martin-dm

While investors sold off Upstart (NASDAQ:UPST) since the start of the year, I continue to like the company for its solid business model and strategy, with significant growth potential still to come. Although the current weakness in the macroeconomic environment and risk-off sentiment in the markets has resulted in challenges faced by the Upstart management, I like that management has been forthcoming about their current situation and their continued efforts to improve their strategy for the current environment. I think that the recovery in Upstart will be fierce and rapid once sentiment around the company changes as the market sees improvement in the investment case for Upstart.

Investment thesis

I have written earlier articles on Upstart to talk about the company’s business models as well as my analysis and opinions on the challenges faced by the company. I reiterate my investment thesis for Upstart and continue to believe that the tide will change for the company in the next 1 year.

- Upstart’s superior artificial intelligence model brings a strong competitive advantage to the company as it brings to its customers and banking partners a strong value proposition. As the model is continuously improved and finetuned, I have also shared that this model and thus the competitive advantage continues to improve in accuracy with time.

- As explained in my previous article, I continue to think that the tactical use of the balance sheet for its loans as a way to adapt to the changing business environment is something that I view as necessary and acceptable. The management has reiterated on countless occasions that the company does not intend to be a bank and that it remains a capital light business model where Upstart acts as an intermediary between consumers and its banking partners.

- In the difficult business environment in which Upstart operates in as well as a weaker credit and loans market, Upstart will continue to see growth in its business due to an expansion in its total addressable market (TAM) into the huge auto loan origination market, bringing about a large market opportunity.

- With improving economies of scale and increasing use of automation, I continue to see Upstart can grow profitability as its margins and unit economics improve over time as its businesses mature.

Improving its funding model

As the main near-term constraint for the Upstart business remains to be a constraint in funding, management has taken steps to transition the funding model to one that involves more committed capital. This committed capital funding model was first mentioned in its previous 2Q22 earnings call.

For investors who may be unfamiliar with the Upstart funding model, as I have elaborated in my previous article, the company has no intention to act as a bank and in its early months as a public company, management did not envision using its balance sheet for funding. However, in 2022, the funding in the market dried up as risk appetite decreased and investors had lower demand for unsecured personal loans, but at the same time, there is somewhat of an information asymmetry as Upstart knows that there are huge outsized profits that can be earned on the platform now even as funding has disappeared. As a result, to benefit from this information asymmetry as well as stabilize the business, Upstart management thought that in this case, it made sense to use its own balance sheet as a transition funding source until funding re-emerged.

However, the market brutally punished Upstart for the change in stance given the huge selloff since then. As a result, management has looked for new methods to ensure that funding remains more consistent in volatile market conditions. One such suggested was as mentioned above, to use a committed funding model. This will be an upgrade and improve the current funding of its marketplace as it means that it will be bringing a different profile of committed capital from partners that are likely to be more consistent in investing in the entire cycle.

As a result, Upstart reiterates that it has no intentions to be a bank and thus will be looking to use this more committed capital funding model to bring in the necessary partners. This will involve longer-term investors, in my view, like sovereign funds and pension funds. As a result of the shift in the profile of the investors from shorter-term investors to longer-term investors, I think we will see that the funding model will also be more balanced as longer-term investors are more likely to be taking up the excess demand in unsecured personal loans when the liquidity in the market dries up.

While I think that this initiative will likely take somewhere from 12 months to 18 months, eventually, we will see the company have about double-digit level of committed capital that will act to supplement this existing funding model.

The auto opportunity

I remain optimistic about the opportunity that Upstart has in the auto market. This will be an excellent cross-sell opportunity for the company given the strong focus on unsecured personal loans initially. As of the last quarter, there are already more than 600 dealerships that use Upstart’s Auto Retail software. Large automakers like Volkswagen (OTCPK:VWAGY) and Subaru (OTCPK:FUJHY) recently showed support from Upstart Auto Retail, on top of many other top global brands around the world. Also, last quarter, Upstart had the first $10 million in retail loan originations, a new milestone for the company, and also expanding the auto retail lending product to almost 30 dealerships.

I expect that Upstart will leverage on its playbook for unsecured personal loans to increase the success of the ramp up of the auto business. The company will likely increase automation in the process in the near-term and finetune their machine learning models to improve the entire auto loans process.

While auto refinancing is currently the largest auto product, it only takes up 3% of the total loans in 2Q22. I take the view that auto can be Upstart’s largest business in the longer-term, as the company is able to leverage on the Auto Retail software as a solid go-to-market strategy.

Artificial intelligence powered model brings strong competitive advantages

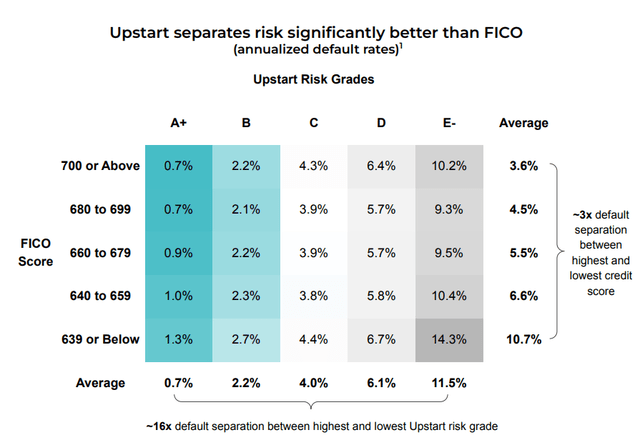

Even as the stock continues to sell off, the fundamentals of the company remain intact as the Upstart models are still yielding better results than traditional methods of measuring credit scores. As a result of a different method and use of technology, Upstart is better able to segment and separate risk than the traditional FICO, allowing Upstart to service under-served customers that are actually creditworthy but deemed risky due to old, traditional FICO scores.

