Gwenvidig/iStock via Getty Images vanguard.com

Introduction

The Vanguard Short-Term Bond ETF (BSV) is an exchange traded fund presenting investors access to a large portion of the short term fixed income universe. The fund has been a stable performer as a result of high quality holdings and a short term bias. However, an elevated rate of inflation challenges the fundamental thesis behind short term funds like BSV. Generally, investors utilize short term fixed income as a cash alternative, hedging against inflation while exposing themselves to very little risk.

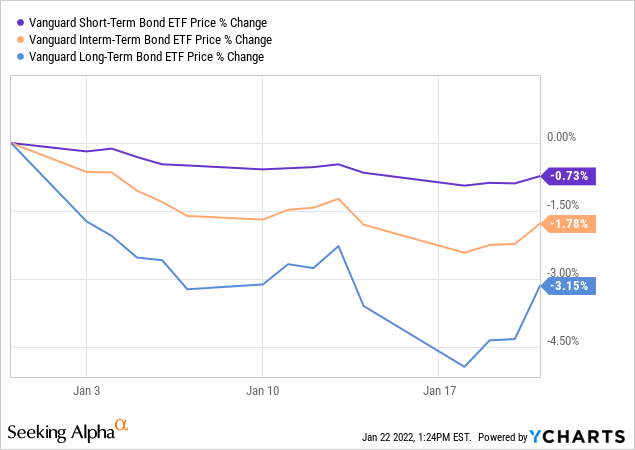

The short term focus has been successful in muting volatility, especially as compared to longer term competitors such as Vanguard’s intermediate and long term funds. This has become especially important over the past few weeks as rising rates are battering bond funds.

For investors looking to take little risk while still earning a productive return may find BSV’s thesis attractive. Although the fund’s distribution has suffered as a result of falling rates, the fund’s safety and measly expense ratio makes it a viable option within its peer group. BSV offers investors an opportunity to access a considerable portion of the investment grade domestic fixed income market. The fund is large with around $75 billion in assets under management. Let’s dive into the portfolio and see what BSV has to offer.

Portfolio

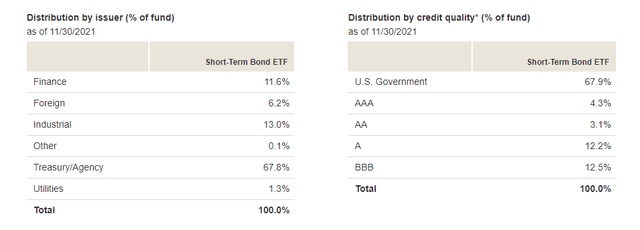

BSV is well diversified by issuers and credit rating. With an enormous and well diversified portfolio, BSV has been able to spread risk very effectively. While the fund is restricted to bonds that mature inside of five, the fund still holds nearly 3,000 individual bonds. Over two thirds of the portfolio (67%) is allocated to government debt. The remainder of the portfolio is allocated to investment grade corporate debt. The largest suballocation within corporate credit is BBB rated, followed by A. It’s worth noting that the distribution of issuers is more diverse than other fixed income funds. Often times, this is the result of a wider breadth of securities available within this maturity range. Compare this to a longer term fund such as the Vanguard Long-Term Bond ETF (BLV). BLV can only invest in bonds maturing outside of ten years. Accordingly, the fund is limited to issuers willing to borrow with far maturities.

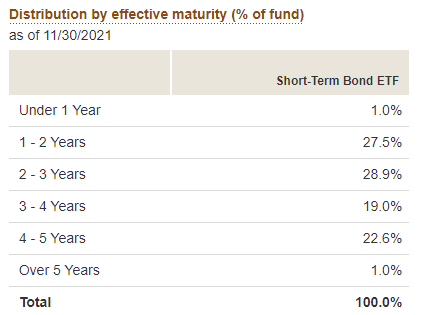

The fund has a mandated goal of providing exposure to short term fixed income, meaning bonds maturing outside of the next five years are excluded almost entirely. For reference, 1.0% of the portfolio has a maturity outside of five years. As the time passes, these positions will fall into the five year range in short order.

