Galeanu Mihai

Thesis

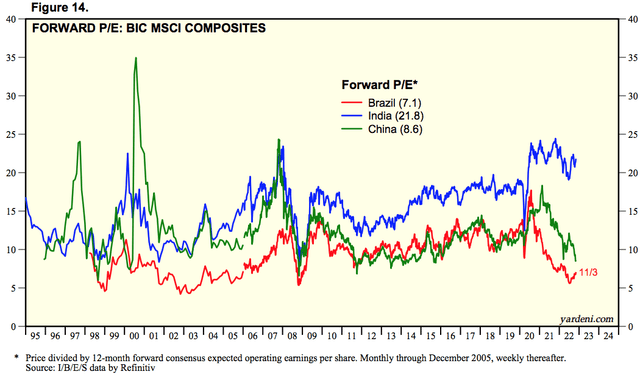

Investors should consider investing in quality companies in emerging markets like Brazil, as equities there are cheaper on a forward P/E basis (7.1) compared to developed markets like the U.S. (16.8). Generally, the lower the valuations, the higher the expected future returns. Investing in Vinci Partners Investments Ltd. (NASDAQ:VINP) is to invest in a fast-growing top asset management Brazilian company.

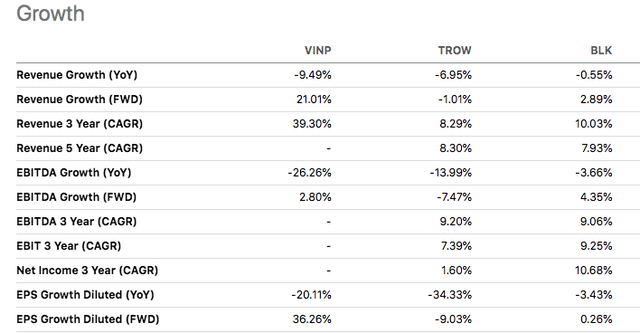

Consensus analysts’ 2023 growth estimates across the board for VINP are in the double-digits, ranging from 24.7% to 36.26%. These far outstrip the expected growth estimates for its much larger counterparts like T. Rowe Price Group, Inc. (TROW) and BlackRock, Inc. (BLK). Brazil is an emerging market with higher political risk but the risks and rewards of investing in this emerging market are much more favorable now after the presidential election.

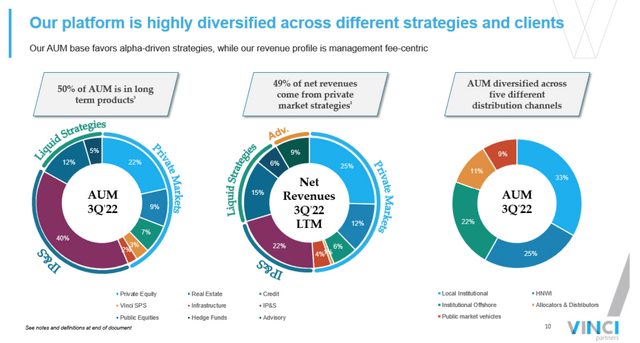

Finally, VINP’s focus on ESG means it could benefit from President Lula’s focus on the environment. VINP is one of the few investment managers in Brazil to be a signatory to the Principles for Responsible Investment, or PRI, and has one of the highest ratings of investment managers in Brazil according to PRI Transparency Reports. Finally, VINP is committed to generating revenue for shareholders and has been paying dividends for the past 6 quarters. Half of VINP’s assets under management (“AUM”) is comprised of long-term products which result in a more predictable revenue stream for management fees. That translates into stability in earnings and dividend distribution, and such a shareholder-friendly approach will offer some short-term downside protection.

1. Consider Investing In Emerging Markets For Better Future Returns

Investors ask themselves several questions regarding asset allocation. An often-asked question is, “Which stocks should I invest in?“

A less commonly asked but equally important question is, “Where should I invest in?”

If you are like me, you could be overweight in U.S. stocks. The U.S. is the place with many of the best companies in the world, but is that still the best place to invest to get the most bang for your buck?

