Kameleon007

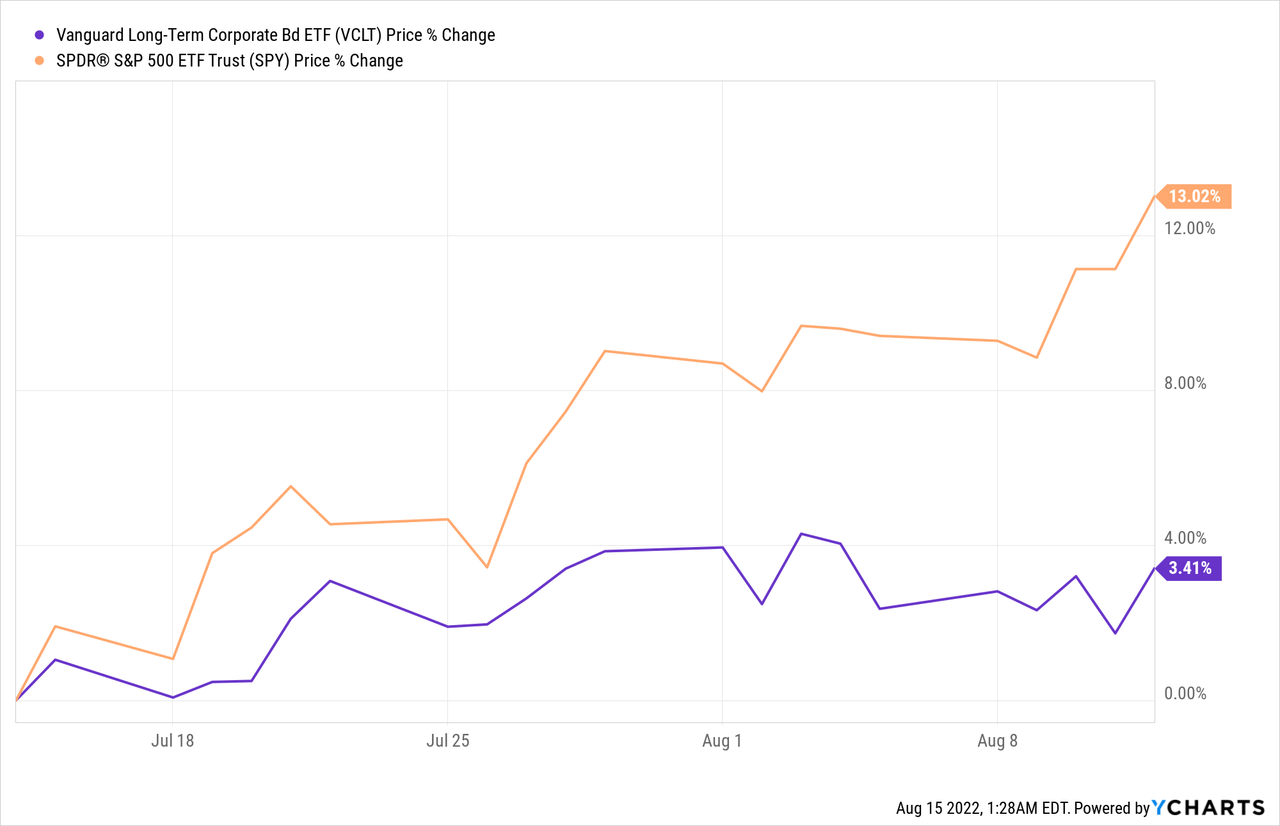

The Vanguard Long-Term Corporate Bond Index ETF (NASDAQ:VCLT) is a fixed-income investment vehicle useful to invest simultaneously in the debt issued by many companies. I became interested in this ETF after noticing that it has produced a 3.41% upside during the last month as shown in the blue chart below, which is abnormally high for bonds given the current high-interest rate environment.

The reason for this gain as depicted by the upbeat S&P 500 price performance of over 13% seems to be related to the fact that U.S. inflation has slowed more than expected in July, implying that the Federal Reserve may reduce the aggressive pace at which it is raising interest rates.

Thus, my objective with this thesis is to assess whether there can be a sustained upside in the Vanguard ETF, but, first for those who are new to the world of bonds, I provide a quick overview of why long-term investment grade bonds make sense at this juncture.

Investment grade bonds

A company that needs fresh cash can issue a bond which can then be used to finance its operations, pay for capital expenses, acquire another company or even pay off older and more expensive loans. Issuing bonds is, therefore, an alternative to bank financing which can under certain circumstances be more expensive and also represents a viable alternative to the issuance of new shares which dilutes corporate capital.

