miljko/E+ via Getty Images

What’s the best plays in the market? Is it the high growth tech stocks that are terribly difficult to understand? Or the “Tesla” duplicates that keep popping up? While these sometimes result in unimaginable gains, I believe finding the “needle in a haystack” is a losing game.

Instead, finding easy to understand, fundamentally sound companies with strong competitive advantages and long term strategies are far more appealing for a rational investor’s portfolio. One company truly stands out; Vista Outdoor (NYSE:VSTO).

The Company With 39 Renowned Brands

Vista manages its 39 brands by separating them into two segments: Sporting Products and Outdoor Products.

Its Sporting Products segment designs, distributes and manufactures ammunition, primers and related equipment for hunters, recreational shooters, federal and local law enforcement and the military.

Now, there’s a lot of ammunition makers globally, each boasting its own competitive advantages and unique attributes that allow them to stand out. So how is Vista’s sporting products segment positioned within the industry?

Well, “Federal” is market leader in premium ammunition, “CCI” is the leader in rimfire, “Speer” is the number 1 brand in law enforcement and “HEVI-shot” is the leader in non-lead shot-shells. There’s one more, but I doubt it really needs an introduction. “Remington”, the renowned big game hunting and rifle maker is also number one in its particular market (not surprising). Combined, Vista is the market leader in both commercial ammunition and U.S. law enforcement ammunition.

The other segment, Outdoor Products, designs, distributes and manufactures gear and equipment for hunters, hikers, campers, cyclists, skiers, snowboarders golfers and others. Under this umbrella, the story is not much different.

“Bushnell” is market leader in GPS and rangefinders (golfing), “CamelBak” leads bike/hike hydration packs and Tritan/bike bottles, “Bell” leads helmets and accessories and is second in snow goggles and “Camp Chef” is number two in camp stoves.

Amazon

Vista’s got some great brands, each uniquely holding its own in its respective markets and is evidently paying off. But why invest?

Well, like you, I thought the same thing. However, when one views the company’s strategic plan and long term goals, it’s hard not to get excited for the road-map ahead.

The Strategic Plan

The company has laid out a “Financial Improvement Plan” seen in the image below.

Financial Improvement Plan (Vista Outdoors)

Where 2018-2019 was stabilizing the company’s financial positioning through improving profitability and reducing leverage, 2020 and 2021 was all about operational efficiency. 2022 is the beginning of what the company can only imply as a foundational framework put in place for organic and strategic growth. However, for this to happen, the second tier would have had to take place. So let’s take a look how Vista has improved their operational efficiencies over the past two years by taking a look at the financials.

The Financials

Let’s start with the top line.

Revenues

The company did $2.23 billion in revenues in 2021. This is 37.3% growth over 2020. Of this, the sporting products segment represented 68% of sales and grew 28% to $1.5 billion in 2021. Management deduces this growth to improved pricing and strong demand in the market across the sporting product line (both will be discussed later).

The remaining 32% of sales came from the outdoor products segment, which grew 25% to $707 million. This was attributable to organic sales from continued growth in the markets for all categories. Management actually made the claim that this growth was independent of the store closures that occurred in the prior year. This last point is important to discuss. 37.3% growth over 2020 is obviously an outlier to its historical roughly 8%-10%. However, I will later discuss why I believe that, in conjunction with the third tier of its financial improvement plan, growth in the future could be much higher.

Operational Efficiencies

We had to discuss the top line in order to understand how each dollar of revenue is flowing into the company.

Gross Profit

Gross profit doubled from $360.3 million from 2020 to $633.7 million in 2021. On a 2019 comparison, gross profit is up 52.5% from $415 million.

EBITDA and Net Income

Adjusted EBITDA climbed to $345 million in 2021 from $114 million in 2020 and $138 million in 2019. This resulted in a 15% EBITDA margin, or a 900 basis point improvement over the prior year. To further show adjusted EBITDA on a comparative basis, 2020 had an adjusted EBITDA of 6% and 2019 7%.

Net Income for the year was $266 million, a large comeback from its last profitability in 2016.