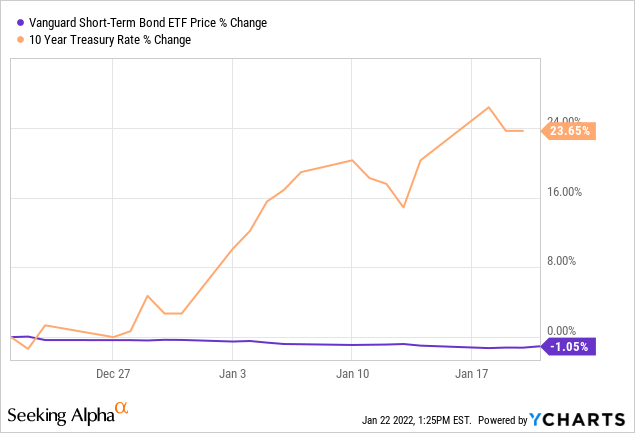

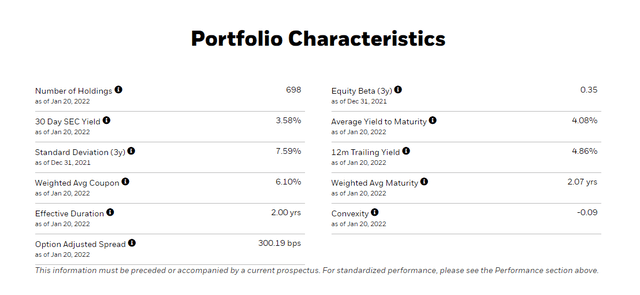

The short term focus results in a weighted average maturity of 2.9 years and an effective duration of 2.8 years. The fund’s duration presents a comparatively small level of interest rate risk to investors. Should interest rates rise by 100 bps, the fund is at risk of losing around 3% of net asset value over that time period. While not necessarily an earth shattering move, it is likely to overshadow the interest income generated by the portfolio during that time period.

This risk has come front and center over the past several weeks as rising rates have begun to affect BSV’s net asset value.

vanguard.com

Yields within the portfolio are weak, which is not necessarily unexpected for a short term fund. Bonds are generally fully priced as they approach maturity, resulting in limited volatility, but also limited upside. The portfolio has an average coupon of 1.9% and a yield to maturity of 1.0%.

Performance

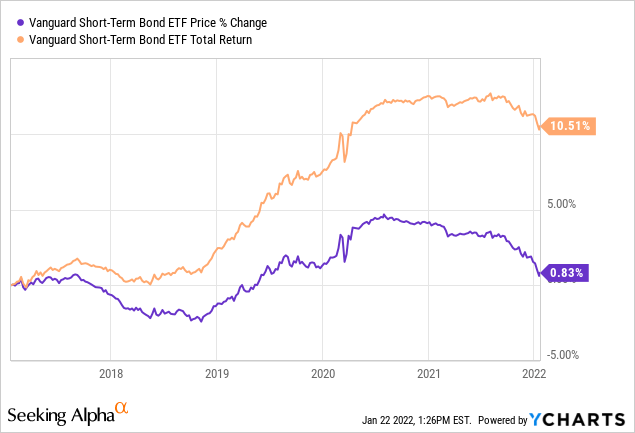

BSV is simple and efficient in what it provides. Investors may access a portfolio of investment grade and government issued securities in a scalable, tax efficient, and transparent vehicle. With impressive price stability and monthly distributions, the fund has been a dependable performer since the fund’s inception.

