CreativaImages

Thesis

Upstart Holdings, Inc.’s (NASDAQ:UPST) meteoric rise in 2021 was sent spiraling from its unsustainable October 2021 highs before grinding to a halt in June 2022. UPST has also been consolidating along its August lows over the past two months. While we continue to observe downside volatility (and UPST is a highly volatile stock), we also gleaned that it has been forming a constructive base.

Accordingly, we assess its selling pressure seems to be getting increasingly exhausted, helping the stock to continue consolidating. Notwithstanding, UPST continues to trade at a premium against its industry, suggesting that the market expects Upstart to return to its high growth momentum.

Our analysis suggests that UPST’s malaise could continue in the near term as the funding environment remains precarious. Moreover, coupled with a lower-income customer base more susceptible to the recessionary headwinds, Upstart’s headwinds could intensify.

However, we gleaned that its earnings estimates have likely reflected its challenges, as Street analysts have also turned bearish (from being bullish in November 2021)

Therefore, we assess that it forebodes well for UPST to regain the market’s confidence if the company can execute well through the cycle. However, we believe that remains the most critical risk in our thesis because management’s execution has been subpar in 2022. Hence, investors are urged to consider any exposure in UPST as speculative.

Accordingly, we reiterate our Speculative Buy rating on UPST but cut our medium-term price target (PT) to $35 (implying a potential upside of 42%).

Q3 Could Be The Bottom For Upstart’s Profitability

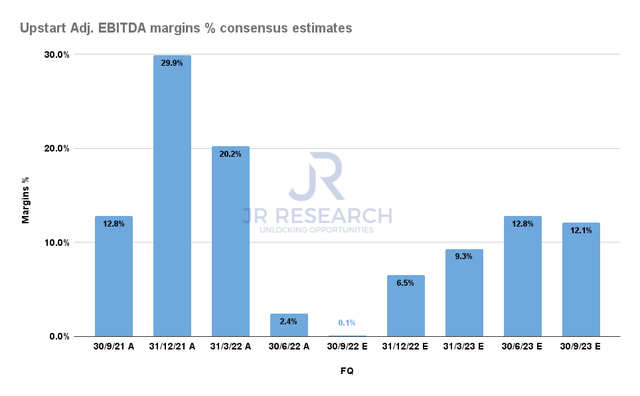

Upstart Adjusted EBITDA margins % consensus estimates (S&P Cap IQ)

Upstart is scheduled to report its Q3 earnings results on November 8. Investors should temper their expectations as Upstart is projected to report nearly 0% adjusted EBITDA margins for the quarter.

Notwithstanding, even the bearish Street analysts project that its profitability should improve from Q4. Upstart’s earnings visibility has been hampered by the lack of committed funding in its pipeline, as institutional investors pulled back given the rapid interest rate hikes and worsening macro headwinds.

Therefore, investors should expect revisions to guidance if the funding situation does not improve, even though Upstart has been deploying its balance sheet.

Notwithstanding, management remains upbeat that it can execute well through the cycle, as CEO David Girouard accentuated:

I think we feel very good that we’re going to be on the other side of this economic period, and we’ll be in a very fast growth mode as we’ve been over our long history. So for me, in the long history of the company and where we’re going, I feel like 2022 is certainly a speed bump. But in the long run, we’re a business that has generated cash since we’ve been public, and very, very optimistic about where we’re going. And as I said in the long run, we’ll view [2022] as a speed bump and nothing more. (Goldman Sachs Communacopia + Technology Conference)

We think there are reasons to believe that Upstart’s near-term challenges should improve through 2023. The Fed’s rate hikes could reach their terminal rate by December or early 2023. Of course, much depends on how the CPI print falls into place, and we should get a good sensing of the Fed’s intentions at the upcoming FOMC meeting in early November (in time for Upstart’s Q3 earnings release).

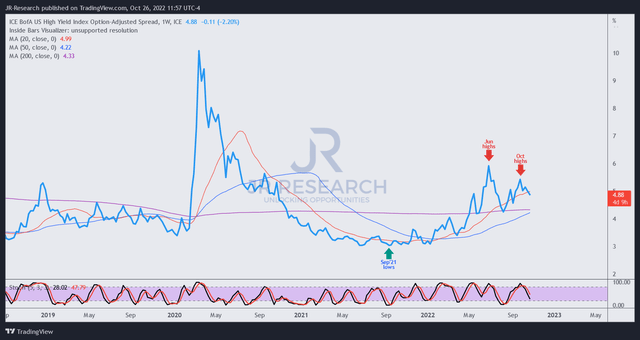

BofA High yield index option-adjusted spread % (TradingView)

Furthermore, the high yield spread has also been making lower highs from its June highs. Therefore, we believe the financial conditions have not deteriorated to the extent that would cause massive destruction in Upstart’s business model.

Management sees the recent challenges in funding as short-term, and they should improve as credit conditions and financial conditions loosen. Therefore, we believe the market is attempting to price in a Fed pause/pivot from December 2022, which could be beneficial for Upstart’s recovery, introducing more certainty to investors’ models to assess risk/reward. Otherwise, investors would likely continue to err on the side of caution, as that’s what the market does.

Is UPST Stock A Buy, Sell, Or Hold?

Make no mistake about it, UPST last traded at an NTM P/E of 37x, well above the S&P 500’s 15x. It’s also well above its consumer finance industry peers’ average of 7.8x. However, it has also demonstrated rapid growth. As such, the market’s positioning suggests that Upstart needs to execute its growth thesis well to deserve its premium tagging. Otherwise, investors cannot rule out further value compression.

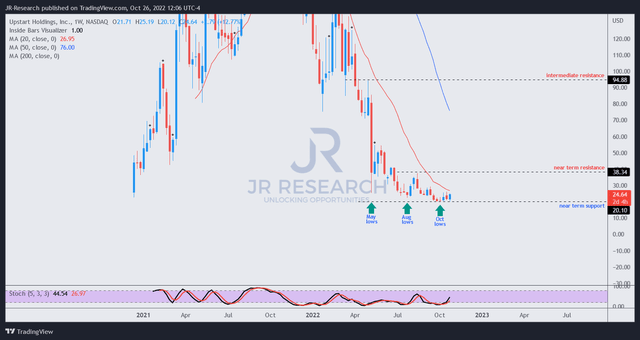

UPST price chart (weekly) (TradingView)

UPST has been trying to form a base against its August lows. However, a further selloff in October broke below those lows but remains well-supported.

While the basing action is constructive, UPST’s price action is getting increasingly weaker if it continues to break into lower lows. Therefore, we wouldn’t consider UPST a highly compelling case for investors considering a core portfolio add from the price action perspective.

Notwithstanding, we assess that a speculative opportunity is still possible for investors with the ability to tolerate downside volatility and know how to execute robust risk management strategies.

As such, we reiterate our Speculative Buy rating on UPST.

Be the first to comment