Vittorio Zunino Celotto

Thesis

V.F. Corporation (NYSE:VFC) is slated to deliver its FQ1’23 earnings release on July 28, as its stock remains close to its March 2020 COVID lows since May. We believe the market has justifiably hammered VFC as it anticipated the recovery from its COVID lows was not sustainable.

Coupled with worsening macro headwinds, global currency headwinds, and its exposure to China’s COVID lockdowns, it created a perfect storm for the leading retailer.

However, our analysis suggests that the market could set up a sustained long-term bottom in VFC. The stock has been basing well over the past two months and created a bear trap (indicating the market decisively rejected further selling downside) on its long-term chart. Therefore, we believe the downside will likely be limited moving forward as it navigates a challenging FQ1. In addition, we believe the market is forward-looking, as it anticipates better times moving ahead. Therefore, we urge investors to pay attention to its forward guidance as retailers navigate some of the most challenging conditions since the onset of the COVID pandemic.

Our valuation analysis indicates that VFC could still underperform the market even at the current levels. Notwithstanding, VFC investors could still use the current bottom to layer in and improve their cost basis if they added at higher levels.

Given the limited downside risk moving forward, we rate VFC as a Buy, with a medium-term price target (PT) of $55 (implying a potential upside of 16%).

Be Prepared For An Ugly Q1 Card

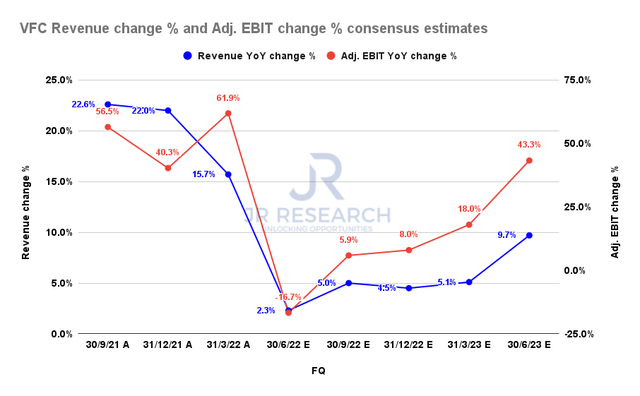

VFC revenue change % and adjusted EBIT change % consensus estimates (S&P Cap IQ)

The consensus estimates (bullish) indicate that VFC’s revenue and adjusted EBIT growth could hit rock bottom in its upcoming Q1 release (calendar quarter ended June 30). Therefore, we believe the market has been preparing for worse results since its Q4 release in May, as retailers continue to see worsening macro headwinds.

Deutsche Bank (DB) also highlighted in a recent note, as it added (edited):

We expect weakness in Vans to be reflected in the earnings report while understood challenges in China and in foreign exchange add to the negativity. However, VFC’s higher-income consumers, history of limited promotional activity, and competent management team should buoy the stock into the second half of 2022. – Seeking Alpha

Therefore, as seen above, the Street expects VFC to climb out of its nadir through FY24 as it continues to gain operating leverage. Hence, VFC investors should parse management’s commentary closely for its forward guidance.

Notwithstanding, we believe a high level of pessimism has been reflected in its current valuation. As long as management doesn’t post guidance far worse and structurally weaker than the Street expects, we are confident its June/July lows should hold.

VFC’s Long-Term Price Action Is Highly Constructive

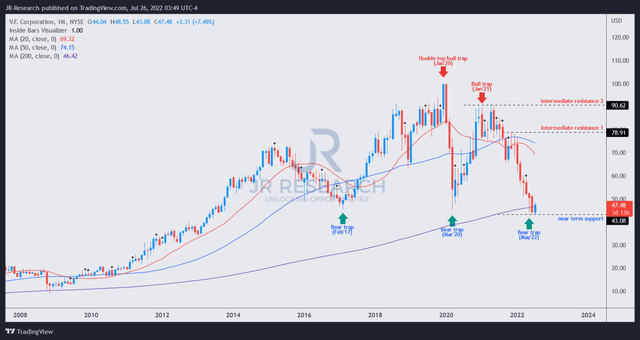

VFC price chart (monthly) (TradingView)

VFC formed a bear trap on its long-term chart in May, as seen above. We accord the highest precedence to long-term charts, given their potency. Therefore, if a bear trap price action occurred on VFC’s long-term chart, we believe the signal of a sustained bottom is robust.

Furthermore, the price action has been basing well over the past two months, supported above its 200-month long-term moving average. Therefore, we believe it has likely attracted long-term dip buyers to add exposure.

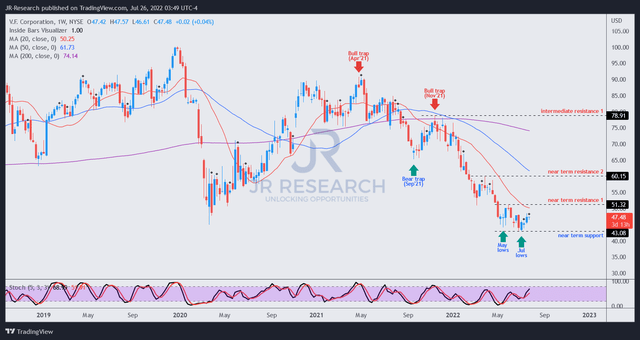

VFC price chart (weekly) (TradingView)

Notwithstanding, the recent recovery from its July lows has sent VFC into short- and medium-term technically overbought zones. As a result, we believe some near-term volatility could follow post-earnings, as the market could use it to shake out weak hands.

However, we don’t expect the market to break below its June/July lows decisively. Therefore, investors can consider waiting for a potential post-earnings retracement before adding exposure.

VFC’s Valuation Is Reasonable

| Stock | VFC |

| Current market cap | $18.45B |

| Hurdle rate (CAGR) | 8% |

| Projection through | CQ4’26 |

| Required FCF yield in CQ4’26 | 7% |

| Assumed TTM FCF margin in CQ4’26 | 11.5% |

| Implied TTM revenue by CQ4’26 | $15.8B |

VFC reverse cash flow valuation model. Data source: S&P Cap IQ, author

We applied a market-underperform hurdle rate of 8% in our model. However, it’s still much better than VFC’s 5Y and 10Y total return CAGR of -2.36% and 5.04%, respectively.

We selected an FCF yield of 7%, which we believe appropriately models the current market dynamics, given the macro headwinds. Notably, VFC posted a 5Y and 10Y mean of its FCF yield of 4.15% and 4.71%, respectively. Hence, we have used an even more conservative risk rating.

Given the recovering free cash flow (FCF) profitability, based on the revised consensus estimates, we require VFC to post a TTM revenue of $15.8B by CQ4’26 to fulfill the hurdle rate implied in our model. We believe it’s achievable.

Is VFC Stock A Buy, Sell, Or Hold?

We rate VFC as a Buy with a medium-term PT of $55 (potential upside of 16%).

Notwithstanding, we expect VFC to underperform the market over the next four years, based on our valuation analysis. Therefore, investors are urged not to hold the bag.

Our price action analysis suggests that VFC is at a sustained long-term bottom. Therefore, we believe its long-term downside risks are limited at the current levels, which justifies a medium-term buy rating.

Notwithstanding, we posit that VFC is overbought in the near term. Therefore, investors considering adding exposure can wait for a retracement first.

Be the first to comment