PashaIgnatov

Main Thesis & Background

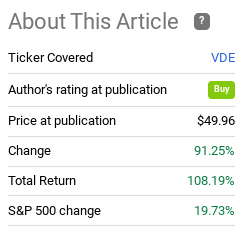

The purpose of this article is to evaluate the Vanguard Energy ETF (NYSEARCA:VDE) as an investment option at its current market price. This is my preferred option for Energy exposure. It is a simple, passive strategy and, given that it is managed by Vanguard, the management fee is very low. Thus, it has been a long-term hold for me for a long time, and I am always looking for value as an opportunity to add to my position. Looking back, I recommended going long VDE almost exactly two years ago. The top holdings of Exxon Mobil (XOM) and Chevron (CVX) looked attractive to me and my macro-outlook for the sector was bullish. In hindsight, this has been one of my best long-term performers, with VDE vastly beating the S&P 500 since that review was written:

Fund Performance (Seeking Alpha)

Clearly, VDE has been a great add to my portfolio over the years. But what is important now is deciding whether I should maintain my position, add to it, or take profits. After a review of the fund and the sector as a whole, I see continued value in putting new cash to work here. Therefore, my rating on this fund will be a “buy”, and I will explain why in detail below.

Energy Has Proven Itself In 2022, Despite Recent Headwinds

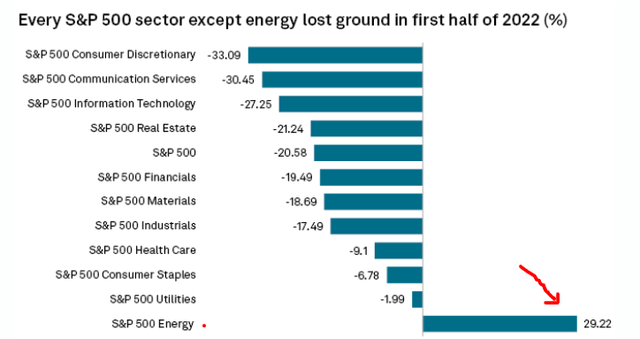

To start this review, I want to consider how Energy (and VDE by extension) have been faring in 2022. As readers are probably aware, Energy has been one of the few bright spots in equity markets year-to-date. While some defensive sectors like Utilities and Consumer Staples have held up reasonably well and have acted as moderate hedges, the bigger picture is most sectors have suffered big time. In fact, with the S&P 500 down 20% in the first half of 2022, it makes the lone gainer, which is Energy, really stand out:

Sector Performance (S&P Global)

To me this shows how useful the Energy sector has been as a hedge. All other sectors are down, with most cyclical sectors down by double-digits. Yet, Energy has rallied immensely, supporting continued positions in this sector.

Of course, while performance in 2022 has been strong as a whole, investors would do well to remember it has not been a straight shot up. In fact, in the short-term, Energy has actually come under quite a bit of pressure. VDE alone is down over 18% in a month, suggesting that momentum has waned in a big way:

VDE’s 1-Month Performance (Seeking Alpha)

While this is a cautionary tale about buying high, I actually view this drop positively because it has given me an opportunity to add to my position. With VDE’s gains racking up in the first half of the year, I was reluctant to chase returns with new cash. Now, the sector has almost hit bear market territory in an extremely short time period. This suggests to me that the selling is overdone and the sector is oversold. Whenever I see such sharp drops my contrarian hat almost always comes on, and that is precisely what is happening in this case. The double-digit drop suggests value to me, not a reason to be fearful, and supports a buy case in my opinion.

Are There Risks To Buying Now? Of Course

As I stated above, I see the recent sell-off in this sector as a buying opportunity. But before I want to dig into the underlying reasons why, I want to emphasize this is not a “risk-off” play. The Energy sector is notoriously more volatile than much of the equity market, in part because crude oil is a very volatile commodity. Also, readers should understand that one of the reasons for crude’s performance in 2022 has been geo-political risks. While crude rallied in 2021 on a stronger economic growth forecast, the baseline off 2020 was very weak. The gains continued in 2022, but for a different reason. Predominantly this was the Russian invasion of Ukraine, which began earlier this year. As the graphic below shows, crude oil shot up on that announcement and has been at elevated levels ever since:

Brent Crude Oil Price (Bloomberg)

While this is “good” for crude oil’s price, it certainly isn’t good for the market as a whole or humanity. But for this review I will focus on the investment implications solely, and not on the humanitarian impact (as sad as it is).

