cemagraphics

Introduction & Key Facts

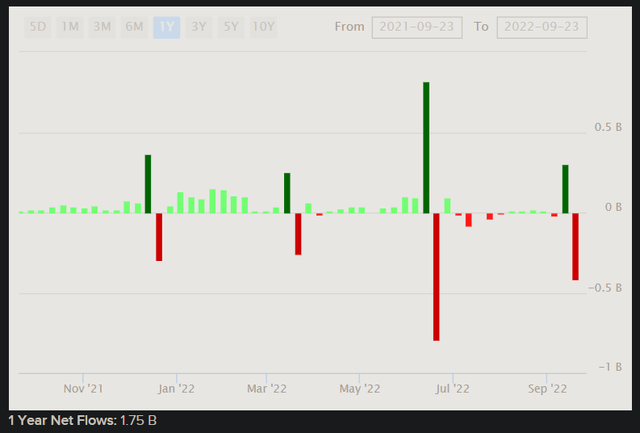

Vanguard Mid-Cap Value ETF (NYSEARCA:VOE) is an exchange-traded fund that, as explained by Vanguard themselves, “seeks to track the performance of the CRSP US Mid Cap Value Index, which measures the investment return of mid-capitalization value stocks.” The expense ratio is 0.07%, and share class net assets were $15.7 billion as of August 31, 2022. That follows a year of still-positive net inflows, in spite of a recent equity market crash.

Flows were roughly $1.75 billion positive over the past year, although VOE has most recently seen net outflows over the past month of circa $105 million.

For reference: There were 199 holdings in the fund as of August 2022 month-end, with a median market cap of $22.6 billion.

Key Statistics

As of August 31, 2022, Vanguard reported a trailing price/earnings ratio of 13.4x for VOE, and a price/book ratio of 2.2x. Separately, Fidelity report a 30-day SEC yield of 2.22% (an approximate dividend yield) as of the same date.

Morningstar provides an indicative forward price/earnings ratio of 12.84x, also as of August month-end. Morningstar’s price/book ratio is 2.04x for VOE, suggesting a forward return on equity of around 15.89%, although Morningstar is known to adjust for various non-operating items in their price/earnings calculations, so some caution is needed. Morningstar also offers a three- to five-year average earnings growth expectation of 15.74%.

Comments on Prior Coverage

My last article covering VOE was published on July 4, 2022. I thought the fund offered outperformance potential. However, since then, VOE has fallen by -4.39%, while the S&P 500 index has fallen by -3.61%, per Seeking Alpha data at the time of writing. VOE has basically underperformed, although only modestly, and therefore traded in line with the broader market. As a reminder of the beta of the fund; the historical five-year beta is roughly 1.04x.

VOE has a defensive component in that it is value oriented, but also a paradoxical risk-on component given that the fund invests in mid-cap stocks, which are characteristically further out on the equity risk spectrum than large- and mega-cap stocks. My prior optimism was driven by an expectation of a strong IRR implied by forward earnings. However, in this case, I will be more conservative, and use a recessionary scenario as my base case.

Bear in mind that the prior thesis can remain intact even with a more conservative approach. In down markets, even undervalued securities can continue to fall due to positive correlations across the equity market. Given VOE’s slightly higher-than-1.00x beta, it is mostly unsurprising to see the fund decline alongside the S&P 500.

Equity Valuation

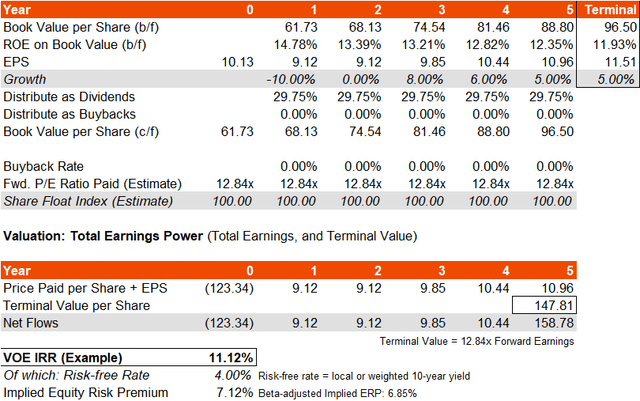

As I will discuss briefly later, the United States (to which VOE is solely exposed on a geographical basis) is approaching a recessionary period in its business cycle alongside plenty of other developed economies. I have begun by using the above information presented to build a model, but overwritten Morningstar’s sanguine earnings estimates with my own negative earnings growth of -10% in my first forward year. That is followed by 0% earnings growth, and then 8% in an earnings bounce-back (“post-recession”) in year two, then tailing off to average out about 0% earnings growth over 3-5 years as opposed to Morningstar’s optimistic 15% consensus.

