krblokhin/iStock via Getty Images

When it comes to analyzing a company’s prospects, it’s necessary to look at how the firm has performed in the past. Often, this can give us some idea as to what the future might hold. At the same time, however, this approach does have its limitations, such as the fact that it can ignore big changes that the company might be going through that could have a material impact on operations moving forward. One wonderful example of this can be seen by looking at Vital Farms (NASDAQ:VITL), a niche business that generates most of its revenue from the sale of pasture-raised eggs. If you were to value the company based solely on historical data, the stock would look drastically overpriced. But management did work on a rather extensive expansion project that has the potential to drastically improve revenue. Although that expansion is now completed, one interesting thing is that we have not seen a material impact on the company’s results that would indicate significant operating capacity has been reached. If this picture does not change before too long, then the expansion could end up not being worth much at all.

Assessing updated performance

On September 1st of this year, I published an article that took a rather neutral stance on Vital Farms. In that article, I found myself impressed by the company’s growth over the prior few years. But I was not impressed by the trajectory of its profitability that had largely remained in a fairly narrow range during that time. Despite achieving rapid topline growth, the company had looked very expensive, making it difficult to justify the price as it stood. What I found, upon digging deeper though, was that investors were likely making a bet not on how the company had been performing, but instead on a rather significant catalyst that management had been pumping up. This led me to conclude that if the company could achieve the kind of growth it was forecasting, that shares very well could warrant the price that they were trading for. And as a result, I ended up rating the enterprise a ‘hold’. Since then, shares have drastically outperformed my own expectations, with the stock up 8.4% compared to the 1.5% increase experienced by the S&P 500 over the same window of time.

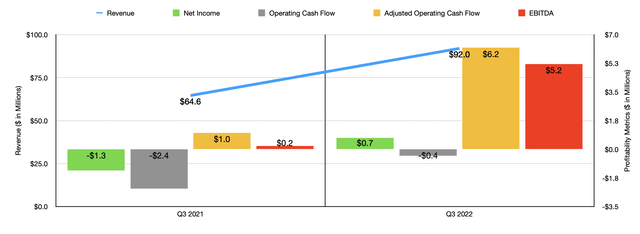

The catalyst in question involved an expansion project management was undergoing at its Egg Central Station egg washing and packing facility in Missouri. That project, originally announced in May of this year, was forecasted to increase the company’s annual revenue by over $300 million. Capable of processing six million eggs per day, this 153,000-square-foot facility would help the company generate over $650 million in revenue per year. Fast-forward to today, though, and we aren’t seeing much in the way of growth. For instance, during the third quarter of the company’s 2022 fiscal year, sales came in at $92 million. That’s 42.4% higher than the $64.6 million generated in the third quarter of 2021. While this growth is definitely impressive, it’s not enough to claim that the expansion project is at full capacity. The only thing management has said is that the expanded plant is now fully operational. But we don’t know exactly what timing this was achieved in and how much that impacted sales during the latest quarter.

On the bottom line, the picture remains as uninspiring as ever. The company went from generating a net loss of $1.3 million in the third quarter of 2021 to generating a profit of only $0.7 million the same time this year. Operating cash flow went from negative $2.4 million to negative $0.4 million. Perhaps the only metrics that came in rather strong were the adjusted operating cash flow and EBITDA ones. The former, which ignores changes in working capital, grew from $1 million last year to $6.2 million this year. Meanwhile, EBITDA increased from $0.2 million to $5.2 million.

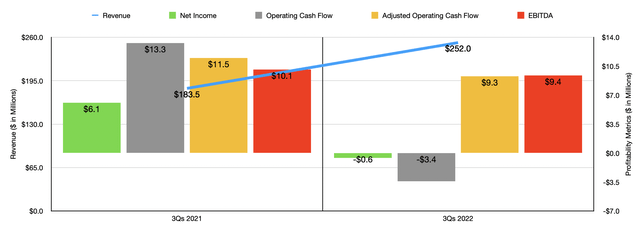

For the first nine months of the 2022 fiscal year as a whole, sales of $252 million do beat out the $183.5 million reported the same time last year. But even so, profit figures look rather disappointing. Net income has gone from a positive $6.1 million to a negative $0.6 million. Operating cash flow went from $13.3 million to negative $3.4 million, while the adjusted figure declined from $11.5 million to $9.3 million. Even EBITDA took a hit, dipping from $10.1 million to $9.4 million.

It is entirely possible that the timing of the completion of the aforementioned expansion is key, it could mean that we need to wait until the fourth quarter to see the magic in action. But this doesn’t seem likely either. At present, management is forecasting revenue of at least $340 million for the 2022 fiscal year in its entirety. This would be over 30% higher than what the company achieved last year. But even if the low end comes to fruition, it would imply sales of only $88 million in the final quarter of the year, up modestly from the $77.4 million generated the same time last year. To be fair, analysts are currently anticipating something a little more impressive, with sales forecasted to hit $96.1 million for the quarter. But that still would not be at a level high enough to indicate that the plant is at full capacity or close to it.

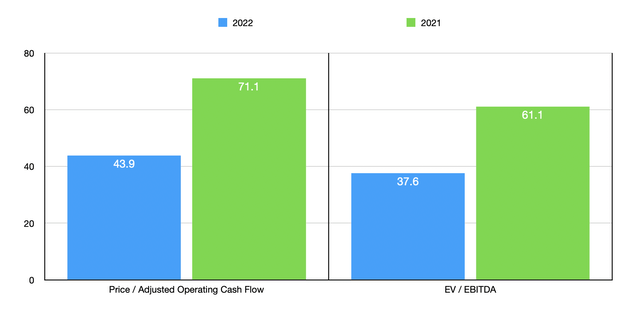

Also, for the 2022 fiscal year as a whole, management is forecasting EBITDA of $13 million. That would imply a 62% increase over what the company achieved last year. If adjusted operating cash flow sees a similar increase, then it should come in at around $13.1 million for the year. Given these numbers, we would see that the company is trading at a forward price to adjusted operating cash flow multiple of 43.9 and at a forward EV to EBITDA multiple of 37.6. By comparison, the multiples using the data from 2021 would be 71.1 and 61.1, respectively. I did compare the company to five similar firms. On a price to operating cash flow basis, these firms ranged from a low of 6.1 to a high of 40.4. In this case, Vital Farms was the most expensive of the group. Meanwhile, using the EV to EBITDA approach, we end up with a range of between 10.1 and 100.4. This would result in three of the five companies being cheaper than our prospect.

| Company | Price/Operating Cash Flow | EV/EBITDA |

| Vital Farms | 43.9 | 37.6 |

| SunOpta (STKL) | 20.5 | 45.8 |

| Mission Produce (AVO) | 40.4 | 21.0 |

| Calavo Growers (CVGW) | 14.8 | 100.4 |

| Whole Earth Brands (FREE) | 23.4 | 10.1 |

| Dole plc (DOLE) | 6.1 | 10.9 |

Takeaway

I do believe that Vital Farms has the production capacity to really be worth what it’s trading for today. But so far, we aren’t seeing that capacity in action. Without it, shares of the enterprise look drastically overvalued and would otherwise warrant a ‘sell’ rating. Of course, I am giving the company some additional time to prove that they only need to ramp up this capacity and put more of their product on the market. But if something doesn’t change before too long, investors would be wise to approach the company very cautiously.

Be the first to comment