Cindy Ord

Thesis

The Dogs of the Dow strategy is a popular method among dividends growth investors. The strategy involves a few simple steps: 1) selecting several (say 10) stocks that have the highest dividend yield from the Dow Jones Industrial Index, 2) holding them for a period of time (say 1 year), and 3) repeating (or balancing) based on steps 1 and 2.

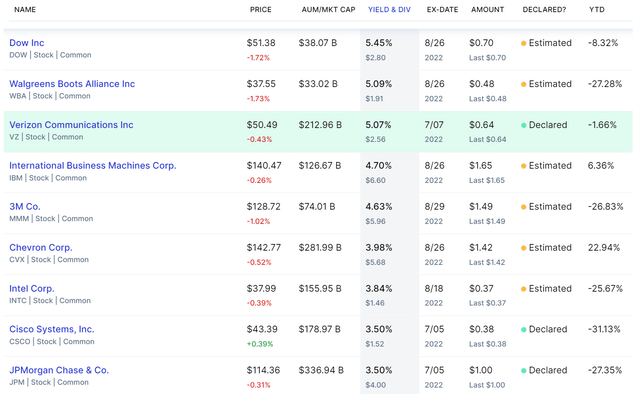

The method is simple yet effective (past performances are provided in section 2 if you cannot wait) because it forces investors to be valued-centric and disciplined. And the Dogs of the Dow list for this month is shown below. As you can see, our main topic for today, Verizon (NYSE:VZ), is currently the 3rd highest yielding dog.

Under the current conditions, VZ indeed presents an attractive investment opportunity. It offers a combination of high current income. With its 5.07% dividend yield, it’s only slightly lower than Walgreens (WBA) and Dow Inc (DOW), which are yielding 5.09% and 5.45%, respectively. At the same time, VZ also provides excellent dividend safety and also healthy growth potential, as discussed next.

How did the method perform?

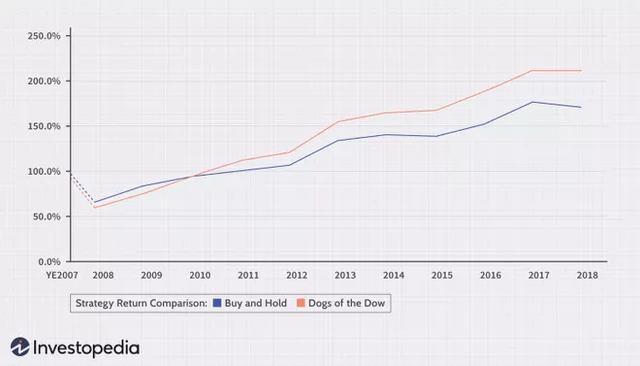

As aforementioned, the method is simple yet effective. The below plot shows the performance of this method since 2007. The chart compares the strategy to simply holding the Dow Jones Industrial index (“DJIA”). As seen, the strategy lagged the DJIA after the 2008 crash till 2010. Then it recovered and has been outperforming DJIA consistently since then. According to Investopedia.com, $10,000 invested in DJIA from the beginning of 2008 would grow to $17,350 in 2018. While the Dogs of the Dow strategy would have grown to $21,420.

VZ vs the Dow Index

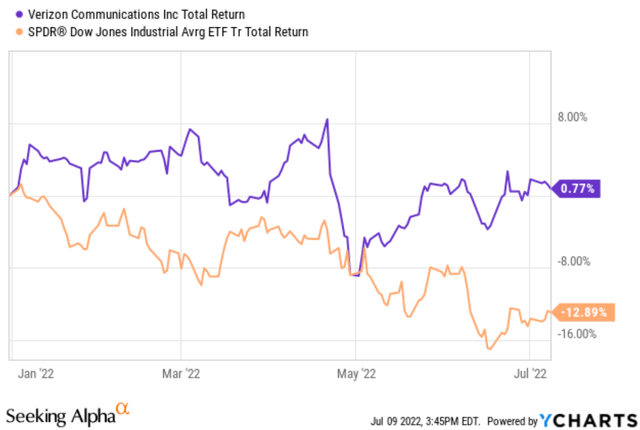

Now back to VZ. As you can see from the following chart, VZ has held up quite remarkably during the recent market correction, demonstrating its stability and safety for income-oriented investors. VZ delivered a positive total return of 0.77% YTD. In contrast, the DIJA index, as represented by the SPDR Dow Jones Industrial Average ETF (DIA), suffered a loss of more than 12.8%.

