imaginima/E+ via Getty Images

Investment Thesis

Vermilion Energy (NYSE:VET) is an international oil and natural gas explorer and production (E&P) company.

Even though Russian sanctions have constricted what was already a tight oil and gas market, I argue that these sanctions are not going to get removed any time soon.

The bullish thesis here is very simple. There’s no way that we are all going back to “normal”.

Russia is now perceived by many as being an unwanted energy supplier. And for as long as populist politicians continue to clamor for sanctions, oil and gas prices are going to continue to move higher.

And on that basis, Vermilion with operations in Europe is well placed to benefit from even further upside.

Vermilion Energy’s Revenue Growth Rates To Inflict Higher

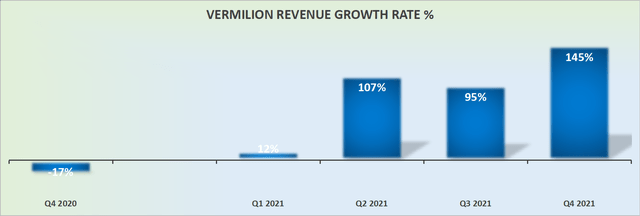

Vermilion revenue growth rates (not including sales of purchased commodities)

Vermilion follows the path of countless other oil and gas companies, in that starting Q2 2021, revenue growth rates have jumped higher and continued higher to move higher into 2022.

Of course, the big question now is how sustainable are these new revenue growth rates? Could we see 2022 remain strong? Or do near-term revenue growth rates implode? And therein lies the argument on both sides of this trade.

Why Vermilion? Why Now?

Vermilion exploration, development, and production of petroleum and natural gas in North America, Europe, and Australia.

As you know, oil and natural gas prices are going higher. And that’s great if you happen to, for example, be a North America pure-play exploration and production refiner.

And this can be even better if you have operations in Europe.

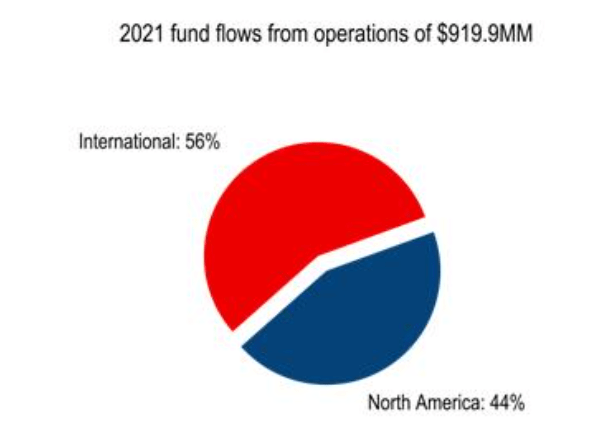

Vermilion 2022 guidance

As you can see above, Vermilion’s fund flows are nicely mixed between its North America and International exposure. What this means in practice is that higher gas prices in Europe are allowing Vermilion to benefit and drive its profitability higher.

However, there’s another consideration to keep in mind.

Vermilion Cash Flows Guidance Discussed

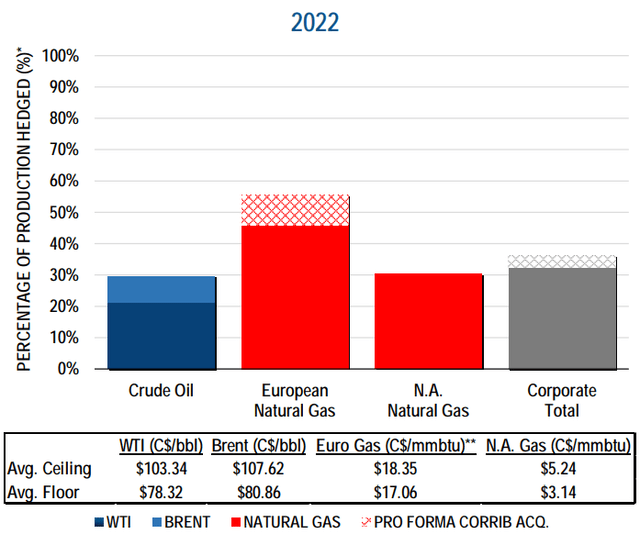

Vermilion Q4 2021 investor presentation

As you can see above, Vermilion is substantially hedged for 2022. Its oil hedges make up 30% of production, meaning that if you have a view that oil prices are going to go higher than where the price is now, at above $103 WTI, shareholders won’t benefit all that much from extremely high WTI and natural gas prices.