Cash Flows and Debt

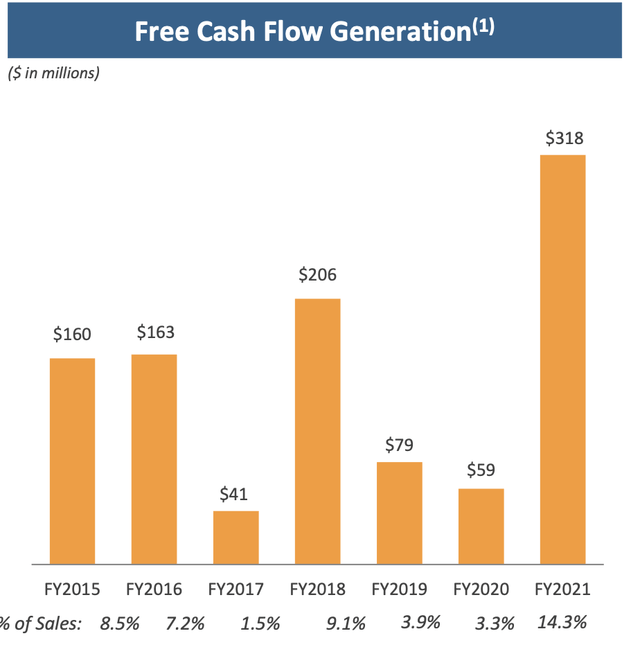

Free cash flow generation for 2021 was $318 million, or a whopping 14.3% of sales. In 2020, FCF generation was a meager 3% of sales or $59 million. This represents its largest FCF generation ever.

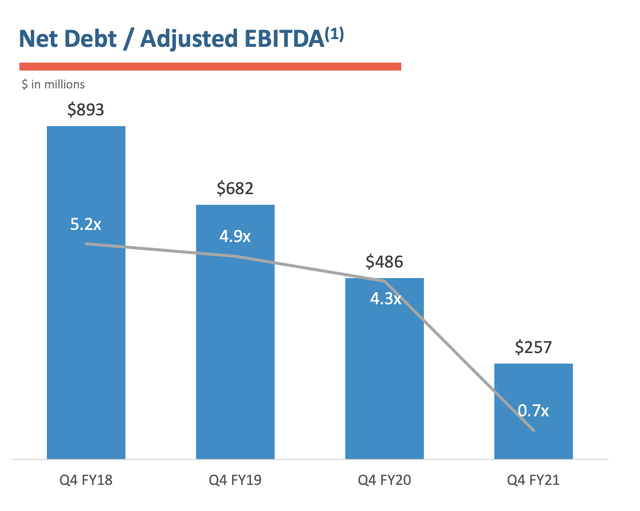

The company’s net debt/ adjusted EBITDA ratio has drastically fallen from 5.2x in Q4 2018 to 0.7x in 2021.

If you put both the increasing cashflow generation and net debt reduction into perspective, you will see that the company is quickly entering a position to deploy strategic capital employment initiatives. Something that should help guide phase 3 of the strategic financial plan.

Synergies

So what’s contributing to the operational efficiencies seen above. Well, one particular contributor is the efficiencies gained through the synergies of leveraging individual brands together. For instance, the acquisition of Remington has allowed for a lower cost of production in individual ammunition rounds. This has contributed into big savings across the sports segment of the company as a lower unit cost will result in higher margins to wholesalers and eventually retailers.

Supply Chain Efficiencies

Another contributing factor to the operational efficiencies seen through the leverage factor is through the company’s broad and deep supply chain network. Management claims this can be broken down into four (4) strengths.

-

Experience: the company has very experienced operators with a proven approach to managing their supply chain. With this, the company has utilized the strengths of each segment as a leveraging tool to increase strength across all segments. This has resulted in total annual procurement savings of $27 million in 2021.

-

Size: the sheer size of the company’s procurement network allows for it to engage in optimal pricing on its raw materials and shipping costs. In addition, its diversified vendor network allows it to mitigate its risks and reduce tariff costs. In 2021 alone, the company, following this strategy, saved nearly 30% on tariff costs.

