David Gyung/iStock via Getty Images

A corporate bond is a coupon issued by a company that wants to raise funds from private investors. If you buy one of these bonds, you will receive interest at the coupon rate, and your invested capital will be returned to you at the end of the bond’s life. It is lower risk compared to stocks as it depends more on the corporate balance sheet than on growth or profitability.

Going a step further towards capital preservation, there are investment-grade or high-quality bonds or those issued by companies that have a lower risk of defaulting on their debts. For this thesis, I will cover the Vanguard Short-Term Corporate Bond ETF (NASDAQ:VCSH) which invests mainly in high-quality corporate bonds.

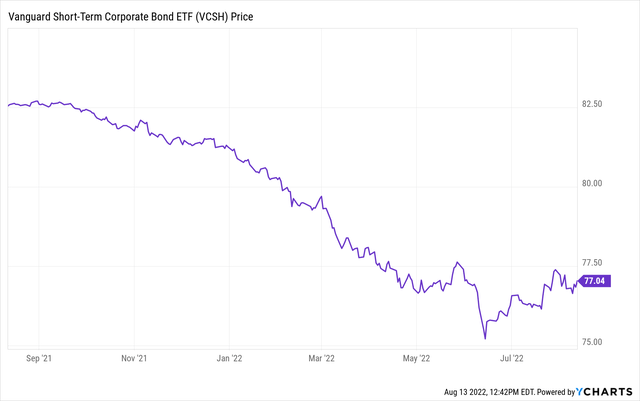

As shown in the chart below, its unit price has delivered a negative performance of -6.7% during the last year.

VCSH one-year performance (ycharts.com)

The uptrend seen during the last month seems to indicate that it has already bottomed out in June, with the next question being whether this upside can be sustained. To provide an answer, I start with the rationale to invest in investment-grade bonds in the first place.

The appeal of Investment Grade Bonds

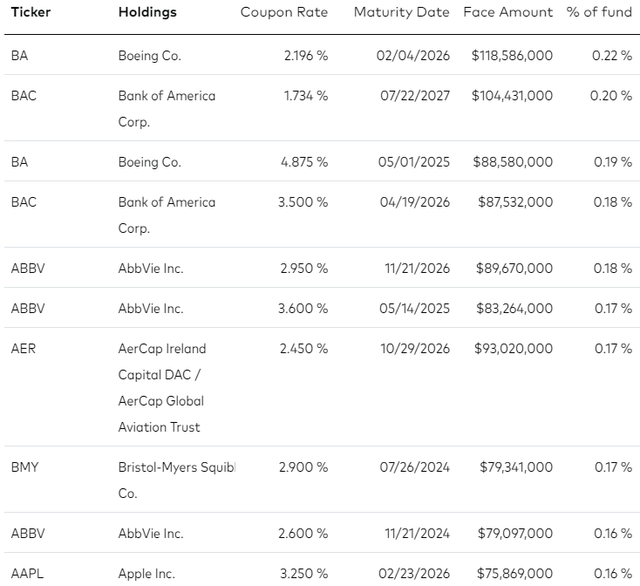

VCSH is managed by the Vanguard Group and invests primarily in U.S. dollar-denominated fixed income securities issued by companies operating in the industrial, financial, healthcare, and IT sectors as shown in the table below.

Portfolio-composition (investor.vanguard.com)

In addition to the fact that it provides exposure to investment grade debt, another of VCSH’s advantages is that its bonds come with a maturity of 1-5 years. This means that they carry a lower risk than debt issued over a more extended period, such as the Vanguard Long-Term Corporate Bond ETF (VCLT) whose investment grade bonds come with an average maturity of 10 to 25 years.

Now, contrarily to some of the bonds that are only accessible to professional investment funds, VCSH can be traded on the stock exchange anytime throughout the year. Thus, any individual can acquire the ETF thereby making its value subject to the laws of demand and supply for its units, similar to the shares of any publicly traded stock.

On the other hand, the value of individual corporate bonds held by VCSH depends on the bond yield (interest rate) that buyers are ready to accept. For this purpose, in the bond market, there is an inverse relationship between the bond price and its yield. This implies volatility risks for investment grade bonds during periods of economic uncertainty and intense market volatility.

The Risks involved

Thus at the onset of the first wave of Covid in March 2020, corporate vulnerability to macroeconomic risks increased markedly with credit agencies downgrading the investment ratings of companies around the world, especially those coming from sectors like aviation and tourism. These were viewed as being most vulnerable to degradation in their balance sheets as concerns over Covid and its implications on economic growth surged. Normally, in these conditions, debtors are less willing to lend money (through bond buying) unless they are paid higher yields for the risks premiums they are willing to undertake.

