bombermoon/iStock via Getty Images

Some weeks ago, Vestas Wind Systems (OTCPK:VWDRY, OTCPK:VWSYF) announced its Q3-2022 earnings with results that were below analysts’ expectations and guidance for FY2022 that was revised downward. In this article, I will provide a review of Vestas’ results and I will explain the reasons behind my BUY recommendation.

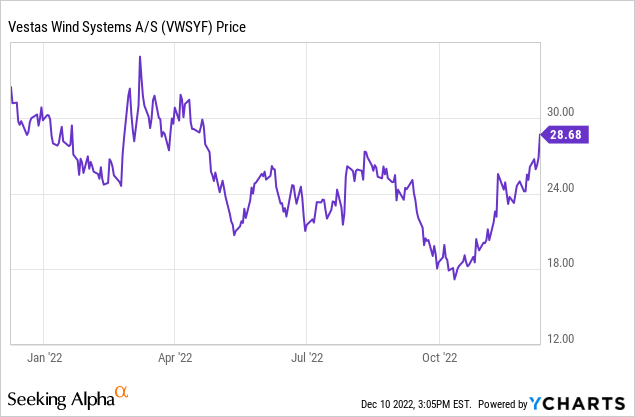

Stock price

Vestas is currently trading at DKK203/share, equivalent to a market capitalization of DKK 205bn ($ 29bn), and it is up 2% year-to-date and down 4% year-on-year. The stock is now trading close to the 52-week maximum DKK 235 (March 8th, 2022) thanks to a strong bullish recovery after reaching the 52-week minimum in October (DKK 135/share).

Q3-2022 operational results

During Q3-2022, order intake for new onshore turbines declined 49% year-on-year to 1.9 GW, of which 1.1 GW in the Americas, 0.8 GW in EMEA and only 94 MW in Asia. The main reason behind this significant drop is to be found in customers delaying new orders due to uncertainty in offtake agreements and rising costs of new projects. In monetary terms, new order intake amounted to € 2bn, versus € 3bn in Q3-2021: the decline in economic value is less than the GW value because Vestas has gradually been increasing the average selling price of order intake, from 0.81 M€/MW to 1.07 M€/MW, to reduce the impact of cost inflation and ensure future profitability.

At the end of Q3, wind turbines backlog was worth € 18.1bn (-6% year-on-year) or 19.2 GW (-20% year-on-year): the year-on-year decline is mostly due to a lower backlog in EMEA (-30%), because of the exclusion of Russia and Ukraine from the perimeter, and in Asia (-20%). As expected, turbine deliveries declined as well with 3.6 GW delivered in Q3-2022 vs 6 GW delivered in Q3-2021 with lower delivery volumes spread mostly in USA, Vietnam, and the UK.

Differently from the wind turbine business, the service business unit had a very positive performance and is gradually becoming the main driver of value generation for Vestas. At the end of Q3, Vestas had 141 GW of active contracts (+14% year-on-year) with APAC growing at a 27% yearly rate and EMEA/Americas at 12%. Almost half of the € 33bn worth of service portfolio is in EMEA (47% or 67 GW), with Americas accounting for 39% (55 GW) and APAC for 13%.

Q3-2022 financial results

Revenue in Q3-2022 was € 3.9bn, almost 30% less than in Q3-2021 (€ 5.5bn). The decline can be explained by lower project deliveries in Europe and USA, where revenues declined by 36% and 25% respectively, and with the Company’s decision of leaving the Russian/Ukrainian markets. In terms of geographical areas, EMEA accounted for 51% of revenues with the Americas at 35% and APAC at 14%. While wind turbine sales declined by 30%, revenues generated by the service business unit increased by 32% and are now representing 20% of Vestas’ total revenues.

Production costs declined 24% year-on-year to € 3.8bn, mostly due to the lower number of produced turbines. SG&A costs were in line with the previous year at € 288M (€ 85M for R&D, € 117M for distribution and € 86M for administrative activities).

Despite positive gross margin (4.1%), EBIT and net income were both negative at € -114M and € -147M, respectively.

Looking at the cash flow statement, one can notice that free cash flow was largely negative at € -644M, mostly for the reduced income and for the increase in net working capital caused by delays in inventory unwind.

At the end of Q3, Vestas had a cash position of € 1.2bn and a net debt of € 1.1bn.

A brighter future ahead

2022 has been a difficult year for Vestas with new orders that have been declining quarter after quarter and losses that have become the normality. However, I believe that 2023 is set to be the year of redemption thanks to different dynamics that are all pushing in the same favorable direction. US and European governments are actively trying to reduce CO2 emissions with policymakers focused on developing policies that can accelerate the development of renewable energy projects (including wind) by reducing the bureaucracy and simplifying the permitting processes.

Moreover, supply chains are slowly getting back to more normal levels with bottlenecks that are gradually being eased: consequently, I believe that this will have a positive impact on Vestas due to a potential reduction in raw material costs and to fewer project delays that have been reducing revenues.

Valuation

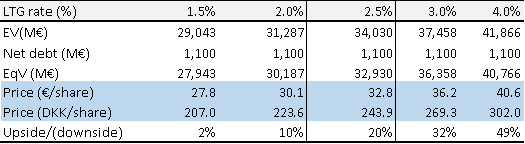

To understand if the stock is currently trading at a discount or premium to its intrinsic value, I calculated a potential target price with a DCF model. These are the main assumptions:

- revenues estimated starting from the 2022 company guidance (€ 15bn) and assumed a 7% annual growth rate in line with the latest report from the Global Wind Energy Council;

- FCFs derived using the average FCF-to-sales ratio of the last years under the assumption that market conditions will gradually return to normality;

- long term growth rate of 2.5% applied to FCFs after 2026;

- FCFs discounted with a 7% WACC.

Under these assumptions, the target price is DKK 244s/share, almost 20% higher than the current trading price. Since the LTG rate has a large impact on the terminal value, and consequently on the target price, I performed some sensitivities with different LTG rates and even with a pessimistic 1.5% LTGR there would be no downside.

Author

Conclusion

Despite Q3-2022 showing a decline in new orders and being the third consecutive quarter with a net loss, I believe that Vestas has a significant unexpressed potential that could be realized in 2023. Policymakers all around the world are working to streamline the permitting processes for the development of new renewable energy projects, including wind, and Vestas – being the leader in wind turbine manufacturing – will benefit from this.

Overall, I believe that the current trading price represents an entry point that could provide a significant upside.

Be the first to comment