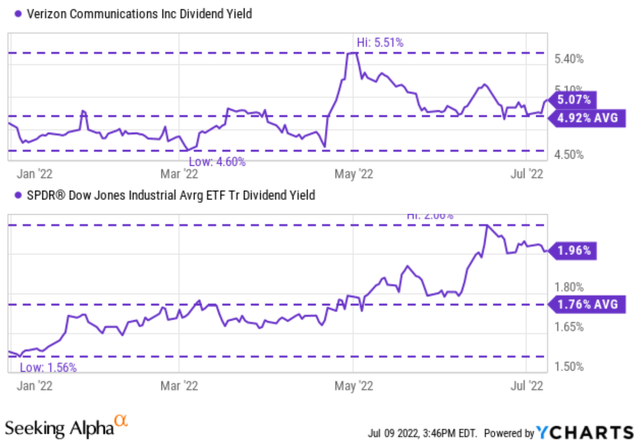

In terms of dividend yields, the dividend for VZ is 5.07% as aforementioned. To put it under historical perspective, its dividend yield has fluctuated in the past 10 years between 4.6% and 5.5% with an average of 4.92%. Note the narrow range of fluctuations here, illustrating one more time its stability. Its current dividend yield of 5.07% is higher than its historical average by about 3% in relative terms, signaling an attractive valuation (more on this later).

Of course, the DIA itself is quite attractive too after the recent correction. Its dividend yield fluctuated in the past 10 years between 1.56% and 2.0% with an average of 1.76%. And it is currently yielding 1.96%, about 11% above its historical average.

Business Outlook

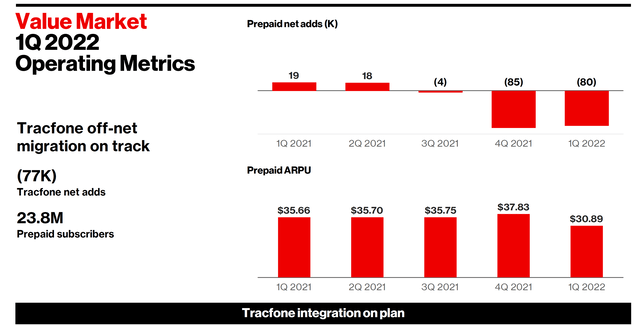

The business is facing some headwinds (more on this in the risk section), but I view the outlook to be bright overall. Notably, the ongoing TracFone integration adds a strong catalyst to its consumer segment. Revenue from this segment grew 10.9% YOY thanks to the TracFone integration, higher equipment revenue, and also strong core wireless service revenue growth. In the past quarter alone, TracFone reported a total of 23.8M prepaid subscribers. By tapping into the value market, TracFone adds resilient to VZ income streams and better shield it from macroeconomic conditions, as commented by CEO Hans Vestberg (the emphases were added by me)

In the consumer business, we grew postpaid average revenue per account by 2.6% as our users upgraded new 5G packages. ARPA growth is a major part of the strategy that we presented at the Investor Day. In the value market, the TracFone integration continues to unlock an addressable consumer market that we have only just scratched the surface on. We now have the ability to service customers in all segments regardless of the macroeconomic outlook. Manon and I are very encouraged by this opportunity and see tremendous value in the customer base Eduardo and his team have cultivated under the TracFone umbrella.

