We Are

Author’s note: This article was released to CEF/ETF Income Laboratory members on November 5th, 2022.

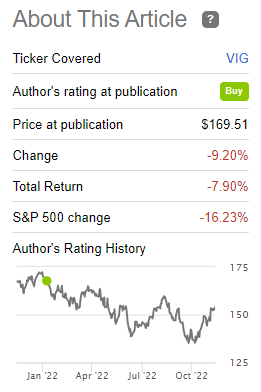

I last covered the Vanguard Dividend Appreciation ETF (NYSEARCA:VIG), a simple dividend growth index ETF, in early January of this year. In that article, I argued that VIG’s diversified high-quality holdings, outstanding dividend growth track-record, and reasonably good total returns made the fund a buy. Since then, the fund has moderately outperformed relative to the S&P 500, a reasonably good performance.

VIG Previous Article

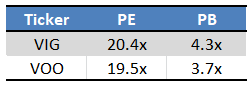

VIG’s recent outperformance was a benefit for past shareholders, but a negative for future or prospective investors, as it worsens fund fundamentals. VIG used to sport a slightly cheaper valuation than the S&P 500, but now the fund trades with a slightly richer valuation instead. VIG only yields 1.9%, marginally higher than the S&P 500’s 1.6% yield, but the difference is barely material.

In my opinion, as VIG remains a simple, diversified, broad-based equity index fund with a strong performance track-record, the fund remains a buy. Recent outperformance does mean that the fund is currently fairly valued, so further outperformance does not seem terribly likely, in my opinion at least.

VIG – Basics

- Investment Manager: Vanguard

- Underlying Index: S&P U.S. Dividend Growers Index.

- Expense Ratio: 0.06%

- Dividend Yield: 1.87%

- Total Returns CAGR 10Y: 11.9%

VIG – Overview

VIG is a simple dividend growth index ETF, tracking the S&P U.S. Dividend Growers Index. It is a simple index, investing in U.S. equities with at least 10 consecutive years of dividend growth, subject to a basic set of size, liquidity, etc., criteria. It explicitly excludes the top 25 highest-yielding companies, a measure meant to reduce risk (high yielding companies are generally risky companies). It is a market-cap weighted index, with security caps meant to ensure a modicum of diversification. It is a reasonable, broad-based index, with no material negatives or issues, in my opinion at least.

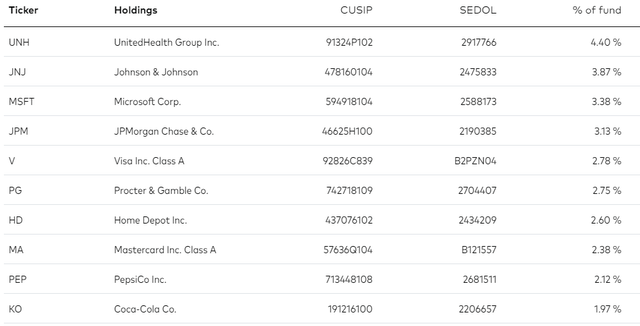

VIG’s underlying index is incredibly broad, which results in an incredibly well-diversified fund. VIG invests in close to 300 different stocks, a roughly comparable number to that of broader equity indexes, including the S&P 500 and the Nasdaq-100. Concentration is below-average relative to its peers, with the fund’s top ten holdings accounting for 16% of its value.

VIG focuses on companies with relatively long dividend growth track-records, which are almost always strong companies with proven business models: dividends would not have grown otherwise. VIG’s largest holdings include strong, blue-chip companies like Johnson & Johnson (JNJ), Microsoft (MSFT), and Visa (V). These are fantastic companies, and quite popular in dividend growth investment circles.

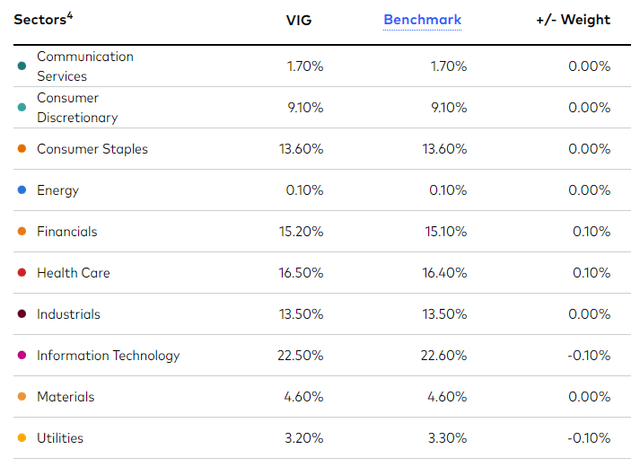

As with most equity index funds, VIG provides sufficient, diversified exposure to most relevant industry segments.

