Scharfsinn86/iStock via Getty Images

Two months ago, fellow contributor Gold Panda introduced Seeking Alpha members to the ambitious BEV transition plans of small Canadian bus manufacturer Vicinity Motor Corp. (NASDAQ:VEV) or “Vicinity”.

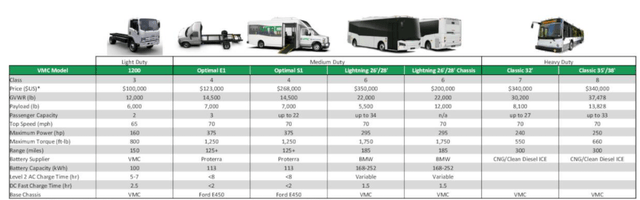

The company recently expanded its bus offerings and is also targeting the light- and medium-duty truck markets:

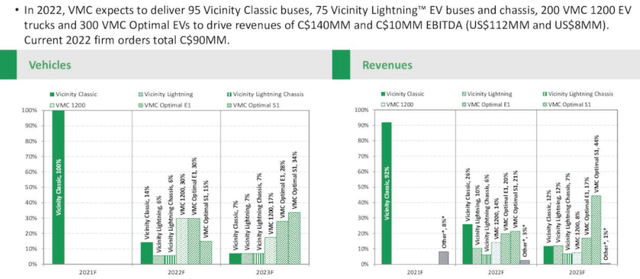

Based on a stated backlog in excess of C$100 million, Vicinity expects 2022 revenues to increase by 170% year-over-year to C$140 million with an adjusted EBITDA margin of approximately 7%:

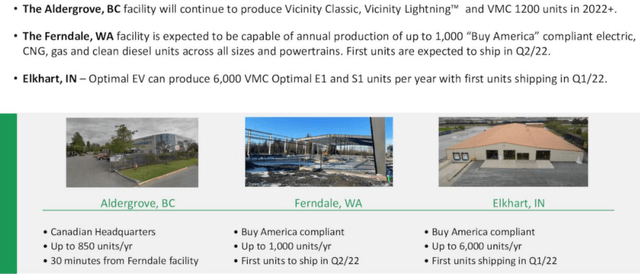

Through the recent licensing and marketing agreement with US-based Optimal Electric Vehicles LLC and the construction of a new “Buy America”-compliant assembly facility in Ferndale, Washington, Vicinity is also looking to make additional inroads into the U.S.:

Not surprisingly, the company’s ambitious expansion plans require a material amount of capital. Since uplisting to Nasdaq in July, Vicinity has raised approximately $30.6 million in gross proceeds from two equity offerings in October 2021 and March 2022 and selling new shares into the open market under its $50 million equity distribution agreement with B. Riley Securities and Spartan Capital Securities.

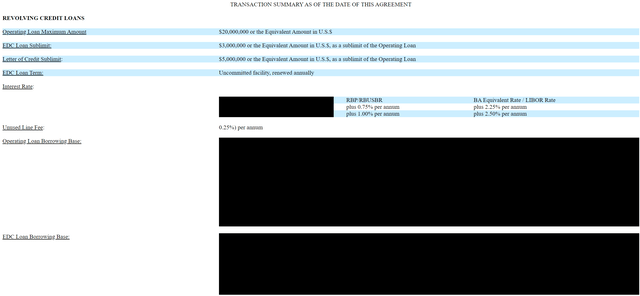

In addition, the company issued C$10.3 million in unsecured debenture units and has access to up to C$20 million under its currently undrawn asset-based revolving credit facility with Royal Bank of Canada. In its respective SEC-filing, Vicinity has abstained from disclosing the initial borrowing base determination by the lender:

Ongoing dilution has resulted in outstanding shares to increase by almost 40% year-over-year to 39.7 million.

While shares look inexpensive for an EV play at below 1x projected FY2022 revenues and 9x adjusted EBITDA, I am not buying the story at this point:

- The company will likely require additional capital to deliver on the order backlog and address the maturity of the above-discussed debentures in October. At the end of December, the company had just $4.4 million in cash left and net proceeds from the recent $12 million capital raise will be required for completing the Ferndale facility.

- The company’s credit facility contains a monthly fixed charge ratio covenant which the company does not comply with at this point.

- Despite management claiming otherwise, it’s difficult to believe that Vicinity won’t be materially affected by ongoing supply chain issues this year.

- The company has no experience in manufacturing BEVs. Looking at the track record of other entrants into the EV space, delays appear to be more likely than not, particularly in the current environment.

- The vast majority of recent orders appears to be from resellers with potential sell-through entirely unknown at this point.

- The company has been engaging in paid stock promotion in Germany since at least late 2020 which is always a red flag. Vicinity (which was named Grande West Transportation at that time) retained “Bullvestor“, one of the leading stock promoters in Germany. Since October 2020, Bullvestor has published almost fifty highly bullish articles on the company.

Personally, I can’t remember a single paid stock promotion which has delivered sustained returns for investors. A couple of years ago, I have published an Instablog piece on transatlantic stock promotion schemes which provides additional background.

Bottom Line

Based on management’s projections for this year, Vicinity Motor looks inexpensive but investors should abstain from chasing the shares given the likely requirement to raise additional capital and elevated execution risk.

According to statements made by management on the recent conference call, Q1 will be another weak quarter with deliveries mostly weighted towards the second half of the year.

My expectation is for the company to raise at least another $20 million in capital over the course of 2022 while missing sales and profitability targets by a wide margin.

Until Vicinity Motor has proven its ability to execute in a very challenging environment, investors should remain on the sidelines.

Be the first to comment