-

Leverage: This one is highly related to the point on experience. However, it adds additional value by stating that the improvements made in the stabilization tier have allowed Vista to prepare for the growth it aims to see in the third tier. With this, the experience of the supply chain operators have solid chemistry in working together to improve speed from procurement to distribution whilst simultaneously reducing costs. In 2021, small improvements in its parcel delivery business allowed the company to drive gross margin expansion in its e-commerce segment.

-

Reliance: This strength is the newest addition to the family and has not been fully integrated, but should still be noted. Vista aims to reduce its exposure to China in the coming years, mitigating the risks attributable to the Eastern world, which at the time of writing, is becoming increasingly heightened. For 2021, it has already positioned production of one of its brand’s “CamelBak” away from Asia and into the Dominican Republic. In addition, it has secured additional ocean freights, offsetting some supply chain disruptions.

E-Commerce

The final point I will make on operational efficiency improvements relate directly to its e-commerce channel. One does not need to read into the company to understand why pursuing e-commerce and the resulting DTC channel is beneficial for a company like this. For one, e-commerce allows the company to leverage its brand onto its own network rather than rely on retailers, allowing control of what should be showcased and how. More important than this however, is the DTC channel that emerges. This channel allows Vista to control its margins, meaning that for many of its products it no longer needs to rely on retailers setting price. In a competitive landscape in which many of its brands operate, Vista Outdoor can easily compete on price, controlling the variance of its margins as it likes.

E-commerce sales as a percent of revenue grew from 13% in 2020 to 21% in 2021. Of this growth, online traffic and conversion grew by roughly 100 basis points. By 2025, the company is aiming for roughly 25%-30% of sales to be from its e-commerce platform. In a 3 phase plan, the company aims to bridge the gap between artificial intelligence and conversion among its customer base.

I would argue the company has recently exited phase 1, where it was building (quickly) its digital marketing and e-commerce ecosystem. Next, is the artificial intelligence phase. Here, the company will leverage AI to gather consumer insights and marketing, leading to more conversions. The final phase, called “Cross-Brand Enablement” will be established through loyalty programs and collaborative marketing. We already know that this company works because it leverages all of its brands to achieve operational efficiency, so I’m confident a Vista Outdoor ecosystem should prove beneficial in the long run.

Okay, we’ve now supported our point for the foundational setup for continued growth. But how will growth continue?

Sporting Products Growth

Let’s start with the Sporting goods segment.

Hunting, Tactical and Observation

Management believes the total hunting tactical and observation addressable market is roughly $3.5 billion (wholesale). Of this, $2.5 billion is highly fragmented, representing an opportunity to gain market share through innovation. The other $1 billion is under-penetrated. Over the past 24 months, there has been a favorable change in consumer trends towards this activity of which, brands like “Bushnell”, “BlackHawk” and “Primos” have benefitted. Here are some growth figures:

-

Hunting participation trends have grown roughly 8% in 2020.

-

The NICS check system registered roughly 8 million new gun owners.

-

Across Vista’s brands, there were a registered 2.4 billion impressions across its media channels and over 2 million followers.

-

On its e-commerce channels, these brands saw 50% YoY growth and 8 million unique visitors across 7 platform sites.

Taking advantage of this, the growth strategy for these products is to:

-

Innovate in the fragmented section of the market. One notable innovation in 2021 was the “ActiveSync Display”, an additional innovation to the hunting experience. Other areas the company plans to innovate on are holsters and trail cameras.

-

Develop products to enter the under-penetrated markets. Solutions in this market include hearing, tactical nylon, speakers and red dot attachments for guns.

-

The company also aims to grow this channel through training, safety and building awareness.

In terms of continued operational efficiencies, the company is continuously innovating to reduce costs while achieving these growth strategies. One efficiency recently created was eliminating full printed manuals and opted for digital ones instead. This has resulted in a reduction of over 13 million pages in 2021.

Ammunition

Vista Outdoor is the world’s ammo leader. Over the past 24 months, like our previous category, there has been a positive consumer trend towards ammunition.

According to Grand View Research, the global market for ammunition was approximately $21 billion in 2020 and is expected to grow at a CAGR of 3.6% from 2021-2028.

