J. Michael Jones

Thesis

Ameriprise’s (NYSE:AMP) shares have fallen by 18% since the January high, creating an investing opportunity in this hard-to-understand name, with one very good underlying business.

Trading at lower levels is nothing new for Ameriprise. The stock has been trading at an average of eleven times earnings since 2012. This is despite the stock price increasing by five times over this period. The company keeps performing, but Wall Street keeps undervaluing this surprisingly good business.

I believe Ameriprise’s low valuation is a result of investors primarily focusing on the annuity business and mutual fund businesses. However, Ameriprise has pivoted away from the annuity and insurance business over the last few years. Most earnings are now coming from the wealth management segment. This business is now the predominant earnings driver, delivering good returns on capital and has a positive outlook as more retirees need help with managing their investments.

Company Overview

Ameriprise Financial primarily offers financial planning, asset management, and insurance products to primarily middle-income families and individuals. The company has about 8,000 franchise advisors and 2,000 employee advisors.

The company was founded in 1894, bought by AMEX in 1983 and then spun off in 2005. The company bought Columbia Threadneedle in 2009. The company has three segments: Advice & Wealth Management (WM), Asset Management (AM) and Retirement and Protections Solutions (RPS)

Ameriprise had $1.4 trillion in owned, managed, and administrative assets at 12/31/21. Vanguard Group is the largest shareholder with 12.1% of the shares followed by BlackRock with 7.6%, per the 3/22 proxy. The chairman and CEO is James Cracchiolo and the company is headquartered in Minneapolis, Minnesota.

Advice & Wealth Management

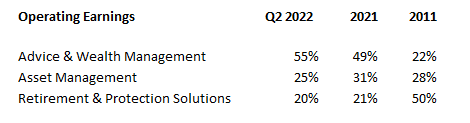

This segment earned revenues of $8 billion on $823 billion of total client assets at the end of 2021. The segment accounted for 55% of the Q2 2022 operating income.

Ameriprise targets the middle-income individuals and families, or the “mass affluent” as they call it. The group is estimated to have over half of U.S. investable assets. Customers include baby boomers going into retirement as well as Gen X and Millennials planning for retirement. The company defines the mass affluent as households with more than $100,000 of assets, but they are moving more and more to those households with $500,000 to $5 million in assets. In my view this is an underserved market with less competition than the high-net-worth space.

Advisors sell a number of products that include financial planning, financials advice, mutual funds, insurance, and annuities. Most advisors (79%) operate their own franchises. Payout rates could be up to 91% of the fees they bring in. However, these advisors do not get any company benefits such as health insurance or office space. Company-employed advisors make up 18% of the advisory workforce. These employees get office space and employee benefits such as health insurance, but payout rates are lower, reaching up to 57% per the company website. I believe Ameriprise’s high level of franchise employees allows it to earn higher return on capital than peers. It is also attractive to advisors looking to move over from competitors where payout rates are generally lower under employee models.

Clients are charged a percentage of assets under management. They negotiate a rate with an advisor when they first sign up. To determine a client’s rate, the advisor will consider factors like the size of your portfolio, clients desired investing strategy and level of service needed.

Although some have questioned the high fees that Ameriprise offers, I believe they serve a real economic need. Advisors help the clients make decisions against their various goals and help them adjust their accounts whilst considering income changes, tax, and help them manage volatility through cycles.

Unit Economics (Advice & Wealth Management)

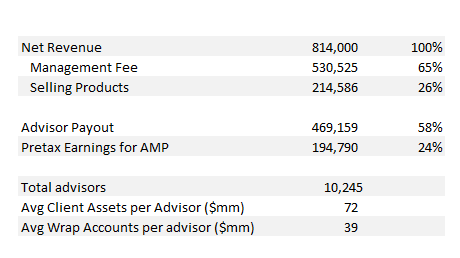

To better understand the business model of an advisor at Ameriprise, I have calculated what the average advisor numbers look like. The average advisor earns revenues of $814,000. Management and advice fees made up 65% of the revenues earned, whilst commissions for selling products such as mutual funds and annuities made up 26% (based on Q2 2022 numbers). Although, earnings commission from selling products has a bad reputation, I believe it provides income for advisors and that helps the prospects of new recruits joining the firm.

The management fees are earned on wrap accounts, which is roughly $40 million per advisor, whilst the total client assets is $72 million, on which the commission is presumably also earned. I believe the assets per advisor is split over a large number of clients.

Advisors receive a payout of $470,000, or 58% of revenue. Ameriprise incurs some cost supporting advisors with technology, training, leadership, and marketing, leaving approximately $195,000 of pre-tax profit for Ameriprise at a 24% margin.