In a nutshell, oil has been rising and that is helping the Energy sector perform well. But the second red arrow on that graphic shows that oil has actually taken a breather of that. It is down $15-20/barrel in the last month or so, which is coinciding precisely with the sharp drop in VDE’s share price that I discussed in the prior paragraph. A big factor in this sell-off is that recession fears have begun to roil markets – impacting crude oil and share prices across the board.

My point here is that recession fears continue to dominate headlines and investor’s mindsets, then oil is likely to see more pressure. Prices have shot up to levels that are historically high over the past decade, and that remains the case today even with the short-term decline. If losses continue, VDE is certainly going to feel the impact, so this is a key factor to keep in mind.

Expanding on this thought, the war in Ukraine is another major catalyst for higher oil prices. If we see a de-escalation in that conflict, or get closer to a resolution, that oil prices will probably give up some of the gains that came about during the onset of the war. While this will certainly be good news on the whole, for the globe and especially for those directly involved in the military effort, it is almost certain to have a negative impact on crude prices.

Unfortunately, I do not see a resolution on the horizon. In fact, there is a very real concern that the conflict is not going to unwind, but rather escalate. We do not know at this point if President Putin has ambitions beyond Ukraine, but that could very well be in the case. If the conflict spills over the border, supply-chains are going to be rattled even more (not to mention the humanitarian toll). Further, there are concerns the leader of Belarus could force his country to take a more direct role in the conflict. The nation was a launch point for part of the Russian invasion and he recently started that his country be included in any talks and a deal to end the conflict, as reported by Yahoo News.

To me, these limits negate some of the recession fears pressuring the oil markets. The military conflict in eastern Europe is not pointing to a resolution in the near term, and that has been a big drive for the increases in the crude oil market. Until there is more clarity on that front, oil prices appear reasonably well supported at these levels.

Oil Prices Are Pressuring Biden, But His Options Are Limited

Another risk to oil that I think is exaggerated for the time being is the political will in Washington to lower prices. While President Biden and the Democratic party as a whole seemed content for a while to allow oil prices to remain high due to environmental and climate goals, that stance has become so politically unpopular that we are starting to see some change in tone from the current administration. This is not really too surprising, given that voters often vote with their wallet rather than their hearts. While “ending fossil fuels” may be a popular message on the campaign trail, when prices start to rise that message becomes a harder one to sell.

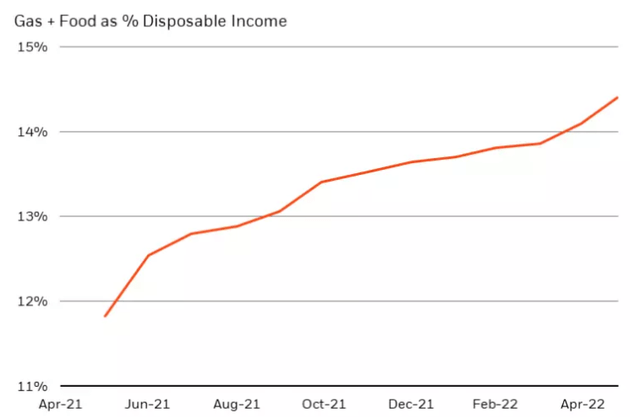

To understand why this is relevant right now, consider the impact inflation is having on American households. While prices are up across the board, some of the biggest rises have come in the energy markets – for oil, gas, and fuel. This has impacted prices at the fuel pump, and also for everyday items that Americans need and are rising in price because the cost of transporting those goods has risen. The result is that consumers are being forced to spend a greater share of their income on necessities like food for their families and fuel for their vehicles:

Percentage of Income Going To Food & Fuel (BlackRock)

This underscores how Americans are feeling the pinch from rising crude prices. While good for oil/energy companies and perhaps investors, the sentiment of average Americans is extremely negative on this front.

So, how is this impacting Washington? Well, for starters the Biden administration is starting to wake up to how unpopular their prior stance on oil and gas has been. They are trying to take actions to lower the costs at the pump, at that creates a headwind for investors in VDE. In the administration is successful in bringing more oil to market, that will lower the price, and negatively impact earnings for VDE’s holdings.