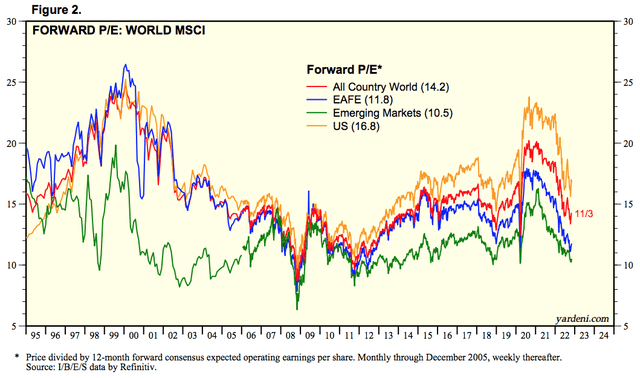

According to Yardeni Research, the forward P/E of the U.S. stock market is the most expensive when compared to the rest of the world (14.2), Europe-Australasia-far-east (11.8), and the emerging markets (10.5).

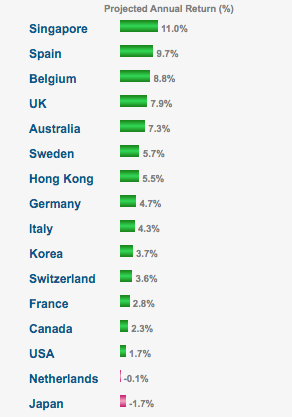

As you know full well, the higher the valuations, the lower the expected future returns. It is no wonder that the expected future return of the U.S. stock market is just 1.7%, according to Gurufocus.

Gurufocus Global Equity Valuation

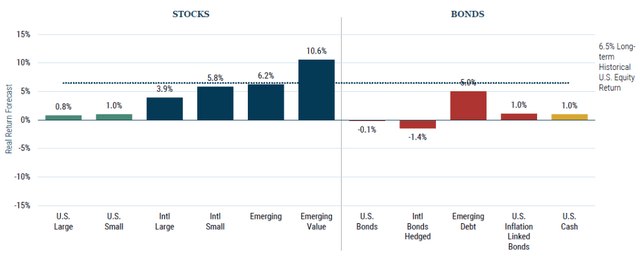

Research from GMO concurred with that from Gurufocus. GMO issued a 7-year equity forecast in Q3 2022 showing their expectation of real returns from two main asset classes of stocks and bonds.

It expects large-cap U.S. stocks to return just 0.8% and small-cap U.S. stocks to return 1% over the next 7 years. These are not exactly market-beating nor inflation-defeating returns.

If not the U.S., then where? Brazil, of course.

You need not agree with the folks at GMO and Gurufocus. You could be bullish like me about U.S. stocks (I am 90% invested in U.S. stocks), but personally, I will keep an open mind when it comes to investing outside of the U.S., even if it is intended as just a hedge. According to Yardeni Research, emerging markets are cheaper as a whole.

Now, there are many countries that fall under the emerging market classification. To better manage my risks, I prefer to invest in larger emerging markets to capture more opportunities. Brazil, India, and China are among the largest. China and Brazil are cheaper than India. As the current sentiments toward any stocks associated with China are mostly negative, the risk-averse investor may choose not to invest there, which leaves Brazil.

With the conclusion of the presidential election in Brazil just a week ago, a lot of uncertainty has been removed. Although the previous President, Jair Bolsonaro, did not openly concede defeat, he did initiate the process for the transition of power over to the newly elected President Lula. According to this article from the Economist, during the previous two terms in office, president Lula accomplished the following:

“4.5% annual growth, on average, during his two terms; reduction of public debt from roughly 60% to 40% of GDP; slowing of inflation from more than 12% in 2002 to just under 6% in 2010; an increase in the minimum wage; and 20m Brazilians who escaped from poverty.”

If President Lula’s beliefs remain unchanged, Brazil’s future looks promising.

Now that the question “Where should I invest in” has been addressed, I will move on to the more common question of “Which stock to invest in.” The Brazilian company Vinci Partners Investments Ltd. is the focus of this article.

2. VINCI’s Business Overview

Vinci Partners is an alternative investment platform in Brazil that started in 2009. This is a small, 244-employee operation. Yet, it has performed remarkably as an asset management company. As of December 2021, it was ranked among the largest 25 asset managers in Brazil out of 801 asset managers. Its business segments include:

(i) Private Market Strategies,

(ii) Liquid Strategies,

(iii) Investment Products and Solutions, and

(iv) Financial Advisory.

