ArLawKa AungTun/iStock via Getty Images

Investment Thesis

Vacasa (NASDAQ:VCSA) is a rental management platform. Unquestionably the crown jewel of this business is that it oozes free cash flow.

The business gets cash upfront via deferred revenues. Technically this is working capital. But since the business is growing over time, its deferred revenues will continue to grow faster than outgoings, leading to its free cash flow looking very good.

There’s a lot to like here in this investment, so let’s get into it.

Revenue Growth Rates of Approximately 22% CAGR

Vacasa’s full-year guidance at the end of Q4 2021 and Q1 2022 was essentially the same. The business was guiding at the high end of its range for $1.175 billion in revenues.

Now, together with its Q2 2022 results, Vacasa upwards revised its estimate by $10 million at the high end. This is obviously not a significant game changer.

However, since including the stock’s premarket jump of 25%, the stock is still down more than 50% from the highs set only a few months ago, anything that wasn’t strictly bad news was going to be perceived as being good news.

Simply put, investors were already bracing themselves for the worst going into the print.

Vacasa’s Near-Term Prospects

Readers are no doubt familiar with Airbnb (ABNB). Vacasa too is exposed to a prevailing market trend that sees alternative accommodations as one of the fastest growing categories in travel, driven by robust consumer demand.

What distinguishes Vacasa from Airbnb is the supply side of the business. Vacasa does all the heavy lifting on the back end to ensure that homeowners maximize their rental income.

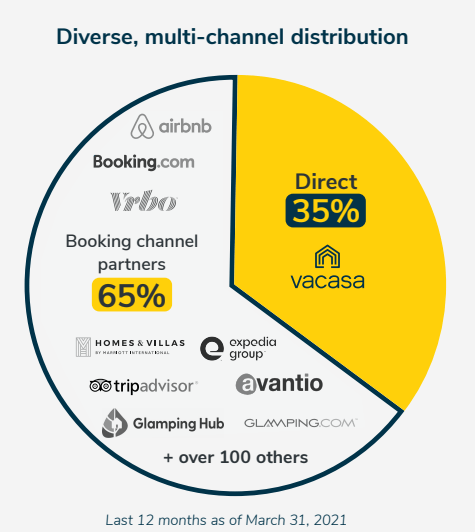

VCSA 2021 presentation

Essentially, you hand the keys to Vacasa and they do all the work to ensure that the property is being used for maximum rental income.

Vacasa takes a commission from both the homeowners and the guests.

Everything from the price checking your property’s listing to getting the property listed through 100s other channels to maximize visibility, including Airbnb as well as its own direct site too.

Profitability Profile Continues Improving

The one stand-out aspect of its full-year guidance is that Vacasa’s EBITDA is now could reach EBITDA breakeven for the year as a whole.

This is a material improvement from the guidance Vacasa provided in Q1 2022 when Vacasa was guiding at the high end towards a negative $14 million of EBITDA.

Given that H1 2022 saw Vacasa’s EBITDA report negative $25 million, this implies that the second half of 2022 will see close to $25 million of positive EBITDA.

For extra color, this is what Vacasa’s management said during the earnings call,

July has historically been our seasonally strongest month of the year and has accounted for 40% to 50% of third quarter gross booking value and revenue.

We also have a high percentage of our expected August booking confirmed at this point, which is our second strongest month of the year. With July complete and high visibility into August, we are confident in our third quarter guidance.

And while we have less visibility into the fourth quarter, given it’s only August, we are currently pacing well against our expectations.

The commentary above implies that Vacasa is attempting to be conservative with its outlook for Q4. Since Q3 2022 is guided for $60 million of EBITDA, this means that there’s a significant likelihood that Q4 2022 could perhaps see reported EBITDA higher than the current expectations.

VCSA Stock Valuation — 1x This Year’s Sales

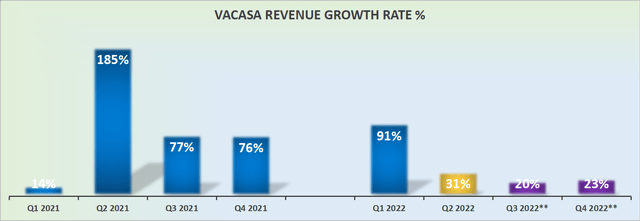

The big question that looms large is exactly what sort of growth rate can investors expect from Vacasa. This time last year its business was sizzling hot, as its revenue growth rates went against much weaker comparables from 2020.

Indeed, Vacasa in 2022 is somewhat similar to Airbnb this year. Both companies are coming up against really tough comparisons with the prior year.

In fact, both companies appear to be growing in the second half of 2022 at very similar rates. If one is a little picky, it’s likely that Airbnb is in fact growing approximately by 300 to 500 basis points faster, at 25% to 28% CAGR, with Vacasa probably growing at 22% to 24% CAGR.

On the other hand, one should keep in mind that Airbnb is a household name, so it obviously carries a higher premium on its stock and gets priced at 9x 2022 sales.

This compares with Vacasa which is priced at 1x sales

The Bottom Line

The one-line takeaway is this, Vacasa reports very strong results and guidance. Meanwhile, the stock is still cheap, despite the 25% premarket jump.

Vacasa’s commentary around its outlook leads one to believe that there’s scope for the business to positively impress investors with improved bottom line profitability in the second half of 2022.

Altogether, paying 1x sales for a business that makes strong free cash flow makes a lot of sense. And it’s even better when that business gets a lot of revenue upfront for bookings that will happen in the future. That’s why even though the business isn’t that profitable today, it simply oozes free cash flow.

Be the first to comment