If you’re a reader of my articles, you’re likely well aware of my stance on long-term bonds. Put simply, I believe they have far more total downside risk than do equities. Even more, I would not be surprised if they fall with equities over the coming weeks and months.

The historical reasons for long-term Treasuries to outperform during recessions is breaking down. This upcoming/current likely recession has both deflationary demand forces (per usual and bullish for long-term Treasuries) and also inflationary supply-shortage forces (which is bearish for long-term Treasuries). More on this in “BLV: Long-Term Top May Be Near For Long-Term Bonds.”

I’d like to zoom in on a new issue that I have not discussed that adds to my long laundry list of bearish cases for long-term bonds. This is the likely/potential impact of the blowout of the U.S. Federal deficit and a massive increase in the intensity of the Fed’s Q.E. policy.

As I’ll demonstrate, these factors make short selling a long-term bond ETF like Vanguard’s (VGLT) a superior risk-reward trade than buying the dip in stocks.

The Myth of the Central Bank ‘Free Lunch’

If you remember the aftermath of 2008, you’ll likely recount the widespread fear of hyperinflation due to the substantial increase to the U.S. Federal deficit and introduction of Q.E. That said, given measures already promised, the 2020 U.S. deficit and Q.E. are likely to be larger than in 2008-2009. Even more, capital gains tax revenue is likely to fall substantially and make it clear to investors that the U.S. government can no longer make debt payments without monetary financing.

Contrary to popular opinion, there is no such thing as a free lunch. Governments cannot rely on central bank money creation as a long-term means of financing. Many believe that the U.S. will be able to become like Japan and maintain a public debt-to-GDP in excess of 200% long term, but that can only occur if inflation remains near zero. Once inflation rises, seigniorage is no longer feasible and hyperinflation risk rises dramatically.

Japan has been able to avoid this for decades due to demographic factors that reduce inflation (i.e., aging population) and, more importantly, the rapid industrialization of the rest of East Asia. Japan has been able to import goods from its close neighbors at much lower prices than it costs to produce them at home while exporting its yen to finance debt in Asia, thus keeping the yen strong.

Now that these deflationary factors are ending, it is likely that Japan, the U.S., and perhaps most of the developed world will see inflation rise far faster than currently expected. Further, it is highly unlikely that the U.S. Federal Reserve and its peers will raise rates during times like today, exacerbating the issue.

In the past, I viewed this as a long-term risk that long-term bond investors should keep in mind. In the short run, I only saw a moderate rise in inflation due to supply shortages. Over the coming month or two, a small drop in inflation is likely due to the collapse of oil prices. However, with $1000 “helicopter money” checks getting ready to be sent out to all Americans and a potential doubling of the U.S. fiscal deficit, I believe this is a much more immediate risk.

A Closer Look at the Federal Deficit and Fiscal Stability

Over the past twelve months, the U.S. Federal deficit has been $1.06T. This was before there was a widespread risk of a recession. As you can see below, this deficit is almost as large as it was in 2009:

Obviously, the deficit is not as large as it was during the last recession, but it is alarming as the deficit is usually rising prior to a recession not falling. Looking purely at this chart, most would think the U.S. has been in a recession since 2016. Indeed, if you exclude the deficit, GDP growth would be much lower.

The deficit is likely to widen tremendously this year. On a TTM basis, we can expect it to be at least $1T. However, Treasury Secretary Steven Mnuchin has arranged a bill that will add an additional $1T stimulus package relating to the coronavirus. Recessions usually see capital gains revenue get cut in half and corporate tax revenue by a third. This implies an additional $140B loss in revenue.

Additionally, Medicare and Medicaid which were expected to be $1.1T this year will likely jump as the elderly and others are in critical condition due to the virus. It is estimated that 10-20% of COVID patients will require hospitalization. Each of these hospitalizations will likely require around $15,000-20,000 and around half are likely to be of Medicare age.

So, if half of the U.S. population eventually catches the virus, we can expect about 25M hospitalizations. Around half are likely to be on Medicare and of the remaining half 20% on Medicaid, meaning 15M hospitalizations on the government’s dime. Assuming $17,000 per hospitalization, this equates to roughly $250B in extra mandatory spending. Obviously, you could change the numbers for a different result, but the magnitude should be similar.

The Medicare system was expected to be insolvent in six years, but the fund only has about $185B in positive assets, so the virus may cause insolvency much sooner (perhaps even this year or next).