Many may argue that this trend will diminish over the years as heightened ammunition demand was seen during periods of unrest in 2020 throughout the world. However, as one can now tell, situations are likely worse and will stay inflated for some time. While I hope this is not true, reality usually trumps optimism.

There is a positive correlation between recessionary periods and crime. Though we are not in a recession, current trends indicate a fast changing macro environment. For one, we all know rising inflation is diminishing disposable household income. With this, a flattened wage rate and higher prices will lead to less affordability of necessary items. Desperation leads to despair. Extrapolating that idea across entire nations will lead to a slippery slope scenario. In the end, the demand for ammunition will rise.

I am sure Vista is of the same thinking, so applying strategic growth initiatives in these times is paramount for their sustainable initiative. Looking ahead, the company plans to add new business by offering consumers new/easier access to ammunition through its DTC channels, federal shops and gun clubs. Strategic partnerships have also been “popping up”. The company is now partnering with a number of gun manufacturers to complement their products. Companies like “Smith and Wesson”, ‘Benelli” and “Hellcat” are promoting Vista’s brands in incredible partnerships. Lastly, a lot of R&D is going into developing new products for this category.

Outdoor Products Growth

Growth in this segment is both possible and achievable. Across its various brands, the company is applying strategic growth initiatives to both continue its market leading positions and capture more of the overall industry growth.

CamelBak

With “CamelBak” the company is targeting consumer trends in the hydration pack and bottle categories, which has an estimated over $2 billion addressable market. With leading status in most of its categories, Vista is working on enhancing its core channel presence through continued merchandising and promotional activity and is growing alternative channels like tech fitness, coffee beer and wine bottling and custom printing. On this front, the company has already improved listings at key retailers like Walmart (WMT) and Amazon (AMZN). In addition, it has seen over 3x engagement on its media channels and 2x DTC channel growth over the past 24 months.

Bell and Giro

Bell, the leader in “biking and snow” has the number 1 market share, covering 60% of the addressable market. Giro, its complement is number one in specialty items. In 2020, the bike industry grew 65%, fueled by 145% growth in e-bikes. The big jump here for me is not the overall bike industry growth, but rather the e-bike segment. According to Mordor intelligence, the e-bike industry was valued at roughly $26 billion in 2021 and is expected to grow at a CAGR of 12.27% through 2027. This represents the most opportunistic area of growth for Bell in my opinion.

To further “beef up” this segment, the company is targeting e-bike accessories like specialized shoes and helmets.

In its other segment, the brands are continuing their growth strategy in biking and snow by licensing their products with a number of third party brands. A quick glimpse at their offerings show a number of Disney collaborations like “Frozen” and “Toy Story”. In its snow segment, it is targeting new areas like back country and alpine to capture additional growth.

In its international markets, Bell sees opportunities in the following:

1) Street market share growth (bikers), of which it only has 2% of the addressable market.

2) MX/Off Road, of which it has 35% of the market share.

Bushnell Golf

According to management, the golfing industry has an addressable market of over $8 billion. Within the industry, there is an estimated 24 million golfing enthusiasts and 9 million avid golf players. “Bushnell” is the leading brand in this market.

The EMD segment, which covers GPS, rangefinders and other technology innovative solutions for golfing, has an estimated market value of $200 million. Bushnell launched the V5 and V5 Shift, from which it gained 20% and 15% market shares respectively. In 2020, the “Wingman” became the number 1 selling GPS golf product.

In terms of future growth engines, the company aims to increase its international offering with its GPS products and improve its adjacent categories by expansion.

The market for golf is growing, and with market leading positions, I’m sure Bushnell will continue to capture a lot of that growth.

Venor and QuietKat

It’s worth mentioning two fast growing parallels to existing markets that Vista is pursuing. The first is a female-inspired hunting brand called Venor. According to an article by Anchorage Daily News, there were an estimated 1.1 million female hunters in 2019, 10% of the hunting population. It’s interesting to see Vista pursue niche markets like this, especially when there’s substantial room for market growth.

