YakobchukOlena/iStock via Getty Images

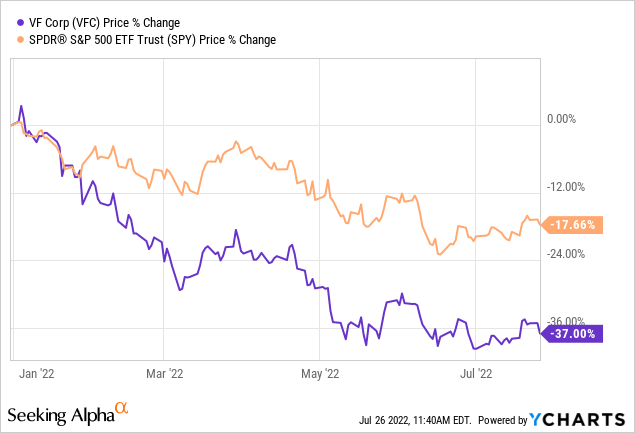

V.F. Corp (NYSE:VFC) has lost 37% of its market value year-to-date, in contrast with the 18% decline of the broader market.

In our opinion, this level of sell off is justified in light of the current macroeconomic environment. On the other hand, when we look at VFC’s performance during times of low consumer confidence in the past 20 years, we can see that the stock has actually performed quite well.

In this article, we will take a look at how VFC has been performing in the last 20 years during periods of low consumer confidence, and what macroeconomic headwinds are likely to hurt VFC’s business in the near term.

Performance During Times Of Low Consumer Confidence

Consumer confidence – a leading economic indicator – is often used to predict near term changes in the consumer spending behavior. A low or declining consumer confidence normally signals the reluctance of the consumer to spend larger sums of money, due to their uncertain financial outlook. Such a behavior could result in cutting cost on durable, discretionary, non-essential items, potentially leading to a decreasing demand for VFC’s products.

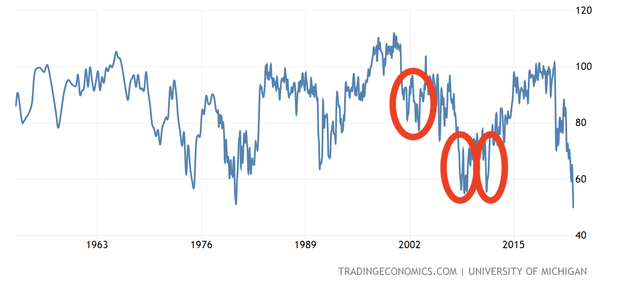

Consumer confidence in the United States has been declining in the past months steadily, falling below 2008-2009 levels.

U.S. Consumer confidence (Tradingeconomics.com)

VFC sells primarily clothing products, under the North Face, Timberland, Smartwool, Icebreaker, Altra, Vans, Supreme, Kipling, Napapijri, Eastpak, JanSport, Dickies, and Timberland PRO brand names.

The income elasticity for these products is estimated to be relatively high, meaning that a change in income (or wealth) has a substantial impact on the demand for the goods. We believe that due to rising inflation, the strong USD, the decreasing net-worth of many investors due to the broader stock market decline could lead to a lower demand for VFC’s products in the near term.

For these reasons, we would expect that VFC has not been performing well during times of low consumer confidence in the past. However, it is not the case.

Let us actually take a look at how VFC’s stock has been performing during the periods highlighted by the red circles on the graph above.

