teekid/E+ via Getty Images

Shares of Upstart Holdings, Inc. (NASDAQ:UPST) are down 80% over the last year and investors are wondering if this is a good time to buy. While bulls argue that the stock is undervalued and oversold at current levels, bears believe the company’s growth story is fundamentally flawed which will keep its shares subdued. Amidst this tug of war between forum commenters, institutional investors seem to have picked sides already. A broad swath of these entities reduced their positions in Upstart Holdings during the last 13F filings cycle, which should encourage the company’s investors to rethink their thesis.

The Institutional Selloff

Let me start by saying that institutional investors don’t always get it right. However, they generally have access to certain tools and resources – such as large analyst teams, access to company managements, supply chain connections, industry reports – that give them an edge over retail investors. So, while blindly mimicking the trading activity of institutional investors may not be a good idea, but heeding to what they’re doing in large numbers can sometimes provide us with leading insights about where a company and its shares might head next. So, I personally monitor institutional trading activity to gauge the Street’s ever-evolving perception about any given stock.

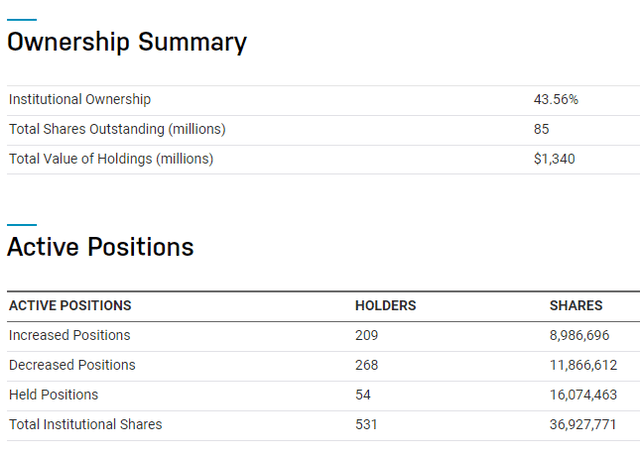

As far as Upstart is concerned, institutional investors collectively sold off approximately 2.88 million shares during the last 13F filings cycle on a net basis. This figure may not mean much in isolation but it actually represents a notable 3.66% of Upstart’s total shares outstanding. For the record, the last 13F filings cycle spanned from April through June, and the data was fully released only this week, on Monday. This means the data is still fresh and relevant for our discussion here.

There’s another takeaway from this data release. Note how the number of institutions that sold their positions in Upstart Holdings, significantly outnumbered those that bought positions in the company. This means that the institutional selloff in Upstart wasn’t driven by a few entities or concentrated across a handful of firms, but was rather widespread across this entire class of investors.

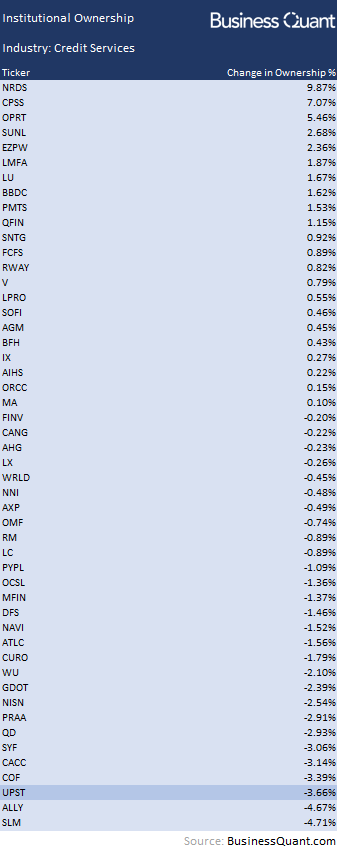

Next, I wanted to determine if this institutional selloff was prevalent across the entire credit services industry, or if it was prominent in Upstart Holdings. So, I pulled the institutional trading activity for 60 stocks that are classified in the credit services industry. As it turns out, there wasn’t an overarching trade direction for these investors. They increased holdings in 22 companies and trimmed exposure in 28 names, indicating they were more or less neutral on the industry.

BusinessQuant.com

But what particularly catches the attention is the fact that Upstart Holdings saw one of the sharpest institutional selloffs in the last quarter. This goes to indicate that this class of investors, although stayed neutral on the industry, grew particularly bearish on Upstart Holdings.

