Abstract Aerial Art/DigitalVision via Getty Images

Introduction

Most readers know that I put almost all of my money (currently 95%) of my net worth in long-term dividend growth investments. However, on the side, I also like to trade, as I can put my money where my mouth is when it comes to macro research and because some companies are just fantastic trading tools. My most recent article covering a great trading vehicle discussed the Terex Corporation (TEX). In this case, I’m staying in the industrial sector, yet I move over to the transportation industry.

I have never covered USA Truck, Inc. (NASDAQ:USAK), which is why this article is long overdue. USA Truck is one of America’s smallest truck companies with a very cyclical business and stock price. In this article, I will guide you through my thoughts and provide you with some insights and hopefully some food for thought.

So, without further ado, let’s get to it.

Trading The Cycle

I’ve been obsessed with the business cycle ever since I was told what it is in school. The basic transition from peak to trough is fascinating, as it moves the market and its many different sectors and industries in many different ways.

Corporate Finance Institute

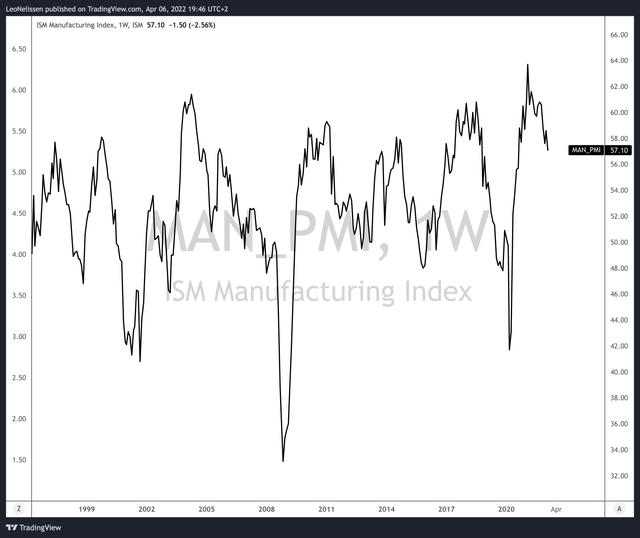

One of my favorite business cycle indicators is the ISM manufacturing index. This business survey is conducted every month and it basically asks purchasing managers to assess the state of their business. As you can see below, it’s very cyclical. A value of 50, in this case, is the neutral line between growth and contraction.

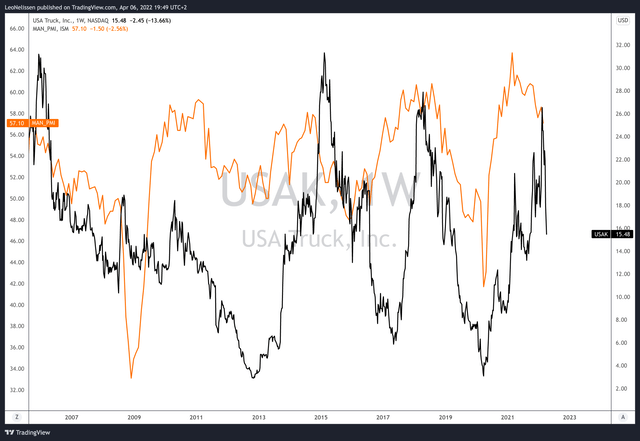

Now, below I’m showing both the USA Truck stock price and the ISM index. They are not moving in lockstep, but they sure are highly correlated. ISM upswings, generally speaking, come with significant USAK stock price upside. Unfortunately for long-term investors, it always happened after a devastating downtrend that crushed everything in its way.

