JJ Gouin/iStock via Getty Images

Investment Thesis

Valero Energy (NYSE:VLO) is a stock that has run up a lot in the past few months. However, as we go through, and discuss some positive and negative considerations of this investment, there are enough reasons to be compelled toward this stock.

Nonetheless, I still highlight some noteworthy negative considerations that investors should think about.

I conclude by arguing that paying a $53 billion market cap for Valero still makes sense, for now.

I rate the stock a lukewarm buy.

Valero Energy’s Near-Term Prospects

Valero is a manufacturer and marketer of liquid transportation fuels.

Last time I wrote about Valero, I noted that approximately 80% of its adjusted operating profits come from its refining business unit.

Now, after Q1 2022 results came out, more than approximately 96% of its adjusted operating income came from its refining business.

Simply said, as long as the crack spread remains strong, Valero is going to have a very strong cash flow-generative period in the very near term.

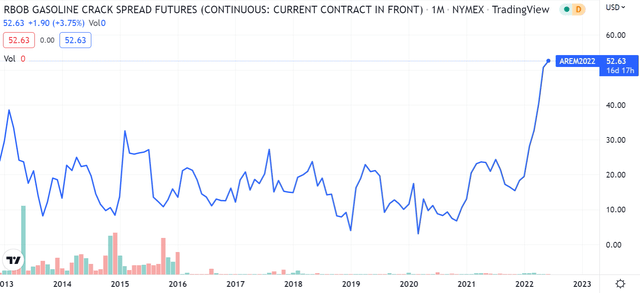

Gasoline Crack Spread Futures (TradingView)

As you can see above, the crack spread is now $52. However, keep in mind that this figure reached $60 just a few days ago.

Accordingly, investors are now on edge. The big question is how sustainable are these high crack spreads? And whether or not Valero is not only well-positioned to benefit from its strong refining capacity, but whether Valero can withstand the inevitable fallout once the crack spread market cools off.

Balance Sheet Position of Strength

Valero’s balance sheet holds total debt and finance lease obligations of $13.2 billion as of Q1.

Valero has paid down some small amounts of debt in the past few days. However, for all intents and purposes, Valero holds around $11 billion of net debt.

On this aspect, when asked during its earnings call, Valero noted its ambition to further bolster its balance sheet with even more cash.

And you [the analyst] said we’re at $2.6 on cash. So we’re not even at — we talked about having at least $3 probably going forward as a minimum, of course, it will vary around, but that’s kind of what we’re looking at. So we’ll build some more cash.

Accordingly, I believe this means that Valero is looking to further strengthen its balance sheet, rather than only aggressively repurchasing its stock.

On the other hand, keep in mind that during Q1, Valero also returned around $545 million via dividends and buybacks. This amounted to 45% of its adjusted net cash provided by operating activities of $1.2 billion.

Valero’s Profitability Profile in Focus

As noted above, during Q1 2022 adjusted net cash provided by operating activities was $1.2 billion. That being said, keep in mind that this adjusted figure adds back approximately $720 million of working capital costs.

What’s more, also note that during Q1 2022, Valero had approximately $840 million of capex requirements.

With these adjustments factored in, the business was barely reporting breakeven free cash flows.

On yet the other hand, the difference between Valero’s Q1 results and the remainder of 2022 is going to be like night and day.

As you know, when Q1 finished, the crack spread ended at approximately $30. While right now, the crack spread is at least 65% higher.

VLO Stock Valuation – Priced at 8x Free Cash Flow

As alluded to several times already, 2022 is going to be a very strong period for Valero.

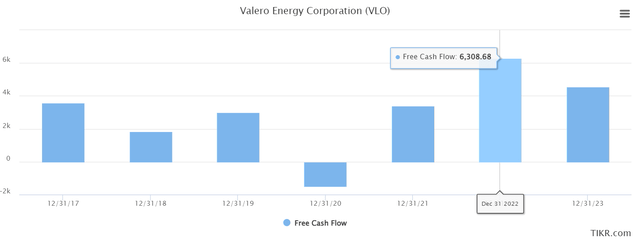

Analysts following the company are expecting around $6.3 billion of free cash flow, as you can see below.

However, once we get further out to next year, Valero’s free cash flows could return down to $4 billion, a figure comparative with Valero in 2021.

That would put Valero trading at 13x next year’s free cash flows.

Next, we’ll discuss some investment risks.

Premortem: Investment Risks

Valero’s investment risks come at the bottom of this analysis but that doesn’t mean they are less meaningful. The risks here are very serious.

The single concern is that with a slowing economy, the demand for diesel products will taper off. And the problem for Valero is that stocks go up like feathers and they drop like rocks.

Valero has a lot of momentum behind the stock. And when crack spreads weaken, the stock will sell off dramatically. The selling will be quick and relentless and likely to undershoot Valero’s intrinsic value.

Another consideration that could drive a sell-off in Valero would be news that some of Russia’s refined supply is being diverted from the East to the US.

For now, there are measures in place to ensure that does not happen. But it’s certainly a possibility that some refined volumes end up being redirected to the US.

This is not an exhaustive list. Although I believe these are some of the risks investors should be mindful of right away.

The Bottom Line

There’s a lot riding on the refining supply market remaining tight for longer. For now, Valero’s stock is priced at 6x this year’s free cash flows, which is not expensive.

However, looking out to next year, the picture rapidly becomes fuzzy.

Considering all the different considerations, such as Valero’s ambition to strengthen its balance sheet rather than simply return cash to shareholders, I believe is the right course of action to put Valero in good stead throughout the cycle.

Altogether, I rate this stock with a lukewarm buy rating.

Be the first to comment