caracterdesign/E+ via Getty Images

Introduction

It’s been just over a year since I wrote a bearish article on uranium royalty and streaming company Uranium Royalty Corp. (NASDAQ:UROY) (URC:CA) and a lot has changed since then.

The McArthur River uranium complex is restarting production, and uranium spot prices have soared more than 50% over the past 12 months. Yet, the share price of Uranium Royalty is currently below its June 2021 level. However, I think that the company continues to look overvalued based on fundamentals. Let’s review.

Overview Of The Business And Financials

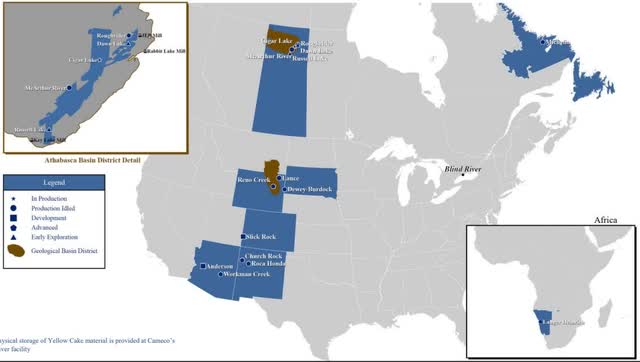

Uranium Royalty currently owns a portfolio of interest in 15 development, advanced, permitted, and past-producing uranium projects across Canada, the USA, Namibia, and Australia.

The company also holds 1,548,068 pounds of physical uranium and marketable securities, which were valued at about C$127 million ($98.3 million) as of June 9. Those marketable securities include 7 million shares in British firm Yellow Cake (OTCPK:YLLXF), which owns physical uranium and aims to provide direct exposure to uranium prices. Those shares have a market value of about $28.5 million as of the time of writing and were pledged as security for a $10 million margin loan Uranium Royalty had as of January 2022. Uranium Royalty also owns 8.6 million shares of Canadian resource-focused investment company Queen’s Road Capital Investment, which are currently valued at C$6.1 million ($4.7 million).

Turning our attention to the royalty portfolio, I think that the two most valuable assets in it at the moment are the interests in McArthur River and Cigar Lake uranium projects in Canada’s Athabasca Basin. They are the main projects of uranium major Cameco (NYSE:CCJ). In May 2021, Uranium Royalty paid $11.5 million for a 1% gross overriding royalty on a 9% share of production from McArthur River as well as a 20% net profits interest on 3.75% of production from Cigar Lake. Back then, I thought that Uranium Royalty was paying too much, but my view has now changed. You see, spot uranium prices have increased significantly over the past year and Cameco has decided to restart McArthur River.

Trading Economics

In 2022, McArthur River is forecast to produce up to 5 million pounds of uranium. This means that Uranium Royalty will receive a 1% royalty on up to 450,000 pounds of uranium production, which should be worth about $0.22 million. However, the sum should increase significantly over the next few years as Cameco wants to boost McArthur River’s output to 15 million pounds per year from 2024. Uranium Royalty’s royalty does not apply to the whole project, but it covers 100% of the reserves and resources. At the moment, McArthur River has reserves of 394 million pounds of uranium, meaning that Uranium Royalty can receive a royalty of 1% on about 35.5 million pounds of uranium. Undiscounted and at $50 per pound of uranium, Uranium Royalty could receive about $17.7 million in cash flow from this royalty.

Turning our attention to Cigar Lake, the calculations are a bit more complicated. The project is expected to produce about 15 million pounds of uranium in 2022, but Cameco wants to slash output to 13.5 million pounds per year starting in 2024, which should drive up unit costs. In Q1 2022, Cigar Lake produced 1.9 million pounds of uranium and the life of mine operating costs are expected to stand at around C$18 ($11.60) per pound. If we’re generous and assume that Cigar Lake’s net profit at $50 per pound of uranium stands at $15 per pound, Uranium Royalty could be making about $11.3 million per year from this royalty. However, the company still hasn’t received a single dollar as this is a profit-based interest that will begin to generate revenue after cumulative expense accounts, including development costs, are exhausted. It’s unclear when this will happen. On top of that, the net profits interest drops to 10% on 3.75% of production once Cigar Lake’s total production surpasses 200 million pounds of uranium.

Overall, I think that Uranium Royalty’s royalties on McArthur River and Cigar Lake might be worth maybe somewhere around $30 million today. Regarding the interests in the other 13 uranium projects, I think that there is little value to be found there, as none of the properties seems close to the production stage.

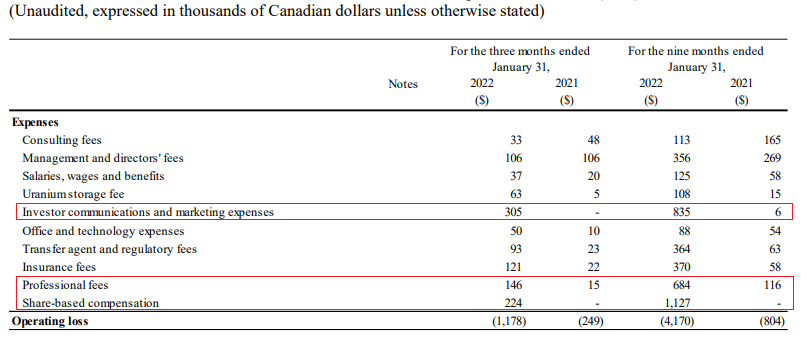

So, Uranium Royalty has a market valuation of $250.1 million as of the time of writing. It has $98.3 million in physical uranium and securities, and cash should be about C$8 million ($6.2 million) at the moment. Add about $30 million for the interests in McArthur River and Cigar Lake and subtract the $10 million loan, and we get a valuation of $124.5 million. However, we also have to take into account that costs have soared over the past few quarters as Uranium Royalty has ramped up its marketing and staff compensation expenses. The company’s operating loss for the nine months ended January 2022 stood at C$4.2 million ($3.2 million), which is an increase of over 600% year-on-year.

Uranium Royalty

That being said, I think that short selling Uranium Royalty stock could be dangerous, as uranium prices are notoriously volatile.

Investor Takeaway

The fundamentals of Uranium Royalty’s business look much stronger compared to a year ago, but I think that they still can’t justify the company’s $250 million market valuation. In my view, its business should be worth maybe half of that amount. On top of that, Uranium Royalty’s operating losses are currently about $1 million per quarter.

However, short selling stocks in the commodities sector is usually dangerous, and I think that risk-averse investors should simply avoid Uranium Royalty for now.

Be the first to comment