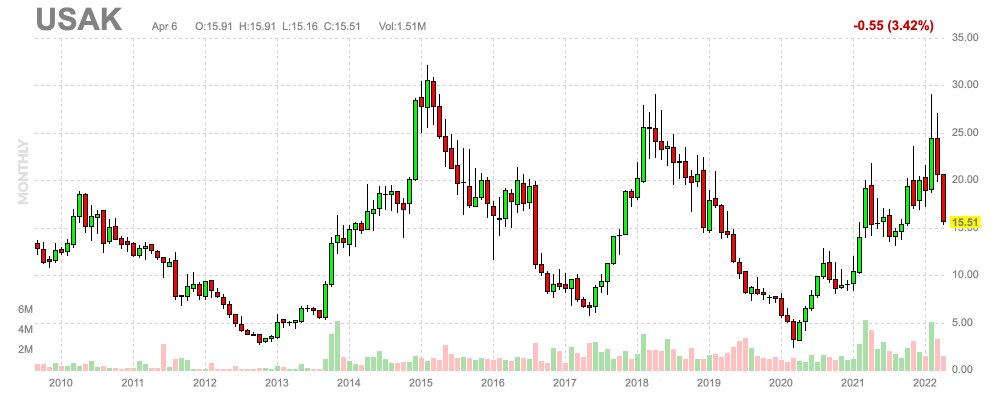

The most recent cycle was the downturn that started in 2014 and lasted until 2017. This was caused by a global manufacturing recession. The upswing that followed was boosted by America-first backed by President Trump. In 2018, USAK collapsed again due to a global growth peak. This was made worse by the pandemic in 2020. Then, the US saw a trucking shortage, which boosted USAK to prior highs again.

To me, as someone who isn’t interested in holding small trucking companies on a long-term basis, this is a perfect foundation for a short- to long-term trade.

Right now, the stock is falling again because of lower economic growth (the ISM index has peaked and is now declining), an inverted yield curve indicating that the Fed might break something as it will hike into economic weakness, the war in Ukraine, which is further boosting inflation, and ongoing economic shortages that disrupt supply chains.

Also, in the case of trucking companies, sky-high energy prices are making life difficult.

Trucking Difficulties

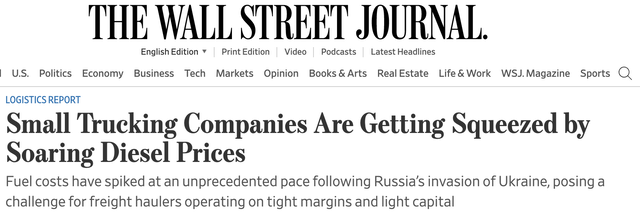

At the end of last month, The Wall Street Journal published an article which focused on the problems that come with sky-high energy prices.

One of the key problems highlighted in that article is fuel surcharges. These additional charges on top of transportation fees typically lag diesel prices by a week according to the article. This adds a new layer of risks:

Larger carriers generally have lines of credit and working capital that provide a financial cushion, so even if they are paid 30 or 45 days after they haul the loads, “whatever pain you incurred today, it’s made good on within a couple of months,” said Avery Vise, a trucking analyst at FTR Transportation Intelligence.

“But a smaller carrier, even if it’s getting surcharges, if it’s not getting that surcharge paid until a month or month-and-a-half down the road, they’re going to have to float that difference in the interim,” he said. “And that’s potentially problematic.”

Moreover:

Smaller operators are adjusting operations to save on fuel, taking steps such as limiting idling and cutting speed. Some are even turning away longer-haul loads to focus on shorter runs to keep their expenses down, industry executives said.

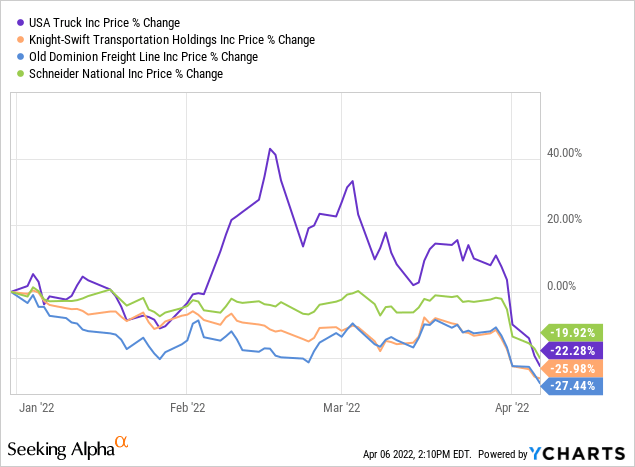

This year, the downtrend in transportation isn’t sparing anyone. I included a few bigger players in the chart below.

Now, let’s take a closer look at USA Truck.