As is the case with most dividend-focused ETFs, VIG is underweight tech, as tech companies rarely have strong, long, dividend growth track-records. There are exceptions, with the fund having a comparatively large 3.4% allocation in Microsoft (MSFT). At the same time, the fund is overweight old-economy industries, including consumer staples, financials, and industrials, as these industries are filled with older companies with long dividend growth track-records.

Unlike most of its peers, the fund is also underweight communication services, as it does not invest in most comms giants, including Google (GOOG), Facebook (META), Disney (DIS), and Verizon (VZ). Unlike its peers, the fund is significantly underweight energy, as the fund explicitly excludes the highest-yielding companies from its portfolio, and these are currently predominantly energy stocks.

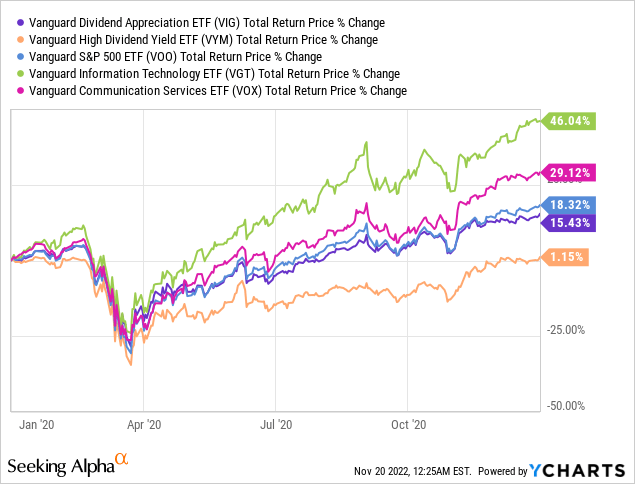

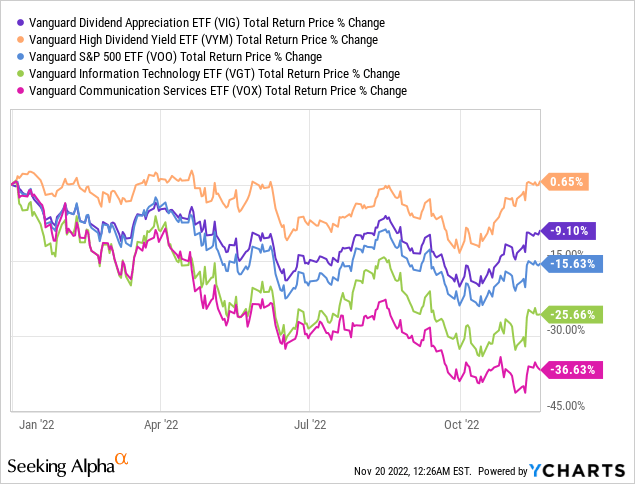

VIG’s industry exposures vis a vis the S&P 500 are a bit complicated, but the net effect seems clear enough. The fund tends to underperform relative to the S&P 500 when tech and comms outperform, as was the case during 2020. On the other hand, the fund tends to underperform by less than other dividend-focused ETFs when this is the case. I’ve included one such fund, the Vanguard High Dividend Yield ETF (VYM), for reference.

On the flipside, the fund tends to outperform when tech and comms underperform, as has been the case YTD. VIG does tend to underperform by less than other dividend-focused ETFs when this is the case.

In general terms, VIG’s industry exposures are neither a negative nor a positive, but an important fact for investors to consider. The fund might not be appropriate for tech bulls, but looks like a particularly compelling investment for tech bears.

To summarize, VIG is a simple, diversified, broad-based equity index fund investing in U.S. equities with at least 10 consecutive years of dividend growth.

