David Ramos

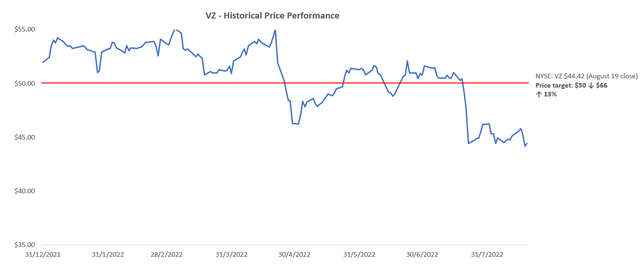

Verizon stock (NYSE:VZ) has continued to trade near its five-year lows as it has yet to recover from the pullback in investors’ confidence after a disappointing second quarter and uncertain second half of the year.

Heading into the latest corporate earnings season, investors have been largely reasonable with expectations considering the blight of macroeconomic uncertainties this year spanning record-high inflation, tightening central bank policies, rising recession risks, as well as impacts from intensifying geopolitical tensions alongside the lingering aftermath of the global pandemic. Yet, Verizon – arguably one of the safest income investments on the market and the leader of U.S. telecom – managed to produce a negative surprise that fell short of already adjusted expectations.

Verizon only signed up 12,000 net new postpaid phone subscribers (+227,000 net adds in business postpaid phone; 215,000 net losses in consumer postpaid phone) during the second quarter, which fell short of consensus estimates of 167,200, as well as rivals AT&T (T) and T-Mobile’s 813,000 (TMUS) and 723,000, respectively, by wide margins. And although Verizon’s broadband business (FIOS and fixed wireless) is offsetting some of the near-term impact on wireless service take-rates, net subscription adds in the second quarter of 268,000 still lags behind AT&T’s Fiber net add of 316,000, underscoring the gradual trajectory of market share loss for the industry leader. On top of that, Verizon’s bottom-line is also getting squeezed by inflationary pressures, with margins taking a greater hit than expected given the added burden of promotional spending. This has accordingly led to a downward adjustment to full-year guidance on adjusted EPS and EBITDA again, exposing Verizon’s heightened vulnerability to industry challenges ahead.

Circling back to management’s long-term promise to restore and maintain GDP-plus growth over the longer-term, the latest results indicate that there is still some way to go for Verizon. Looking ahead, the second half of the year will be a critical determinant for whether the stock can salvage its reputation as a safe income investment. Specifically, investors will look to Verizon’s ability in executing 2H22 reacceleration plans as promised, including revenue growth restoration through both price hikes on existing legacy plans and subscription share gains on budget-friendly unlimited plans.

The stock currently trades at about 8x forward earnings and 1x forward sales, representing a discount to its telco peer group average (2x forward sales; 18x forward earnings) while also boasting an attractive annualized dividend yield of close to 6%. Although we are still optimistic on Verizon’s long-term fundamental health buoyed by the gradual acceleration in 5G adoption, in addition to its currently attractive dividend yield, we continue to caution potential for further volatility in the near-term as 2H22 remains on a critical execution watch.

Navigating Through GDP+ Growth

During Investor Day 2021, Verizon reiterated its guidance on restoring GDP+ growth at a specific rate of more than 3% on an annual basis over the longer-term, with 5G acceleration being the core driver. The goal was further refined during Investor Day 2022, with a promise from management to deliver “4% annual service and other revenue growth in 2024 and beyond” as it looks to bolster Verizon’s market share gains across 5G mobility and national broadband opportunities.

As mentioned in our previous coverage on the stock, 5G penetration remains a large part of Verizon’s long-term growth playbook. Close to half of its consumer phone base now owns a 5G-enabled device, up from about a quarter from earlier in the year, and management is aiming to top 60% by the end of 2022. 5G usage and penetration rates are also accelerating, with its C-Band spectrum accounting for more than one-third of the Verizon network’s wireless traffic, up from approximately 10% during initial deployment. 5G roll-out has also continued to encourage consumer subscription step-up volumes – about 39% of its consumer phone base is now hooked on a premium plan, with close to 60% of the account base now on the more expensive premium unlimited plans.

