US Dollar Price, Chart, and Analysis

- US Treasury two-year yields touch a fresh 23-month high.

- US dollar sell-off begins to stall.

The interest rate-sensitive UST two-year is currently quoted around 0.935%, its highest level since February 2020, as bond markets continue to price in a round of 0.25% rate hikes in the US this year. The market currently expects a minimum of three 25 basis point hikes – and possibly four – along with the end of the current bond-buying program.

One of the consensus trades for 2022 was the long-US dollar trade on the back of this expected central bank tightening cycle. The US dollar basket (DXY) rallied from just below 90.00 around the start of H2 to just under 97.00 in mid-December as investor demand for the greenback continued unabated. This heavy, one-sided positioning left the US dollar vulnerable to any setbacks with market expectations seemingly getting ahead of reality. The recent sell-off in the US dollar is a reaction to these expectations already being fully priced into the market, leaving the greenback with little short-term upside potential.

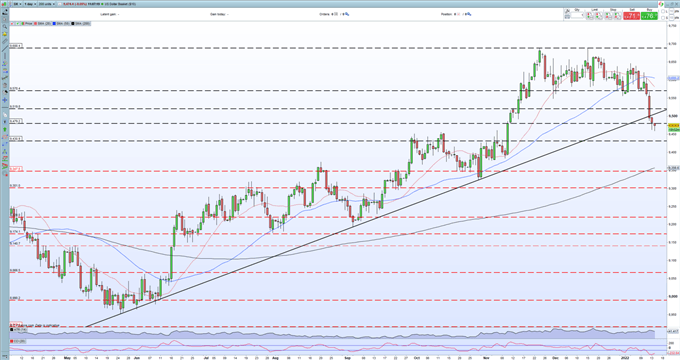

The US dollar basket is now flashing an extreme oversold signal after the sharp sell-off over the last few days. The CCI indicator is now at a multi-year low and this signal should provide the greenback with a supportive bid until it moves back into neutral territory. US dollar bears will point to the break and open below the supportive multi-month trend line and the recent downturn in both the 20- and 50-day simple moving averages, as ongoing negative signs and these should also be factored into any US dollar trading decision.

US Dollar (DXY)Daily Price Chart January 14, 2022

What is your view on the US Dollar – bullish or bearish?? You can let us know via the form at the end of this piece or you can contact the author via Twitter @nickcawley1.

Be the first to comment