Scharfsinn86/iStock via Getty Images

I want to be a bear on Vista Outdoor (NYSE:VSTO) stock but I can’t. Let me explain. For all practical purposes, it appears a recession is essentially a forgone conclusion. At least that’s what many people incentivized to freak you into action want you to believe. But when it comes to many consumer discretionary oriented stocks (and anything housing related), the fears of a recession have already weighed heavily on valuation multiples. In fact, many of the stocks I follow were already trading around 4-5x forward earnings reflecting, in my estimation, a massive deterioration in revenues/operating margins as these earnings multiples are generally among 5 to 10 year low multiples – depending on the specific name. At less than 4.5x forward earnings, Vista Outdoor fits cleanly into this camp.

Best I can tell, any company that experienced an outsized benefit in revenue growth, and operating margins, during the pandemic has been lumped into a metaphorical bucket of fear that outsized demand is more attributable to a “pull forward” in demand vs. structural growth in demand. And in essence, now that we are moving forward from the pandemic and fuel prices are high, and interest rates are moving up, and general inflation is rampant… the current expectations for the bulk of the companies in this bucket appear to be calling for a massive deterioration in fundamentals over the coming 6-18 months. And while the temptation to join the bear bandwagon is certainly palpable, I just can’t bring myself to be a bear on VSTO for a myriad of reasons.

VSTO may be one company but it operates in two different segments – one of which is strategically positioned to crush it for a lot longer than many people realize

It’s best to think about VSTO in the two operating segments in which they now report, Sporting Products (read: ammunition) and Outdoor Products (read: all other things of awesomeness and fun besides ammunition). While both segments supply goods in the outdoor activities and hobbies space, etc., the two segments operate from fairly different competitive positions.

Sporting Products

In my opinion, Sporting Products operates in an increasingly specialized industry that could be characterized by stout underlying demand coupled with a supply landscape – landscape more likely than not to become increasingly restrictive over time. This industry segment is also characterized by relatively fast revenue growth with over 8MM new gun owners emerging over the course of the past two years driving Sporting Products revenue growth north of 60% year over year, and strong pricing power which translated to higher margins (both shown in the table below) and a significant shortage in ammunition as manufacturers like VSTO try to keep up. Personally, I have not seen any signs pointing to a change in this dynamic. Case in point, when I was out on the clay range last week, the folks in the clubhouse mentioned that they have not received 20 gauge ammunition supply in over 8 months. So naturally, I asked about 28 gauge and they chuckled. So while this is an N = 1 case, take a look at the comments in my last post on VSTO and you will see several other folks who have their own N = 1 experiences with the shortage first hand. Mr. Metz, CEO of VSTO, also described the tightness across the market as he was describing the multi-faceted surge in demand across the spectrum of calibers during the investor conference with UBS.

Outdoor Products

By contrast, the Outdoor Products segment in my opinion is characterized by growing demand (albeit less eye popping than Sporting Products), but I believe operates in a more competitive landscape in the sense that there are far fewer barriers to entry in terms of new competitors coming into the scene with innovative products. Meaning, VSTO brands in some sense have to remain on their toes, driving innovation to remain relevant and grow in the marketplace. Why do I believe this segment is more competitive than Sporting Products? First of all, I do occasionally indulge in “allow myself to get influenced” purchases on Instagram, and there is never a shortage of new goodies to consider for outdoor widgets, or things that I just have to have. Like a new hands-free leash for my dog. Additionally, if you listen to the conference conversation with UBS, the CEO talks about ever emerging competition from <$100MM dollar companies with the newest widget. And empirically, I believe it is true that strong margins within highly competitive industries struggle to persist as competition competes the margins away particularly when there are relatively few barriers to entry.

