FG Trade

Veru Inc. (NASDAQ:VERU) has dropped considerably in recent weeks following the negative recommendation of its potential Covid-19 treatment (sabizabulin), and its investment case continues to be highly dependent on sabizabulin approval in the next few quarters.

Background

As I’ve analyzed in a recent article, Veru has an interesting business profile given that its business is a combination of a relatively stable operation (the sexual health division), plus it has upside from its growth opportunities in oncology and potential treatment for Covid-19. However, most of this potential growth was already priced in at the time and potential risks were significant and were a major threat for the company’s investment case.

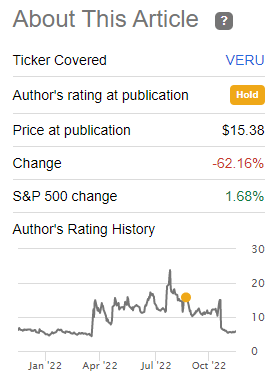

My rating on Veru on that article was ‘Hold’ and I didn’t buy its shares for my personal portfolio, as the risk-reward proposition was not particularly compelling. Since my article, Veru’s stock price has declined by more than 60%, supporting my view that its shares were already reflecting a positive outcome regarding its growth projects, which wasn’t certain.

Performance (Seeking Alpha)

Considering that Veru’s stock price is now much lower than it was some three months ago, I think it is a good time to revisit its investment case, also taking into account that Veru has very recently released its most recent quarterly earnings.

Veru Q4 Earnings Analysis & Drug Developments

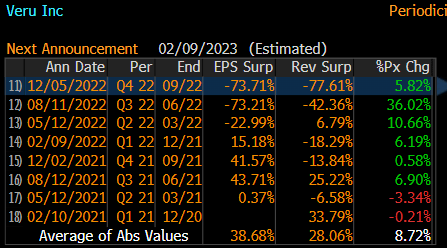

Regarding its most recent quarterly financial figures, Veru reported yesterday its Q4 and annual results for fiscal year (FY) 2022, which were way below market expectations. Indeed, as shown in the next table, Veru’s revenue and EPS were both more than 70% below estimates, being the worst quarter by these measures over the past eight quarters.

Earnings surprise (Bloomberg)

For the full year, Veru’s revenue was $39.4 million, compared to $61.3 million in the previous year. Investors should note that all of its revenue comes from the FC2 female condom, which had a tough year due to the challenging business conditions of its telemedicine customers.

While its gross margin was stable at 78% of revenue, Veru’s research and development expenses increased to $70.6 million (vs. $32.7 million in FY 2021), which led to an operating loss of $83 million in the year (vs. operating income of $13 million in FY 2021). Despite its negative earnings, the company still has a sound financial position, given that its cash balance was about $80 million at the end of last September, which is enough to finance its operations in the short to medium term.

Investors should note that Veru’s business model is to use its current mature business based on the FC2 female condom to finance the development of several drugs, which require significant investments. Therefore, Veru is highly dependent on its Sexual Health Division to generate revenue and cash flow, which is then used to fund the clinical development of the company’s drug pipeline.

This strategy has been successful in recent years, even though its free cash flow has been historically negative, but at relatively small amounts in absolute terms. However, Veru’s free cash flow was negative by some $48 million in FY 2022 (vs. negative $15 million in Fy 2021), which can be considered a warning sign for investors.

To improve revenue of its FC2 female condom, which is key to generating cash flow in the coming quarters, Veru intends to seek additional partnerships with telemedicine and internet pharmacy services, plus it also has created and launched its own direct-to-patient telemedicine and internet pharmacy services platform. It is already a growing source of revenue, and the company is committed to expand its customer reach and base, which can be important to achieve revenue and cash flow growth in the next few quarters.

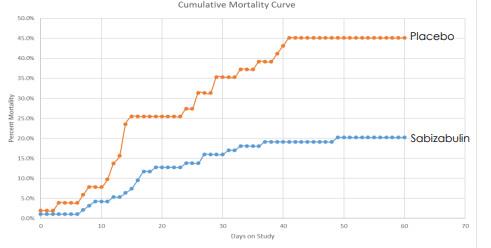

Regarding its drug pipeline, Veru’s most promising product is its anticancer drug sabizabulin, which can potentially be used for the treatment of hospitalized Covid-19 patients, which have a high risk of developing acute respiratory distress syndrome (ARDS). This treatment has dual antiviral and anti-inflammatory effects and has provided good indications of its efficiency, reducing the mortality rate considerably compared to patients treated with placebo.

Trial data (Veru)

While Veru is encouraged that sabizabulin will be approved for use in both the U.S. and abroad, the company suffered a setback recently, when an advisory committee of the FDA voted against granting the emergency use authorization for sabizabulin. This led to a sharp drop on Veru’s share price, even though this committee only issue non-binding recommendations.

Nevertheless, FDA usually follows these recommendations before making a final decision on authorizations, not boding well for sabizabulin’s approval in the U.S. While an emergency use authorization (EUA) seems unlikely at this stage, Veru can further improve its Stage 3 trial to include more patients and countries, as the lack of enough data seems to be a major issue in the advisory committee recommendation.

Beyond the U.S., sabizabulin is also being reviewed in Europe, by the European Medicine Agency (EMA), for potential use in 31 member states. The review is currently under the Emergency Task Force, which will also issue a recommendation to the EMA, but there isn’t a timeline for approval or not of the drug in Europe. In addition to these applications, Veru has also submitted requests for emergency use authorization in the U.K., Australia, Switzerland, Canada, and South Korea, plus the company is also in discussion with regulatory agencies in other countries, such as Israel, Egypt, Singapore, and South Africa.

This means that sabizabulin may eventually be approved in the U.S. and abroad for treatment of Covid-19 patients in hospitalization, which would be a key milestone for the company and improve significantly its financial figures. However, as it happened recently in the U.S., negative recommendations or rejections of authorization may happen in foreign countries, which would be another blow for Veru’s share price.

Despite these uncertainties, Veru has already established manufacturing processes and has commercial drug supply on hand to address anticipated drug needs, expecting to obtain FDA approval in the U.S. Moreover, it also established Veru International for the commercialization of sabizabulin to the rest of the world, if it receives approval from various regulatory agencies.

Going forward, Veru expects to start generating revenue from the launch of ENTADFI, which is now commercially available and should be another source of growing revenue and cash flow stream. While Veru’s management expects this product to have some $200 million annual sales potential, it is difficult to estimate how much revenue the company will generate from this product over the next few years.

Nevertheless, according to analysts’ estimates, Veru should decrease its revenue from $48 million in FY 2022 to only $44 million in FY 2023, and grow to $90 million in 2024 and about $205 million by 2025. These estimates are much lower than back in September, when analysts were expecting revenue to be about $450 million by 2025, showing that expectations were severely reduced following the negative recommendation from the advisory committee.

Conclusion

Veru’s current market value is about $466 million, much lower than its $1.3 billion value when I last analyzed the company back in September, but still much higher than can be justified by its current business. Therefore, most of Veru’s value is still justified by the potential approval of sabizabulin in the U.S. and abroad, which is likely to take time. Further complementary Stage 3 trial data is likely to be requested in the U.S., while abroad the regulatory process seems to be still at an early phase. Thus, investors should remain on the sidelines on Veru for the time being, at least until there is more certainty about the prospects of sabizabulin as an effective Covid-19 treatment.

Be the first to comment