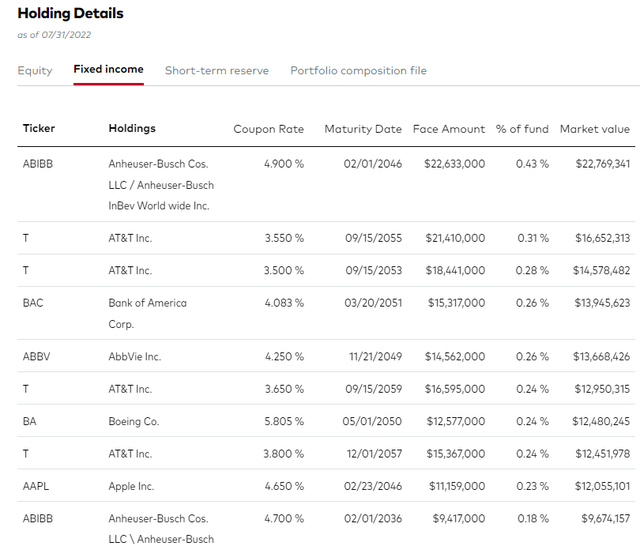

Furthermore, individuals who have tried to invest in the bonds issued by individual corporations already know the constraints like having to make minimum investments of $2000 or more. Thus, unless you are an institutional investor with hundreds of thousands of dollars to invest, VCLT makes life easier as you can buy any amount of its shares on the stock market just like for a stock. It also enables diversification in your bond portfolio as it holds the debt instruments of many companies as shown in the table below. Moreover, as per Vanguard, these consist primarily of high-quality (investment-grade) corporate bonds.

VCLT top holdings (investor.vanguard.com/)

Looking deeper in the above table, one can see the maturity dates which extend anytime from 2036 to 2055 which means that these are long-duration bonds, namely with (a dollar-weighted average) maturity of 10 to 25 years.

Another observation is the coupon rate which varies from 3.5% to 5.8%. The average coupon rate is 4.5% which is above the Vanguard Short-Term Corporate Bond Index ETF’s (VCSH) 3.1%. The reason is the duration, with short-term bonds with an average maturity of three years being the safest as they are commonly used by companies to finance a need for cash. On the other hand, longer-term bonds with a term of more than 10 years are generally issued by companies to finance development or acquisition projects. Consequently, they offer higher interest rates because they tie up lenders’ money for much more time, in this case over a decade.

The risks

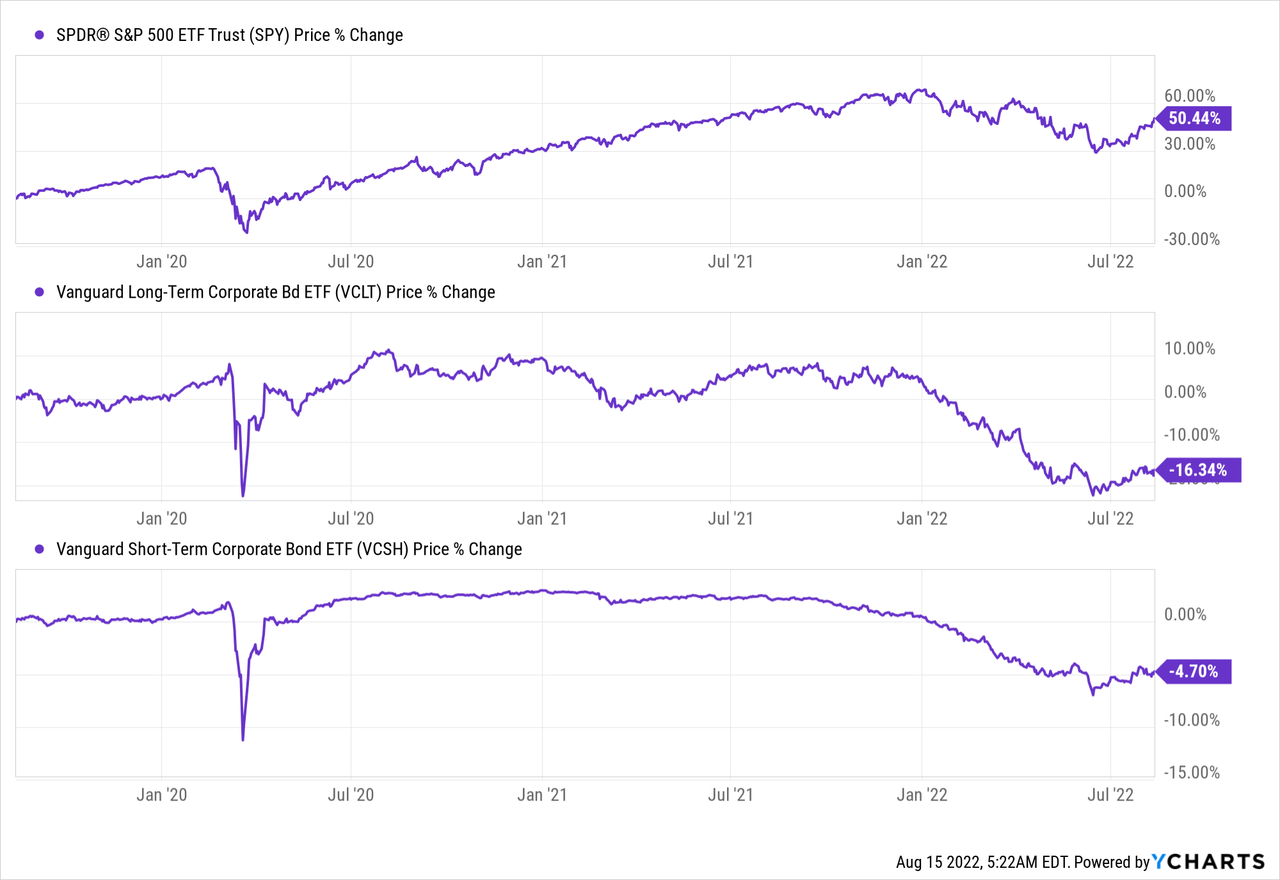

This implies more risks for those who invest in long-term corporate bonds as they are more likely to endure several economic cycles, together with the associated market turbulences. One such example was in March 2020 when lockdowns by governments throughout the world after the World Health Organization declared COVID a pandemic resulted in economic uncertainty with investors starting to pull out their money from stocks. As a result, the S&P 500 lost over 30% as shown in the chart below. However, even the investment grade bonds held by VCLT suffered as shown in the middle chart, but the loss was less severe than the broader stock market and the ETF recovered faster too.

Also, the above chart shows that even VCSH despite holding short-term duration bonds also saw considerable outflows.

Consequently, during periods of severe market volatility, corporate bonds whether they are long or short-term durations, are likely to suffer. This said investment grade corporate bonds are likely to recover faster, not only compared to the S&P 500 but also compared to other forms of debt investment tools, like high yield bonds. One example of high-yield corporate bonds is the Vanguard High-Yield Corporate Fund (VWEHX) which delivers an average coupon rate of 4.8%.

However, this higher yield comes with more risks and this brings me to the risk level associated with bonds.

In this respect, investment grade bonds are issued by companies whose risk of default or not paying interests on borrowed money is considered virtually zero (nil) in the future, with this being exemplified by companies like Bank of America (BAC), Apple (AAPL), or even Boeing (BA), as per the above table. For this matter, they are rated at least Baa3 by Moody’s, a credit rating agency. For investors, obligations rated Aaa are judged to carry minimal credit risk or highest quality, while Baa3 are subject to moderate credit risk. These are rated better than the bonds held by VWEHX.

Balancing Risks and Returns

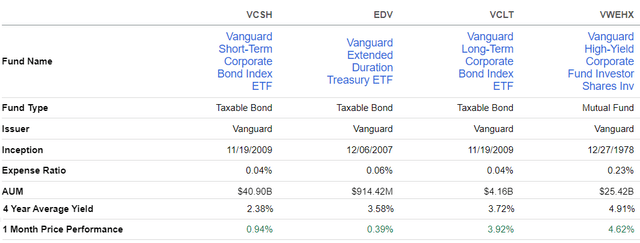

Consequently, when balancing out the risks with the average coupon rate, VCLT makes for a better investment than either VCSH or VWEHX. I have also included a comparison with the Vanguard Extended Duration Treasury ETF (EDV) as per the table below, for those who seek comfort in treasuries or government-issued bonds. These are viewed to be more secure than private corporations and Moody rates the U.S. government’s long-term issues as Aaa, or investment grade.

Comparison with short-term corporate bonds, high yield, and treasuries (www.seekingalpha.com)

Looking at the price action, the above table indicates that with a one-month performance of 0.39% which is the lowest, treasuries are not enjoying the same level of investor enthusiasm as corporate bonds. This is explained by the fact that while this remains an uncertain macroeconomic environment, things are not as bad. Thus, unemployment numbers have decreased to 3.5% in July, or the lowest since February 2020 while inflation also appears to have reached a peak as I mentioned above.

In these conditions, investors are embracing stocks as some analysts now expect to see the S&P 500 at 4,800 after a 14% rally. However, inflation remains high and there are also talks about a recession occurring in 2023.

In these circumstances, VCLT represents a more balanced approach, between high yield bonds also termed “junk bonds” and treasuries to put idle cash in the savings account at work. Also, while corporate bonds are considered less safe than government bonds, in current market conditions there is less probability that companies will default, especially those with investment-grade ratings. In this respect, the VCLT’s one-month performance of 3.92% supports the fact that the market sees it as a more rational investment.

Conclusion

Finally, with the Federal Reserve still tightening monetary policy to combat inflation, interest rates are likely to stay high till the end of this year, thereby implying that bond yields will not go down. Thus, since the yield and value of the bond are inversely related, do not expect VCLT to move higher any time soon. Instead, at less than $85 after its one-year underperformance of -20%, use it as an income-generating investment vehicle in your portfolio.

Be the first to comment