Using a notional risk-free rate of 4% (just above the current U.S. 10-year of about 3.9% at the time of writing) lends to an IRR of about 11%, and an implied equity risk premium of 7.12% assuming a constant price/earnings multiple.

Assuming a terminal earnings growth rate of 2%, and an equity risk premium of say, 5%, and a notional risk-free rate of 4%, a fair price/earnings multiple would be in the region of 14.29x. Therefore, there is also some possibility of price/earnings multiple expansion for VOE over the long run, but I will not build this into the investment case (to again, err on the cautious side). However, I think VOE looks relatively inexpensive still, even assuming a protracted earnings recession.

Behavioral Model

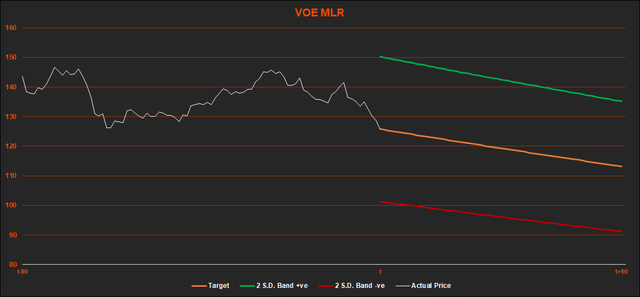

VOE’s inception was in August 2006, and therefore is a significant amount of price history that we can use to build a multiple linear regression model. My model below uses over 10 years’ data to identify recent moves in over 100 inter-market variables, to estimate the future near-term direction of VOE’s share price over the next three months. Bands surround the base-case estimate using measures of trailing one-year volatility levels.

Unfortunately, the model is guiding for 10% downside. VOE could beat the forecast and trade upward, but it would appear that recent market moves are guiding for a bias toward risk aversion. Key negative factors in this case include recently elevated energy prices (bad for stagflationary pressures, and inflation-adjusted profit margins), a stronger U.S. dollar (which hurts asset prices, most importantly risk assets), and higher interest rates (yields).

On a two-standard deviation basis, three-month upside is capped to about 8%, which would be strong, but compares to a negative potential of -27%, and so the bias is clearly negative.

Rates & Credit

The Federal Reserve is currently embarking on a quantitative tightening program, and last increased its short-term target rate from 2.25-2.50% to 3.00-3.25% on September 21, 2022. The Fed’s next meeting is set for November 2, 2022. At this meeting, it is generally thought that the short-term rate will rise by at least another 50 basis points, unless or until inflationary pressures are showing strong signs of abating. The next hike could be as much as 75 basis points, although it makes sense to adopt a wait-and-see approach.

In any event, the Fed is currently in a tightening scenario, while the trailing credit impulse is negative for the United States. This does not mean that earnings will necessarily underwhelm (credit creation is a good leading indicator of earnings). However, it does create another negative bias for equities, and that includes VOE.

Business Cycle

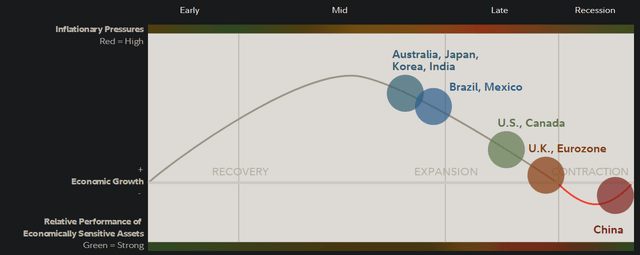

Earlier, I hinted that the United States is approaching recessionary territory in its current business cycle. As of Q3 2022, Fidelity research suggests as much. Although the U.K. and the Eurozone are ahead, and therefore closer to (or even within) recession, the U.S. and Canada are thought to be both closely behind. Since equities tend to lead the economy, it is likely that the recent declines in equity markets (including funds like VOE) are signaling that recession is approaching.

It is anyone’s guess as to whether equity markets have already bottomed. It is possible; the market was arguably early to predicting recession this time around, and therefore it may well be early to “predict” an economic recovery. Energy and certain industrial commodity prices (e.g., copper) are beginning to fall, and so this could well be underway, which is bullish for equities. However, as it stands, characteristically we have a negative bias cyclically for funds like VOE.

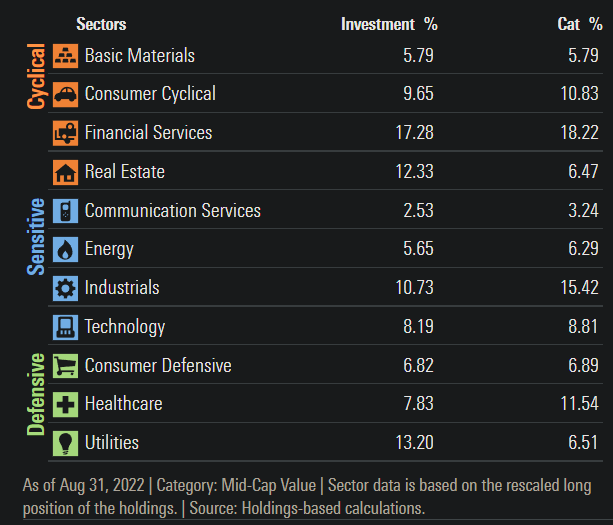

Per Morningstar data, VOE’s sector exposures are actually largely well balanced. However, there is a bias in favor of cyclical sectors at 45% of the portfolio. A further 27% of the portfolio is exposed to sensitive sectors.

Morningstar.com

So, while there is a “value” component to the portfolio (i.e., VOE invests in relatively lower-priced mid-cap stocks, judging by price/earnings and price/book ratios), the fund is not immune to market beta and will find itself just as susceptible to equity market corrections as the broader market. Having said that, the relative cheapness of portfolio has enabled VOE to modestly outperform the S&P 500 since the very start of the year.

Foreign Exchange

The U.S. dollar is probably close to fair value, judging from The Economist’s Big Mac Index, at least against major currencies such as the euro. U.S. yields still beat Europe and Japan, and recent risk aversion has driven the U.S. dollar higher. However, it is probable that USD strength will begin to tail off. This would be constructive for equities. But on a fair-value basis, there is no tailwind here; equity investors can only hope for stability, from a momentum perspective.

More happily, once USD volatility softens, this will likely help to compress equity market volatility, and therefore the equity risk premium. This will in turn, by definition, lift equity valuations, which could begin the start of a new bull market.

Summary

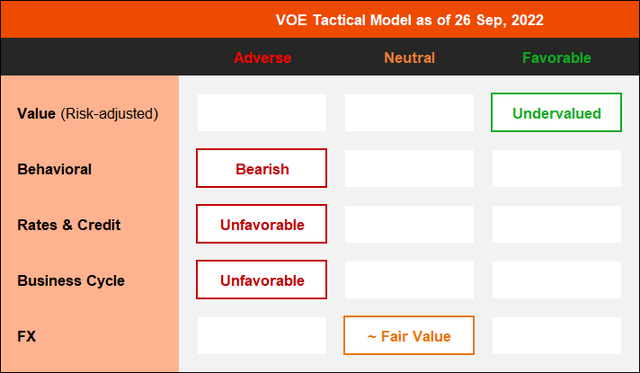

VOE is likely undervalued, or at worst fairly valued, offering a decent IRR above 10% over the next few years. However, the current market and macro environment create a bearish bias. Meanwhile, I do not see any powerful FX tailwinds for VOE, although as noted, a less volatile USD should help equity investors by attracting more risk-on activity.

For now, I would remain neutral on funds such as VOE until the market and macro environment offer a more constructive stance. Long-term investors in VOE should however rest assured in remaining invested, as the fund is well diversified, and appears underpriced.

Be the first to comment