luza studios

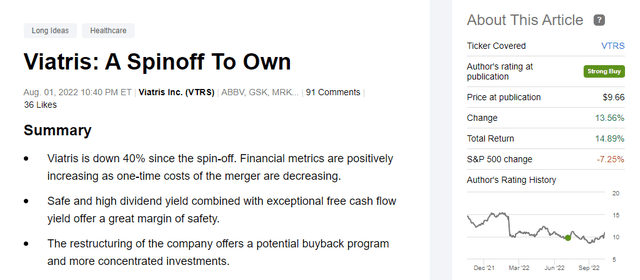

In Augustus, I wrote my first article around Viatris(NASDAQ:VTRS). The company and management team was being doubted by many. Not only have investors been rewarded by almost 15% since then, all of this happened when the market was in a downtrend. The last point in the summary of my last article is what made the tide shift: The restructuring of the company offers a potential buyback program and more concentrated investments. In particular, the latter part.

Better than expected results, despite FX headwinds

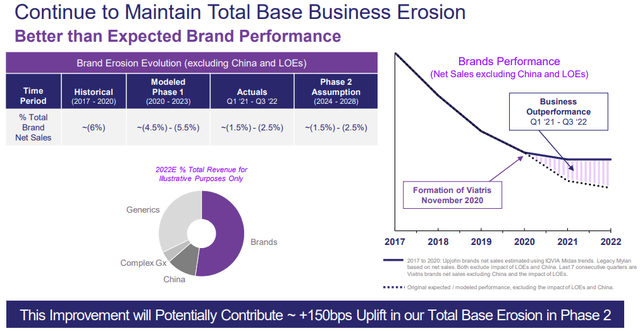

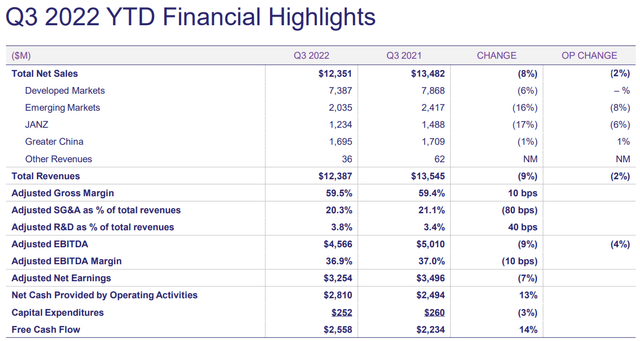

It is well-known that the sales of medicines decline as time goes on due to competition. Although this has been the case for Viatris, the sales of Viatris’ portfolio have been quite resilient.

Total net sales have only declined 2% YTD (Q1-Q3) compared that of the previous year based on operational performance. Including FX headwinds net sales declined by 8%. On the other hand, it is important to note that free cash flow has been increasing by 14%. Brand medicine continue to hold up firmly against erosion, making room for stable financials. In addition, cost of goods sold and SG&A optimization is helping to decrease expenses. Further, Viatris has exited all transitional post-merger services with Pfizer.

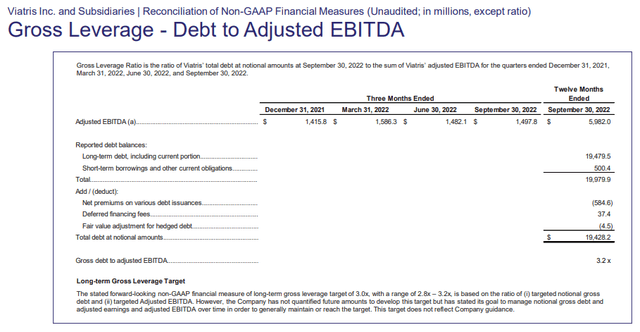

Debt repayment picking up pace

Viatris met the annual target of paying down $2.1 billion of debt, one quarter ahead of schedule. Thereby, they are on track to pay down $6.5 billion of debt by the end of 2023 since the merger. Gross debt to adjusted EBITDA currently sits at 3.2x, which is nearing the target of 3x. Commitment to the investment-grade rating stays a high priority as it provides the company with lower interest rate on debt and allows for cheaper financing. Once debt is under control investors can expect higher shareholder returns through dividends and share buybacks, but can also see more reinvestments into the business to keep free cash flow strong.