Putting this all together, I believe that it is very likely that the Federal deficit reaches roughly $2.5T this year plus or minus a few hundred billion. The deficit alone will be roughly 10% or more of the entire U.S. GDP.

Of course, this is before accounting for the potential insolvency of the U.S. Government’s Pension Guaranty Corporation which insures the pension of over 35 million American workers and retirees. Past estimates mentioned that the PBGC was expected to be insolvent by 2025 (and perhaps earlier). However, most pensions have around 60% of their assets in equity and private equity exposure at an extreme (among other high-yield instruments), I’d estimate insolvency will come much sooner.

This is a conservative estimate. If all current stimulus bills make their way through, an additional $1T in stimulus could be added that would bring the total well over $3T. As is rarely the case, both parties seem resolute that pouring digitally printed money on an extremely complex problem is a solution. While hyperinflation in the U.S. would be more catastrophic for the globe than past isolated cases, investors should not assume that the U.S. dollar is inherently immune. A review of hyperinflationary history makes that clear.

Put simply, this is not a budget I want to be lending to be financing. Particularly with a long-term obligation that pays slightly over 1%.

The Federal Reserve Factor

If my deficit projections pan out, it is likely that the market value of U.S. Federal debt will be around $27.5T by year-end. Since the deficit has grown during a “bullish economy” and the government collects far less than it pays, I do not believe it is reasonable to believe that it will eventually be able to generate a near-zero deficit again.

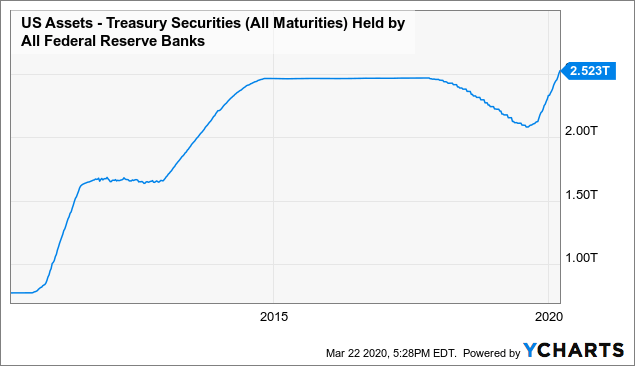

Obviously, this does not mean the government will default since the Federal Reserve can use Q.E. to finance the deficit. This has already been occurring over the past few months as you can see below:

Data by YCharts

Data by YCharts

As I mentioned at the beginning of the article, this can be sustained so long as inflation remains low. If the Fed creates money in the face of rising inflation, they risk causing a currency collapse as has happened countless times in the past. Even the Federal Reserve has warned that going down this path may eventually cause hyperinflation in the U.S. Quote from the Federal Reserve:

Credit risk is the risk to the lender that the borrower will not repay the loan. It is one component of the interest rate that borrowers pay. Like for all loans, interest rates on Treasury securities reflect risk of default. The higher the risk of default, the higher the interest rate investors will expect: A country perceived as a higher credit risk must pay bond holders higher interest rates than a country perceived as a lower credit risk, all else equal. Thus, when bond yields spike, it might reflect rising risk.

Economist Herb Stein once said, ‘If something cannot go on forever, it will stop.’ In other words, trends that are unsustainable will not continue because the economy will adjust, sometimes in abrupt and jarring ways. While governments never have to entirely pay off debt, there are debt levels that investors might perceive as unsustainable. A solution some countries with high levels of unsustainable debt have tried is printing money. In this scenario, the government borrows money by issuing bonds and then orders the central bank to buy those bonds by creating (printing) money. History has taught us, however, that this type of policy leads to extremely high rates of inflation (hyperinflation) and often ends in economic ruin. Some of the better-known examples of such polices are Germany in 1921-23, Zimbabwe in 2007-09, and Venezuela currently.

If you want a signal to sell Treasury bonds, this is it.

A Short Opportunity for VGLT

Hyperinflation is a dirty word as it has never occurred in the U.S. However, just because it has yet to occur and would be disastrous does not mean it will not. All it takes is the mass-realization that there is no feasible way for the U.S. government to pay off its debt without creating substantial inflation by printing up to $27 trillion.

If investors believe “print risk” is likely, many will sell their historically high allocation toward bonds and cause rates to rise. Major U.S. creditors like China are also currently dumping treasuries at record rates in order to (try to) keep their currency strong and others like Japan may follow suit.