While this may sound bad, the reality is I’m not too worried about it as a holder of VDE in my portfolio. The reason is that the Biden administration has largely backed itself into a corner without an easy fix. This suggests to me that finding an avenue to materially lower prices is not going to work, limiting the headwinds facing the sector. Take, for example, the release of Strategic Petroleum Reserves (SPRs). This was a major administration action to try to bring down prices for American consumers.

Now, while I personally disagreed with the premise behind the release, the fact is it never really had much of a chance at impacting prices. The reasons behind this are multi-fold. One, as investors in oil markets now, the price of crude today is a result of expectations about the future. Commodities trade in the futures market, meaning that prices as even in the immediate term are driven by expectations about the future. SPRs are already baked into existing supply. While releasing them does bring them in to the market, the reality is they will need to be replaced at some point. Ultimately, it is not “new” supply, it is just shifting supply from reserves to purchase now. As soon as they have been released, the market is now forecasting further under-supply in the future (since the SPRs are gone). This is not how you lower prices.

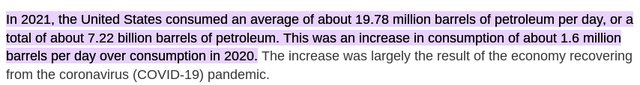

In fairness, had the release of SPRs been massive, then there probably would have been a little bit of a supply glut in the short-term and that could have weighed on prices temporarily. But this isn’t what happened. Since earlier this year, the administration has been releasing one million barrels per day out of the SPRs, as reported by the U.S. Department of Energy. Sounds like a lot, right? Well, wrong. It really is not that significant of a supply bump, considering recent estimates suggest the U.S. alone consumes considerably more than that on a daily basis:

U.S. Oil Consumption (U.S. Energy Information Administration)

The conclusion I draw here is the release of SPRs has been almost irrelevant, since the U.S. consumers almost 20 times that per day, and the globe even more.

Additionally, the Biden administration has been attempting to convince other countries to produce more, in the hopes this will increase global supply without him having to confront environmentalists domestically. These efforts have also largely failed up to this point. In fact, just over this past week President Biden made a trip to the Middle East to discuss a number of strategic objectives. The one most relevant here was his visit with the Saudi Prince, in which he was hopeful to extract production concessions from the country, or OPEC+ by extension. While department officials struck an optimistic tone after the meetings, the fact is that Biden did not secure a clear assurance on an oil production increase, with Saudi officials advising that output decisions would be made within OPEC+, as reported by Yahoo News.

I will wrap up this thought by saying simply that I don’t see the U.S. government taking any practical steps that are going to hinder oil’s move higher. The biggest risks remain a resolution of the conflict in Ukraine and/or a recession in the U.S. or globally. Rhetoric from the Biden administration has not proven to be useful in driving down prices in 2022, and that is not a story I think will change materially in the second half of the year.

Earnings Season Could Boost Shares

I now want to talk about some positives for the sector. At the moment, this should include a discussion about upcoming earnings from the Energy majors. Specifically, earnings season is kicking-off and Energy shares are poised to shine. After the sharp sell-off in shares that I mentioned above, I think earnings reports will set the sector up nicely for some gains. My point being that if stocks had kept rising and expectations were very high, selling into earnings may make sense. But the opposite is actually true at the moment. Shares have been falling and investors are pessimistic – a ripe opportunity for a contrarian play.

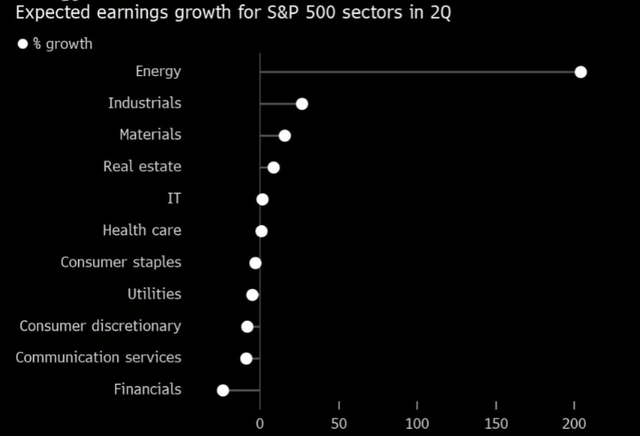

This is supported by the fact that earnings growth for the Energy sector is expected to be quite strong in Q2. Figures should be well ahead of other sectors, offering the chance for post-earnings boosts:

Expected Earnings Growth in Q2 (By Sector) (Yahoo Finance)

My thought is I see a recent sell-off and the potential for strong earnings reports as a buy catalyst. This is a theme that has been working for most of 2022, so I see little incentive not to stay long in the second half of the year. I don’t see a big enough change in tone out of Washington to see the supply imbalance correct itself, and this is an area I actually want to add exposure to, not divest.

