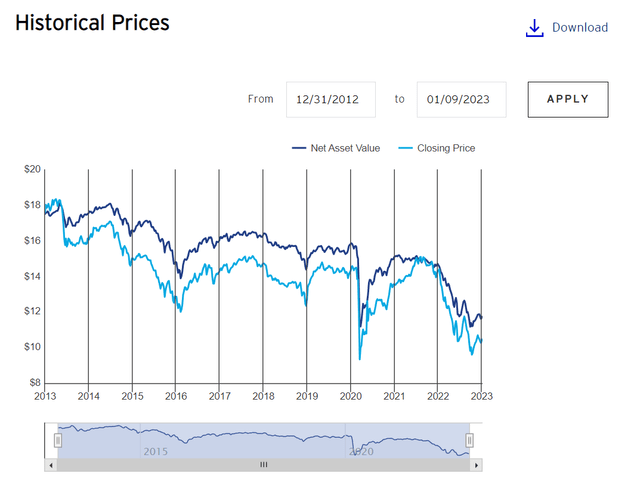

Over the past decade, VLT’s NAV has shrunk from $17.42 at the end of 2012 to $11.88 currently, or a -3.8% CAGR (Figure 9).

Figure 9 – VLT’s NAV has declined at a 3.8% CAGR over past decade (invesco.com)

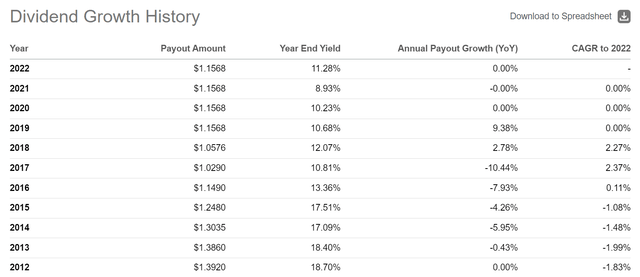

Similarly, the VLT fund’s distribution has declined from $1.39 annually to $1.16 in 2022, or a -1.8% CAGR (Figure 10).

Figure 10 – VLT distributions have shrunk at 1.8% CAGR (Seeking Alpha)

Long-term investors in VLT have lost both principal (from NAV declines) and income (from distribution declines).

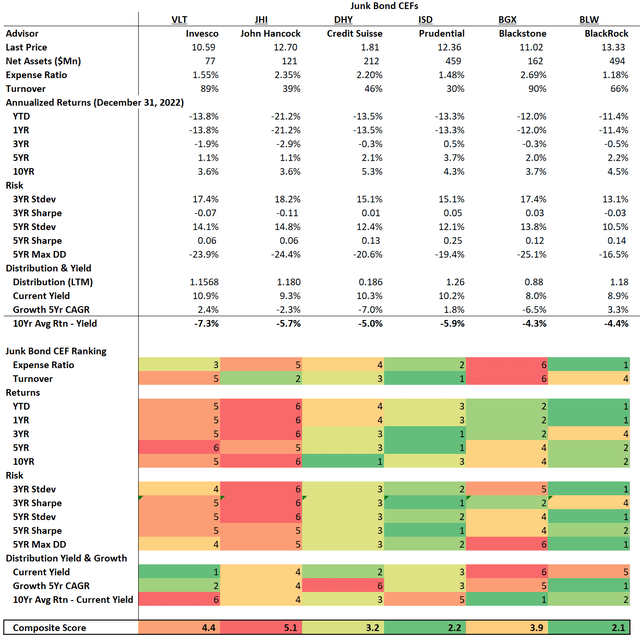

VLT vs. Peers

Comparing the VLT fund to its peer group of junk bond-focused CEFs, we can see that the VLT fund has poor annualized historical performance and risk metrics. It does, however, have the highest current yield. Readers should note that VLT’s yield is massively underfunded, as measured by the difference between the 10Yr average annual return and the current yield (Figure 11).

Figure 11 – VLT vs. peers (Author created with return and risk metrics from Morningstar and fund details and distribution from Seeking Alpha)

Overall, the VLT fund scores poorly against its peers.

Conclusion

The Invesco High Income Trust II fund aims to provide high current income through a portfolio of junk bonds. Although Invesco High Income Trust II has a high current yield of 10.9%, the distribution is not fully funded from investment income and total returns. Comparing the VLT to peer junk bond-focused CEFs, the VLT scores poorly on many metrics. I would avoid Invesco High Income Trust II.

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

Be the first to comment