Unit economics (Author calculations using company financials)

Industry Overview (Advice & Wealth Management)

In my view, the growth of wealth management can in part be traced back to the introduction of the 401(K) in 1978 resulting in a decline in company sponsored pensions plans. Pension plans participation fell from 38% in 1980 to 20% in 2008. This trend is expected to continue and the outlook for wealth management is good.

The wealth management industry can be segmented into Registered Investment Advisors, independent broker dealers and wirehouses.

Registered Investment Advisor (RIA) providers/custodians such as Schwab, TD Ameritrade, Fidelity, and Pershing offer the least expensive platform for an advisor but come with the least support. I believe this to be the fastest growing part of the market.

I believe the second-fastest-growing segment is the independent brokers that include Ameriprise, LPL, and Raymond James. These advisors can retain between 70-90% of the fees they generated. Advisors, working for independent brokers, are able to be part of a larger corporation and maintain independence through their franchises or own brands.

There are some differences between these firms. LPL for instance allows advisors to form RIAs (but strongly encourages custody with LPL), whilst Ameriprise isn’t supportive of advisors forming outside RIAs. With the RIA market growing faster than the broker-dealer business, I would like to see Ameriprise push further into that market.

In my view, the slowest growing segment is the wirehouses such as Merrill Lynch, Morgan Stanley, UBS, and Wells Fargo. Brokers at wirehouses get to keep about 30-50% of the fees they generate. They do not have as much autonomy as independent brokers but are able to use the strong brand names that the wirehouses have.

I believe the shift away from wirehouses towards RIAs is due to clients not wanting to pay expensive management fees and commissions for investment products that they can get cheaper elsewhere. Whilst, advisors can earn higher payout as independents. Wirehouses’ share of the industry’s assets dropped from 33% in 2010 to 25% in 2021 and is expected to drop to 22% by 2025, and I believe Ameriprise could benefit.

Risks (Advice & Wealth Management)

Ameriprise’s Wealth Management segment has at times had a reputation for pushing products on customers. In addition, Ameriprise is a broker dealer that generates commissions through products that it sells, creating the appearance that broker profits can take precedence over client needs.

In addition, there has been margin pressure on brokers, as clients shift towards cheaper ETFs and index funds. The fees on Ameriprise wrap accounts have declined from 1.47% in 2014 to 1.28% in 2021. The Ameriprise CEO recently said that fee compression is due to benchmarking against wirehouses and the fact that the company is moving upmarket and charging less for the larger clients.

Results Outlook (Advice & Wealth Management)

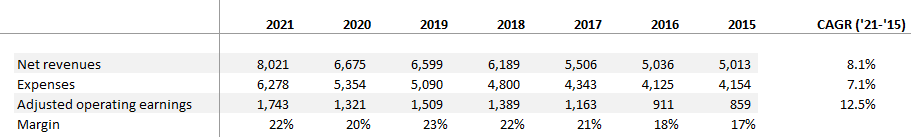

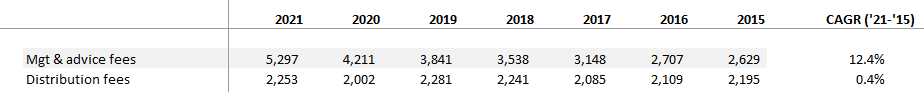

Despite the industry pressures, revenue in the Wealth Management division has been growing by 8.1% since 2015, whilst the operating margin has been increasing too. This has been driven by management fees as clients have moved towards wrap accounts.

AUM under wrap accounts have grown by a CAGR of 14% since 2015 and wrap AUM as percentage of total company assets under administration has increased from 23% in 2015 to 32% at the end of last year. The bigger wrap business has the benefit of revenue being stable and there is less pressure on advisors to push expensive products on clients.

Segment Financials (Author calculations, company financials) Segment Financials (Author calculations, company financials)

The transition towards wrap accounts have come at the expense of distribution fees earned from selling mutual funds and annuities. Distributions fees earned by advisors have not grown at all since 2015.

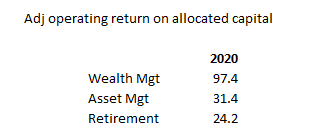

Ameriprise’s franchise model generates a very high ROE. Ameriprise calculated that the Wealth Management business has a 97% return on capital in 2020. The company hasn’t provided an updated figure since.