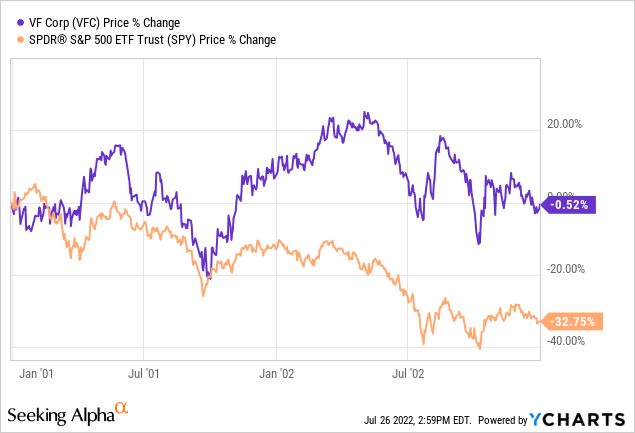

2001-2003

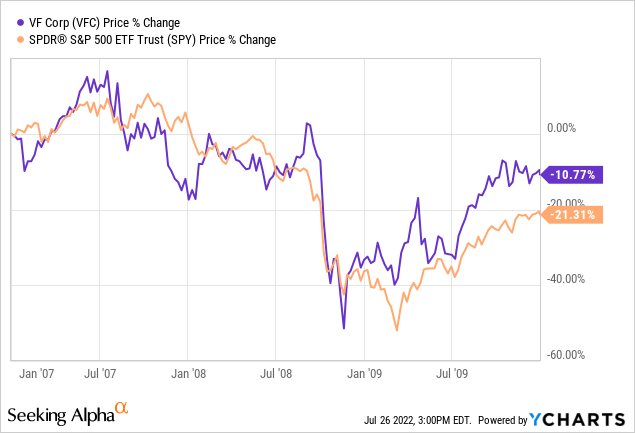

2007-2010

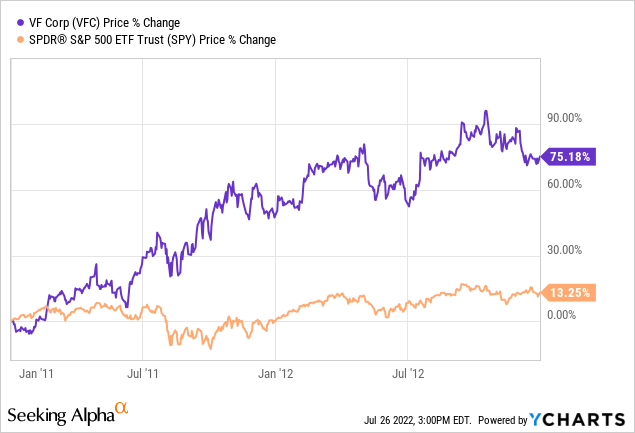

2011-2013

In all three periods, characterized by low consumer confidence, VFC has substantially outperformed the S&P500 (SPY).

The price increase in these periods were actually reflecting the growth in earnings and sales. In our opinion, such growth was possible to achieve due to VFC’s diversified product portfolio and exceptional brand recognition and loyalty. The main question is, are these periods indicative enough of the current market environment?

Let us take a look now, what other macroeconomic headwinds are in play currently.

High Foreign Market Exposure, Strong U.S. Dollar

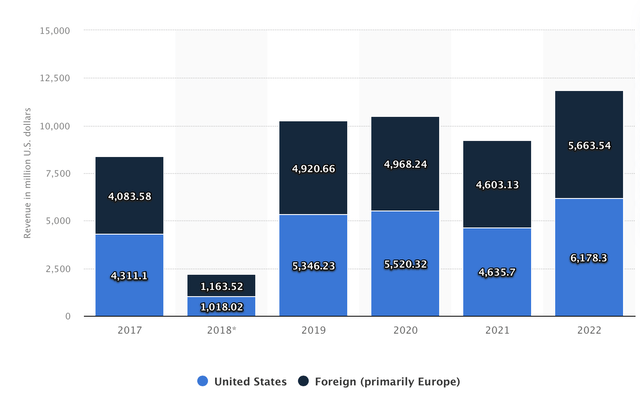

In 2022, almost 50% of VFC’s sales were coming from outside of the United States. This creates a significant foreign exchange risk for the firm.

Revenue by region (Statista.com)

As the USD has gained significant strength against the EUR in the past years, reaching even a 10-year high, we expect VFC earnings to be hurt by the unfavorable foreign exchange rates.

Elevated Commodity Prices

In February 2022, energy prices have skyrocketed as the geopolitical tension between Russia and Ukraine unfolded. The elevated oil and gas prices have put a significant downward pressure on the margins of many retailers, due to increasing raw material and freight costs.

WTI price (Tradingeconomics.com)

Although in the past weeks the price of WTI has slightly retreated, it is trading significantly above the 2021 levels. Due to the high geopolitical uncertainty, we expect the oil price to remain high in the rest of 2022, potentially continuing to create downward pressure on VFC’s margins too.

Retailers Have Been Struggling With Inventory Management

In the first half of 2022, retailers have had hard times managing their inventory. The main drivers for these were changing demand and supply chain disruptions.

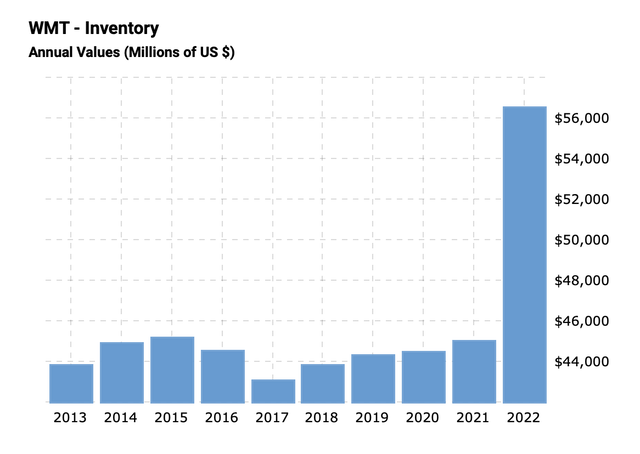

One of the latest examples is Walmart. Walmart’s inventory levels have significantly increased in 2022.

WMT inventory (Macrotrends.net)

However, this inventory turned out to be not suitable for the current demand. In order to get rid of the excess, Walmart had to sell some of their products at significant discounts, leading to a weaker than expected outlook. The highlighted apparel as one of the most critical items in their inventories.

As VFC is selling apparel, the firm may face similar issues in the near term.

Key Takeaways

Although VFC has been performing exceptionally well in the past during times characterized by low consumer confidence, year to date the stock is down by about 37%.

In our opinion, the selloff is justified as the firm is likely to face several macroeconomic headwinds, including elevated commodity prices, a strong USD and rising inflation, which could all have a material impact on the firm’s financial performance.

Many retailers in the first half of 2022 have been struggling with inventory management. VFC may face similar issues, as trend in demand seem to be changing.

While we believe that some of these headwinds are only temporary, we currently rate the stock as “hold”.

Be the first to comment