Yet, the services and other segment’s revenues fell by close to 4% y/y during the second quarter, exposing every vulnerability that Verizon is facing amid mounting macro headwinds and industry competition directly under the spotlight. Although more of Verizon’s customers are adopting 5G today, its subscription base is contracting. As mentioned in the earlier section, Verizon is experiencing one of the highest churn rates on record, with competitors aggressively vying for market share through similar offerings. While AT&T has also raised prices on legacy plans this year as part of a push to encourage greater migration to its higher priced, higher margin unlimited plans, Verizon seems to have executed its strategy rather poorly based on the wide distance in both carriers’ postpaid phone net adds during the second quarter. Rising telco star T-Mobile has also taken advantage of its rivals’ price hikes by introducing “Price Lock” – a commitment to “not raise the price of its existing wireless rate plans even as costs for everything else increase” – to encourage switches, which served another punch to Verizon’s weakening market leadership.

With T-Mobile bolstered by its integration of Sprint, and AT&T now “refocused on its communications business”, the spirit of competition within the telco industry is high, making Verizon’s promise to mitigate share losses with reacceleration in 2H22 and through 2023 critical for restoring its reputation as a safe long-term income investment. Specifically, to mitigate further top-line erosion, Verizon has introduced the “Welcome Unlimited” plan, which targets budget-conscious customers by offering “unlimited text, talk and data on Verizon’s 5G Nationwide network for $30 per month”. To entice switches, Verizon is also offering a $240 gift card when customers activate the Welcome Unlimited plan with their own phones. While the attractive offer might put Verizon back ahead of rivals that have been taking advantage of industry-wide price hikes to boost subscription volumes (e.g. T-Mobile), the $240 promotional rebate risks worsening the burden that its margins already carry from “device subsidies and promotional spending associated with increased wireless activations”.

Verizon has also stood by its decision to raise prices on legacy plans to both “increase revenue per plan and motivate step-ups to unlimited offerings”, despite the strategy being a “partial culprit” of the telco giant’s market share loss during 1H22. We call Verizon’s pricing actions a “partial culprit” because it has been observed that AT&T has also taken a similar route to mitigate inflationary headwinds, but the latter came out on the other side unscathed with no significant churn, which suggests that the former’s market share loss may be a result of poor management execution instead.

It is too soon to tell if Verizon’s mitigation strategies for 2H22 is “too little too late”, but we remain optimistic that its growth opportunity is still on the table:

Global smartphone connections are expected to increase at a compounded annual growth rate (“CAGR”) of 4% over the next five years, with the U.S. market being one of the largest drivers. Data consumption rates are expected to rise accordingly at a CAGR of 26.9% over the same period. Meanwhile, global demand for 5G-enabled devices is expected to grow at a five-year CAGR of 38% as users continue their transition to the faster network. Even smartphone giants like Apple (AAPL) have observed strong upgrade and switch rates to 5G-enabled devices in recent months. More than 97% of iPhone 12/13 buyers have indicated an appreciation for enhanced 5G speeds, a strong indicator for rising 5G wireless plan subscription opportunities ahead for Verizon.

Source: “Verizon Stock: Outsized Returns With Extended 5G Rollouts In 2022“

Verizon still boasts one of the largest 5G coverages in the U.S., with 135 million C-Band PoPs today and further expansion to 175 million PoPs by the end of the year (please see here for a brief overview of C-Band spectrums and 5G). This compares to AT&T’s 70 million mid-band PoPs today with further expansion to 100 million PoPs by the end of the year. With the availability of its 5G coverage still rapidly expanding, Verizon remains well-positioned to capitalize on growing adoption opportunities outlined above, buoyed by next-generation technology and connectivity demands – all it needs to do is to demonstrate it has the execution skills required to remain a market leader within the increasingly competitive industry over the coming quarters as promised.

Verizon Fundamental and Valuation Analysis Update

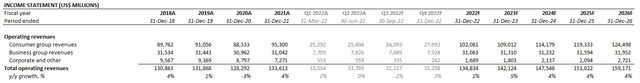

Adjusting our previous fundamental forecast for Verizon’s actual performance in 1H22, as well as the foregoing analysis of anticipated near-term operational challenges, we are expecting top-line growth to remain relatively flat in the current year. Specifically, the restoration of GPD+ growth in the services and other revenue segment is expected to remain in moderation through 2H22 as management works to regain a strong foothold within the increasingly saturated industry first, while also managing the inevitable decline in demand for its legacy voice and data services within the business wireline segment due to the secular rotation into cloud-based solutions. And over the longer-term, we forecast consolidated group revenues to expand at a CAGR of 3.4% on the modest expectation that Verizon’s sprawling 5G network will imminently benefit from the eventual adoption of faster connectivity speeds to support next-generation technology requirements.