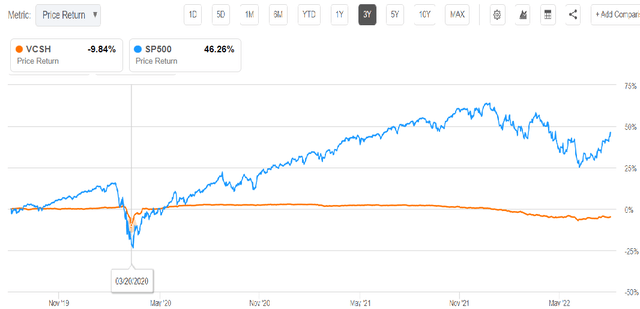

As a result and as shown in the orange chart below, VCSH experienced its worst month in over ten years as it dropped by around 12% from March 9, thereby indicating that investment grade bonds are not without risks.

Comparison of performances – VCSH and S&P 500 (www.seekingalpha.com)

Still, the ETF had already recouped most of its losses by April 9 while for the S&P 500 as shown in the blue chart above, it took over three months. This shows the importance of opting for investment-grade bonds instead of stocks during periods of high volatility. Alternatively, one can hold a diversified portfolio containing both fixed income and stocks.

Exploring the reasons for VCSH’s rapid surge, this was not due to an acceleration in the pace of economic recovery, which occurred well into 2021. Rather, the main reason for bond prices moving higher was the low level of interest rates prevailing at that time, with the Fed Reserve also intensifying quantitative easing through asset purchases.

The Rationale for choosing VCSH

Now, in sharp contrast to 2020, the current high-interest rate environment is not conducive to bond prices surging higher (as a result of yields coming down). Rather, the degree of upside that can be experienced by the Vanguard ETF will ultimately depend on whether the Fed is able to reduce the pace at which it raises interest rates. With the current high inflation, this appears unlikely, at least in the short to medium term.

At this stage, it is important to remind investors that people do not buy investment-grade bonds for growth purposes or in the hope of the unit price rising rapidly so that they can sell them to make capital gains. Instead, the aim is more towards achieving capital preservation while benefiting from regular monthly income. In this case, VCSH pays distributions to bondholders at an average coupon yield of 3.1%.

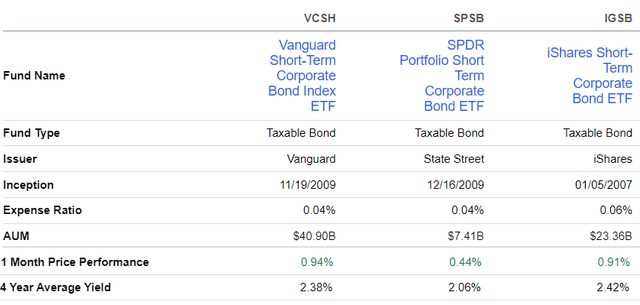

Alternatively, one can also invest in the SPDR Portfolio Short Term Corporate Bond ETF (SPSB) whose holdings have an average maturity of 2.06 years compared to 3.1 years for VCSH. As seen in the table below, there is also the iShares Short-Term Corporate Bond ETF (IGSB) by Blackrock.

Comparison of metrics (www.seekingalpha.com)

Arguing the case for VCSH, with assets under management of more than $40 billion, an expense ratio of only 0.04%, and a reasonable 4-year average yield, it has also delivered a better price performance during the last month. It is, therefore, a better choice.

Also noteworthy, during this last month period, the S&P 500 has delivered a 12% performance as investors have been pricing in the possibility of a rate cut at the beginning of next year with some hints of inflation appearing to have peaked. At the same time, the U.S. unemployment rate also continues to go down. However, many economists believe that inflation should stay high for the foreseeable future with some even expecting a recession in 2023.

Thus, there is still uncertainty and in these conditions, while not offering the same gains as the S&P 500 and for those looking more towards capital preservation, the investment grade bonds held by VCSH are better to weather adverse market conditions.

Conclusion

Therefore, in the current volatile environment for the stock market, it is better to choose investment-grade bonds that carry lower risks than investing in the broader stock market as I have explained earlier on. Bonds can also be held as part of a diversified portfolio for those who already hold stocks, as well as for putting some of your low-yielding cash held in the bank to work. In this respect, for those who do not want to take the hassle of looking for individual bonds, there is VCSH.

Finally, due to interest rates likely to stay on the high side, do not expect any significant upside in 2022 and this is the reason I am not bullish.

Be the first to comment