Jordan Siemens/DigitalVision via Getty Images

Investment Thesis

When I last covered Vertex (NASDAQ:VRTX) for Seeking Alpha in May last year, its stock was trading at a value of $209, down from an all-time high of $294 12 months prior, and I urged investors to buy the dip at the time based on the overall strength of Vertex’ Cystic Fibrosis franchise, which drives exceptional revenues and profitability, cash position of nearly $7bn, and partnerships in place with gene and mRNA drug developers, most notably in Sickle Cell Disease with CRISPR Therapeutics.

Fast forward nearly one year, and Vertex shares have risen in value by 30% to reach a value of $273 at the time of writing, not far off their all time high.

At the end of January, Vertex released its Q421 and FY21 earnings results, and across the full year, revenues grew by 22% to reach $7.6bn, with a staggering $5.7bn of those revenues generated by TRIKAFTA/KAFTRIO, Vertex’ triplet combo targeting Cystic Fibrosis (“CF”), which has replaced Vertex older therapies SYMDEKO, ORKAMBI, and KALYDECO as the standard of care.

Net income in FY21 was $2.34bn, implying a net profit margin of 31%, and EPS was $9 on a GAAP basis and $13 on a non-GAAP basis, for a price to earnings ratio of either 30x, or 21x.

Guidance for 2022 is for $8.4bn – $8.6bn, and combined GAAP R&D and SG&A expenses of $3.3 – $3.45bn, with a GAAP tax rate of 21%, which by my calculation, suggests EPS in the region of $15.8, or a forward PE of ~17.5x.

These are very attractive numbers, and perhaps deservedly so, since Vertex dominance in CF has been good not just for the company, but for patients also.

According to Vertex’ latest earnings presentation, real world data gathered from 16k CF patients has shown that treatment with TRIKAFTA reduces the risk of lung transplant by 87%, leads to 77% fewer pulmonary exacerbations, and a 74% reduction in risk of death.

Vertex enjoys near total dominance in the CF market, with AbbVie (ABBV) it’s only credible challenger, marketing and selling the pancreatic enzyme replacement therapy (“PERT”) agent Creon, whilst Italian Pharma Chiesi, Gilead Sciences (GILD), Teva Pharmaceutical Industries (TEVA), Roche (OTCQX:RHHBY) subsidiary Genentech, AbbVie and Horizon Therapeutics (HZNP) remain active in the space.

In my previous note on Vertex, I discussed the history of the Boston based biotech and how its CF franchise was built, as well as the mechanism of action (“MoA”) underscoring the success of the CFTR modulator TRIKAFTA, so I will not repeat myself in this post, but I will address the major concern that analysts tend to have in relation to Vertex, which is whether its drug development pipeline can match the incredible success of its marketed CF drugs.

In some ways it’s an odd concern to have about Vertex – its patents for TRIKAFTA/KAFTRIO don’t expire until 2037, there’s no other company currently capable of challenging for market share in CF, and according to Vertex management, ~25k of an 83k patient market in CF in the US, Europe, Australia and Canada remain untreated, meaning Vertex can continue to grow and thrive for perhaps a decade or more purely based on its CF franchise.

With that said, Vertex’ current market cap of $69bn is arguably quite high for a company generating <$10bn per annum in revenues, implying a P/S ratio of >10x, compared to the US big Pharma sector’s average P/S of ~5X, plus all 8 of the US’ largest Pharma’s pay a dividend, with an average yield of 3%, whereas Vertex does not.

Therefore, it seems reasonable to question whether there’s sufficient growth in the CF space alone to justify such a high market cap valuation, and when development of one of Vertex’ leading pipeline candidates – VX-814, indicated for the genetic liver and lung disorder Alpha-1 antitrypsin deficiency (“AATD”) – was discontinued last year after patients exhibited elevated liver enzymes 8x the normal limit – it came as a severe blow to the company and to its share price.