But even in that event, Vermilion will still make a large amount of free cash flow.

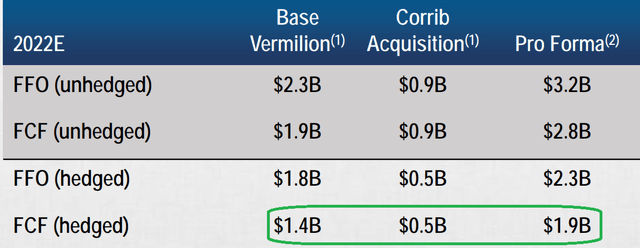

Vermilion 2022 guidance

On the other side of the equation, Vermilion’s hedges are able to provide the company and investors with meaningful visibility for 2022.

As you can see above, driven in part by its Corrib acquisition, Vermilion’s base case free cash flow points to approximately $1.9 billion in 2022.

VET Stock Valuation – Becoming Attractive

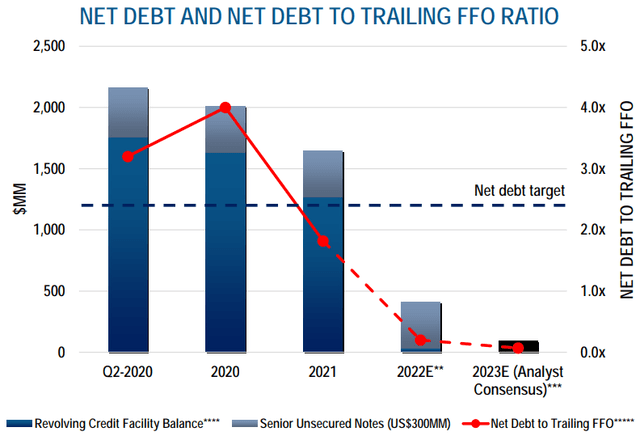

Before discussing its valuation, keep in mind that Vermilion’s balance sheet carries a net debt position of approximately $1.6 billion. This is essentially totally made up of debt, with very little cash on its balance sheet.

To be clear, this doesn’t pose much risk to shareholders, given that Vermilion has such strong positive near-term outlooks.

Vermilion Q4 2021 investor presentation

What this does mean is that given the strong outlook for this year, Vermilion’s net debt position has gone from around 2x as it enters 2022 to below 1x for 2022 as a whole.

This puts Vermilion in a much stronger position, with a more flexible balance sheet. Altogether, this means more options for Vermilion to deploy capital back to shareholders. This is what Vermilion stated on its Q4 2021 earnings call,

Going forward, we will continue to prioritize free cash flow to debt reduction until we reach our next mid-cycle debt target of $1.2 billion of total debt. With this debt target approaching in the second half of 2022, we will look to increase the amount of capital returned to shareholders, either in the form of an increase to the base dividend, share buybacks, and issuance of a special dividend or a combination of these options.

At the current valuation, buybacks are compelling and even more impactful as we did not issue equity over the past 2 years.

So far, we’ve seen the reinstatement of a $0.06 quarterly base dividend in Q1 2022, which puts the current dividend yield at around 1% for investors of its NYSE shares.

But given the high WTI and natural gas prices, we can assume that Vermilion will later in 2022 update its capital return policy.

The Bottom Line

The situation with oil and gas is extremely fluid. Right now, Russian sanctions have implied that getting oil and gas out of Russia and into Europe is essentially impossible.

Many investors have assumed that Russia and Ukraine get to a peace agreement that any oil and gas company with exposure to Europe will see its shares sell off.

However, I believe that this is much more nuanced than that. Ultimately, the reality is that getting sanctions put on Russia are a lot easier than getting them removed. Sanctions are sticky. And oil prices were already moving higher before the Russian sanctions came into the fray.

Now that Russia has moved from being a reliable energy supplier to an unwanted energy supplier, I believe that these dynamics will continue to provide oil and gas producers like Vermilion with positive upside potential.

To preempt your question, I don’t own shares here, but I have picked up shares in a peer in this space.

I’m not sure that it makes a lot of difference exactly which company one is invested in this space as the dynamics are all largely the same. It’s just a question of which one has the best capital return program. Whatever you decide, good luck and happy investing.

Be the first to comment