DKosig/iStock via Getty Images

Author’s note: This article was released to CEF/ETF Income Laboratory members on December 26th, 2021.

The Vanguard International Dividend Appreciation ETF (VIGI) invests in all international equities with at least seven consecutive years of dividend growth. VIGI’s diversified holdings, outstanding dividend growth track-record, market-beating returns, and cheap valuation, make the fund a buy. On the other hand, the fund’s 1.1% dividend yield is extremely low, and make VIGI a lackluster income vehicle. As such, and notwithstanding the fund’s dividend growth track-record, I think VIGI makes more sense for investors looking for total returns, not so much for income investors.

VIGI Basics

VIGI Investment Thesis

VIGI is an international equity dividend growth index ETF. It is administered by Vanguard, the second-largest investment manager in the world, and the largest index fund provider in the same. Vanguard is generally my top choice for simple, cheap index funds, and VIGI is no exception.

VIGI’s investment thesis rests on the fund’s:

- Diversified holdings, which provide investors with all the international diversification they need, and which reduce portfolio risk and volatility

- Outstanding dividend growth track-record, with the fund’s dividend growing at a double-digit annualized rate since inception

- Market-beating returns, with the fund outperforming broader international equity indexes since inception

- Cheap valuation, as international equities are undervalued relative to U.S. equities

The above combine to create a strong fund and investment opportunity, and one which is particularly for long-term investors looking for international diversification and funds. Let’s have a look at each of these four points.

Diversified Holdings

VIGI is an international dividend growth index ETF, tracking the S&P Global Ex-U.S. Dividend Growers Index, an index of these same securities. It is a relatively simple index, including all international stocks with at least 7 consecutive years of dividend growth, subject to a basic set of liquidity, size, trading, etc., criteria. It is a market-capitalization weighted index, although weights are capped at 4.0% to ensure diversification.

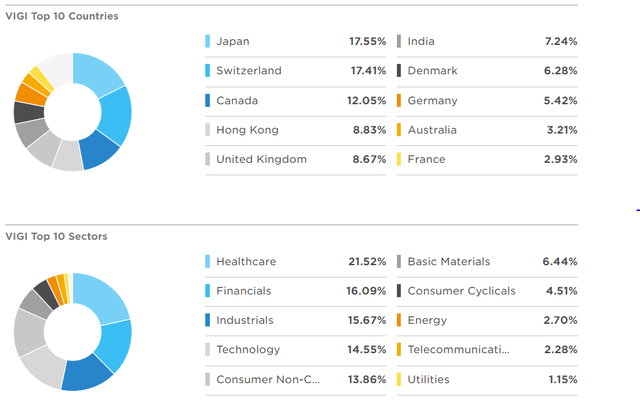

VIGI’s underlying index is quite broad, which results in a well-diversified fund. VIGI invests in 351 different stocks, with exposure to most international markets and industry segments. The fund is overweight established developed markets like Switzerland and Japan, which account for a relatively large proportion of more mature companies with longer dividend growth track-records. The fund is underweight smaller emerging markets like Brazil, for the same reasons. VIGI, like most international funds, is somewhat underweight tech, although somewhat less than average.

(Source: ETF.com)

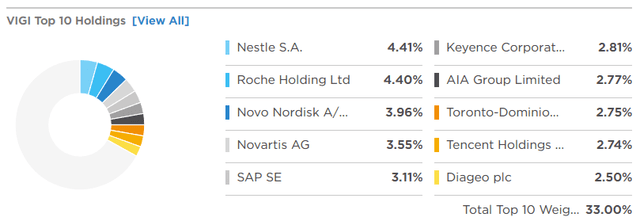

VIGI itself focuses on large-cap, blue-chip international stocks. The fund’s holdings include household names like Nestle (OTCPK:NSRGY), Novartis (NVS), Diageo (DEO). These are all established companies with proven, resilient business models, a benefit for the fund and its shareholders, and especially important considering the fund’s international focus. International stocks tend to be riskier than U.S. equities, due to the size and resiliency of the country’s economy, so risk-reduction measures are important. VIGI’s largest holdings are as follows.

(Source: ETF.com)

VIGI’s diversified holdings provide investors with more than sufficient exposure to international equities, reduce portfolio risk and volatility, and are significant benefits for the fund and its shareholders. VIGI’s holdings are diversified enough that the fund could function as a core portfolio holding, or as an investor’s only international equity holding.

Outstanding Dividend Growth Track-Record

VIGI only invests in companies with at least 7 consecutive years of dividend growth. These companies, by definition, have strong dividend growth track-records, a direct benefit for the fund and its shareholders. More importantly, companies with lengthy dividend growth track-records tend to be comparatively safe, high-quality, resilient business: dividends would not have grown so consistently otherwise. A lengthy dividend growth track-record is also evidence of a shareholder-friendly management team with long-term vision and execution. In my opinion, a lengthy dividend growth track-record, and the implications thereof, are very beneficial for shareholders.

VIGI’s dividend growth metrics are also quite high, with the fund’s dividend growing at a 12% CAGR since inception. Dividends, however, fluctuate quite a bit quarter to quarter, and so these growth figures are very rough. Still, and from what I’ve seen, it seems clear that the fund’s dividends have seen strong growth since inception. Particularly clear evidence of this is the fund’s increasing yield on cost metrics, which show a consistently-increasing yield.