Upstart separates risk better than FICO (Upstart IR)

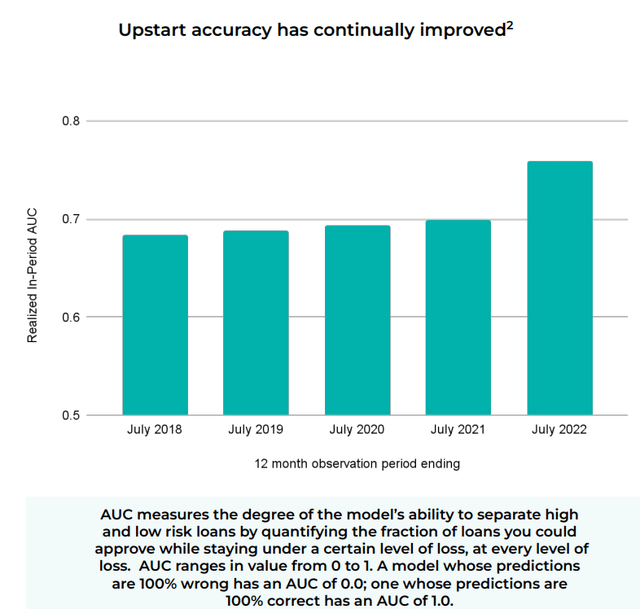

In addition, apart from having a stronger separation of risk, Upstart has also seen increasing accuracy. As a result of the focus on improving accuracy, this will result in more accurate decisions in terms of providing loans to customers that have a lower likelihood of default based on their models.

Upstart continues to improve accuracy (Upstart IR)

Improving margins through pricing

As a result of the higher interest rate environment that we see today as well as uncertain macroeconomic environment that increases the perceived market risk, this has led to Upstart having an increased ability to protect its margins. Upstart has increased its take-rates to banks and its borrowers and the overall take-rate for Upstart has improved in the quarter. This will likely move in-line with the rates situation as I would also expect that the take-rates should come down as rates are lowered.

Valuation

To value Upstart, I will use a DCF model based on my own financial forecasts for the company as well as some valuation assumptions. As a result of accounting for the weaker macroeconomic environment, lower guidance for the year as well as considering the funding constraint in my previous DCF model, the DCF model from my previous article still holds given that this was a recent article. In my assumptions, I did increase my WACC assumption for Upstart to 15% and lowered my estimates for 2022 and 2023 in my previous DCF model, which in my view has already accounted for the challenges that Upstart is facing as mentioned above.

As a result, my 1-year price target for Upstart is $45.30, implying 95% upside potential from current levels. In the near-term, funding constraint is the main driver of the stock price and if there is any news or signs that the constraint in funding is improving either from the improving market conditions or from successfully attracting new long-term committed capital, this will drive huge upside for the company. In the long-term, I continue to have confidence in the company as the company continues to value add in the financial industry though the use of its artificial intelligence model and using its technological expertise to expand into different credit segments. Over time, I am confident that Upstart will be attractive to investors as it continues to demonstrate an attractive growth profile and solid competitive advantages.

Risks

Weakening macroeconomic environment

As Upstart is in a cyclical industry that is affected by the rising and falling demand for credit, the weakening global macroeconomic environment brings increasing risks to Upstart. If there were to be a deep recession scenario and consumer sentiment were to be reduced drastically, this would also imply a weaker demand for loans and credit and as a result, Upstart will see a slower growth profile as loan volume growth slows down. As a result, investors need to be clear that just like others in the industry, Upstart will also be vulnerable to the credit cycle.

Competitive pressures

While Upstart’s competitive advantage has been its technology, there is a risk that its competitors or other banks might spend large amounts of resources to develop a model that could compete with that of Upstart’s technology. As a result, it is important for Upstart to constantly innovate and improve its technology to ensure that it remains ahead of the competition and that its models can bring about results and outcomes that are beneficial to both consumers and bank partners, and bring additional value add to continue to remain ahead of the competition.

Concentration risk

While the company is expanding into the auto segment, a significant portion of the business remains to be in the unsecured personal loans segment, which brings about a large concentration in the segment. There is a need to ramp up the auto segment to ensure that there are other diversifying sources within the business to reduce this concentration risk. In the long-term, I continue to see multiple segments that Upstart can expand into to diversify its revenues.

Execution risk

As Upstart continues to finetune its operations and models for the unsecured personal loans segment, it also needs to ensure that they are executing well in the auto loans and other new segments as well. It is important that management knows that although a similar playbook can be employed, these are ultimately different lines of business that may require different strategies for success.

Conclusion

While Upstart faces challenges right now, the key stock driver and constraint in the business remains to be funding. When funding improves, either through improving market conditions or success in bringing in long-term committed capital, the stock will have a fierce and rapid recovery given the strong fundamentals and growth profile of the company.

Upstart continues to finetune its funding model by bringing in longer-term committed capital to complement its existing funding model to ensure that future funding will be more stable across cycles. At the same time, Upstart’s artificial intelligence model continues to bring value add to its customers and bank partners for its existing unsecured personal loans segments, and the new auto segment. My 1-year price target for Upstart is $45.30, implying 95% upside potential from current levels.

Be the first to comment