trenchcoates

Thesis

We updated in a pre-earnings piece on V.F. Corporation (NYSE:VFC) in July that we are confident that its downside risks seemed limited. We were optimistic about the improvement in its operating metrics through FY23, coupled with a well-battered valuation. Furthermore, VFC’s price action appeared constructive of a long-term bottom as it headed into its FQ1’23 earnings release.

However, the market has not agreed with us over the past month, as VFC continued to underperform the SPDR S&P 500 ETF (SPY). VFC posted a return of -11% against the SPY’s gain of 2.6% since our previous article. Therefore, we revisited our thesis and reassessed whether fundamental tweaks were necessary. However, despite the market’s negative reaction, we remain confident of a medium-term re-rating in VFC. We posit that the near-term downside volatility has likely created a capitulation bottom, which we are convinced that it should reverse subsequently.

In its recent earnings call, management’s commentary indicates that VFC is still well-positioned for growth in its critical segments, with limited impact seen in its ex-China consumer base. Coupled with an improvement in YoY comps moving forward, we posit that investors should expect VFC to post an improvement in its underlying metrics, despite worsening macroeconomic headwinds.

Therefore, we reiterate our Buy rating on VFC and urge investors to use the downside volatility to add more positions.

VFC Is Well-Configured To Climb Out Of Its Malaise

Management delivered a confident FQ1 earnings card, which underscored the importance of its target customer segments. Management highlighted that it’s confident its focus on the mid to higher-end consumers should help maintain the strength of its growth drivers.

Notwithstanding, we postulate that VFC should continue to come under pressure from softer consumer spending due to the worsening macro headwinds. Coupled with forex headwinds due to a strong USD, it should put further pressure on VFC’s FY23 performance as management revised its profitability guidance downwards.

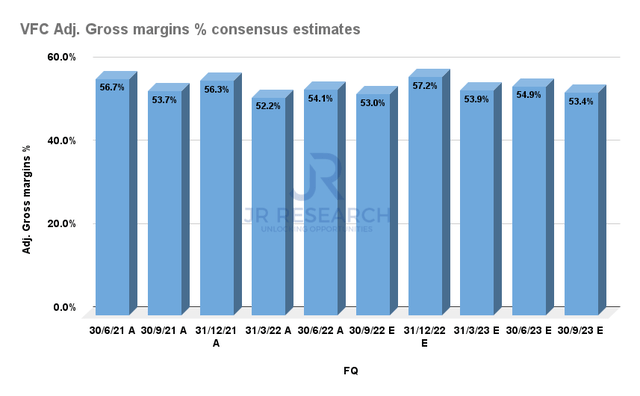

VFC adjusted gross margins % consensus estimates (S&P Cap IQ)

But, the consensus estimates (bullish) suggest that VFC’s adjusted gross margins should bottom out in FQ2 before recovering subsequently. Therefore, VFC is still expected to maintain robust price leadership, helping it cope with recessionary headwinds and an elevated inventory situation.

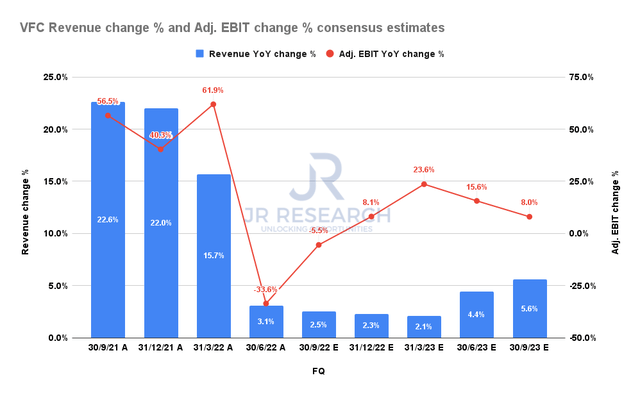

VFC revenue change % and adjusted EBIT change % consensus estimates (S&P Cap IQ)

In addition, its adjusted EBIT growth is expected to climb out of its nadir in FQ1, indicating that the company’s profitability profile should improve markedly through FY23 as it laps challenging comps from FY22.

We are confident that some of the near-term headwinds impacting VFC have abated. For instance, logistics and freight costs have continued to improve through August, even though they remain well above their pre-COVID highs. However, the ongoing moderation in freight costs should help support the recovery of its profitability growth profile.

Moreover, VFC also telegraphed sanguine commentary related to its challenges in China. It remains a long-term investor in the Chinese market, and sees further improvement in COVID-related headwinds through FY23, as management articulated:

Clearly, we think long term, [China] remains a clear opportunity for growth. We are navigating short-term challenges. Looking at the numbers from a compare standpoint and obviously expecting the China business to improve sequentially through the year as well. But, we’ll still be negative in Q2 is our expectation, [negative] mid-teens to 20% is kind of the way to think about that. And then returning to some level of growth as we move into the back half of the year. (VFC FQ1’23 earnings call)

VFC’s Valuation Has Been De-Risked

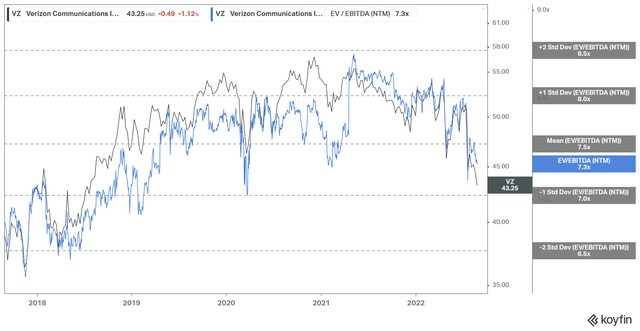

VFC EV/NTM EBITDA valuation trend (koyfin)

As seen above, VFC’s NTM EBITDA multiples traded close to the one standard deviation zone below its 5Y mean at its July lows. That zone also supported its March 2020 bottom and its previous one in 2019. Therefore, we are confident that VFC has likely staged its long-term bottom in July/August.

Is VFC Stock A Buy, Sell, Or Hold?

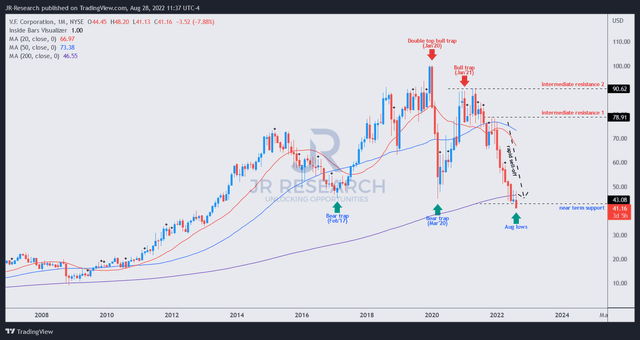

VFC price chart (weekly) (TradingView)

VFC’s recent selloff appears to have breached its near-term support ($43) on its long-term chart. However, we also gleaned that the rapid collapse in VFC is unsustainable, as it’s emblematic of capitulation moves to force weak holders to give up their shares.

As a result, while there’s potential downside volatility given VFC’s downward momentum, we are confident that buying support should return to deny further selling downside moving forward. Coupled with our assessment of a de-risked valuation, we remain optimistic about an attractive reward-to-risk profile in VFC.

Accordingly, we reiterate our Buy rating on VFC, with a medium-term price target of $55 (implying a potential upside of 34%).

Be the first to comment