Drew Angerer/Getty Images News

When Pfizer’s (PFE) Upjohn merged with Mylan, there was Viatris (NASDAQ:VTRS). Viatris is a relatively low multiple stock with a decent dividend that plays in the generics space. It has had pressures from China in bidding process and substantial downside risk to dollar appreciation. China is also an issue on the retail side with lockdowns. However, on an operations basis, they are not too bad. They produce profits at rather phenomenal margins and their dividend has gone up since it was initiated by almost 10%, paying out a 4.5% yield on a compressed price. From a valuation standpoint, we point out an argument that can be made for upside due to the acquisition by Biocon of the biosimilars portfolio, which isn’t really the best part of the Viatris business. There is a case for Viatris, just not one we’re jumping on.

Q2 Note and Segue

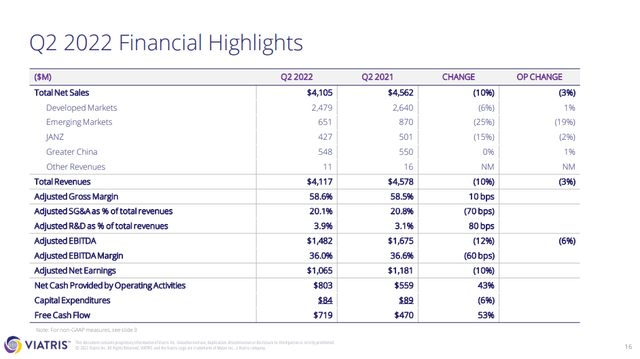

Viatris makes a lot of money outside of the US, which means the monumental increases in the value of the dollar have been a problem. This has driven the headline declines in revenue for the company both on a 3 month and 6 month basis.

Operational changes which account for the negative FX impacts show that the business was pretty stable. There was some pressure in the supply chain broadly but also with retail sales in China which continue to experience pretty severe intermittent lockdowns over COVID-19. Hospital sales partially offset the negatives here but not completely.

The declines in EBITDA end up being driven primarily by increases in R&D expenses which remain a naturally low part of the cost basis due to VTRS being a generics company. Nonetheless, a growing focus on more complex biologics in order to sit at a more valuable point within the world of generics puts the only real pressure on EBITDA besides the loss of sales from primarily FX effects.

The company continues to move forward with getting regulatory approval mainly on antitrust matters regarding the sale of the biosimilars business almost in full to Biocon Biologics which is a pharma company that trades on the Indian markets. They worked in collaboration with VTRS on a lot of the biosimilars in its portfolio with commercialisation agreements, but also manufacturing and supply agreements across the developed markets that VTRS operates in. Now they are buying the whole portfolio.

The Biocon Sale

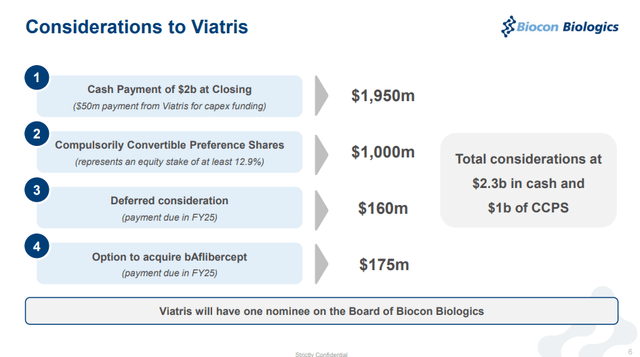

The acquisition ends up painting a pretty favourable picture regarding the possible overall value of the VTRS portfolio. The terms of the agreement to sell the biosimilars portfolio is as follows. About $2.3 billion in cash payments, a portion of which is deferred and another which is a contingent option to buy a biologic from VTRS, as well as leaving a 12.5% economic interest in Biocon through preferred shares which gives some special addition liquidation rights in the event of change of control situations for the “new Biocon”.

It’s hard to value the preferred shares exactly, but the face value ends up being $1 billion according to Biocon, where Biocon has a value of $4 billion in market cap. A 12.5% economic interest would be about $400 million in value, less than the $1 billion given, and this is maybe a better way of valuing them since they are compulsorily convertible. The portfolio that Biocon is buying produces $250 million in forecast annual EBITDA in 2023 and the valuation is effectively 13.2x for the business EV/EBITDA.

Bottom Line

The biosimilars portfolio is a strong part of VTRS, but investors have put a lot of value on the brands in the portfolio, like Viagra and Lipitor, which have been able to produce recurring revenues and maintain certain pricing and value despite having lost exclusivity in some cases decades ago. These are massive brands. Currently biosimilars is where the growth is coming from, because new developments come into that portfolio, but the brands portfolio is the cash cow and has that brand moat that is unusual in pharma.

Therefore, one might think that if corporates value the biosimilar portfolio at 13x, the brands portfolio may deserve something similar. We must point out that the sold assets are only about 5-7% of VTRS current business in both EBITDA and revenues. Still, VTRS currently trades at 5x EV/EBITDA which could be low given this precedent. Perhaps the deal being made in February 2022 precedes the period where capital market multiple started to completely fail the carve-out and spin-off markets. We are relatively optimistic about those multiples coming back at some point in the next couple of years, but still times have changed for now.

The dividend has been raised 9% since it started last year, and the company continues to uphold the dividend and its current yield is 4.5%. There is an income proposition here too on top of the value proposition. Would we bite? No. Besides the China retail risk, we still worry about how sustainable, even ethically sustainable, VTRS margins might be. China is making it harder in the bidding processes and such attitudes could spread to other governments. Still, VTRS does not look expensive right now.

Be the first to comment