Moving up the value chain

Viatris has been all about stabilizing the business, creating synergies, looking for valuable divestitures and paying down debt, in which they have been doing a good job. However, strategic plans are now nearing the next stage, the road back to growth. Wall Street immediately woke up and shares rose by at least 13% after the company announced their first plans to grow again.

The plan exist out of 3 core segments: divestitures, higher-margin organic pipeline and creating the foundation to be the next ophthalmology leader.

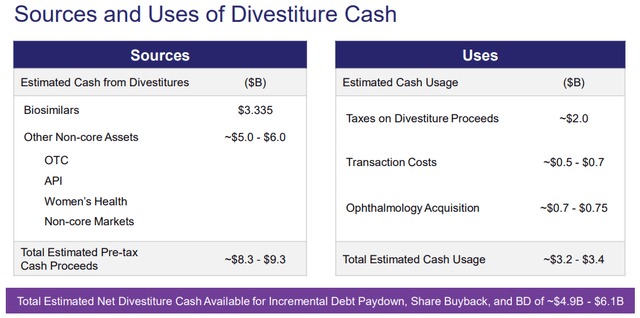

Divestitures

Knowing that parts of the business are eroding, it isn’t a bad move to sell some of those assets to create new valuable assets. The assets with a lower-than-average margin will be sold; these include: OTC, API, Women’s Health and non-core assets. The total estimated pre-tax cash proceeds are around $5-6 billion. Together with the Biosimilars divestitures the grand total is $8.3-9.3. Part of this goes to taxes and transaction costs. On top of that, the divestitures are also used to fund the new ophthalmology acquisitions, so no new debt will be issued.

After that, $4.9-6.1B is left in cash to paydown debt, do share buybacks and further develop the business. Since we know debt is already reduced substantially, most of it can go to shareholder rewards, M&A or R&D. The gives a much clearer prospect and certainly attracts more investors on board.

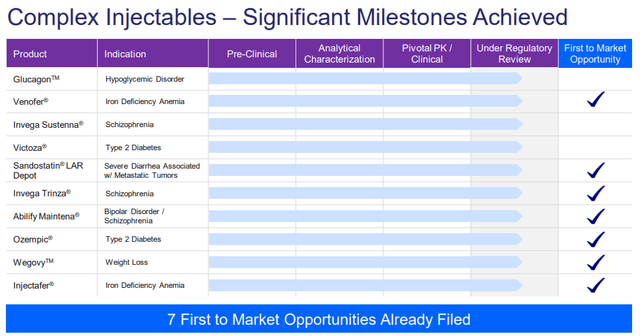

Higher-margin organic pipeline

The boost in R&D will go towards the in-house pipeline, while focusing on the higher-margin segments, to counteract the eroding in the other parts of the business. The main focus will be in the complex injectables franchise and the select novel & complex products pipelines. Both of these could deliver up to $1 billion in net sales towards 2027-2028.

The complex injectables franchise has 7 first to market opportunities already filed.

The select novel & complex products pipeline has 3 products in phase 3 with regulatory approval up next.

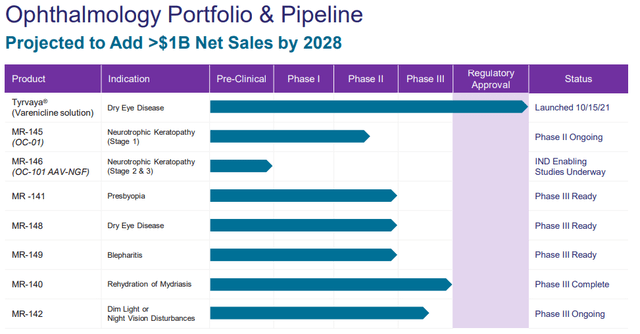

The next ophthalmology leader

Biotech companies have been crashing all over the place, which created new M&A opportunities for big pharma. Viatris took advantage of the market downturn and acquired two companies: Oyster Point Pharma (OYST) and Famy Life Sciences.

Both companies specialize in medicine for eye disorders. Oyster Point Pharma currently has a product on the market, Tyrvaya, to cure dry eye disease. Tyrvaya is the first and only nasal spray approved for dry eye disease. Famy Life Sciences on the other hand has promising phase 3 ready products. The ophthalmology franchise is expected to add $1 billion in sales by 2028. Although the companies are not yet profitable; Viatris has the expertise, infrastructure and marketing to make these businesses EBITDA positive. By 2028, at least $500 million in adjusted EBITDA is expected to be earned.

