industryview/iStock via Getty Images

Univar Solutions (NYSE:UNVR) is an American chemical and ingredients distributor that provides its products and services to several different industries across the globe. These include the Canadian, Latin American, and the European, Middle Eastern, and African segments, apart from their primary base in the US. The company is able to efficiently manage and distribute its products through these strategic locations that can be separately assessed and managed.

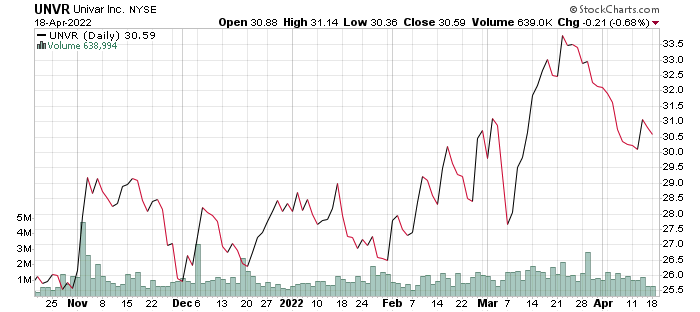

stockcharts.com

Following its acquisition of Nexeo Solutions in 2019, the company changed its name from Royal Vopak to Univar Solutions in a year significant in many ways. A look at how the company has changed since then will show why any sense of volatility should be dismissed in favor of a more optimistic outlook on the company’s future.

Market Outlook

The chemical industry production was on a good run before COVID-19 hit, affecting many manufacturing companies and subsequently reducing the demand for chemical products needed during this period. Growth of the chemical industry production in the coming years will vary per region, with Asia Pacific expected to see the largest growth after seeing an estimated 8.2% growth in 2021. This is much higher than the global increase of 5.8% estimated in that same year, and even more so when compared to the North American market, which saw a mere 1.8% growth. This growth is expected to slow down in the next two years, at a rate of approximately 3.8% in 2022, a year in which the industry’s enthusiastic recovery from pandemic-related issues finally cools off. This reduced growth will be experienced in all markets across the globe and continue into 2023, at least, though the 3%+ rate of growth continues to be a positive development. The industry certainly will not see a decline in interest as the use of chemical products continues to prove necessary across multiple industries around the world. Just as growth was experienced in varying degrees across different regions, there will be a number of contributing factors that will slow growth across all sub-sectors of the industry, including inflation, rising energy prices, and changes in government policies that directly affect the market.

Financial Analysis

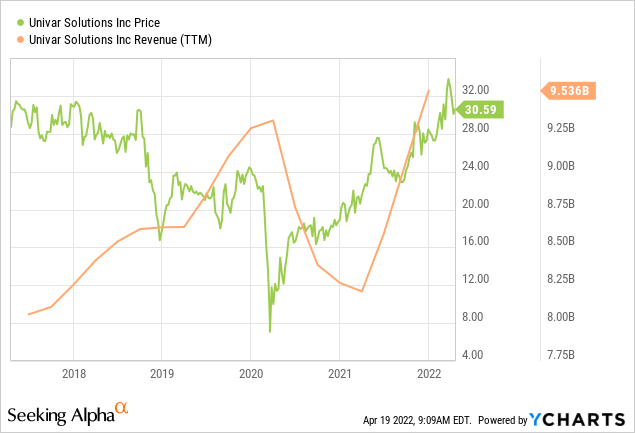

Univar has experienced an interesting past three years of ups and downs caused both by global factors and changes within the company. In the year of the Nexeo purchase, which saw the company become a subsidiary of Univar, the company reported a record $9.3 billion in revenues in 2019.

ycharts.com

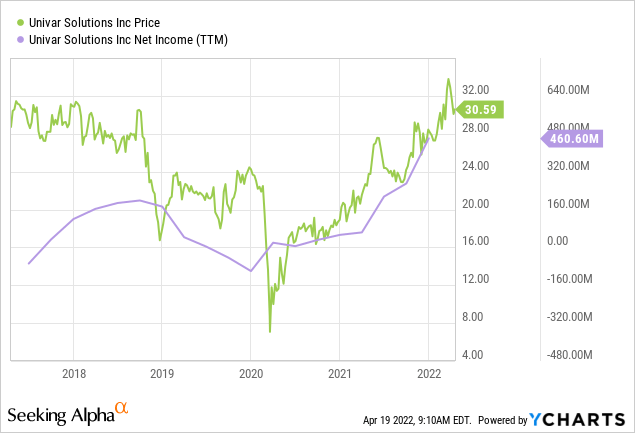

This was all before the global pandemic caused a decline in all markets. Following that record-breaking year, the company’s annual revenue declined to $8.3 billion in 2020, suffering from reduced demand for products and higher operational costs. The company was able to bounce back in 2021, concluding the fiscal year with a total of $9.5 billion in revenue, slightly beating what the company had achieved prior to the pandemic. Upon closer inspection, however, there is more to be said about the past three years, and the progress the company made surpasses mere revenue figures. While 2019 was a significant year in terms of sales, the company actually reported net losses of $100 million in that year, as operating expenses reached an all-time high. Despite the reduced growth in the following year, the company was able to manage its expenses better, reporting a net income of $53 million by the end of 2020. Progress continued into the following year, saw revenues rise again, and having learned from past experiences, Univar was able to better manage its operations and conclude the fiscal year with a net income of $460 million in 2021. So, how did the company achieve such impressive results in such a short amount of time?