The diversification allows VINP to navigate different business cycles and to benefit from fund in-flows during various sector rotations.

The areas that VINP operates in are extensive:

- Infrastructure: There is a critical need for infrastructure investments and the weak financial position of the central government and the higher leveraged profile of traditional players give VINP an edge. VINP has ample transactional expertise (over 30 transactions) and only faces more limited competition from local investment managers in deals averaging from R$50 million to R$100 million.

- Private Equity: It focuses on acquiring businesses or making investments outside of structured auction processes, so in many cases, VINP will not encounter competition during the sourcing phase. This allows it to negotiate more favorable investment terms and downside protections to help generate more attractive returns.

- Credit: It offers private credit funds focused on long-term direct lending to meet the financing needs of both established and growing businesses while generating interesting credit investment opportunities for its investors across four core sub-strategies/asset classes of debt, namely: (i) Infrastructure (VES) with an ESG focus, (ii) Real Estate ((VCI and VCI 2)) in electrical power, retail, healthcare, shopping malls, and commercial properties, among others, (iii) Structured Credit usually in senior and mezzanine tranches, and (iv) Exclusive Mandates which refers to a rising pool of single-investor mandates where the investment policy is totally client driven.

- Real Estate: It is the ninth-largest manager of listed REITs in Brazil. VINP’s REIT funds have performed well (more later).

- Public Equities: There are significant opportunities in this segment as Brazilian investors continue to invest very little in variable income instruments and Brazil does not have a long-term investment culture. It is helpful that the VINP brand is very recognizable in Brazil. VINP is ranked #1 in media appearances, based on media space (according to data prepared by Danthi Comunicações using information from Topclip), ahead of Advent, Gavea, Brasil Plural, Blackstone, and other competitors. LINP reaches a broad audience of over 3.9 million individuals through LinkedIn, actively engaging with over 549,500 individuals. In 2021, VINP launched its first marketing campaign, which has been responsible for increasing viewership of our webpage fivefold, with 26 million digital impressions and reaching over 2.5 million people over television and newspaper ads so far. Its funds have an established and recognized track record of achieving returns above benchmarks across its business segments and were awarded by market leader research entities across all its segments in 2021. For example, Vinci Impact and Return IV, or VIR IV, was recognized by Environmental Finance as the “Private Equity ESG Fund of the year.” Another fund, “Vinci Valorem,” was recognized by the Valor Econômico newspaper as one of the five Brazilian commingled funds with the largest number of investors and highest net asset values.

- Hedge Funds: It is the first multi-manager model, versus the traditional “star-manager model.” With increasing complexity of global markets, a lone manager may find it harder to achieve alpha and beat the market, and VINP’s “multi-manager” model with different managers having expertise in different areas positions VINP to generate alpha.

- Investment Products and Solutions or IP&S: This segment offers clients access to tailored financial products through an open architecture platform, in addition to in-house asset allocation and risk management. The strategy aims to provide a sophisticated investment strategy with alpha generation according to its clients’ targets. In the execution of these strategies, VINP takes into account risk profile assessment, preparation of investment policies and product selection, among other factors. The strategy is divided in four sub-strategies: (1) separate exclusive mandates; (2) commingled funds; (3) International allocation; and (4) pension plans.

- Financial Advisory: This segment competes mainly against local and international M&A boutiques.

3. VINCI’s Performance

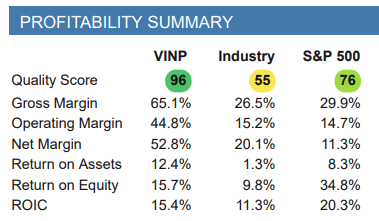

The company has very good margins that exceed the industry’s average.

Stock Rover

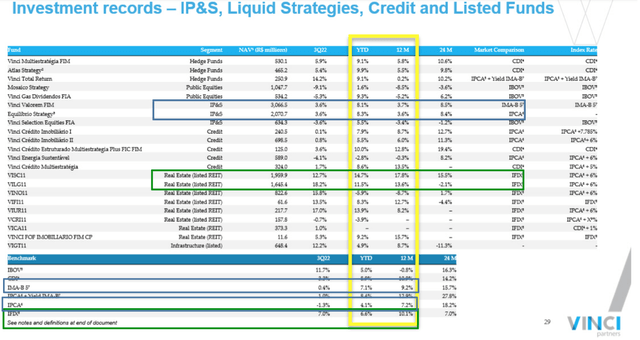

Most of its funds with the largest net asset value (NAV) have outperformed the benchmarks IMA-B 5, IPCA, and IFIX over the past 12 months as well as a year-to-date comparison.