(Source: Seeking Alpha)

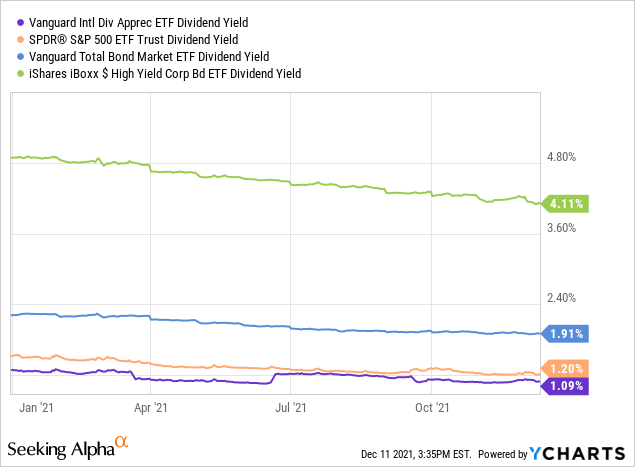

Finally, and on a more negative note, is the fact that VIGI yields a paltry 1.1%, excluding a recent massive, unrepresentative capital gains distribution. This is an incredibly low figure on an absolute basis, slightly lower than that of the S&P 500, and lower than that of bonds in general and most bond sub-asset classes.

VIGI’s comparatively low dividend yield is a direct negative for the fund and its shareholders, and also serves to blunt the impact of its outstanding dividend growth. Rapid growth means little starting from such a low base, which means even long-term investors are unlikely to ever see strong dividends from the fund. Due to this, I believe that the fund is not a particularly strong income vehicle. It might still be a good investment opportunity for investors looking for capital gains and total returns, which brings me to my next point.

Market-Beating Returns

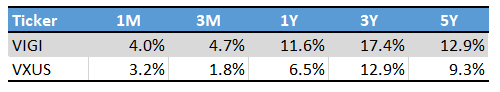

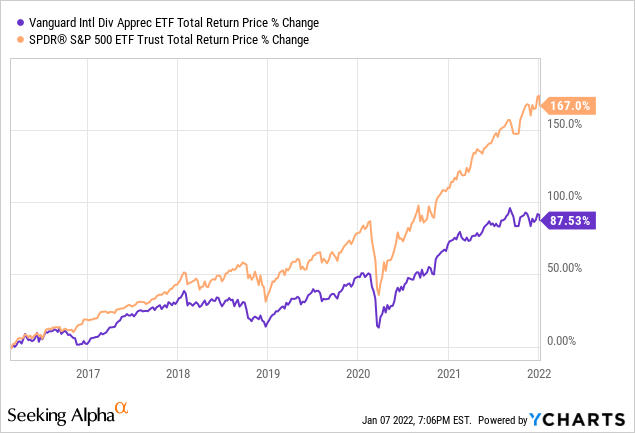

VIGI’s dividend growth track-record is outstanding, and so is the fund’s performance track-record. VIGI has outperformed international equity indexes since inception, and for all relevant time periods too.

(Source: ETF.com – Chart by author)

VIGI’s strong performance track-record is due to two key reasons.

First, is the fact that most international equity indexes are overweight financials, which have underperformed for quite a few years, and underweight tech, which have outperformed for years. VIGI’s industry exposures are less lopsided, which have benefited the fund these past few years. Although the situation could always change, I’ve been wary of the industry exposures of most international equity funds for quite a while, and see VIGI’s more diversified exposures as a positive. They have helped the fund outperform in the past, and will, I believe, help the fund outperform in the future. As a small aside, do remember that this is an international equity fund, and so is not impacted by the frothy valuations of many U.S. tech stocks.

Second, is the fact that strong dividend growth should, in theory, lead to strong total shareholder returns too. Assuming valuations remain roughly constant, a big if, then capital gains should equal underlying dividend growth, as this keeps dividend yields (a rough valuation measure) constant. Total returns would then equal dividend growth plus dividend yield. This is a very rough estimation, but it seems to describe VIGI relatively well. VIGI’s total returns have equaled 12.9% these past few years, versus dividend growth of 12.0% and a dividend yield of 1.1%.

In my opinion, and taking into consideration the above, the fund’s outstanding dividend growth metrics should continue to lead to market-beating returns in the coming months and years.

On the other hand, VIGI has underperformed relative to most U.S. equity indexes, including the S&P 500, since inception.

Cheap Valuation

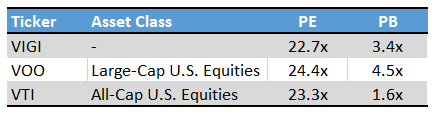

Finally, VIGI offers investors a competitive valuation, as international equities are currently undervalued relative to U.S. equities. The fund sports a PE ratio of 22.7x, PB ratio of 3.4x, which is slightly lower than that of most comparable U.S. equity indexes. It is a small difference, but a difference nonetheless.

(Source: Vanguard Website – Chart by author)

VIGI’s comparatively cheap valuation could lead to strong capital gains and market-beating returns, assuming valuations were to normalize.

Conclusion

VIGI’s diversified holdings, outstanding dividend growth track-record, market-beating returns, and cheap valuation, make the fund a buy.

Be the first to comment