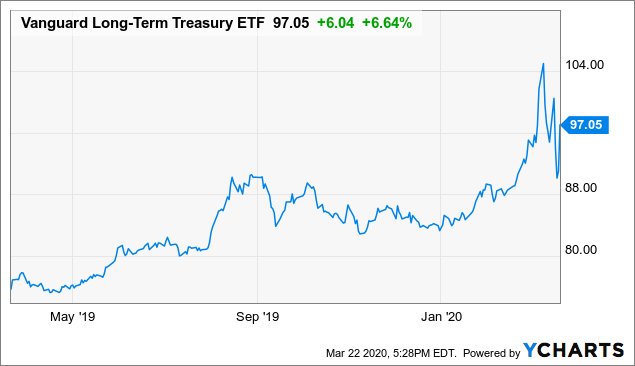

Even more, today when the White House announced its historical stimulus package, the Treasury market crashed, with VGLT falling a staggering 6.72%. Of course, this comes after a meteoric few months, but this is a signal that the “blow-off top” is quickly on the verge of becoming a bust. See below:

Data by YCharts

Data by YCharts

If you’re looking to “buy the dip” in equities, short selling long-term Treasuries is likely to offer far superior risk-reward at this point. As seen today, increases to the U.S. deficit are likely to harm long-term Treasuries before short-term bonds since they carry the highest default/”print” risk.

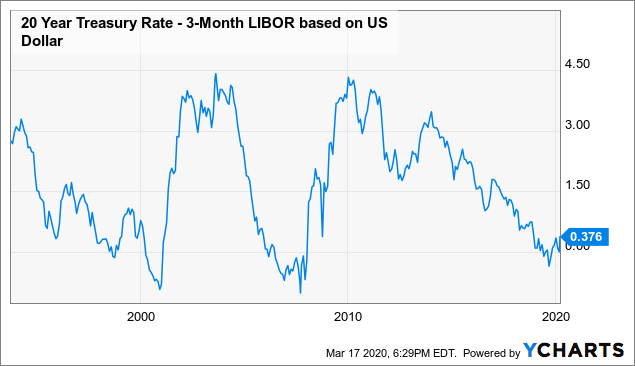

Looking at an extended yield-curve of 20-year minus LIBOR, we can also see that there has been another clear bottom:

Data by YCharts

Data by YCharts

As you can see in the past, the curve usually rises during recessions which cause long-term bonds to underperform short-term peers.

There are multiple long-term Treasury ETFs one can use to short, but I believe that VGLT is a solid choice. It has a low YTM of 1.6% and a very high effective maturity of 25.3 years, giving it a substantial duration of 18 years. This means a 1% rise in rates is expected to cause VGLT to fall 18%. VGLT is also extremely liquid with $5B in AUM due to its extremely low expense ratio of 5 bps. While the iShares (TLT) has a larger AUM of $25B, I believe that money will flow into VGLT since TLT has a higher expense ratio of 15 bps. This gives VGLT likely superior volume going forward.

The Bottom Line

With the U.S. deficit likely to expand to unprecedented levels in 2020, investors would be smart to sell their long-term Treasury positions and even look to short selling. Remember, if you own a 25-year maturity Treasury bond at 1.5%, you’re betting that inflation will stay below 1.5% for 25 years (it’s currently higher) and that the Federal Government will run into zero financial difficulties within that time period.

I know this is a high contrarian view, but I’d be surprised if the Federal government does not run into financial difficulties within the next three years. If you consider the decreasing pool of Treasury buyers in Asia and the fact that many in the U.S. do not plan on holding their Treasuries once equities bottom, it seems the printing press will be their only buyer. This will make deficit financing difficult without creating possibly substantial inflation that would cause VGLT to fall well over 50%.

In other words, I firmly believe that VGLT is a “sell.”

Interested In My More-Exclusive Research?

My fellow contributor BOOX Research and I run the Core-Satellite Dossier here on Seeking Alpha. The marketplace service provides an array of in-depth portfolios designed using the academically-backed Core-Satellite approach. This involves creating a base long-term portfolio (the core) and generating alpha using unique well-researched tactical trades (the satellite).

As an added benefit, we’re allowing each new member one exclusive pick where they can have us provide in-depth research on any company or ETF they’d like. You can learn about what we can do for you here.

Disclosure: I am/we are short VGLT. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Be the first to comment