ycharts.com

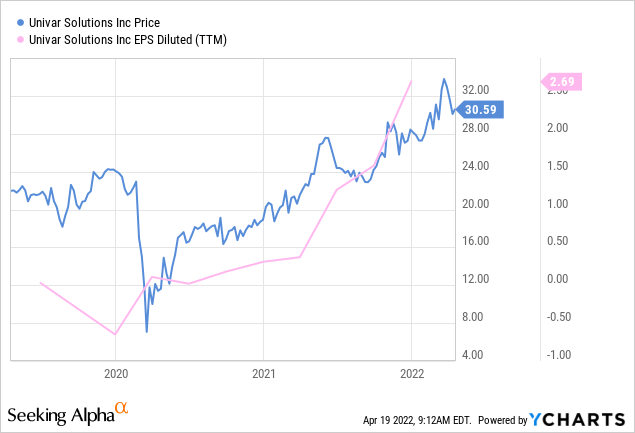

Univar reported net sales of $2.5 billion in the fourth quarter last year representing a 22.7% increase compared to the same quarter in 2020. Gains in market share, more efficient operations and the rise in chemical product prices all contributed to the company’s growth over the quarter. The company could have made even greater gains were it not for the exit of the Canadian Agriculture wholesale distribution and Distrupol divestiture, which spelled the end of its Plastics distribution activities in Europe. In the end, this was not enough to offset the substantial gains made, and the final quarter of 2021 saw Univar register $157 million in net income applicable to shareholders. The company’s adjusted earnings per share increased from a mere $0.31 to $2.69 per diluted share in the space of a year.

ycharts.com

Another important factor in determining the valuation for companies such as Univar is their price to sales ratio, especially when compared to the sector median. Due to the nature of some of Univar’s business as a major distributor, their ability to drive sales verticals across their portfolio of chemicals and related products is fundamental to determining their performance over time. Over the past year, Univar’s price to sales ratio has stayed relatively consistent despite some volatility that we saw in the price. Currently, the price to sales ratio for Univar is 0.56, nearly one-third of the sector median of 1.49. Such a drastic difference strongly supports that Univar is undervalued when compared to the sector. With plenty of breathing room to grow, as evident by the rapid recovery of sales and significant rise in net income from below zero to nearly half a billion dollars over the past two years, all of the cards are in place for significant appreciation in the company’s share price over the coming quarters.

Growth Factors

Univar’s growth varied per region but didn’t necessarily reflect the trend of the industry, instead of growing according to where the company has a greater operational concentration. As such, the US saw the highest growth rate, accounting for 31.8% in the final quarter. This was followed by the Latin American region, which saw a 27.1% growth rate, followed by the joint regions of Europe, the Middle East, and Africa. The Canadian regions saw the least amount of sales growth, at 5.1%, due to the aforementioned exit of the Canadian Agriculture wholesale distribution business and the divesting of the Canadian Agriculture services business.

As for the current year, Univar is forecasting revenues of up to $280 million in the first quarter of the year and a total of up to $890 million by the end of the year. Growth had been offset by the company pulling out businesses in certain regions, causing temporary disruptions in earning but also resulting in reduced operational costs that will begin to reflect throughout the year. The market will continue to grow, albeit at a reduced pace, but still enough for Univar to reap the benefits and continue to grow in the industry. The company has also set its sights at 50% net free cash flow conversion and up to 30% of adjusted net income in annual capital return to shareholders.

Risk Factors

Univar is pretty stable on all fronts, but like any other company, it also faces potential risks that could threaten its operations around the globe. The most common of these is the prolonged pandemic and the consequences of potential disruptions in the industry that could adversely affect sales and distribution. The company has done well to improve operational costs, as evidenced by both the similar revenue numbers in 2019 and 2021 and very different net income figures between those two years, but such disruptions can cause losses as they result in reduced sales and could spell the beginning of an adaptation period that could last months. Finally, transportation could prove difficult in a number of ways, the least of which is a potential increase in prices during distribution.

Conclusion

Univar’s comeback is more significant than that experienced by other companies in the industry. While growth was expected, the company has shown maturity above anything else. By prioritizing businesses that increase profitability while divesting those that do not, the company has improved its financials significantly and shown it is capable of being resilient through tough times. One could not take a more bullish stance on the company, based on its numbers and the leadership of the company that has shown it is more than competent enough to guide the business to greater success and see greater profits for those invested in its future.

Be the first to comment