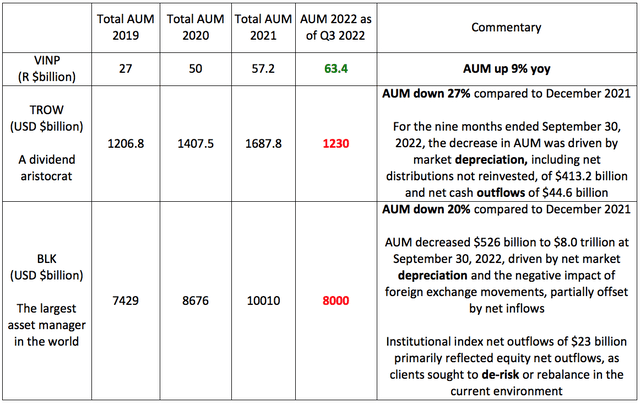

This explains the in-flow of funds to Vinci Partners Investments Ltd. that fueled its assets under management even in this bearish and forgettable 2022, at a time when many investors have been fleeing this industry and choosing to either go to sectors like Energy or Consumer Defensive or de-risk by going into cash. See the comparison below with blue-chip asset managers like TROW and BLK. Since they are all asset managers, their profitability is directly tied to the assets they manage, so it is critical to look at the net inflows or outflows of the assets they are managing. Although VINP is a minnow compared to BLK and TROW, VINP’s growing AUM trend is clear.

Author’s compilation. Data from respective latest 10Qs

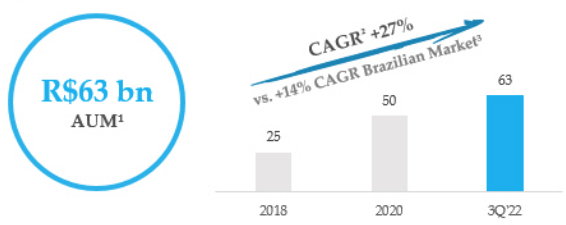

VINP’s performance is outstanding among the 801 asset managers in Brazil. The AUM grew by a CAGR of 27% since 2018, driven by increasing interest in its products and in the Brazilian market. This growth rate is greater than the growth rate for all other funds in the Brazilian alternative investments market including funds in classes similar to VINP’s alternative investment verticals (public equities, hedge funds, pension funds, credit rights investment funds, private equity investment funds, and REITs).

VINP 3rd Quarter 10Q

VINP’s expected future growth in revenue and earnings is in the double-digits.

SPGI analysts expect VINP to grow revenue by 21.01% and EPS by 36.26% in 2023. Those figures far surpassed the expected revenue growth for TROW (-1.01%) and BLK (2.89%) and the future EPS growth for TROW (-9.03%) and BLK (0.26%).

FactSet analysts concur with the positive expectations for VINP, projecting 35.35% revenue growth and 34.97% EPS growth in 2023.

Refinitiv analysts also projected double-digit growth for VINP, expecting revenue to grow 24.7% in 2023.

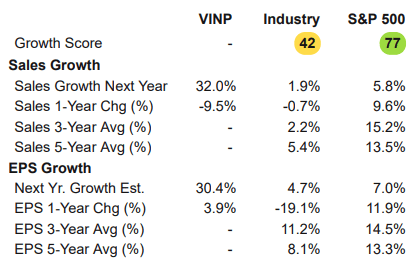

Lastly, research from Stove Rover shows the expected 2023 growth in sales (32%) and EPS (30.4%) to far exceed its industry and S&P 500.