USA Truck

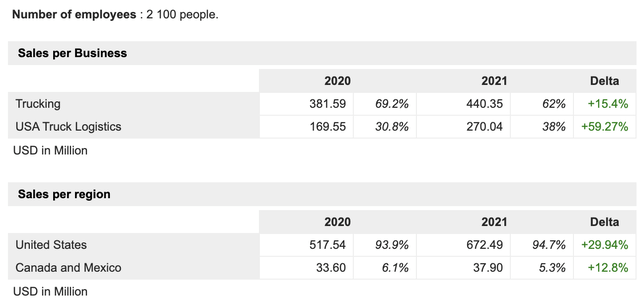

USA Truck is one of America’s smallest stock-listed trucking companies with a market cap of $137 million. Headquartered in Van Buren, Arkansas, the company is one of North America’s top 25 truckload carriers when measured by operating revenue. In other words, being a small public company in this industry does not make a company “small” by any means. Last year, the company did roughly $710 million in revenue with 2,157 tractors including 641 independent contractor tractors as well as 6,548 trailers.

The Company has two reportable segments:

- Trucking consists of the company’s truckload and dedicated freight service offerings, and

- USAT Logistics consists of the Company’s freight brokerage, logistics, and rail intermodal service offerings.

While the company does most of its business directly with customers, it also works via third-party providers. According to the company:

While the Company prefers direct relationships with customers, some high volume shippers require their carriers to conduct business with designated third party logistics providers. Obtaining shipments through these providers is a significant opportunity that allows the Company to provide services for high-volume shippers to which it might not otherwise have access. During 2021, one customer accounted for more than 10% of the Company’s consolidated operating revenues. The Company’s largest 10 customers together comprised approximately 47% of the Company’s consolidated operating revenue. Overall in 2021, the Company provided services to more than 600 customers.

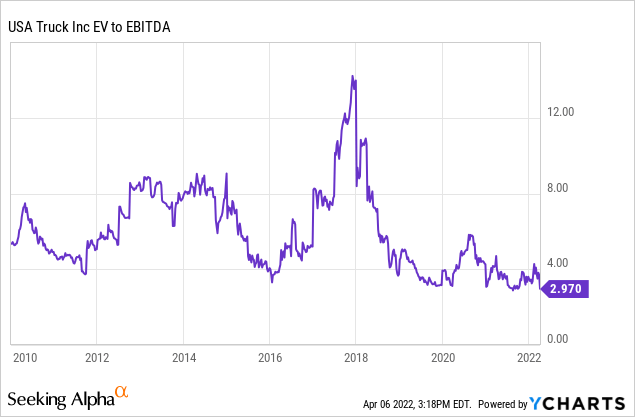

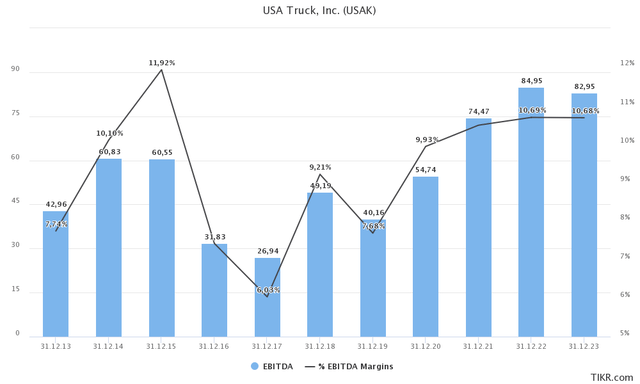

Needless to say, just like the economy, USAK’s financials are cyclical as well. During the economic lows in 2016, EBITDA fell to $32 million followed by a decline to $27 million in 2017.

In its 2021 year, the company reported $75 million in EBITDA, one of its best results ever.

One of the reasons why margins are improving is the company’s asset-light approach. The company is still named USA Truck, but its go-to-market name is now USAT Capacity Solutions. It includes a USAT Connect technology in innovative ways that won the company the CCJ Innovator of the Year award. It includes API pricing tools, which means that 21% of the company’s freight is now booked automatically.