Nevertheless, Vertex’ management – led by CEO Reshma Kewalramani – has been working hard to address this issue, and in the remainder of this post, I will take a closer look at the company’s pipeline and what it may be worth to Vertex’ top and bottom lines between now and the end of the decade.

At this time, despite its promise, I must admit I don’t see too much upside for Vertex stock based on most standard measures of value, including discounted cash flow and EBITDA multiple modeling, investment ratios such as forward P/E and P/S ratios and perhaps even cash flow generation, despite Vertex’ phenomenal profitability.

Vertex has invested $2bn in share buybacks since 2019, management told analysts on the recent Q421 earnings call, which has been great for shareholders, but share buyback programs don’t offer the same consistency of shareholder income that a dividend does.

As such, it’s possible to make the case that selling at the current high of $273 could be a wise move, and that prospective buyers of Vertex stock may want to wait for a more discounted price point.

The CRISPR Partnership In Sickle Cell Disease Remains Vertex’s Premier Opportunity

This much is certainly clear – Vertex has made a massive bet that its partner Crispr Therapeutics (CRSP) will be the first Crispr/Cas9 gene editing specialist to successfully bring a drug to market, CTX-001, treating both Sickle Cell Disease (“SCD”) and Beta Thalassemia (“TDT”).

The SCD market is estimated to reach $7.7bn in size by 2027, and Vertex stands to earn 60% of all global sales of CTX-001 if it makes it to market.

The therapy – which uses the Nobel Prize winning gene editing “scissors” Crispr/Cas9 to re-engineer a patients’ hematopoietic stem cells ex vivo and restore fetal hemoglobin production – has “functionally cured” 15 patients with TDT and 7 with SCD in a Phase 1/2 trial, and Vertex and Crispr Therapeutics hopes to file its Biologics License Application (“BLA”) for FDA approval before the end of this year, after initiating 2 Phase 3 trials.

Analysts have pegged CTX-001 for sales of $1.3bn, but that was before the therapy’s biggest rival in SCD and TDT, Bluebird Bio’s Lentiglobin, faced delays in its own approval process linked to chemistry, manufacturing and control (“CMC”) issues. CTX-001 is now likely to be first to market – providing the Phase 3 trials support Phase 1/2 data – and based on an addressable population of 32k patients, Vertex management views this as a multi-billion dollar opportunity.

Vertex paid Crispr Therapeutics $900m upfront last April to increase its share of net sales from 50%, to 60%, effectively valuing the therapy at nearly $10bn. Based on sales alone – let’s optimistically estimate $2bn per annum for Vertex – it does not catapult Vertex towards major pharmaceutical status, given that, of the Big 8 US pharmas, the two smallest by revenues are Gilead (GILD) and Amgen (AMGN), earning, respectively, $27.3bn, and $26bn in FY21.

CTX-001 may help Vertex climb beyond the double-digit billion mark revenues wise, but that remains 2.5x less than Amgen, whose market cap is currently $135bn – less than 2x for Vertex.

Again, this suggests to me that Vertex stock is trading at a premium based on revenue and there’s no dividend either. With that said, CTX-011, if successful, will become a genuine breakthrough therapy, and Vertex’ first mover advantage in the gene therapy space justifies its higher valuation, in my view.

Pain Therapeutics, Kidney Disease and Diabetes Candidates Are Powerful Potential Value-Adds

Vertex’ share price received a boost last week after the company announced that its candidate, VX-548, met endpoints in both of its Phase 2 proof-of-concept acute pain studies following abdominoplasty or bunionectomy surgery.