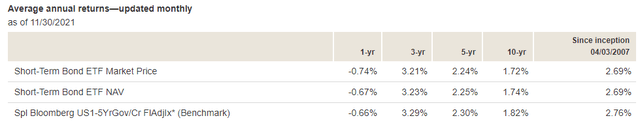

The fund has delivered dependable income to shareholders without substantial falter along the way. Over the past ten years, the fund has delivered under 2.00% annual returns, primarily through monthly distribution of interest.

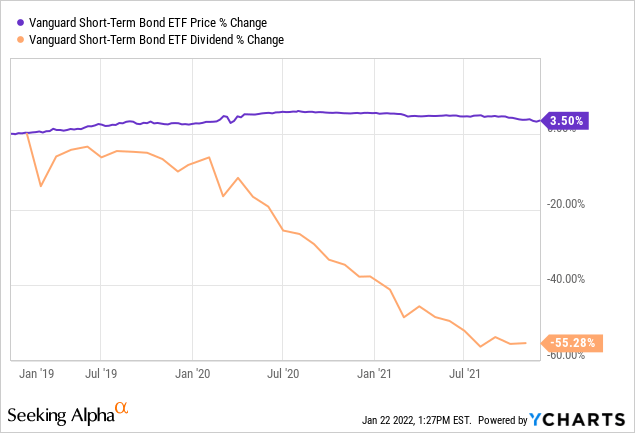

BSV passes through dividend distributions which have declined since inception as a result of falling interest rates. As interest rates dropped, issuers refinanced debt at lower rates. While certainly beneficial for issuers who are paying less interest, the fund’s dividend has suffered.

BSV has offered dependable income and stable share prices with some appreciation to be enjoyed along the way. For over a decade, the fund has delivered solid performance. However, we must always acknowledge that past performance is an unreliable of future returns. To that extent, BSV’s outlook is remains weak.

Outlook

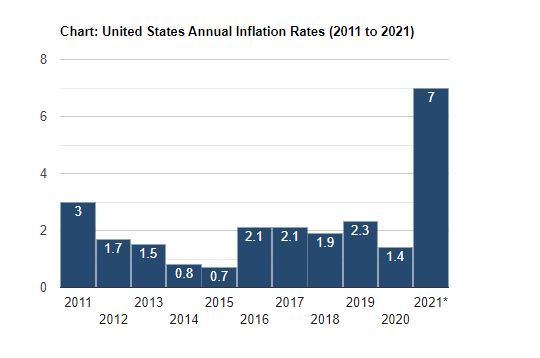

In the short term, one of the most significant risks facing funds like BSV is inflation. BSV itself is a stable fund and we believe it will continue to perform in line with its goals. However, on a broader level, investors should consider the efficacy of short term bonds. Facing an elevated rate of inflation, we must consider if BSV is even able to generate a real return. Keep in mind, the fund has never provided an annual return greater than the current rate of inflation.

inflationdata.com

Inflation has now become a crucial consideration for investors. While tepid inflation is generally not a concern as outperforming comes almost naturally, times have changed. As of now, inflation effectively acts as a substantial hurdle rate. If investors cannot earn at least the rate of inflation, they are not earning a real return on their money. With rates at a bottom, it seems unlikely that further price return will be feasible. Going further, it appears that there is no combination of rate changes and income that will provide a return greater than 7.00% in the next twelve months.

Interest income should continue to remain stable, but modest for the duration of low interest rates. One silver lining worth mentioning is the benefit of rising rates. When issuers begin to refinance at higher rates, the newly issued bonds that fall into the maturity range of BSV will include higher coupons. Increases in coupon rates will translate to rising monthly distributions for shareholders. However, at this time, investors looking to earn a real return may need to look elsewhere.

The Alternative

Having observed the issues of BSV, it feels prudent to explore strategic alternatives which may be able to offer a real return. Given the depth of the investment universe, we will stick with relatively close competitors, excluding some riskier categories such as business development companies, closed end funds, and other fixed income oriented asset classes exposed to higher leverage.