According to the company,

roughly 64% of our company’s revenues are now derived from non-asset or asset-light businesses, where someone else provides the tractor in capital. That’s an important statistic that notably improves our financial and operational metrics. Our company now looks much differently than it once did. We are a solutions provider or said differently, a logistics provider that also has an available fleet of approximately 1,900 trucks. The benefits of becoming more asset-light are many.

The company expected 2022 to be stronger than 2021 due to “unrecognized opportunities.” I am using past tense for a reason (“expected”) because I’m eager to hear what the company has to say in its next earnings call. Right now, the market is saying “no way” to the company’s comments. After all, the stock is selling off along with some of the strongest transportation companies in the USA.

And that’s OK. Despite the company’s improvements, it remains highly dependent on trucking demand. If the economy continues to slow, growth expectations need to come down. And, as things are now, I don’t expect the company to do more than $80 million in EBITDA.

So, what about the company’s current valuation?

Valuation

The company has a $137 million market cap. In addition to that, the company has roughly $74.4 million in long-term debt. This consists of $38 million outstanding under its revolving credit agreement, $32.7 million in sale-leaseback finance obligations, and $3.6 million in insurance premium financing.

This gives us an enterprise value of $211.4 million. That’s 2.9x 2021 EBITDA of $74 million.

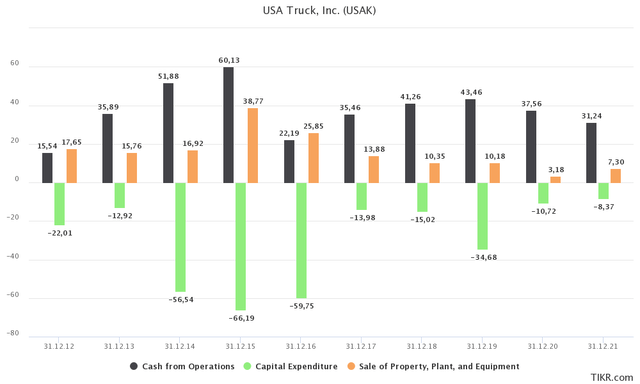

This is way too cheap for a number of reasons. First of all, I’m using 2021 EBITDA. If economic growth were to remain steady, the company could improve EBITDA by at least $5 million. Additionally, the company is generating positive free cash flow, which I did not even mention. In 2021, the company did $31 million in operating income. Capital expenditures were $8.4 million. The proceeds from the sale of property and related were $7.3 million. This means free cash flow was roughly $30 million.

The graph below shows that the company was able to balance capital expenditures and operating cash flow nicely every single year since 2012 – that’s how far this data goes back. This is extremely important because the company has no problems financing its operations and it always bounces back after economic downturns or recessions. If this were not the case, I would not use the company as a trading vehicle.

So, let’s summarize things.

Takeaway

USAK is a great “little” stock to use as a trading vehicle. While its market cap is just $137 million, the company is one of America’s largest trucking companies with an increasing focus on asset-light services.

EBITDA and margins have recovered nicely, and if economic growth were to remain stable, the company could improve both EBITDA and margins despite a rise in fuel.

However, investors and traders are dumping the stock, which is currently trading at what seems to be a very attractive valuation. The problem is that growth expectations are coming down. We’re once again in the early stages of a growth slowing cycle. Hence, USAK is selling off after almost touching $30 earlier this year.

FINVIZ

The good news is that even if we enter a recession, I do not expect USAK to suffer to an extent that will prevent the company from bouncing back like it did in prior cycles. The debt load is sustainable and free cash flow is high enough to lower net debt further before economic growth gets worse.

Personally, I hope that USAK drops to less than $8. This has happened during every downturn since the Great Financial Crisis. However, this time, the company is healthier and more “asset-light.” Hence, I advise investors to look for the $8-$10 area before buying.

The best thing to do is to put the USAK ticker on a watchlist. If economic growth continues to fall, we’ll have something to buy. If economic growth does not go down and USAK does not fall further, I’m going to ignore the company as I purely see it as a trading vehicle.

For now, I will maintain a neutral rating as I don’t want anyone buying or shorting the stock. Needless to say, I’ll update my thesis if new meaningful developments occur.

(Dis)agree? Let me know in the comments!

Be the first to comment