MarsBars/E+ via Getty Images

As a value investor, I get more excited about market dips than market rallies. That’s because bargain opportunities result in higher yields, with which I can put into my income portfolio. This brings me to V.F. Corp (NYSE:VFC), which is now trading at near early pandemic levels, after falling by 32% over the past 12 months. This article highlights what makes this a good buying opportunity for dividend investors, so let’s get started.

A Smart Bargain For Dividend Investors

V.F. Corp is a global leader in branded lifestyle apparel, footwear and accessories with 40K employees and annual revenue of $11.6 billion. VFC’s product offerings span multiple channels including retail, wholesale and e-commerce. The company’s portfolio of iconic lifestyle brands includes Vans, The North Face, Timberland, Wrangler and Lee. Notably, the first three aforementioned brands dominate at the company, representing 80% of its sales.

VFC’s business is performing well, with revenue from continuing operations rising by 22% during Q3 of FY’22 (ended January 1st). Excluding acquisitions, revenues still increased by a respectable 15% (up 16% excluding currency effects). This was driven by robust 26% revenue growth in Europe, partially offset by a 6% decline in Greater China.

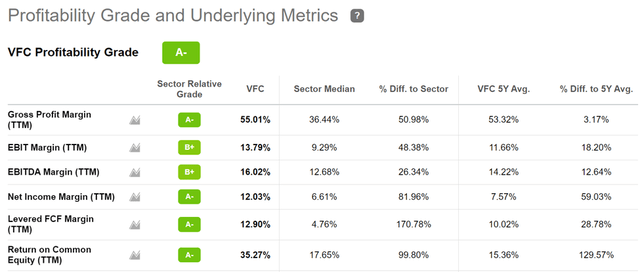

Moreover, VFC is seeing positive operating leverage, as gross margin increased by 140 bps YoY to 56.1%. This is also driven by VFC’s pricing power, as customers are willing to pay a premium for its brands and perceived quality. As shown below, VFC scores an A- score for Profitability, with EBITDA and FCF margins sitting well above the sector median.

VFC Profitability (Seeking Alpha)

Near-term risks to the company include the COVID-related shutdowns happening in China, which could dampen product demand in the short-term and cause supply chain disruptions. In addition, a decline in the physical retail channel in the form of store closures may force VFC to have to adapt quicker to online sales and rely more on discounted products at its outlet stores.

I see these risks as being offset by management continuing its track record of innovation, as they are rolling out Vectiv and FutureLight to resonate with consumers in footwear and outerwear. Furthermore, VFC’s Wander collection and off-mountain lifestyle products are seeing strong growth momentum.

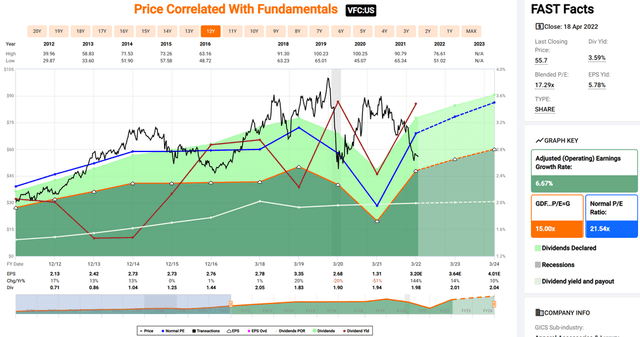

Plus, I see VFC’s cheaper valuation as making up for the short-term headwinds. At the current price of $57.37, VFC carries a forward PE of 17.9, sitting well below its normal PE of 21.5 over the past decade.

VFC Valuation (FAST Graphs)

It maintains a strong A- rated balance sheet, and its 3.5% dividend yield is also well-covered by a 69% payout ratio. It also comes with a 5-year dividend CAGR of 6% and 48 years of consecutive dividend growth. This puts VFC well on track to become a Dividend King in 2 years.

Sell side analysts have a consensus Buy rating on VFC with an average price target of $73. This translates to a potential one-year 31% total return including dividends.

Investor Takeaway

VFC has a strong portfolio of iconic brands, positive operating leverage and pricing power to more than offset the near-term headwinds. Meanwhile, VFC pays a healthy and growing dividend yield, and is well on track to become a Dividend King. VFC is an attractive opportunity at the current price for long-term dividend growth investors.

Be the first to comment