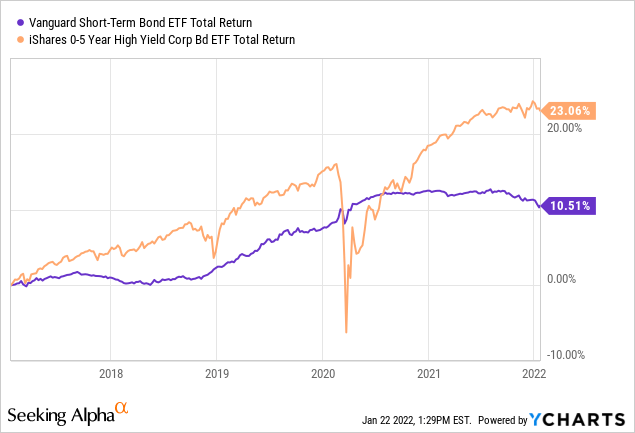

We certainly don’t recommend that investors venture further out in terms of maturity, as they will be exposed to significant duration risk. Just look at how interest rate speculation has affected bond funds over the past two weeks Given the continued strength of the economy, investors may be able to benefit from looking slightly down the credit curve. BSV is likely the safest short term fixed income ETF, or close to it, the premium offered to investors willing to look down the yield curve is meaningful in an inflationary environment.

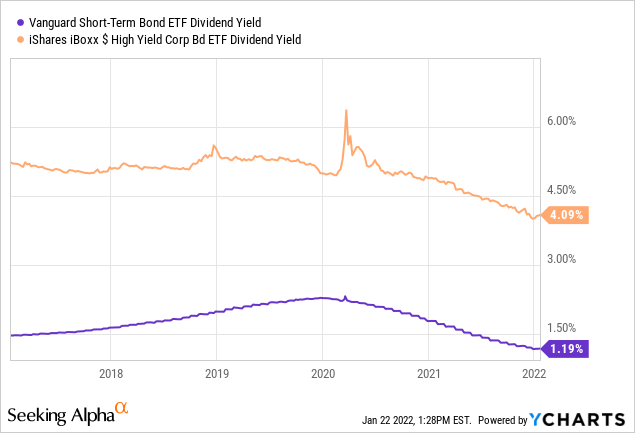

The iShares 0-5 Year High Yield Corp Bond ETF (SHYG) is a viable alternative for investors comfortable touching high yield credit. Vanguard does not offer funds with exposure to high yield credit, so the BlackRock product must satisfy us for the time being. The fund has a similar maturity mandate inside of five years and focuses entirely on non-investment grade issuers. Many of these issuers remain on the upper end of the high yield credit ratings.

SHYG offers a TTM yield of 4.86% which dramatically outpaces BSV and lands investors closer to the rate of inflation. With inflation expected to temper over time, SHYG may offer shareholders a yield that can match. While the fund is inevitably more volatile, it has been able to outperform BSV over time without too much added price movement.

At any rate, investors should still note that high yield fixed income is inherently riskier than investment grade and treasury. Even though fixed income across the board has been stable with remarkably low default rates, investors need to note the risks.

Conclusion

BSV is a simple fund which has delivered value to shareholders for over a decade. Vanguard is one of the world’s largest asset managers and BSV is a sizeable fund with nearly $12 billion in assets. We failed to mention the expense ratio of five basis points, one of the lowest available. The fund has provided a dependable, core portfolio to income investors. The portfolio is safe with assets invested in high quality fixed income issued by the U.S. treasury and investment grade corporations.

Bonds deserve a spot in every portfolio. Their consistency provides a moat of stability in volatile times and their interest income can offer yields that are comparably attractive. That said, it’s difficult to get excited about BSV with a TTM yield of 1.45%. BSV will survive and over longer terms, may even thrive. At this point, we are neutral. If you are a shareholder in desperate need of a short term bond fund, BSV is one of the best available.

Be the first to comment