Canadian Dollar Talking Points

USD/CAD extends the series of lower highs and lows from earlier this week as the Federal Reserve refrains from quantitative tightening (QT), with the exchange rate on track to threaten the opening range for March following the failed attempts to test the 2021 high (1.2964).

USD/CAD Rate on Track to Threaten March Opening Range

USD/CAD quickly approaches the monthly low (1.2587) as the Federal Open Market Committee (FOMC) appears to be in no rush to winddown its balance sheet, and the advance from the yearly low (1.2450) may continue to unravel if the exchange rate fails to defend the opening range for March.

Even though USD/CAD rallied to a fresh yearly high (1.2901) earlier this month, the recent selloff keeps the exchange rate within the range from the fourth-quarter of 2021, and it seems as though swings in investor confidence will influence foreign exchange markets over the remainder of the month amid the recovery in global equity prices.

In turn, a further improvement in risk appetite may keep USD/CAD under pressure, but a further decline in the exchange rate may fuel the recent flip in retail sentiment like the behavior seen during the previous year.

The IG Client Sentiment report shows 65.85% of traders are currently net-long USD/CAD, with the ratio of traders long to short standing at 1.93 to 1.

The number of traders net-long is 8.62% higher than yesterday and 29.82% higher from last week, while the number of traders net-short is 1.60% lower than yesterday and 30.86% lower from last week. The jump in net-long interest has fueled the flip in retail sentiment as 57.28% of traders were net-long USD/CAD earlier this week, while the decline in net-short position comes as the exchange rate trades to a fresh weekly low (1.2613).

With that said, USD/CAD appears to be on track to test the monthly low (1.2587) as it extends the series of lower highs and lows from earlier this week, and the advance from the yearly low (1.2450) may continue to unravel if the exchange rate fails to defend the opening range for March.

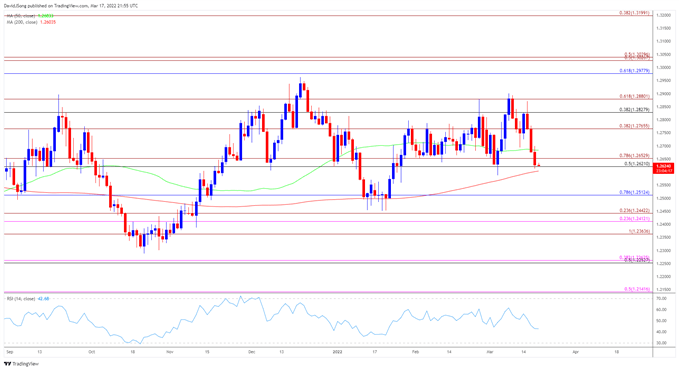

USD/CAD Rate Daily Chart

Source: Trading View

- USD/CAD appeared to be on track to test the test the 2021 high (1.2964) earlier this month as it climbed to fresh yearly high (1.2901), but lack of momentum to extend the series of higher highs and lows from the monthly low (1.2587) has pulled the exchange rate back towards the 1.2620 (50% retracement) to 1.2650 (78.6% expansion) region.

- USD/CAD may track the range from the fourth-quarter of 2021 if it fails to defend the opening range for March, with a move below the monthly low (1.2587) bringing the 1.2510 (78.6% retracement) back on the radar.

- A break of the yearly low (1.2450) opens up the Fibonacci overlap around 1.2410 (23.6% expansion) to 1.2440 (23.6% expansion), with the next area of interest coming in around 1.2360 (100% expansion).

— Written by David Song, Currency Strategist

Follow me on Twitter at @DavidJSong

Be the first to comment