Stock Rover

4. Valuation

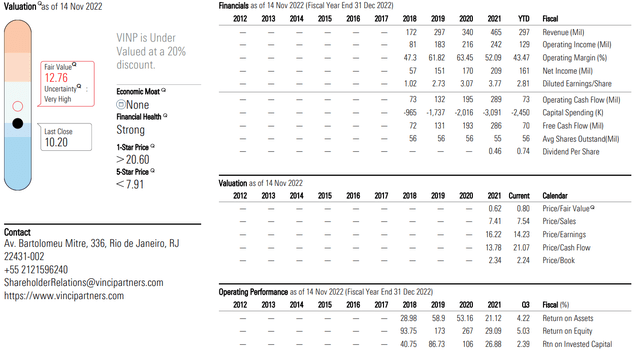

Morningstar gives Vinci Partners Investments Ltd. a 4-star rating. The analyst believes that VINP is currently 20% undervalued.

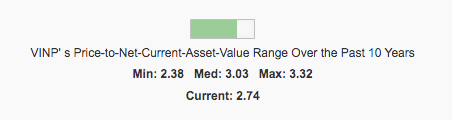

As this is an asset management company, I would look at its net asset value. In deriving the Net Current Asset Value, I used Gurufocus’ NCAV calculator which uses the company’s current assets (such as cash, marketable securities, and inventories) minus its total liabilities (including preferred stock, minority interest, and long-term debt). VINP’s net current asset value per share for the quarter that ended in Sep. 2022 was $3.65.

Gurufocus

Based on VINP’s Price/NCAP of 2.74 which is around the mid-range between the low of 2.38 and maximum of 3.32, and Morningstar’s Fair Valuation assessment of $12.76, and considering that this is an emerging market with a volatile political environment (though less so now after the presidential election), I will say that VINP is a cautious buy at the current price of $10.04.

5. Potential Near-to-Mid-term Catalysts

Management is positive about the upcoming quarters and is confident of reporting higher revenue, EPS, and AUM.

1. The acquisition of SPS is just completed, so revenues from SPS will be included from the fourth quarter onwards.

2. VICA, the first fund formed from the agribusiness strategy was over-subscribed, and the company expects to launch another round of fundraising in the first half of 2023 which will attract more assets under management.

3. The Infrastructure Segment brought in at least R $750 million worth of assets from the sustainable regional development fund or FDIRS to manage and that should start in the fourth quarter.

4. The new Retirement Segment VRS should start to earn fees in 2023.

5. The R $900 million in AUM from the Vinci Credit Infra within VINP’s credit strategy will start to generate management once that money is progressively invested.

6. Brazil started tightening interest rates in early 2021, much earlier than the rest of the world, and rate hikes have ended a few months ago, so it is well-positioned to start reducing interest rates. That will bring more investor interest and greater net inflows into VINP’s funds, and more AUM will increase management fees.

7. President Lula is expected to present a more moderate economic policy that will likely be a further tailwind to the scenario of growth and a further reduction in interest rates. His focus on climate change and environmental issues will bring more favorable attention to VINP’s ESG credentials and ESG focused funds.

6. Risk: Declining Fees Revenue Could Come From The Financial Advisory Segment

VINP’s revenue profile is management-fee-centric. This is measured by FRE or fee-related earnings, and PRE or performance-related earnings.

This will be VINP’s key business risk. As stated in their 2021 10k,

VINP’s performance directly ties into the payment of fund management and performance fees by its investment funds, which, in turn, are subject to a number of risks inherent to their operations and also to the risk of the businesses and industries in which the portfolio companies of such investment funds operate, as well as advisory fees for financial advisory services, which are subject to transaction closings and realization of IPOs advised by Vinci Partners.

2021 was a year of bounty for VINP’s Financial Advisory Segment focusing mostly on pre-initial public offering (pre-IPO) and mergers and acquisitions (M&A) related services for middle-market companies. Lots of deals translated to lots of advisory fees from the financial advisory business segment.

However, in a vastly more muted 2022 in terms of deals, unlike the SPAC boom that lifted Wall Street’s investment banks in 2020-2021, VINP’s revenue from this business segment fell. Total FRE or fee-related revenues (combining revenues from management fees and advisory fees) fell 17% year on year from R $168 billion to R $140 billion. Due to the lower deal activity, PRE or performance-based compensation fell 77% from R$21.3 billion to R$4.0 billion.

