Spencer Platt/Getty Images News

(This article was co-produced with Hoya Capital Real Estate)

Introduction

Most articles, like my “Adding Income Using Cash-Covered Puts And Covered Calls,” discuss how writing options can be used to generate income for the investor. This one takes that concept and covers the idea of using Cash Secured Puts in place of bank CDs by selling deep OTM contracts.

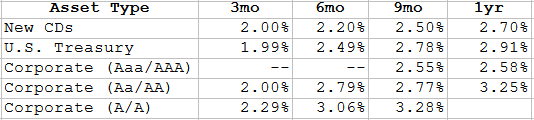

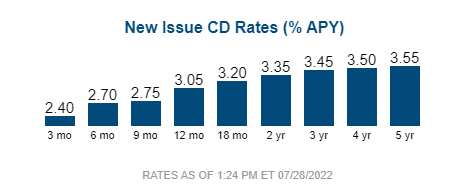

Even with the Fed pushing up rates, short-term CDs still earn below 2.5%. That return is risk-free compared to writing Put options. Using easily tradable exchange-traded funds (“ETFs”) with quarter-ending Put contracts, investors can increase their yield. How much depends on the risk level they want to employ.

This data from Fidelity was collected on July 1st, supposedly the day an investor would have sold new CSPs to replace the ones that expired the day before.

Fidelity.com; compiled by Author

I included assets other than CDs for comparison purposes. Short-term CD rates have more than doubled in the last month and should continue to climb as the Fed raises the short-term Fed rate.

Compared to CDs, this article will show what investors might earn selling Put options on the SPDR S&P 500 ETF (SPY) or the iShares Russell 2000 ETF (IWM). I picked these ETF for several reasons:

- They invest in two well known, popular equity indices. Plus, an index should be a safer investment than an individual stock.

- Their options trade frequently, with significant volume (SPY more so than IWM), numerous strikes, and narrow bid/ask spreads. SPY has strikes only$1 apart; IWM $5. SPY Bid/Ask spreads were $.05; IMW’s $.07.

- Unlike most options, they have contracts that expire on the last trading day of the calendar quarter, making them a possible substitute for 3-mo and/or 6-mo CDs.

CDs versus CSP options, a risk assessment

Unless an investor exceeds the FDIC coverage per issuer used, in theory, there is no risk of loss using CDs. By using options on index-based ETFs, the investor should experience less risk than trying this with individual stocks. One measure of that can be found by examining the Delta of ETF options against stocks, even one in more stable sectors.

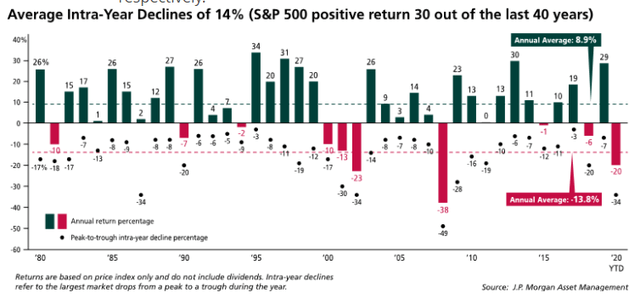

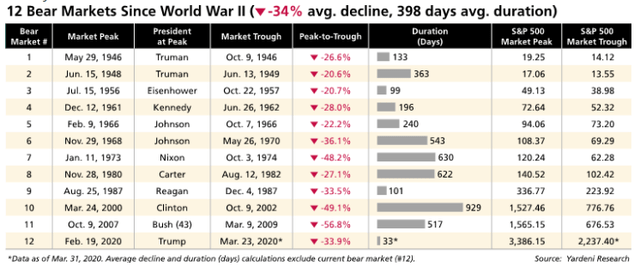

I did go searching for some charts for a historical perspective to this question. I found these.

keatingwealth.com keatingwealth.com

Since I will be discussing both 3-mo and 6-mo options, I looked but did not find what the worst quarters have been for the US stock market. Avoiding the average intra-year declines of 14% is easily done and still can generate a higher return than current CDs offer. As with most investments, the more risk an investor is willing to take on, the more return they can generate.

