David McNew/Getty Images News

In December 2021, we analyzed Virgin Galactic (NYSE:SPCE), and our idea about the stock was a Hold.

From December to today, the situation has changed, the results of Q4 and full-year 2021 have been published, but most importantly, management provided information regarding future years.

So, this article is the update to the previous article of December.

Reservations

SPCE has not yet started its space travels consistently. However, the company keeps raising money through the pre-sale of tickets. As of now, the company has opened up new ticket sales to reach 1,000 bookings.

At the time of the call, there were still 250 tickets available to the public; but as of today, although there is no data available, we think they may have sold more. Therefore, we believe they may reach their goal of 1,000 in a few months. Another essential aspect is the increase in prices for individual tickets: the price has been raised to $450k each. This price increase shows that SPCE has no problems related to the shortage in demand. In particular, with so few places available, the company has strong pricing power.

It remains unsure what a long term price tag could be when the flights are more frequent, and the greater offer might push the prices slightly down.

Of that $450k, a $150k deposit is required ($25k of which is for a non-refundable membership fee).

However, it is important to stress that the problem of SPCE has never been to find customers and sell tickets, but it is the ability to provide this service. Today the company has declared to have about 750 bookings, some of which date back to years and years ago.

So, it’s undoubtedly good news that the company has reservations for so many flights, but how long will it take the company to satisfy these bookings? We guess that it could take (in a neutral scenario) at least three years, and consequently not before 2025.

Space fleet

However, the most critical updates from the previous analysis concern the development and timing of the formation of the space fleet because the key to evaluating the company is trying to figure out when the spacecraft will be ready and able to carry tourists.

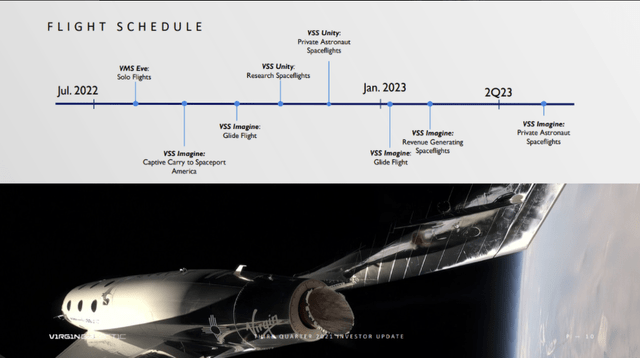

This image is the road map given by the company in Q3 2021.

Flight Schedule (Q3 2021 Earnings Presentation)

The differences aren’t huge, and as we expected, they don’t concern an advance in timing but some slight delays. However, as we have seen in the past, SPCE’s timeline always tends to be stretched. For this reason, we do not expect the company to keep up with the schedule in the coming years.

For VVS Unity, the roadmap follows much the same pattern, except for the fact that it will be able to start generating revenue through flights only in Q4 2022. The VVS Imagine roadmap maintains the first half of 2023 as the period to start the revenue-generating flights; however, the development is not at an advanced stage as the first part of the testing is still to be done. So, to be realistic, we can consider a date for the start of tourist flights as the last months of 2023.

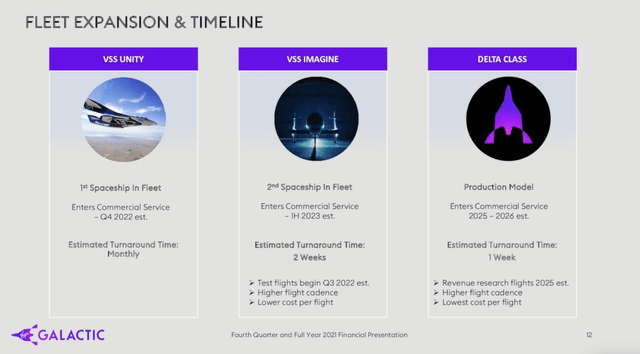

However, the fleet will remain composed of VVS Unity and VVS Imagine until the Delta Class is developed and produced. Delta Class is a type of spacecraft that will be able to fly once a week and whose production should be simple enough to allow the company to produce 5/6 of them every year. For this reason, we keep believing that this model will be essential to make Virgin profitable and essential delays in this spaceship might strongly affect valuation.

In Q4 earnings presentations, some new information has been provided for the target period for the use of the Delta Class. The target provided is 2026. However, given the company’s history of delays in producing the spacecraft, we must consider this date only as a base date before they will be ready. Therefore, we do not expect the company to have the Delta flight available before 2026. However, we would not be surprised if the Delta class became available in 2028 (two years longer than the company’s target).

So, from late 2023 to 2026 (i.e. the estimated Delta class production timeframe), the company will be able to make a maximum of 3 trips per month. This means 36 per year at total capacity and about just over 200 customers/year (considering six passengers each trip).

Virgin Galactic Space Fleet (Q4 and Full Year 2021 Financial Presentation)

Capital raising

These still rather long lead times for the spacecraft preparation (a pivotal moment for the turnaround in terms of increased revenues) mean that the company has to finance its expenses.

For this reason, the company raised $425 million through convertible bonds. We believe that gives the company about one year and a half of the expenses needed to support the business and invest in the new spaceships.

Our model

Assumptions of our model can be seen in the December article.

We have updated our assessment model based on new information from the company, our expectations for the timing of the spacecraft implementation and macroeconomic events (i.e. the increase in treasury yields).

Our updated model indicates that SPCE could begin to be attractive at a market cap of around $2 billion; therefore, we did not start a position. However, we will keep a hold rating on the stock until we do not see enough margin of safety.

Conclusion

In particular, on a stock like SPCE, a margin of safety is needed as the future is enormously uncertain. SPCE remains a problematic company to evaluate because it has no comparable companies and because any profitability estimates depend almost entirely on developments in spacecraft design. The only information we have is provided by the company whose reliability has been questionable.

So, going back to the previous article, if you decide to invest in the company, you do it for the underlying business idea, being aware that its profitability will not come before at least five years.

Be the first to comment