ayo888/iStock via Getty Images

By Chris Turner & Francesco Pesole

Intervention: It’s been a while

The Japanese yen has been one of the weakest currencies anywhere in the world this year. It only seems a few months ago that we were asking ourselves whether Japanese authorities would mind USD/JPY trading through 115, only to see it touch 125 in late March. Driving the rally has been the perfect storm of a hawkish Federal Reserve, a dovish Bank of Japan (BoJ), and Japan’s negative terms of trade shock as a major fossil fuel importer.

The move to 125 did elicit some remarks from Japanese politicians that they were watching FX rates very carefully. More recently, BoJ Governor Haruhiko Kuroda has characterised the USD/JPY rise as ‘somewhat rapid’. But will this concern trigger FX intervention to support the yen?

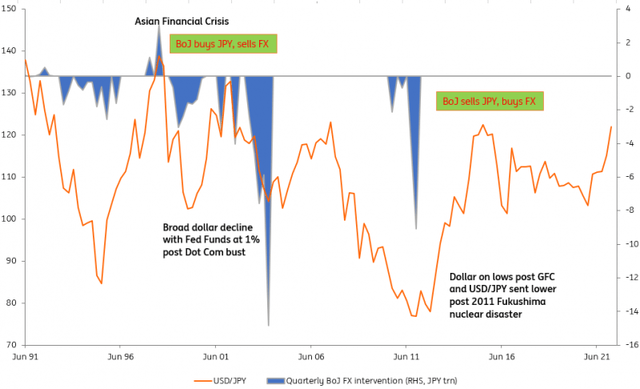

Japan’s last foray into the world of FX intervention was in late 2011 when it bought USD/JPY to support it near 75. The last time the BoJ sold USD/JPY (a rare occurrence) was back in June 1998 in the middle of the Asian crisis when USD/JPY was trading at 145.

USD/JPY is at neither of those extreme levels now, though the inflation-adjusted real exchange rate does actually show the yen weaker today than it was in the late 1990s. In theory, then, the BoJ could have a case to use intervention to support the JPY. But we think that is unlikely, largely because of communication challenges and G20 protocol.

Japanese FX intervention has become the exception not the rule

Japanese Ministry of Finance, ING

Why FX intervention is unlikely

One of the first, and perhaps the only, objective of FX intervention is that it needs to be successful. Not that we have seen much FX intervention in the G3 FX space over the last decade, but successful intervention in liquid FX pairs would need to be coordinated. Getting the Fed involved in an operation to sell dollars at a time when the Fed is about to hike rates 300bp is highly unlikely. If intervention were to occur, it would probably be Japan going alone.

But as our chart above shows, what was more common during the 1990s and up until about 2003, Japanese FX intervention over the last couple of decades has been the rare exception rather than the rule. As a member of the G20 and the closer-knit G7 group, Japan has had to adhere to flexible exchange rates – as a means to bring China in line with a less managed currency.

To justify own account FX intervention to sell USD/JPY, Japanese authorities would have to strongly argue that the weak yen was not only a Japanese problem but a global problem. In fact, it seems hard to argue that a weak JPY is even a problem for Japan. There certainly seems no ‘sell Japan’ mentality developing – Japanese equities have not underperformed. And if the Japanese are concerned that the spike in energy prices is being exacerbated by the weak Yen – they can either hike interest rates or adopt fiscal support measures (an inflation shield) rather than intervening.

The only case we see for the Japanese Ministry of Finance to instruct the BoJ to sell USD/JPY is in the case of a disorderly FX move. What is disorderly? That will be a function of the speed of the move and market conditions. In the past, Japanese policymakers have looked at the FX options market to judge market conditions. Prior FX interventions for disorderly moves have come when one month traded USD/JPY volatility was closer to 18/20%. The recent move to 125 saw traded volatility rise to 11%. We suspect USD/JPY would have to be trading at or above 130 for volatility to be anywhere near the 18/20% again.

USD/JPY not over-stretched on valuation metrics

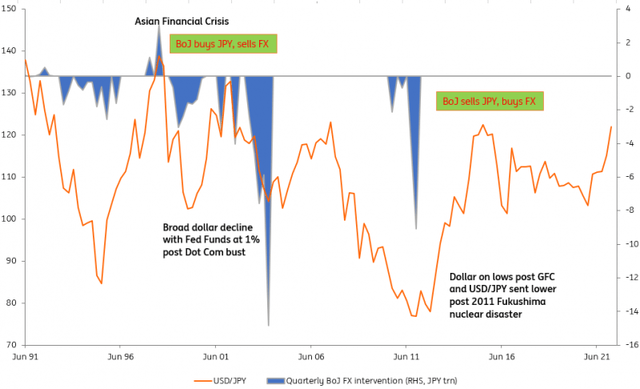

As noted above, the real yen exchange rate is very low by historical standards. But is it severely undervalued? Our Behavioural Equilibrium Exchange Model (BEER) shows a real medium-term 9-10% overvaluation of USD/JPY. On average, oscillations within the 1.5 standard deviation band (currently, +/- 15%), suggest that the valuation is not overstretched. Mis-valuations outside of this band have normally been followed by convergence towards fair value.

The terms of trade differential and productivity differential are the variables with the highest beta in our model. It must be noted that the calculated fair value is based on 4Q21 figures, as some of the data in the model are released only quarterly. The sharp increase in energy prices in 1Q22 has caused a further deterioration in Japan’s terms of trade, which has likely pushed the USD/JPY fair value higher and reduced the mis-valuation gap. In short, we do not think USD/JPY is yet at the kind of extreme over-valuation levels which prevent it from going much further.

USD/JPY deviation from ING medium term fair value model

Japanese Ministry of Finance, ING

Bringing it all together, we think a front-loaded Fed tightening cycle, a dovish BoJ and a deteriorating Japanese balance of payments position on the back of the fossil fuel spike will keep USD/JPY bid for most of the year – and it should be nearing 130 by year-end. Probably the biggest risk to that view is that the BoJ becomes less dovish – as evidenced by it allowing 10-year JGB yields to trade above 0.25%. That is not what we forecast.

Content Disclaimer

This publication has been prepared by ING solely for information purposes irrespective of a particular user’s means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment