USD, EUR/USD, USD/JPY Analysis & News

QUICK TAKE: USD/JPY Pops asBoJ Takes a Leaf Out of the ECB’s Currency War Book

Equities: Another day of gains in store for US markets as EU bourses trade modestly in the green, while crude futures continue to track higher. While the slight miss in US CPI relative to expectations has provided an extra lift for equity markets, given that it reinforces the lower for longer trade, particularly with the Fed’s AIT policy.

Euro Stoxx 50 Sector Breakdown

Outperformers: IT (1%), Financials (0.7%), Real Estate (0.3%)

Laggards: Energy (-1.4%), Basic Materials (-0.8%), Healthcare (-0.6%)

US Futures: S&P 500 (0.4%), DJIA (0.4%), Nasdaq 100 (0.5%)

Intra-day FX Performance

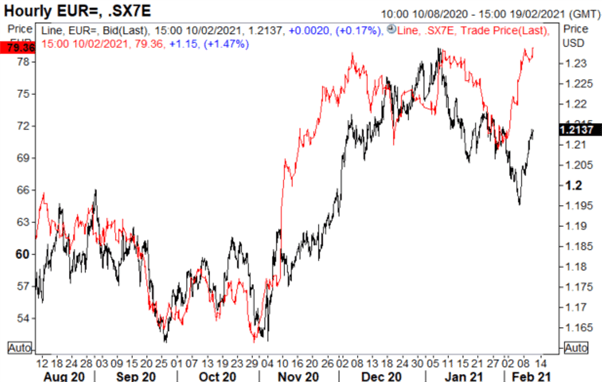

USD: The miss on US CPI (1.4% vs 1.5%) provides another blow for USD bulls with the greenback now trading below its 50DMA. The next line of support sits at 90.20 and the psychological 90.00 handle. In turn, with the USD slipping, both the Euro and Pound have been among the major beneficiaries. As set-up that tends to grab my attention is the Euro vs the EU Banking Index, which currently signals further gains are in store for the Euro towards 1.23.

EUR/USD vs Stoxx Banking Index

Source: Refinitiv

JPY: BoJ look to have taken a leaf out of the ECB’s book and attempt to step up rhetoric regarding deeper negative rates.

“BOJ MAY SEEK TO CLARIFY IN MARCH POLICY REVIEW THAT IT HAS ROOM TO DEEPEN NEGATIVE INTEREST RATES – JIJI”

While the headline crossing on the wires prompted a bounce off the 100DMA (noted yesterday) in USD/JPY and see cross-JPY at session highs. The step-up in rhetoric is unlikely to lead to significant currency weakness.

| Change in | Longs | Shorts | OI |

| Daily | 4% | -14% | -3% |

| Weekly | 1% | -30% | -14% |

Commodities: Oil prices have gone from strength to strength with Brent above $61/bbl. Tight supply, firmer risk appetite and a softer USD provides a concoction of positives for oil to extend further. Elsewhere, gold prices saw a marginal $10 rise post the softer than expected inflation data as both a drop in the USD and US real yields underpins.

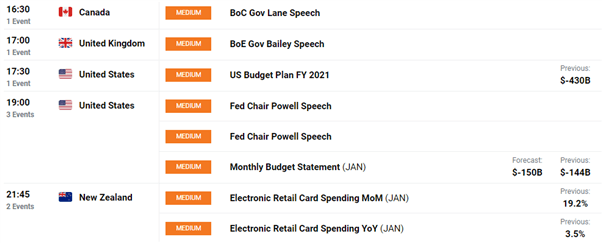

Looking ahead: With US CPI now out of the way, much of the focus will be on central bank speakers with Fed’s Powell, BoE’s Bailey and BoC’s Lane due to speak.

Source: DailyFX

Be the first to comment