US DOLLAR OUTLOOK: CONSUMER SENTIMENT, INFLATION EXPECTATIONS EYED

- US Dollar strengthened modestly on Thursday as GBP/USD tumbled lower

- DXY Index remains stuck in its range between the 91.75-93.40 price levels

- Consumer sentiment data on deck for release poses upcoming event risk

The US Dollar was little changed on Thursday with the broader DXY Index gaining a mere 0.12% for the session. GBP/USD price action declining 56-pips largely fueled the move as both EUR/USD and USD/JPY closed flat. Improving jobless claims and stubbornly high PPI data could have contributed to upward pressure on Treasury yields, which likely weighed positively on the US Dollar in turn.

DXY INDEX – US DOLLAR PRICE CHART: DAILY TIME FRAME (12 FEB TO 12 AUG 2021)

Chart by @RichDvorakFX created using TradingView

The DXY Index remains stuck in a trading range between the 91.75-93.40 price levels, however, with the US Dollar awaiting a catalyst that can ignite a breakout (or breakdown). Looking to the DailyFX Economic Calendar we see high-impact event risk on deck posed by consumer sentiment data scheduled to cross market wires at 14:00 GMT. That said, there might be little reaction across USD price action to the upcoming consumer sentiment report release barring a material surprise.

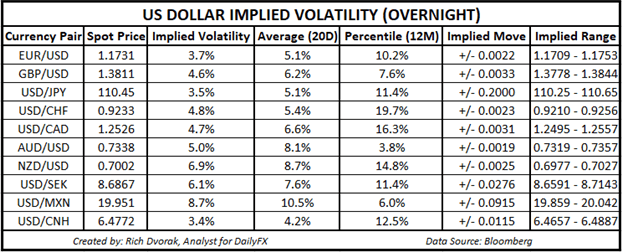

USD PRICE OUTLOOK – US DOLLAR IMPLIED VOLATILITY TRADING RANGES (OVERNIGHT)

Relatively muted overnight implied volatility readings for major currency pairs hints at this. Though consumer inflation expectations highlighted in the sentiment report might garner some attention, Fed taper rhetoric found in the FOMC minutes due next week is likely more pertinent for US Dollar outlook. As such, traders may want to keep close tabs on Treasury yields for a possible bellwether to where USD price action heads next given their generally strong positive relationship.

— Written by Rich Dvorak, Analyst for DailyFX.com

Connect with @RichDvorakFX on Twitter for real-time market insight

Be the first to comment