The Dividend Story Impresses

My next thought on VDE concerns the fund’s dividend. With a current yield nearing 4%, the yield looks attractive on the surface. This is especially true if we consider that inflation is rising fast and investors need a fairly high yield in order to keep pace. While 4% is lower than the rate of inflation, it is still higher than most sectors are offering, so there is value there.

Furthermore, what really is exciting to me about VDE’s dividend right now is the rate of growth. If we look at payouts for the first half of 2021 compared to 2022, we see that this year had a tremendous YOY growth rate:

| Jan – June 2021 Distributions | Jan – June 2022 Distributions | YOY Change |

| $1.34/share | $1.82 | 35% |

Source: Vanguard

This is certainly a very strong metric, and one I am quite impressed with as a “dividend seeker”. For me personally, dividend growth is more important than high yield, but VDE seems to offer both at the moment – on a relative basis compared with the broader market. This makes inclusion of this fund in my portfolio a no-brainer, to the point where adding to my position is an easy call to me.

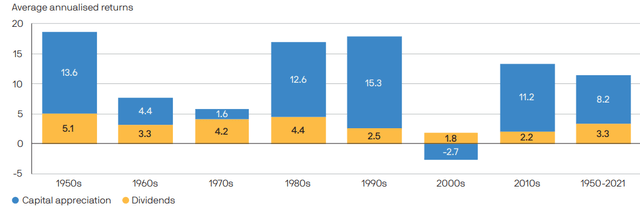

Expanding on this idea, let me further support why dividends are so important at the moment. Consider that a big risk in the equity markets right now is that inflation is high and economic growth is low. Under this scenario, equity returns are often weak. Corporate earnings are pressured, and growth is not strong enough to make up for the decline in the value of the dollar. This is a difficult investment climate, and one that the country has experienced before.

However, that does not mean investors cannot generate positive returns. But it does mean that the dividend stream from stocks or stock funds becomes more valuable. What I mean is, if equity prices do not move much, investors will generate a higher percentage of their return from any income stream the stock or fund offers. Looking back at history, this is precisely the case in other high inflation / low growth environments.

One such time period was the 1970’s. Annual stock returns were quite low during that decade, especially compared to the decades immediately following it. Of note, inflation was high then, and equity investors ended up earning a substantial portion of their total return from dividend income:

Annualized Returns (By Decade) (JPMorgan Chase)

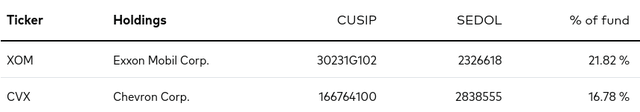

The takeaway is that in times of market stress, especially when derived from inflation, dividend investing becomes of paramount importance. Fortunately, VDE has a strong dividend story. The top holdings of the fund – XOM and CVX – are actually both dividend aristocrats. This means they have (at least) a twenty-year history of consecutively raising their dividends. This helps explain why VDE’s dividend growth rate has been so impressive.

While this ETF has over 100 stock holdings, XOM and CVX combine to make up almost 40% of total fund assets:

This amplifies that the dividend history of these two companies is so vital to VDE’s dividend story. Given their status as dividend aristocrats, I feel confident knowing the dividend is safe, and almost certain to grow, in the year ahead.

Bottom-line

VDE has been performing extremely well this year, but it has been under pressure in the short run. Rather than worrying about this trend, I am using the sell-off opportunistically to add to my position. Oil prices are likely to remain elevated and the broader equity market is facing some serious headwinds that suggest sticking with a sector that has been winning 2022 makes sense. With a positive dividend story and top holdings that have a strong earnings outlook, I am comfortable placing a “buy” rating on VDE at this time.

Be the first to comment