Verizon Revenue Forecast (Author)

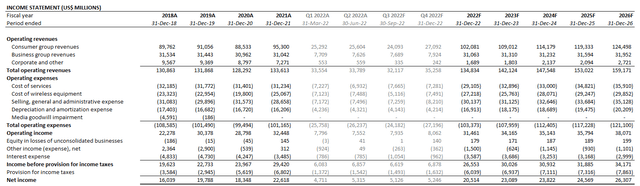

Meanwhile, profit margins will continue to face near-term pressure from the current inflationary environment despite management’s plans to reaccelerate growth in 2H22. This is consistent with the expectation that the inflation mitigation strategies, such as price hikes on legacy contracts and the roll-out of budget-conscious unlimited plans, will take a few quarters to ramp-up before having a meaningful positive impact on margins. On this basis, we are forecasting income declines for the current year as management has guided, with accelerated cost improvements through 2023 and stabilization over the longer-term.

Verizon Financial Forecast (Author)

Verizon_-_Forecasted_Financial_Information.pdf

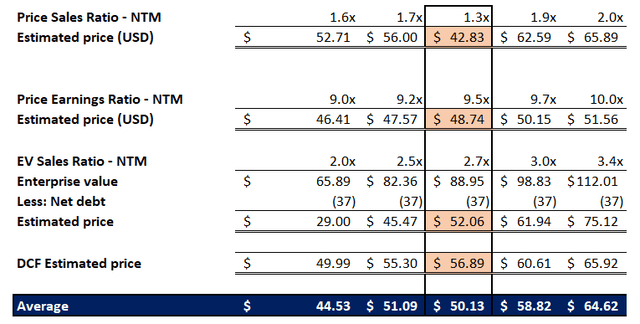

From a valuation perspective, we are updating our near-term price target for the Verizon stock from $66 to $50, which represents upside potential of 13% based on the shares’ last traded price of $44.42 on August 19th. The adjustment reflects the contraction of multiples observed across the industry during 1H22, as well as the near-term fundamental challenges facing Verizon.

Verizon Valuation Analysis (Author)

The price target is derived by equally weighing a multiple-based and discounted cash flow (“DCF”) valuation approach. The forward valuation multiple assumptions applied across our analysis remain in line with Verizon’s anticipated fundamental growth prospects compared to its broader telco peer group. We have maintained a WACC of about 6.5% used in discounting Verizon’s projected free cash flows to equity in our valuation analysis given its capital structure and risk profile remains in line with expectations outlined in our previous coverage.

Verizon Valuation Analysis (Author)

Offsetting Dividend Yield

Now, let’s take a break from the fundamental aspect and shift focus to Verizon’s dividend payout – another key focus area for (potential) investors in the stock.

Verizon currently pays a quarterly dividend of $0.64 a share, totaling $2.56 on an annualized basis. With the stock currently trading at a five-year low, the annualized dividend yield translates to an attractive 5.8%. This makes Verizon one of the top contenders within the limited range of safe yet high-yield income investments. With the company on track to topping $14 billion in free cash flows for the year based on the 1H22 run-rate and anticipated margin moderation in 2H22, the stock’s dividend pay-out remains safely shielded from risks of being slashed despite the underlying business’ near-term fundamental mishap. Paring Verizon’s current dividend yield of 5.8% with anticipated valuation upsides of 13%, the stock boasts an impressive 19% in potential returns.

However, reckoning that the Verizon stock has lost some of its credibility as a “safe” investment due to its vulnerability exposed during the second quarter to the looming economic downturn and intensifying industry competition, we expect further volatility to the shares’ performance over coming months, which could potentially lead to better entries with more attractive yield and long-term valuation upside potential. Alternatively, investors could take advantage of Verizon’s five-year low valuation today, and partially make-up for the near-term valuation underperformance through selling covered calls.

Final Thoughts

Verizon’s business performance in the latter half of the year will be a tell-tale for whether the stock could recoup its reputation as a safe income investment. For now, its credibility remains on the line as investors mull on its prospects of delivering sustained long-term market share gains and cash flow generation as promised – it is also a potential reason for why Verizon’s long-time shareholder Berkshire Hathaway (BRK.A / BRK.B) has recently offloaded its entire stake in the telco giant in favor of other opportunities.

Despite Verizon’s significant growth opportunity stemming from 5G and broadband that has yet to be unlocked, the company will need to show consistent positive progress in 2H22 to undo its mishap in the first half and regain investors’ confidence in the stock. While we remain optimistic about the combination of Verizon’s generous dividend yields and long-term valuation upside potential at current levels, we look to better entry opportunities over the next two quarters considering elevated execution risks pertaining to its near-term recovery plan from ongoing macro and industry challenges.

Be the first to comment