Return on Capital by Segment (Author calcs, company financials )

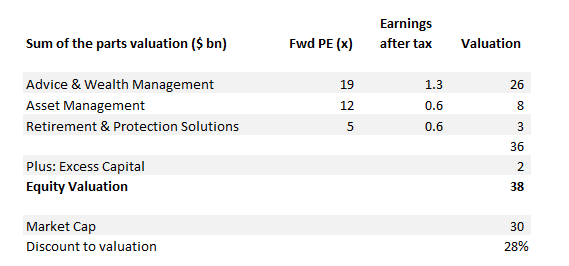

Independent brokers trade at a high multiples due to the high growth and the good returns on capital they earn. If we apply the average forward price earnings multiple of LPL and RJF of nineteen times to the Ameriprise Wealth Management business, I get a valuation of $26 billion.

Assets Management

Ameriprise’s asset management business is called Columbia Threadneedle Investments. This also includes BMO Global Asset Management, bought in November 2021.) They sell primality mutual fund products. Columbia is primarily marketed through third parties, but Ameriprise offers it through their advisors too.

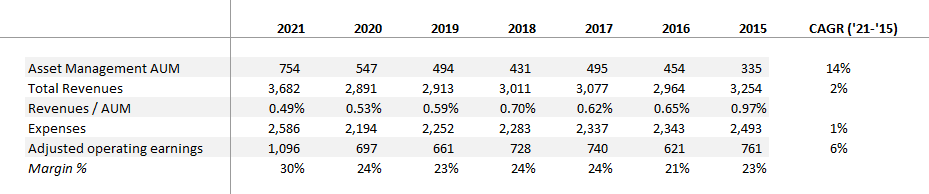

Revenues of $3.7 billion were earned on managed assets of $754 billion, at the end of 2021. This business represented 25% of the Q2 2022 operating income. The company has 91 Columbia funds, 92 Threadneedle funds, 62 BMO funds. Assets are allocated with 54% is in equity, 37% in Fixed income and 9% in alternatives and other types. Peers include T. Rowe Price (TROW), Franklin Resources (BEN) and Affiliated Managers (AMG).

Risks (Assets Management)

Actively managed mutual funds have been losing assets to ETFs and indexed mutual funds, this business is in a decline as low-cost ETF have become the product of choice. Since 2000 mutual funds net assets have grown by two times, compared to eighty-two times for ETFs. Of the nearly $30 trillion of net assets split between ETF and Mutual funds, the ETF now makes up 18% of net assets, up from 1% in 2000.

I believe this is largely due to the liquidity that an ETF provides, giving investors the ability to trade in and out of them. ETF in general have much lower fees than mutual funds and have resulted in fee pressure on the mutual fund industry.

Another shift that has happened in the mutual fund industry has been the shift to indexed investing. Passive indexed investing accounted for 19% of net assets in 2010 and increased to 40% of assets in 2020. Adding additional fee pressure on the industry. As a result, since 2015 Ameriprise’s revenues as percentage of AUM fell from 0.97% to 0.49%.

Results and Outlook (Assets Management)

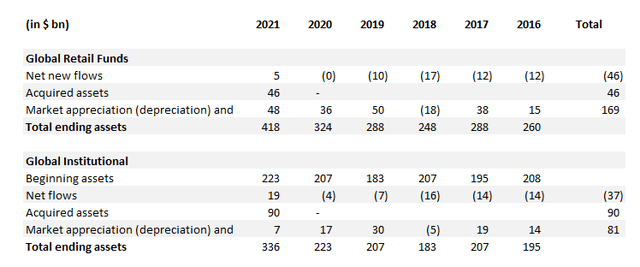

Despite these industry headwinds, Ameriprise has increased asset management assets from $195 billion to $336 billion, between 2016 and 2021 and revenue for the Asset Management segment increased from $3.0 billion to $3.7 billion over the same period.

Asset Management Fund Flows (Company Financials and Author calcs)

The AUM growth came mostly from market appreciation, helped by the BMO acquisitions, which was offset by net outflows. As a result, revenues increased by 2% per year since 2015.

Segment Financials (Author calculations, company financials)

These surprisingly decent results are due to the sticky nature of the mutual funds’ assets. Ameriprise has also been able to keep expenses down. The asset management business also benefits from low capital requirements.

If we look at peers, TROW, BEN, and AMG, they trade at an average forward price earnings multiples of 12x. If we apply that to the after-tax operating income of the Asset Management segment, it gives us a valuation of around $8 billion for this business based on normalized earnings.