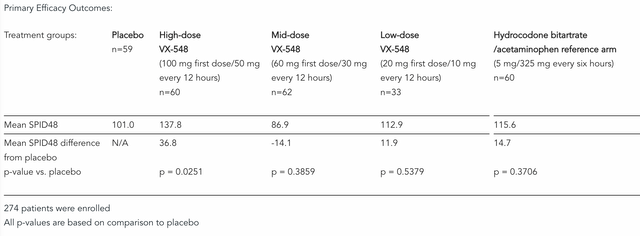

In both trials, VX-548 showed “rapid, statistically significant and clinically meaningful improvement” in Sum of Pain Intensity Difference over 48 hours (“SPID48”) vs. placebo, and its mechanism of action, inhibiting Nav1.8 – a “voltage-gated sodium channel that plays a critical role in pain signalling in the peripheral nervous system” – is clearly preferable to treatment with opioid analgesics, and hence, potentially a huge step forward in the treatment of pain associated with surgical procedures such as a bunionectomy or “tummy tuck” abdominoplasty.

For good measure, Vertex included an active reference arm of the opioid hydrocodone bitartrate/acetaminophen (HB/APAP) in its trial, which it appeared to significantly outperform also, as shown below, and pivotal trials are expected to begin before the end of 2022.

Results from Vertex Phase trial of VX-548 versus placebo, HB/APAP. (press release)

Analysts have expressed some doubts over whether pain management is ideally suited to Vertex’ business, but personally, I believe the space is attractive, with smaller players such as Pacira Biosciences (PCRX) which are generating >$500m per annum from a single major non-opioid pain therapeutic and earning a ~15% net profit margin.

It should not therefore be too difficult for Vertex to make the necessary changes and hires to its sales and marketing team to go out and grab market share in a new and high growth field of medicine. Personally, I can see $1-$2bn in revenues from VX-548 in revenue before the end of the decade.

In kidney disease Vertex is advancing VX-147, its APOL1 inhibitor, and CEO Kewalramani had this to say on the Q421 earnings call:

In the Phase II single-arm study of 16 patients with APOL1-mediated FSGS, VX-147 demonstrated unprecedented reductions in proteinuria, a marker of kidney damage. Importantly, the 47.6% mean reduction in proteinuria was on top of standard of care. These Phase II results propel the advancement of VX-147 into pivotal development.

Our next step is an end of Phase II meeting with the FDA, and our goal is to initiate pivotal development, targeting the broad AMKD population of approximately 100,000 patients including, but not limited to those with APOL1-mediated FSGS later this quarter.

Kidney disease is a tricky space for biotechs – witness the abject failure of companies such as Akebia Therapeutics (AKBA), FibroGen (FGEN), Angion Biomedica (ANGN) and others besides, but these companies were targeting chronic kidney disease, not Focal Segmental Glomerulosclerosis, as VX-147 is, and this is a market expected to reach ~$15bn by 2025, it’s estimated.

I would still be a little wary, both about the market opportunity and prospect of success, but we can perhaps add a further $1bn to Vertex’ future earnings over the next 3-5 years based on this drug and indication.

Finally, Diabetes is a massive, 2.5m patient market, and Vertex’ acquisition of Semma Therapeutics, for $950m in 2019, has led to the development of VX-880, a potentially curative therapy and as such is a transformative opportunity. As CEO Kewalramani again explained on the earnings call:

Achieving durable results in type 1 diabetes requires 2 things: high-quality insulin-producing islet cells, we have that; and a method to protect these cells from the immune system.

We can address the immune response in several different ways. Today, with VX-880, we’re combining the stem cell islets with standard immunosuppression in the Phase I/II study. We can shield the same stem cell islets with an immunoprotective device. In this approach, immunosuppressives would not be needed.

Results from the Phase 1/2 ought to be available before the end of the year, while the second opportunity mentioned is still at the Investigational New Drug (“IND”) enabling stage i.e. permission is required from the FDA before clinical trials can be initiated.

Conclusion – Vertex’s Pipeline Was A Disappointment In 2020, A Triumph In 2021, And Its Valuation Grew Accordingly, Meaning Stock Is Priced About Right

What really got to Vertex stock to jump in 2022 – the stock price is +52% over the past six months – was the outstanding Q421 and FY21 earnings, which blew away analysts estimates, and it’s possible that Vertex could spring a similar surprise this year, since analysts believe the forecast ~$8.5bn of revenues is a conservative one.

