VioletaStoimenova

Investment Thesis

Visa (NYSE:V) and American Express (NYSE:AXP) are two giants in the finance industry. Since inception, Visa has facilitated transactions among financial institutions, merchants, and consumers. Using their vast payment network, their core business provides transaction processing services (authorization, clearing, and settlement) through VisaNet. In 2021, the Visa brand processed 232 billion payments and cash transactions. In the case of American Express, their business model is to provide an integrated payments platform. American Express maintains direct relationships with both card members (as a card issuer) and merchants (as an acquirer). They provide a wide range of credit card products, and they offer several premium credit card products geared towards travel and lifestyle.

The trend, especially among younger generations, towards cash-less transactions has spurred substantial growth for both Visa and American Express in the past couple of decades. Also, both companies are putting considerable efforts towards expanding their presence in the digital payments market. Visa and American Express certainly have a very well defined economic moat, and I expect that to remain the case for the foreseeable future.

I will use my Cappuccino Stock rating to discuss which one is the better investment right now.

Cappuccino Stock Rating

| Weighting | V | AXP | |

| Economic Moat Strength | 30% | 5 | 5 |

| Financial Strength | 30% | 5 | 4 |

| Growth Rate vs. Sector | 15% | 4 | 3 |

| Margin of Safety | 15% | 3 | 4 |

| Sector Outlook | 10% | 4 | 4 |

| Overall | 4.5 | 4.2 |

Economic Moat Strength

Visa and American Express both carry a strong economic moat, and I expect them to maintain their competitive edge for the foreseeable future. Visa is the largest major payment network around. They have over 330 million card holders around the world and are accepted by more than 40 million merchants. Visa and their cardholders enjoy a strong network effect (increasing service value as the number of participants grows), and this competitive advantage won’t erode anytime soon. Visa is also actively working on maintaining the strongest payment network by investing in R&D and acquiring companies (e.g., Currencycloud and Tink).

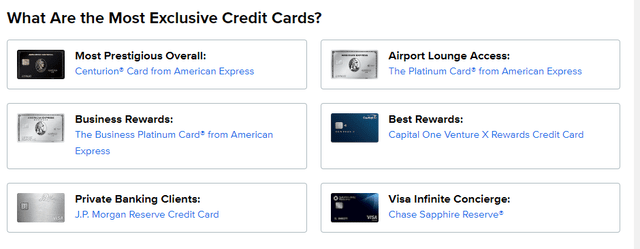

American Express also has a vast network, and they are the largest issuer of credit cards in terms of transactions (averaging 6 billion transactions per year). They focus on providing credit card products with travel and entertainment benefits that appeal to high-income cardholders. American Express is often associated with prestige and exclusivity, and their customer base is highly loyal. To maintain brand recognition and a loyal customer base, American Express keeps developing and offering new features and products (e.g., membership rewards for a fully digital business checking account). American Express will also maintain their economic moat for a long time.

Most Exclusive Credit Cards (Wallethub)

Financial Strength

Both American Express and Visa are financially strong companies. Both of them have a strong cash position (Visa with $13.5 B and American Express with $25.19 B), and operating cash flows are outstanding (Visa with $16.1 B and American Express with $17.3 B). Also, their profit margins are well above the sector medians.

However, Visa gets an edge over American Express in this category. As Visa doesn’t actually issue credit cards and lend money to the customer, Visa inherently carries less risk than American Express. During a recession, American Express may have to carry a larger write-off (provision for loan losses) and that will cut into profit.

Growth Rate vs. Sector

American Express reported outstanding results last quarter. Revenue rose 31% year-over-year, and card member spending reached a record high. Particularly the Travel and Entertainment segment, which is American Express’ strength, roared upward and broke its pre-pandemic level (108% of 2019 same quarter). Also, millennials and Gen Z consumers, the fastest growing age cohort, are spending more at the start of their American Express experience than previous generations. Spending by the younger generations grew 48% in the last quarter and significantly outpaced the older generations, which will provide a long growth trajectory for American Express in the future.

However, I expect Visa to see a higher growth trajectory than American Express in the long run. This is mainly because I believe Visa’s business model will be easier to scale. Since the main business involves providing a digital network, Visa will see a greater tailwind from digital transformation. The recent acquisitions of Currencycloud and Tink will enable Visa to expand its footprint into the digital payment space.

Margin of Safety

American Express dropped 25% from its $200 level of March 2022, and their stock price is now undervalued. Looking at their valuation metric, the P/E ratio of 15.4x is about 25% lower than its 5 year average (21.0x). With continuing recovery of the Travel and Entertainment segment and a healthy customer credit rating, I expect American Express to recover to its previous level in the future.

Compared to the overall market (and American Express), Visa’s stock has held up well. It dropped only about 15% compared to the last year’s high, and its P/E ratio (33.4x) is about 10% lower than its 5 year average. Thanks to their strong economic moat and stable finances, Visa’s stock price fared well against market volatility and uncertainties around the world. Therefore, between the two companies, American Express currently presents a larger margin of safety.

Sector Outlook

The need for payment systems and credit cards will only expand in the future as the population grows and more parts of the world develop. As more and more people join the Visa and American Express networks, their business and revenue will naturally grow, and their economic moat will strengthen. Spending levels certainly fluctuate with the economic cycle, so revenue and profit will also fluctuate, but the overall long-term growth trajectory looks robust for both Visa and American Express.

Risk

Some major bank CEOs delivered a grim economic outlook for later this year and early next year. In preparation, most banks have increased their provision for bad loans. Even though I don’t expect a severe recession, an economic slowdown seems inevitable given the sharp interest rate hikes and high inflation. A slower economy translates into lower levels of consumer spending, which will negatively impact both Visa and American Express. Between the two, I believe an economic slowdown will impact American Express more than Visa, due to their business model.

As technology develops, many alternative payment systems and networks are entering the market. Companies like Venmo and Square are getting increasingly popular, and new fintech companies are popping up everywhere. These companies could certainly erode the market share of Visa and American Express and negatively impact their growth trajectory.

Conclusion

American Express and Visa are both outstanding investment options. Both companies have a strong economic moat, and their profitability and vast network are hard to compete against.

Between the two, I believe Visa is a slightly better long-term investment option due to lower financial risk and better growth prospects. An economic slowdown triggered by high interest rates and inflation, and potential technological disruption may challenge both companies, but I expect them to have the resources to adapt to changing market trends.

Over the shorter term (~12 months), I do expect a better return from American Express (20-25%) than Visa (10-15%) because of its lower present valuation.

Marketplace In Preparation

Thank you all for reading my article. I’m in preparation for a Marketplace launch soon. Please get excited! Also, let me know the types of analysis or information you would like to see more of in my articles. I will take that into consideration for the marketplace. Thank you all for your support!

Be the first to comment