VIG – Dividend Analysis

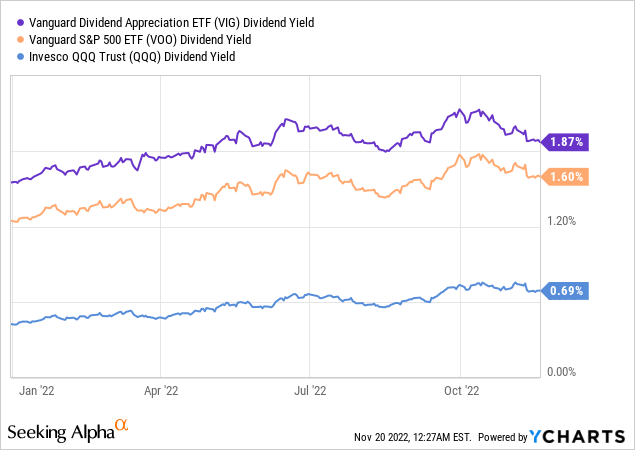

VIG is overweight old-economy industries like financials and consumer staples. Said industries have above-average yields, which boosts the fund’s yield to 1.9%, slightly higher than average for a U.S. equity index fund. VIG’s yield would be much higher if the fund did not exclude the highest-yielding companies, however.

VIG’s slightly above-average dividend yield is a small benefit for the fund and its shareholders, but a benefit, nonetheless.

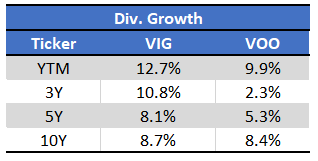

VIG focuses on companies with at least 10 consecutive years of dividend growth. These are, by definition, companies with strong, long dividend growth track-records, which bodes well for the fund’s dividend growth. VIG’s dividends tend to see consistent, strong growth year after year, slightly higher than average relative to the S&P 500.

Seeking Alpha – Chart by Author

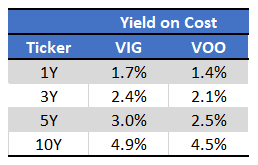

VIG’s above-average yield and dividend growth results in a slightly higher yield on cost relative to the S&P 500, for all relevant time periods.

Seeking Alpha – Chart by Author

VIG’s strong dividend growth track-record is a benefit for the fund and its shareholders. On the other hand, as the fund’s starting yield is a meager 1.9%, it would take decades until the fund is providing a reasonable level of income to shareholders. VIG does yield more than average, and its dividends also grow faster than average, but the difference is small, and does not have a significant impact on the fund or its investors.

VIG – Performance Analysis

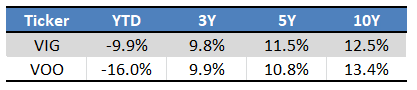

VIG’s performance track-record is reasonably good, if not outstanding. The fund broadly matches the performance of the S&P 500. VIG sometimes outperforms, sometimes underperforms, but rarely significantly deviating from the performance of said index. These past few months have been an exception, with the fund moderately outperforming due to tech weakness.

Seeking Alpha – Chart By Author

VIG’s recent outperformance was a benefit for shareholders in the past, less so for investors moving forward. As the S&P 500 tumbles, VIG’s yield looks less and less attractive, with the fund only providing a 0.30% higher yield than said index. VIG’s relative valuation has suffered too, with the fund currently trading with a marginally more expensive valuation than its index.

Fund Filings – Chart By Author

VIG’s more expensive valuation is a negative for the fund and its shareholders, and could lead to losses in the future, contingent on valuation gaps narrowing. Prospective losses are quite low, as the fund is only marginally more expensive than average.

In general terms, VIG has several important benefits and drawbacks, but most are quite small. The fund yields more than most of its peers, but a 1.9% yield is still low in an absolute sense. The fund’s dividends grow faster, but not faster enough that its yield on cost is that much higher than average. The fund’s valuation is more expensive than average, but only slightly so. Performance rarely deviates too much from that of its index, although these past few months have been something of an exception. As such, I expect the fund to perform broadly in-line with the S&P 500 moving forward: there is simply no reason to expect otherwise.

Conclusion

VIG’s diversified holdings, above-average yield and dividend growth track-record, and strong performance track-record, make the fund a buy. As the fund does not significantly deviate from its index, I do not expect significant over or underperformance moving forward.

Be the first to comment