With that said, analysts are right to look to Vertex’ pipeline as a bellwether for the company’s future success, because there’s only so much more revenue to be extracted from the CF franchise, and there are some challengers on the horizon – most notably AbbVie, although its partnership with Galapagos is stumbling and may never produce the data the Big Pharma needs to compete in this space.

Even if AbbVie were to succeed, Vertex has two more triplet combos under development, as well as drugs in development partnered with both Moderna (MRNA) and Crispr Therapeutics, evaluating new approaches to treating the disease.

The point is, however, that Vertex stock is trading at something of a premium now, at nearly 10x sales, so in order to drive growth in the share price beyond the current $70bn market cap, perhaps toward a triple-digit billion valuation and “big pharma” status, more and differentiated revenue streams are required.

Will those streams arrive before the middle of the decade? Possibly, in kidney disease, pain management, and SCD / TDT, and arguably all of these are blockbuster sales opportunities, although not quite large enough to suggest that Vertex shares are undervalued in my view.

My combined DCF and EBITDA multiple analysis, which assumes Vertex revenues grow 10% in every year after 2022, to >$12bn by 2026, and most other factors – profit margins, cash flow etc, remain the same – gives me a target share price of ~$293 – only a 7% premium to current price.

Diabetes can be considered a game changer, with >$10bn revenues on the table in this indication, in my estimation, and above and beyond that, the types of therapies that Vertex is working on are curative, “one and done” gene therapies and stem cell therapies, for which the company deserves both praise, and an extra chunk added to its valuation just as is added to the valuations of e.g. Crispr Therapeutics, Intellia Therapeutics (NTLA). Arguably however, that $10 – $15bn chunk has already been added.

Perhaps Vertex’ most closely comparable companies in the biotech space are the likes of e.g. Moderna and BioNTech (BNTX) – pioneering new approaches to disease treatments whilst generating major revenues and very wide profit margins from a single source – COVID vaccination – as Vertex is doing in CF.

While Moderna’s and BioNTech’s future revenue streams are uncertain, however, Vertex’ are virtually guaranteed, which is why the company is valued higher than Moderna’s $62bn market cap, and BioNTech’s $40bn, in my opinion.

Vertex also has the superior pipeline – in the near term at least – and the next stop for the company is big pharma status, but I don’t think Vertex is there yet, and there’s no evidence it will reach that stage before the end of the decade.

That’s why I would hesitate to give Vertex stock an outright bull rating at the present time. The company is close to the limit of what it can achieve in CF, and although there may be blockbusters in the pipeline, there’s risk in the fact they are not yet approved, and even if commercialized they do not, in my view, reduce the P/S ratio to a low enough level to match the Big Pharma sector, which is the benchmark for Vertex.

As such, although I think Vertex is a very strong company, driving exceptional revenue growth and profitability, I think there’s a ceiling to its valuation that even a very exciting pipeline cannot break through at the present time.

We have seen (in 2020) how damaging pipeline failures can be to Vertex’ valuation, which may mean opportunities will present themselves to acquire Vertex stock at a significantly discounted price as some of its candidates will inevitably suffer setbacks.

A pipeline failure would not necessarily concern me, given Vertex’ ~$7bn cash position and cash flow generation, enough to go out and buy any biotech with a lead asset that suggests it has blockbuster potential, as e.g. Bristol Myers Squibb (BMY) did with Myokardia, or Pfizer (PFE) has done with Arena Pharmaceuticals. These companies were acquired for, respectively, $13bn and $7bn, and Mavacamtem and Etrasimod are both expected to generate $2 – $4bn of revenues for their acquiree companies. Food for thought for Vertex, perhaps.

Be the first to comment