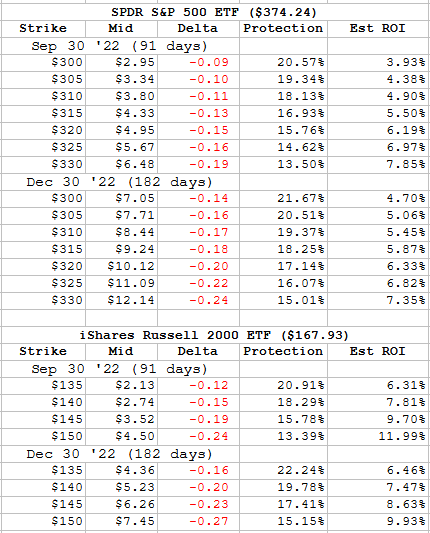

Option data and results

All the option data was captured from Fidelity.com during the day on 7/1/22. I included each ETF’s price at the time. Columns represent:

- Strike: strike price for the option. An investor would need 100X in cash to back each contract sold.

- Mid: The midpoint between the Bid and Ask prices at the time the data was collected.

- Delta: One of the Greeks defining how the option price moves in relationship to the ETF’s price. The negative value show how many pennies the option price would drop if the ETF price climb $1. I chose not to show other Greeks but here is a link to understanding six of them.

- Protection: Reflects how far the ETF price would need to fall before the investor suffered a loss on the trade.

- Est ROI: Premium earned/strike used, then annualized. This what gets compared to any available CD ROI, or yield.

Remember, all this data is from a point in time. Premiums will move based on time elapsing, price movement of the ETF, and changes in the risk assessment of both the ETF and the stock market overall. If I had collected data after the market closed on 7/1/22, SPY was up to $381.24, and the premiums shown here were all down by the Delta times 7.

Fidelity.com; compiled by Author

Even though SPY offers strike only $1 apart, I chose to show them at $5 increments, as that is the closes they come for IWM. The expiration dates are also available for both, including ones that expire each Friday; out several months.

Analyzing the data

Using SPY CSPs, one could double their income even if the ETF lost 20+% of its value at the end of the quarter. IWM CSPs triple the income possibility. As bad as the 2nd quarter was, using the 20% protection strikes should have expired OTM. Going for the extra yield of the 15% protected strikes would have failed, assuming the ultimate goal is not getting assigned.

Comparing SPY versus IWM as the ETF to use

- IWM shows higher Implied Volatility than SPY (42% vs 33%), resulting in better ROIs for the same level of protection.

- SPY has more strikes available, higher trading volume and narrower Bid/Ask spreads, making them easier to trade.

- The ETFs have no overlap in holdings, thus an investor could use both without doubling up their exposure to the same set of stocks.

- IWM’s higher security count makes it less dependent on its largest stocks: 4% in Top 10 compared to 27% for SPY.

Portfolio strategy

When putting together an investment plan and making those allocation decisions, understanding the risk/return profiles of each asset type and their correlations to each other is important. Time horizons and investing goals also come into play. This article focused on what is an interesting idea for the low-yielding cash allocation investors’ might have for various reasons, such as risk avoidance or waiting for better investment opportunities.

Despite the ability to possibly earn double-digit returns, the concept here is finding a low-risk alternative to a bank CD, not making a fortune. By using options in place of a bank CD, you also have full access to your funds by simply closing out your Put position. While there is no penalty for early withdraw, you could loss money if not enough of the time premium evaporated to offset an increase in the price of the Put option.

Another possible advantage over CDs is how the income is taxed. While some states do not tax interest income, most times it counts as ordinary income, no favorable treatment. Premiums from expired options are always taxed as a short-term gain. They are taxed the same as interest income unless you can offset them with any trading losses elsewhere in a taxable account.

Final thoughts

As I was collecting the data for this, I sold 2 3Q SPY $310 Puts with 17% downside protection. If they expire OTM, the yield will be 4.7% versus the 2% my broker is offering on any CD in their inventory. A then sold a $150 IWM for a potential ROI of 7.3% with a 14% protection level.

After the July action by the Federal Reserve, CD rates were up about 40bps across the time periods.

Fidelity.com

Be the first to comment