Transitioning to Some Numbers:

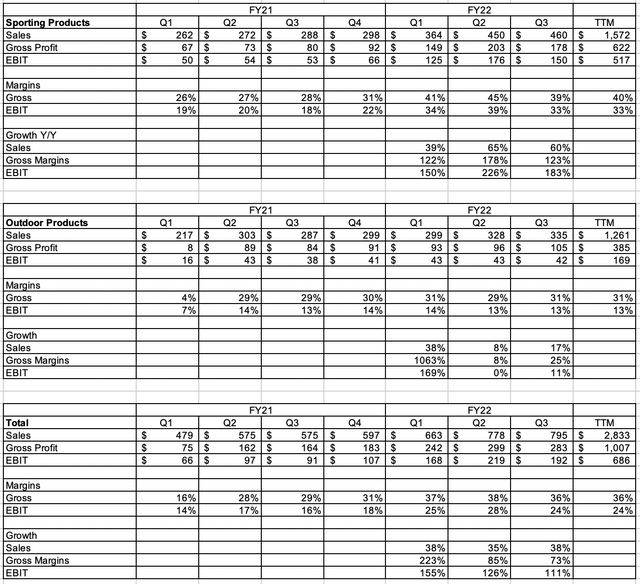

You can see how these respective characteristics play out in the numbers quite easily in the information provided by VSTO in the Q3 earnings release which I utilized to build out the table below (link to original data).

Authors work based on company data

The first thing I would point out to provide some context is the relative contribution of each segment to the key metrics provided by the company:

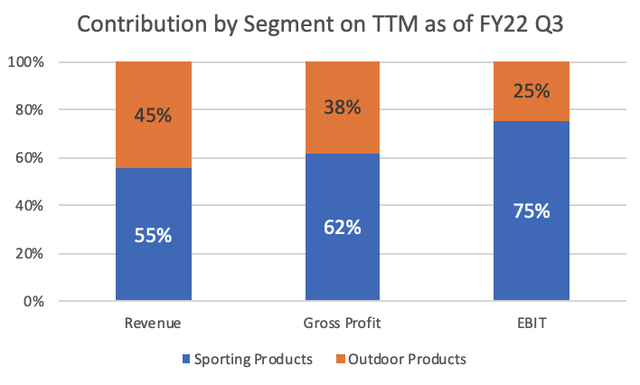

Author’s work based on company data

On a TTM basis, Sporting Products contributed 55% of total revenue but 75% of the company’s profitability as measured by EBIT. For the sake of stating the obvious, this argues the future growth and profitability of Sporting Products will likely play an outsized role in driving the overall financial performance of VSTO as a whole. So let’s dig into my second big reason I just can’t bring myself to be a bear on VSTO stock.

Emerging factors going forward are more likely than on balance to support sustained pricing power which should translate to higher margins for longer than currently reflected in the stock price

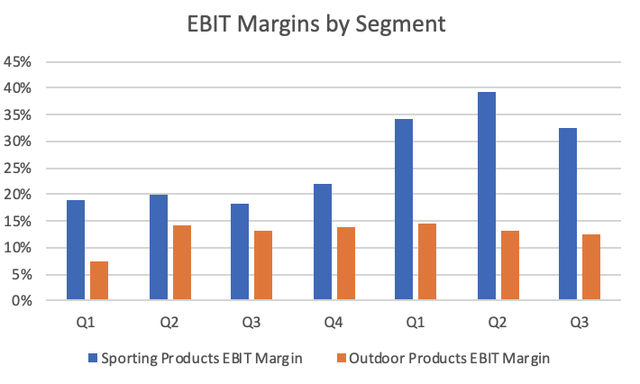

The second thing I would point out is the relative profitability trends by segment. The profitability of Sporting Products exploded to the upside, which you can see in the chart below. In my opinion, this is attributable to a massive increase in underlying demand for ammunition coupled with limited supply growth (if there even was any). And if anything, I think the underlying support for robust margins is likely to increase going forward vs. decrease for a few reasons. First, although this may sound biased (cause it is FYI), I believe many of the bureaucrats of the party in power have been and will continue to use all means necessary to put frictions on, or reduce, activities they don’t support including via permitting processes. Just calling it like I see it, I don’t see a lot of allies for shooting sports or personal defense among the bulk of the folks in DC. Which is to say I believe it will be as hard as ever for would-be emerging domestic, or existing foreign competition, to add greenfield ammunition manufacturing capacity to compete with VSTO within the United States and, if this is true, it is de facto supportive for the profitability of all of the existing capacity which includes VSTO.