Valuation and expected returns

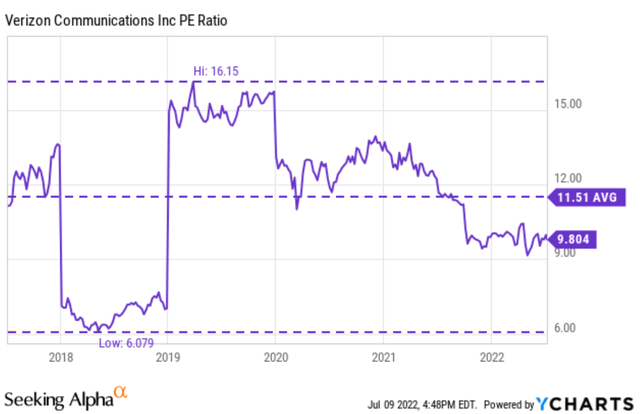

Onto valuation. The stock is currently trading at a discount relative to its historical valuations. The extent of the discount depends on the metric you choose. As aforementioned, in terms of dividend yields, its current yield of 5.07% is about 3% above its 10-year average, indicating a small discount of 3%. In terms of PE multiple, the discount is about 15% as you can see from the following chart. Its PE has fluctuated in the past five years between 6x and 16x with an average of 9.8%. And its current PE of 9.8x is 15% below the historical average.

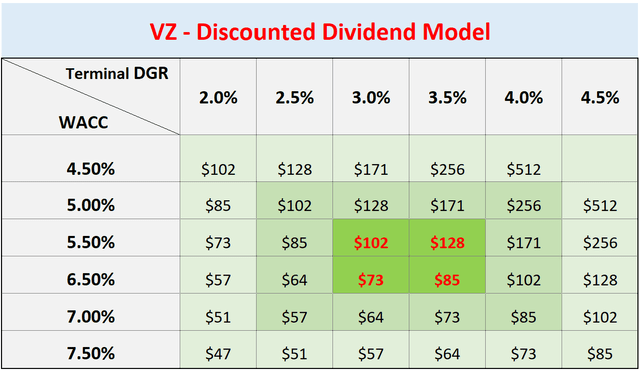

Given VZ’s stable dividends and yield as discussed above, it is a good place to apply the discounted dividend model (“DDM”). Details are in an earlier article, and the key assumptions are:

- The Weighted Average Cost of Capital (“WACC”) is assumed to be between 4.5% to 7.5% based on its historical records.

- The terminal dividend growth rates (“DGR”) are assumed to be in the range of 2.0 to 4.5%.

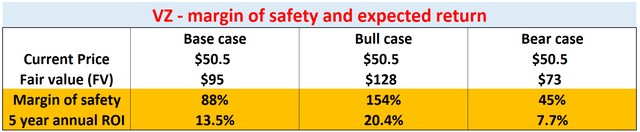

Under these assumptions, the most probable scenarios are highlighted in red in the middle of the table below. Overall, I see a very asymmetric return/risk profile. For example, as a base case, I expect the fair value to be about $95 and the current price represents a margin of safety of about 88%. The base case assumed an average cost of capital around 5.5% to 6.5% and a DGR of only 3% to 3.5%.

Final thoughts and risks

VZ is currently one of the Dogs of the Dow. With a 5.07% yield, it’s the 3rd highest yielding stock on the list. Besides providing a high current income, it also provides excellent dividend safety, healthy growth potential, and price appreciation potential as shown by a dividends discount model.

While its consumer segment reported healthy growth thanks to the TracFone integration, its Business Segment revenues continue to decline. Last quarter, the sales dropped 0.9% in the business segment as its legacy wireline customers continue to decline. Such decline partially cancels the Wireless revenue growth, and it is uncertain when such decline would reach a steady state. Its launch of the C-Band and the expansion of its 5G Ultra-Wideband network require substantial investment. And management had to temper its 2022 outlook due to these expenses.

Be the first to comment