Canadian Dollar Talking Points

USD/CAD consolidates ahead of Canada’s Employment report and the exchange rate may continue to face range bound conditions going into the Easter holiday as it fails to track the pennant formation carried over from the previous month.

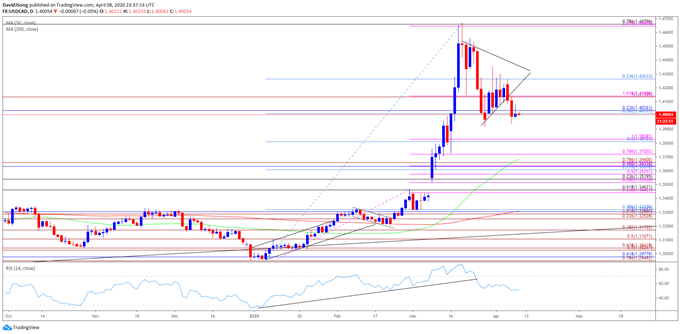

USD/CAD Negates Pennant Formation Ahead of Canada Employment Report

USD/CAD attempts to retrace the decline from earlier this week as the Bank of Canada’s (BoC) Business Outlook Survey reveals that “business sentiment had softened in most regions even before concerns around COVID‑19,” and the update to the employment report may produce headwinds for the Canadian Dollar as the economy is anticipated to shed 500K jobs in March.

At the same time, the Unemployment Rate is expected to increase to 7.5% from 5.6% in February, which would mark the highest reading since 2012, and the economic shock from the coronavirus may force the BoC to further support Canadian households and businesses as the “Governing Council stands ready to take further action as required to support the Canadian economy and its financial system and to keep inflation on target.”

It seems as though the BoC will rely on its unconventional tools to combat the weakening outlook for growth as the emergency rate cut in March “brings the policy rate to its effective lower bound,” and the central bank may look to expand its asset purchase programs over the coming months in order to “minimize any permanent damage to the structure of the economy.”

In turn, Governor Stephen Poloz and Co. may continue to endorse a dovish forward guidance at their next meeting on April 15, and the BoC may continue to push monetary policy into uncharted territory as the central bank carries out the Commercial Paper Purchase Program while acquiring Government of Canada securities in the secondary market.

With that said, it remains to be seen if Canada’s Employment report will alter the near-term outlook for USD/CAD amid the limited reaction to the US Non-Farm Payrolls report, and the exchange rate may continue to face range bound conditions over the coming days as it fails to track the pennant formation carried over from the previous month.

Recommended by David Song

Forex for Beginners

Sign up and join DailyFX Currency Strategist David Song LIVE for an opportunity to discuss potential trade setups.

USD/CAD Rate Daily Chart

Source: Trading View

- Keep in mind, the near-term rally in USD/CAD emerged following the failed attempt to break/close belowthe Fibonacci overlap around 1.2950 (78.6% expansion) to 1.2980 (61.8% retracement), with the yearly opening range highlighting a similar dynamic as the exchange rate failed to test the 2019 low (1.2952) during the first full week of January.

- The shift in USD/CAD behavior may persist in 2020 as the exchange rate breaks out of the range from the fourth quarter of 2019 and clears the October high (1.3383), but the Relative Strength Index (RSI) offers a mixed signal as the oscillator fails to retain the upward trend from earlier this year.

- As a result, USD/CAD may face range bound conditions as it snaps the pennant formation carried over from the previous month.

- However, the lack of momentum to hold above the 1.4010 (38.2% retracement) to 1.4040 (23.6% retracement) region may open up the Fibonacci overlap around 1.3810 (50% retracement) to 1.3830 (100% expansion), with the next area of interest coming in around 1.3720 (78.6% expansion).

Recommended by David Song

Traits of Successful Traders

— Written by David Song, Currency Strategist

Follow me on Twitter at @DavidJSong

Be the first to comment