primeimages/iStock via Getty Images

Investment Thesis

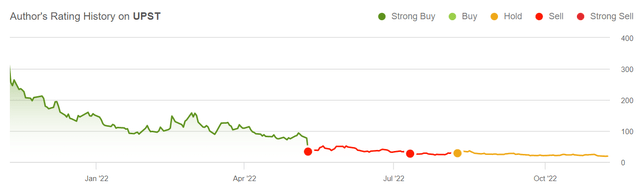

Upstart (NASDAQ:UPST) has been a total disaster for a while now. I was wrong to have been so bullish in 2021. I was also wrong to have turned less bearish on it in the summer.

I can’t do anything about the past. Looking back is easy. Now, as I look ahead, I can’t find an easy way for shareholders to see a path back up.

All that being said, with Upstart now priced at an all-time low, I believe that it’s safe to assume that there’s a lot of pessimism now priced in. So let’s go through these results together and discuss the positives and negatives facing Upstart.

What’s Happening Right Now?

Upstart’s ability to securitize their loans and get them off their balance sheet is proving troublesome. Accordingly, complicating the business model is that a significant proportion of Upstart’s loans are unsecured.

Hence, even as Upstart describes its business as having ”no credit risk”, I believe that this is semantics, as we’ll soon discuss.

The other consideration appears to be that Upstart’s AI model of picking up only the highest prime customers, with the highest scores, could now be coming up against limitations in this macro environment. To illustrate, conversion on rate requests was 10% in Q3 2022, down from 23% in the same quarter of the prior year.

Next, let’s dig into the quarter.

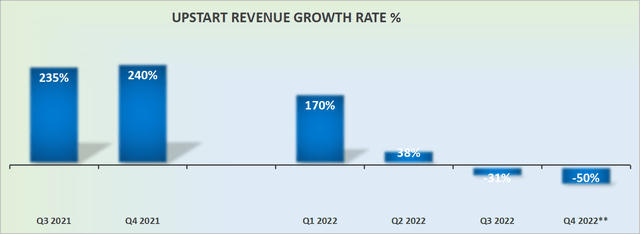

Revenue Growth Rates Turn Very Negative

The graph above speaks for itself. There’s a massive deceleration in Upstart’s revenue growth rates. As we look out to Q4, revenues are going to be approximately negative 50% y/y.

And as we look ahead to early 2023, the comparisons are going to be very challenging too.

This means that investors will have to become accustomed to Upstart posting negative y/y revenue growth rates.

Profitability Profile Turns Negative

Upstart ended Q3 2022 with a negative 36% GAAP net income margin. This translated into a negative 9% non-GAAP adjusted EBITDA margin.

However, as we look ahead into Q4, Upstart’s EBITDA margin is expected to reach negative 24%. This means that on a GAAP net income margin, we should expect somewhere in the ballpark of negative 40% to negative 50%.

Put simply, Upstart is going to be bleeding cash on a go-forward basis.

A positive insight is that Upstart ended Q4 2022 with 98.8 million shares outstanding. However, as we look ahead to Q4 2023, Upstart expects to end with 89.3 million shares outstanding, a reduction of 9.6% shares y/y, as Upstart repurchased some of its shares.

But I don’t believe bringing down its total share count is what is going to save this investment.

UPST Stock Valuation – Difficult to Value

How do you even start to value a business that’s bleeding cash flows, with rapidly raising debt?

As a reminder, this is how Upstart’s business model works:

After origination, Upstart-powered loans are either retained by bank partners, purchased by the Company for immediate resale to institutional investors under loan sale agreements, or purchased and held by the Company.

In good times, Upstart is able to perform its function of facilitating loan origination on behalf of its banking partners, and the loan rolls off.

Yet, when macro conditions worsen, the banks don’t want to retain hold of those loans, and Upstart increasingly retains those loans.

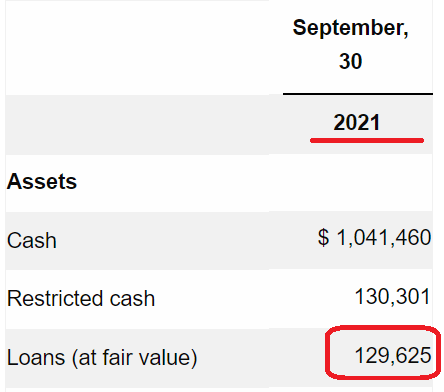

This time last year, Upstart’s loans on its balance sheet can be seen below:

UPST Q3 2021

You can see that Upstart held just over $1 billion of cash and $130 million in loans.

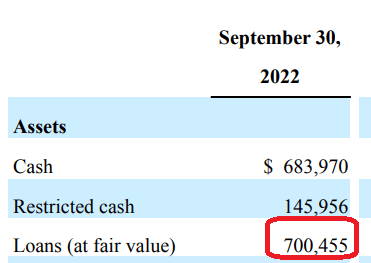

While for Q3 2022, Upstart’s balance sheet can be seen below:

UPST Q3 2022

Cash is now less than $700 million, while its loans have increased by more than $500 million.

Now that we have discussed the first part of Upstart’s problem, we’ll discuss the second part.

That Upstart is somewhat restricted in its ability to collect on its loans if the borrower defaults.

The vast majority of Upstart-powered loans are not secured by any collateral, guaranteed […] As a result, we are limited in our ability to collect on such loans on behalf of our bank partners and investors of our loan funding programs if a borrower is unwilling or unable to repay them.

The Bottom Line

As I look through these results, there’s really no glimmer of hope left for Upstart. That being said, now that I’m a little more experienced, having been through a few investment cycles, I’ve learned a key lesson.

You could have either exited your position back in May as I suggested when the stock was at $33. Or now, you sit tight and wait a few years for the waters to calm down and hope to see Upstart back at $33.

Even if one has to wait 5 years for Upstart to retrace its march higher, that would still be around a 14% CAGR from this point. And in this market, I honestly believe that 14% CAGR isn’t anything to curl one’s lip at. Whatever happens, good luck.

Be the first to comment