Another parallel is QuietKat, the leading rugged e-bike brand in the overloading category. With the already mentioned CAGR of over 12% in the e-bike industry, it is no surprise that all-terrain e-bike markets will arise. Similar to Venor, this strategy of chasing parallels is becoming more active with Vista to acquire further organic growth.

Overall Market

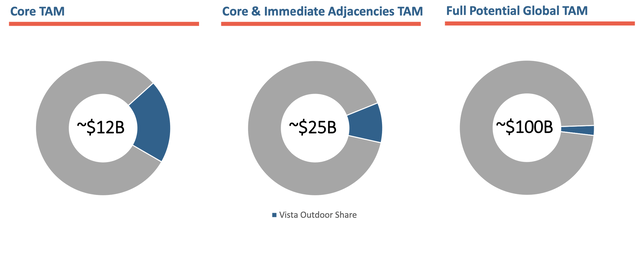

We have now touched on the broader two segments and the leading subcategories within each. I will provide a quick snapchat of the total addressable market (TAM) for Vista Outdoor below.

In terms of its core TAM (includes only the core markets it participates in) Vista has a substantially small market share of the $12 billion addressable market (less than 25%). However, when we begin to include our previous discussions, the TAM can grow to over $100 billion. Remember, I’ve only touched on a few major categories. So when combined together, the potential is effortlessly limitless.

Not to mention all the points we previously discussed were based on organic growth through existing brands. 2020 has allowed Vista to solidify its balance sheet by reducing its leverage and increasing its FCF, opening it up for opportunistic, but strategic acquisitions like Remington. Even if organic growth doesn’t get Vista to these levels, I’m certain acquisitions would give it the boost.

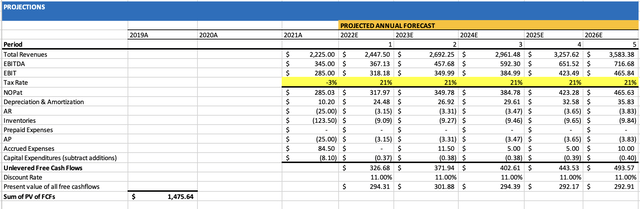

Valuation

I decided to stick with management’s estimates for some of my analysis. For instance, management expects 10%+ growth for the next 3 years. I have since made the claim that this growth will continue at 10% for my other 2 years in the analysis due to continued organic and acquired growth.

I have grown EBITDA margin from 15% in 2022 to 20% in 2025, in line with management’s estimates and kept it there. This will be due to continued operational efficiency improvements from the points discussed in the financials section. In addition, I have kept the EBIT margin steady at 13%.

I have reduced debt between 5% and 10% through the proceeding years to reflect the fact that the company will slow debt reduction to fuel expansion. In other words, the continued cash flow generation will go more towards growth than debt reduction.

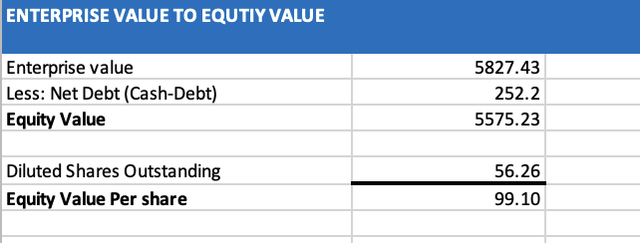

Altogether, I ended with an equity value of $5.5 billion, which when divided by its small flat leaves an equity value per share of $99.10. This represents significant upside from current levels and an honorable margin of safety.

Bottom Line

Now, I could be wrong about all my projections. Especially revenue growth. After all, before 2020, the company was experiencing significant downfalls. However, I believe the pandemic solidified its strategic plan, heightening all aspects of its business in order to capitalize on future sustainable growth. Is it possible that the current trends diminish and people stop using Vista Outdoor’s products? Of course it is! Is it likely? No, it’s not. I try not to be too optimistic, but I really don’t see people coming out of the homes after two years in a pandemic and getting bored of the outdoors. I actually believe it reignited that passion and brought many more onboard.

With a foundational framework in place, excellent execution of operational efficiencies and a plan to move forward, I think it’s time to invest in the outdoors.

Be the first to comment