cifotart

Vimeo (NASDAQ:VMEO) has not had a good time lately. Markets have punished high multiple stocks and for good reason. Rates are rising and earnings growth potential has fallen too, therefore hard multiples become doubly less justifiable. The problem for Vimeo is that they really could have an earnings growth problem, which is devastating them to this pretty reasonable looking multiple in the old rate paradigm. Q3 guidance should keep investors on the sidelines because recession signs are already showing.

Our Q2 Commentary

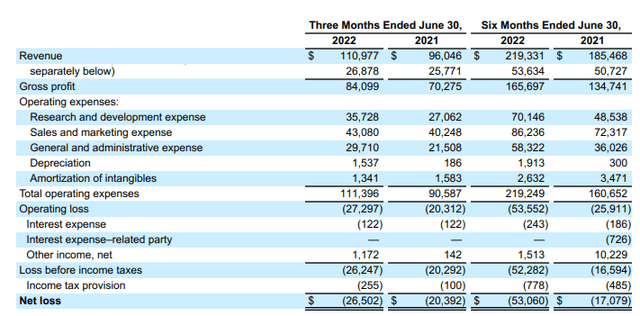

The revenue growth was 16% and the gross profit growth was 20%, so there was some nice gross margin expansion and the movement towards breakeven is progressing. Here is the key point, though, ARPU growth was 10%, which is coming from sales-assisted growth. That’s accounting for a lot of the revenue growth now, and apparently, it’ll have to account for more revenue growth in the Q3 according to guidance.

The guidance is where things start to look a bit grim. They say they expect about 5% revenue growth which isn’t much at all. This indicates that the subscriber growth will only continue to slow, and what’s worse is that driving sales-assisted growth may not be able to compensate for self-service declines, or that sales-assisted growth may slow perhaps due to weaker conversion rates and corporate slowdown. Remember, sales-assisted revenue, which is now about 35% of revenue, is higher ARPU and drives positive price and mix effects as it comes from converting self-service enterprise profiles into sales-assisted, per-seat customers.

Another thing to consider is that Vimeo has a lot of international exposure, apparently about 30% of their business. The dollar has graduated into a totally privileged position as a global reserve. The rate hiking’s impact on the entrenchment of the USD’s exorbitant privilege is one of the major mitigants of the US woes in the face of pretty aggressive rate hikes. Still, a 50% exposure is not ideal, as these FX headwinds are having an impact on revenues. A mitigating factor here is that the sales-assisted revenue is USD denominated, so in addition to the upselling going on in the sales-assisted shift, there is the benefit of reducing FX exposure. However, apparently conversions in international markets are lagging as it is.

Income Statement (Q2 2022 Pres)

Finally, we notice that the moves to grow the marketing efforts have continued. Apparently, they are still only 75% done as of today and will be growing marketing expenses further. There is no question that upselling customers is a good strategy and a source of untapped value, but this aggressive marketing spend will have to be supported by good retention for marketing ROIs not to collapse. That could become difficult in a tougher macro environment. Conversions are especially harder to pull off in a tough economic scenario, and they’ll have to keep those up as well. Upfront there is the effect that losses are deepening and reflexivity effects rear their head.

Remarks

The price has declined by a third since we last covered, and this is partly to do with reflexivity factors playing into all unprofitable companies. But in general, markets are adjusting to higher risk free rates and what that means for required returns in the equity market. The VMEO multiple isn’t so bad, it lies at 0.8x price/sales. With businesses like this capable of producing between 20% and 30% in EBITDA margin, it implies a pretty low multiple on forward EBITDA of less than 3x.

However, in the meantime are years of producing no earnings and burning cash in a hostile equity market environment where funding has dried up in public markets completely. ECM is dead for now, and that creates reflexivity effects, and long periods of risk free rates potentially compounding returns at as much as 6% per year given the clip of the rate hiking cycle and risks of long-term inflation. Earnings growth, and indeed any earnings at all, need to come soon and quick for VMEO otherwise this current multiple won’t get better and cash will get burned to hit directly the value in the coffers.

Speaking of cash burn, it is annualising at about $100 million per year. According to the comments on marketing, this will rise to about $125 million, unless the 6% workforce cut is followed by some more cuts. As of Q2, there then is about 2 years of cash to cover that burn rate. If as the guidance suggests revenue growth could become more limited with mounting headwinds, that rate might not come down quickly and therefore 2 years is the maximum period before a capital raise comes, and it’ll likely come before as a precaution. The bear market may not be up at that point when it starts in force. Dilution could come, and even with eventual earnings in Vimeo’s future, multiples may not improve much. In other words, there are few levers for return. The only thing Vimeo can do is to keep upselling. The untapped potential remains, and if there isn’t too much of a decline in leads and conversion rates, and we don’t get much churn, all these dilution and cash destruction concerns dissipate. Still, long-term rates are a problem for the multiple story.

Be the first to comment