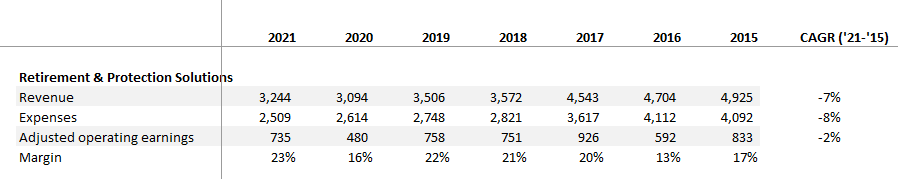

Retirement and Protections Solutions

This segment earned revenues of $3.2 billion in 2021 and represented 20% of the company operating income in the latest quarter. It operates under the RiverSource brand, offering annuities (Retirement), life insurance and disability insurance (Protection). I will at times refer to this segment as the annuities business in this article. Only Ameriprise advisors can offer the products. In the latest proxy, Ameriprise lists Lincoln (LNC), Principal Financial (PFG) and Prudential (PRU) as peers.

Risks (Retirement and Protections Solutions)

Within Ameriprise’s Retirement and Protections Solutions is a company called Riversource that sells annuities and life insurance. When Ameriprise was spun off from Amex in 2005 the company was primarily an insurance and annuities provider.

In my view, these businesses normally trade at a discount to the rest of the market due to the fact that it is very hard to determine the economics of these businesses. Products are sold today that promise future payments. The liability of these future payments is estimated by the company and investors have limited insight into these liability calculations.

In addition, the companies that sell these products do not do well in low interest environments as the money received by Ameriprise from selling annuities and life insurance is invested in fixed income products. As interest rates have been lower over the last few decades, it has been harder and harder to invest the money received.

Results and Outlook (Retirement and Protections Solutions)

Ameriprise has purposefully shifted away from the RPS business over the last 10 years. RPS operating earnings, as a percentage of the total company, has declined from 50% to 20% since 2011. In contrast the WM segment profits went from 22% to 55% of total company earnings.

Operating Earnings (Author calcs, company financials)

Ameriprise’s management has stated that they believe their RPS book is much higher quality than those of peers. This is in part backed-up by the consistency of profits it generates, shown below. Even as part of this business has been sold off (in 2019 Auto and Home Insurance segment was sold) and the business has been operating in a low interest rate environment, it has maintained relatively stable earnings.

Segment Financials (Author calculations, company financials)

If we assume this business should be valued in line with peers LNC, PFG and PRU, BHF at a forward earnings multiple of eight times, that will give this business a valuation of about $4.2 billion. It should be noted that in 2020 Ameriprise only allocated $1.5 billion of capital to this business.

Assuming the $1.5 billion number was a book value figure, then I would assume this business would only be worth around that. The average of the two valuations is $3.0 billion, which is what I will use in the sum of the parts valuation below. This valuation difference does point out one thing: Although this is a low growth business, it is one that generates good return on capital.

Valuation

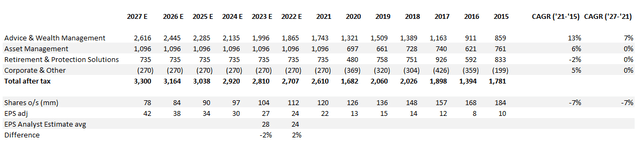

Since 2015 the operating earnings for the WM, AM, RPS segments grew by 13%, 6%, -2%, respectively. In the model below, I assume these growth rates fall to 7%, 0%, 0% over the next few years.

The good returns on capital that the company generates has allowed the return of large amounts of capital back to shareholders. Reducing shares outstanding by 7% every year, since 2015. I expect this to continue.

This results in EPS almost doubling to $42 in 2027. My EPS estimates are 2% lower than the average analyst estimates for 2022 and 2023.

Operating Earnings Model (Author calcs, company financials )

My sum-of-the-parts valuation uses the valuations discussed throughout the article. I assume WM, AM, RPS segments are valued at $26 billion, $8 billion, and $3 billion. At the latest quarter-end the company had $7.5 billion of cash and equivalents and $2.8 billion of debt. However, the company stated in the last call earnings that it has $1.6 billion of excess capital, which I have added to the valuation. The final sum-of-the-parts valuation is $38 billion, which is 28% more than the current market capitalization.

Sum of the parts valuation (Author calcs)

Conclusion

Ameriprise is currently trading well below its recent high. It has historically had a low valuation despite good results. The company is seen by many investors as primarily an annuity business, with a slow growth mutual fund segment, whilst fee pressure is hurting the Wealth Management business.

However, the company now generates the majority of income from the Wealth Management segment which is growing fast with very high returns on equity. The Asset Management and Retirement and Protections businesses are not growing much, but are generating lots of free cash flow and the company is using this to buyback shares. As retirees continue to look for retirement advice, they should continue to turn to Ameriprise, and perhaps investors should take a look too.

Be the first to comment