Author’s work based on company data

Secondly, at an investor conference call with UBS, the CEO of VSTO shared some helpful estimates that provide context around a ban on Russian ammunition imports into the U.S. going into effect over the next year or so which could remove approximately 10% of ammunition supply from the U.S. market. The estimate was that roughly 30% of ammunition supply in the U.S. is from imports of which, approximately 30% originates from Russia. So in theory, as much as 10% of ammunition imports into the U.S. could be phased out. For a minor digression on imports in general, as logistics costs remain super-high in the meantime, VSTO essentially has an arbitrage of sorts as VSTO can price against competition who is forced to supply the market from a less competitive logistics position which further sustains extraordinary profitability in this segment versus what would otherwise be the case – end digression. In any case, the limitation on Russian imports alone stands to provide future support for continued sustainability in revenue, and future revenue growth, as well as profitability of the Sporting Products segment.

So what could normal look like going forward?

All of this is not to say that revenue growth and margins won’t normalize to a lower level over time. They probably will. But many investors are essentially pricing in a complete normalization back to EBIT margins of 5-7% in aggregate. And I personally think that that sort of analysis fails to capture the disproportionate impact Sporting Products will likely have on the top and bottom line of VSTO going forward as well as the particularly strong competitive position Sporting Products is operating from. In my view, Sporting Products stands to normalize to a whole step-change level above what investors would have considered feasible in the past when analyzing VSTO and at $35/36 per share, I don’t think this dynamic is remotely factored into the calculus.

Outdoor Products will probably be more susceptible to mean reversion pressures on top line as well as profitability as the competition for new cool things with better features, lighter materials, etc. can come from virtually anywhere at any given time. VSTO is a competitor with some awesome brands that appear to do a great job driving innovation; but as good as they might be, it is only reasonable to acknowledge that there are not the same barriers to entry to support this segment. Considering innovation in this space can come from anywhere, this is likely why the company pointed out in the UBS conference that M&A will likely play an important role in driving top line growth over the next several years. In fact, they guided that roughly 50% of their annualized growth goal (which was 10% per year) for the next several years will come from inorganic growth.

The bottom line for me is that the current sales guidance calling for 10% growth for the next few years (think it was 3 to be exact), coupled with 15-20% EBITDA margins, appears not only plausible but I would argue probable. And in the near term, the EBITDA margins will likely be the upper end of that range considering the current starting point on a TTM basis, which the IR manager on the UBS conference call also acknowledged. I would also point out that the IR manager noted that roughly 50% of their EBITDA flows straight through to FCF. Thus, VSTO is poised to generate a significant amount of cash flow over the next several years based on the guidance they have provided, or more specifically some $1.2B or so in FCF over the next 3 years as I recall from the conference call. Let’s not forget VSTO is only a $2B market cap company, so this is pretty remarkable.

The biggest factor that I personally think makes company guidance probable is the strategic position of the Sporting Products segment, which I believe will play the role of a growing cash cow, supplying way more cash back to the company for reinvestment into good organic and inorganic growth ideas as well as returns to shareholders in the coming years. And based on the fact that management is increasingly talking about and beginning to execute share buybacks, I have additional confidence that this management team won’t get carried away, trying to force fit growth where growth doesn’t make sense for shareholders/stakeholders of the company.

Based on all of the above, I just don’t see how you can argue that $35/36 share is the right value for the company. So while I want to be a bear on VSTO because it is easy to ride with the consensus, I just can’t do it. In my own valuation work on the shares, I think the company could easily be worth somewhere between $50/60 per share, considering my assumptions on how the company could evolve over the next 5 years while not being particularly heroic on my terminal value estimates.

Where am I wrong?

Where am I wrong on this?

Be the first to comment