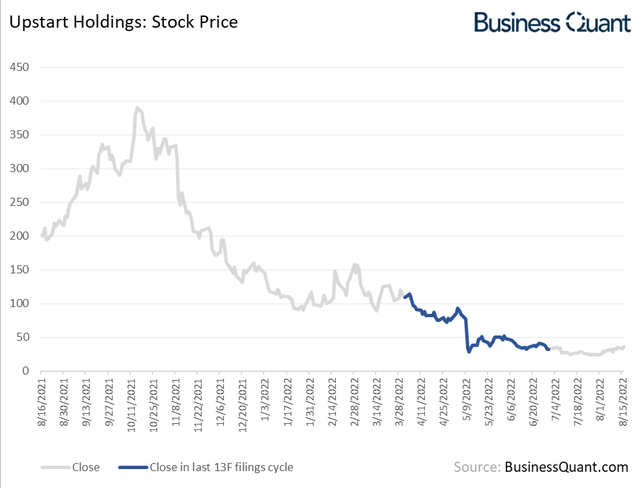

It’s important to note here that these institutions continued to sell their holdings in Upstart, as its shares continued to plummet to 52-week lows. This suggests that these entities perceive Upstart’s shares to be overvalued and, perhaps, also anticipate its value to decline further in the near future. But this brings us to an important question – why are institutional investors growing bearish on Upstart Holdings of late?

Reasons for Caution

It’s important to understand that Upstart is largely a low-cost AI-based credit ratings provider. It saves time and costs for banks that issue loans. The banks, then, pass on a part of these cost savings to end-customers in the form of lucrative interest rates. Upstart, on the other hand, earns a fee largely by connecting buyers and lenders on its platform.

But there’s a problem here.

See, as the Fed continues to hike interest rates and the recession deepens, there’s bound to be a rise in delinquencies and default rates. We don’t know how well will Upstart’s artificial intelligence model perform in the coming months. The company itself disclosed in its 10Q filing that its model is trained on data from recent years, when the economy was growing overall. So, the future of Upstart’s credit scoring model, which is its breadwinner, is uncertain.

While our AI models have been refined and updated to account for the COVID-19 pandemic, the bulk of the data gathered and the development of our AI models have largely occurred during a period of sustained economic growth, and our AI models have not been extensively tested during a down-cycle economy or recession and have not been tested at all during a down-cycle economy or recession without significant levels of government assistance.

What exacerbates the problem is that Upstart-powered loans are unsecured in nature. This means the borrowers who’re unable to make ends meet, would prefer to default on Upstart-powered unsecured loans, rather than defaulting on other loans that are secured against some form of collateral. While a material rise in default rates won’t directly bankrupt Upstart, it’s going to ding the financials of the company’s partner banks that actually fund those loans. At this point, partner banks are going to cutback on funding unsecured loans in hordes and Upstart’s revenue is likely to decline considerably.

I had warned investors about these very dynamics in a prior article published in May, but was chided for it. While some investors felt the stock was already at its bottom, others felt the concerns were exaggerated. As it turns out, the stock has dropped nearly 70% since then and it can still fall further. (Read – Upstart: New Concerns Emerge)

Upstart’s management confirmed my suspicion in its latest earnings call. They noted that some of its partner banks are “…moving to limit their overall exposure to unsecured lending.” They also guided Q3 revenue to amount to $170 million, which would mark a year-on-year decline of 19%, and withdrew their yearly guidance. I contend that more partner banks will join the bandwagon and reduce their exposure to unsecured lending for the time being at least, and Upstart’s revenue consequently will decline further.

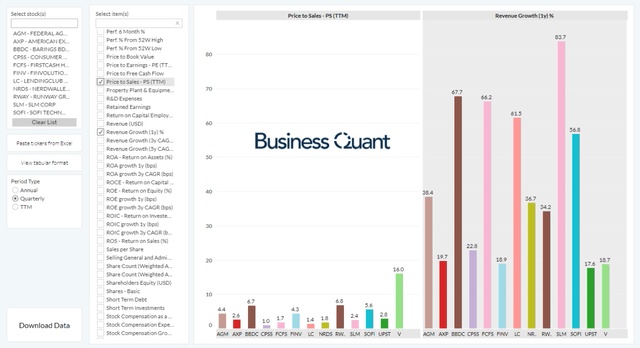

Lastly, Upstart’s shares are currently trading at 2.8-times their trailing twelve-month sales. This seems too steep when considering that the company is faced with the prospect of business deterioration and revenue declines. Besides, many of the other credit services companies that are growing revenue at a rapid rate, are trading at lower Price-to-Sales (or P/S) multiples. This suggests that Upstart’s shares are overvalued at their current levels.

Final Thoughts

As a reminder, institutional trading activity just highlights the trades that have already taken place in the past and aren’t necessarily indicative of future price action. But having said that, the fact that a broad swath of institutional investors grew bearish on Upstart in the last quarter, should encourage readers and investors to rethink their investment rationale in the name. These entities wouldn’t have sold their positions in the company if they perceived its shares to be undervalued or in the process of bottoming out.

Although Upstart’s AI-based credit scoring model serves a practical need for lenders, the company’s growth prospects are mired with uncertainty for the time being at least, which is likely to keep its bloated stock price subdued in the near future. Good Luck!

Be the first to comment