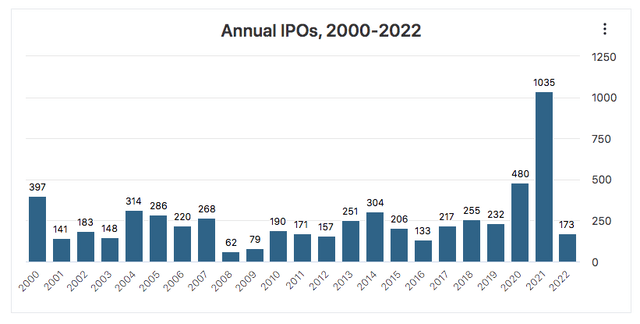

This risk-off and cautious investor sentiments are likely to continue in the face of the prolonged global bear market and the likelihood of a worldwide recession in the first half of 2023. As you can see from the chart below, a recessionary environment (2001, 2008, 2009) is usually not great for IPO activities, which will depress the total fee-related revenues and performance-based compensation from the Financial Advisory Segment.

There is one consolation: this segment contributed just 5% – the lowest – of the total fee-related earnings by Q3 2022 year-to-date so it is likely that fee increases in other larger segments will make up for the possibly poorer performance in this Financial Advisory Segment.

7. Conclusion

VINP is a fast-growing asset management business located in Brazil, one of the fastest-growing economies in the world and the largest among all Latin American countries. While its larger competitors like BLK and TROW are seeing investors cash out and are reporting declining AUM in 2022, VINP’s AUM continues to grow. VINP’s expected 2023 double-digit growth rates, a reasonable valuation, and the multiple short-term to mid-term catalysts that will start to boost AUM and management fees as soon as the fourth quarter of 2022, all point to VINP doing well in the next 12 months.

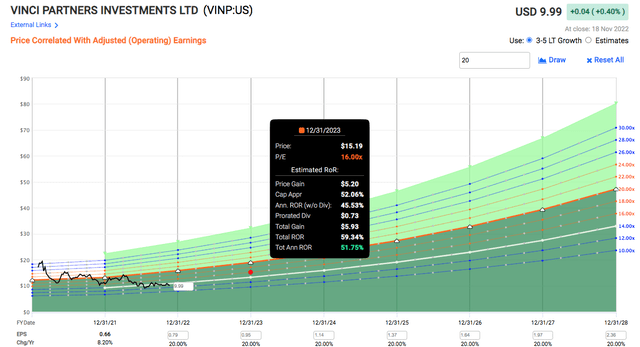

FactSet analysts projected that VINP’s EPS will grow at a giddy 34.97% in 2023. Analysts that report to Stock Rover expect a 2023 EPS growth rate of 30.4%.To build in a margin of safety, I bring that growth rate down to 20%. If VINQ can trade at its normal P/E of 16, it could potentially have a 45.53% upside by the end of 2023, and 51.75% when dividends are included.

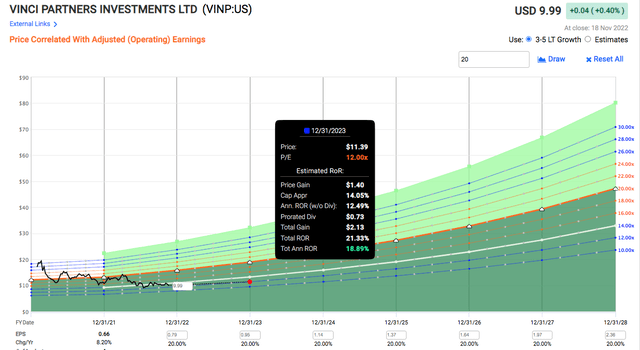

And in the scenario where market sentiments have yet to turn and VINP trades down to a P/E of 12 (P/E is 14.11 now) while its earnings grow at 20%, I can still reasonably expect an 18.89% return by the end of 2023, and I can live with that! And while I wait for capital appreciation, I will continue to collect dividends, and the current yield is an attractive 7%.

In short, VINP is offering good upside potential even with conservative assumptions, and I will be initiating a small position soon in this dividend-paying quality company that is expected to hit a growth spurt in 2023. However, instead of a strong buy, I am issuing a cautious buy, as Vinci Partners is situated in an emerging market with a more dicey political environment than developed nations. Finally, investors should note that Vinci Partners Investments Ltd. trading volume is low, so liquidating it fast may be a problem.

Be the first to comment