The acquisitions are funded by the Biosimilars divestitures and are expected to cost around $700-750 million. The leftovers of the Biosimilars divestitures is planned to go towards share buybacks.

Buyback action while the shares are cheap

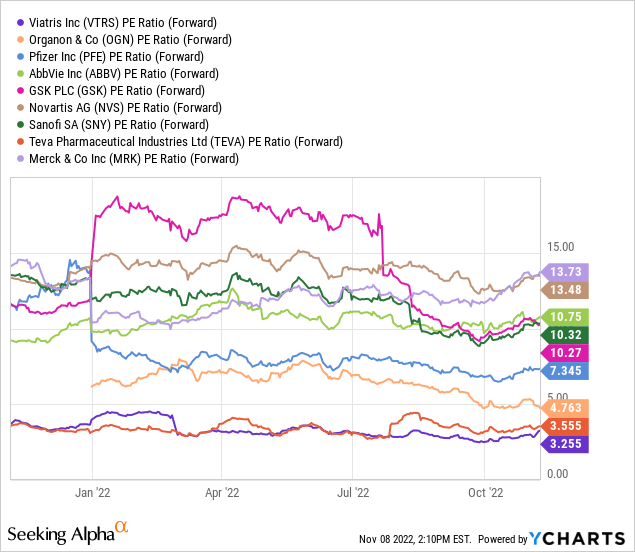

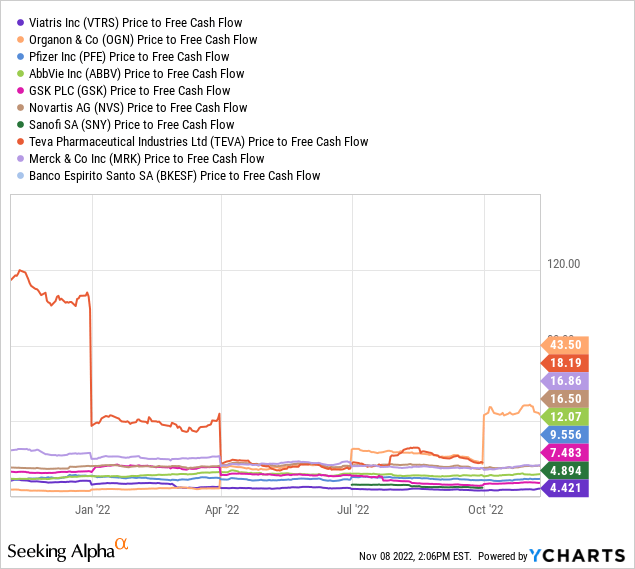

The following graphs illustrate that Viatris is trading the cheapest compared to its peers at only 3.25x forward earnings and 4.42x price-to-free cash flow. There is no better time to do buybacks than at an all-time low valuation. Further, buying back shares now will decrease future dividend payouts, as a result of less shares outstanding. The company has been authorized to buyback back $1 billion in shares, representing more than 7% of the current market cap. Now that the firm is back on a growth trajectory is seems that the present valuation is a bit too low. Therefore, I do anticipate stock appreciation in the following months.

Takeaway

The significant worries of investors have finally been answered. The management showed some good-looking prospects for the business and the willingness the make Viatris more than just a “spinoff”. Debt is decreasing at a solid pace securing the safety of their investment grade rating. Divestitures opened up opportunities for more R&D spending to counter the business erosion, M&A’s to create a new path to growth, and extra shareholder value

The company has been resized/optimized for a new chapter and so far, it looks very promising. A clear plan has been laid out, the next step will be a proper execution. Up to this point, the slowdown of the business erosion and the fast M&A action give me a good sign.

Next to stock appreciation, investors should not forget they get a fat dividend paid to wait. Additionally, there is a good chance we will see another dividend increase around January. In consequence of more free capital and the commitment to give back 50% of free cash flow to shareholders. Viatris’ dividend as of now is 4.96% with a 23-26% payout of free cash flow.

Investors do need to be wary that debt can still pose a risk, if free cash flow is not able to stabilize and is able to decrease into the following years. The management team is aware of this risk and is now proactively keeping it at bay.

I retain my rating of a Strong Buy. The future for Viatris has become more visible and the business is expected to grow at a 3% CAGR (2024-2028). Therefore, the present price is still attractive for long-term investors after the recent price action.

Be the first to comment